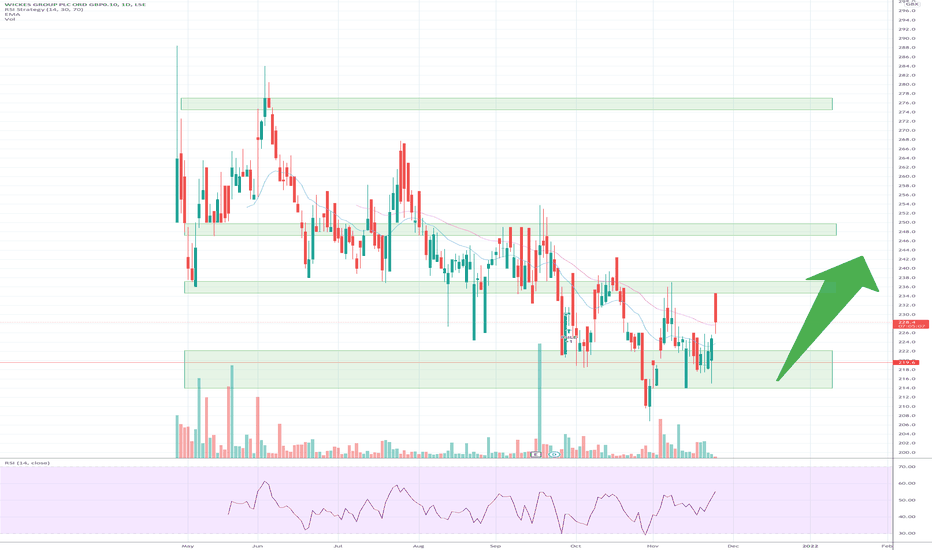

#WIX - Perfect value play for rocket rate hike season#WIX - Perfect value play for rocket rate hike season

Although sales have slowed post-lockdowns, profit is up significantly compared to pre-pandemic.

Cash rich

asset rich

Analysts have this at 317 in net 12 months (43% upside)

Take profits at these levels on our way up

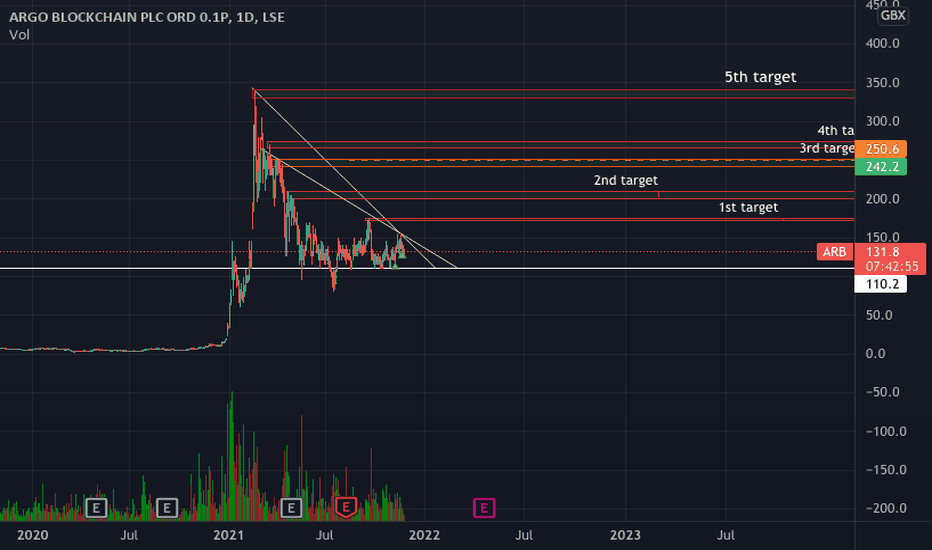

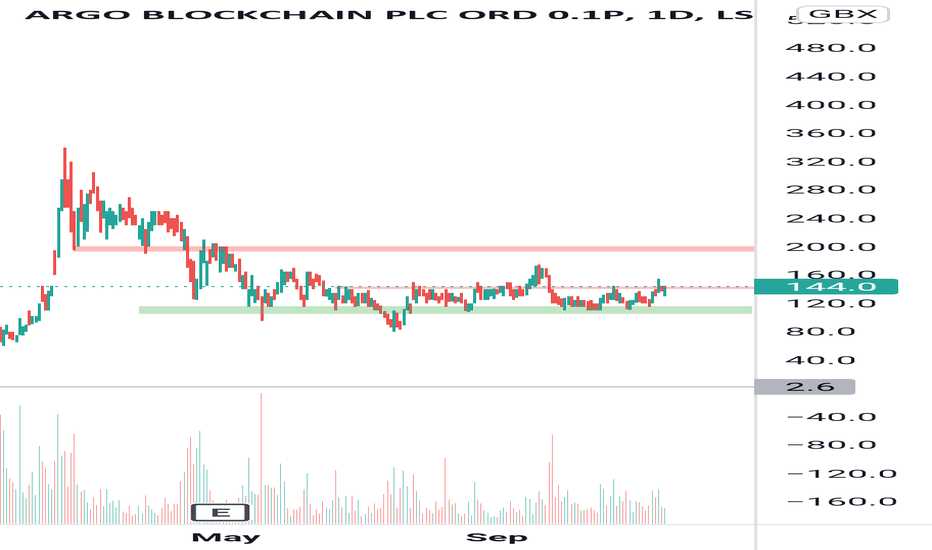

ARB argo blockchain LSE , long target In this idea I show you where are the main price targets for a long in Argo .

As previous ideas I've published ( check it out if you did see it before)

It seems we are currently in the accumulation phase of Wyckoff waiting for a push upwards testing the main resistance at 170 .

It's likely possible that the price will touch the others targets I've drawn .

Let's see what will happen in the upcoming weeks .

Let me know in the comments what are you thoughts about it and share with the community your ideas.

( not financial advise just my opinion , make your own research )

Good luck ! =)

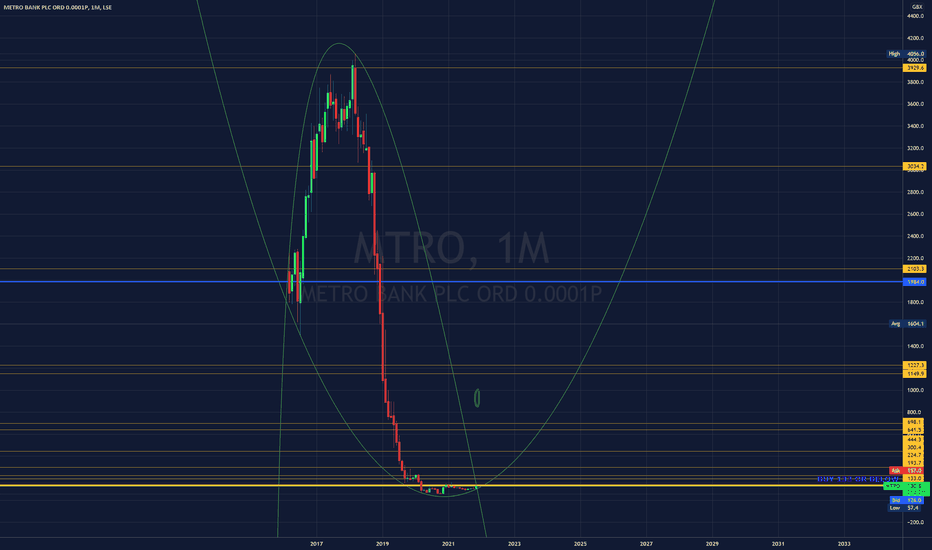

MTRO - METRO BANK - BULLISH - (LSE) An interesting one here gaining much interest from Global investors.

Recently interest in buying the bank has surfaced expect volatility but up is the way

2 funds are short on this with only 2% short float should be able to crush the shorts

BUY the stocks

LSE:MTRO

OANDA:UK100GBP

LSE:LLOY

LSE:BARC

NYSE:LYG

NYSE:BCS

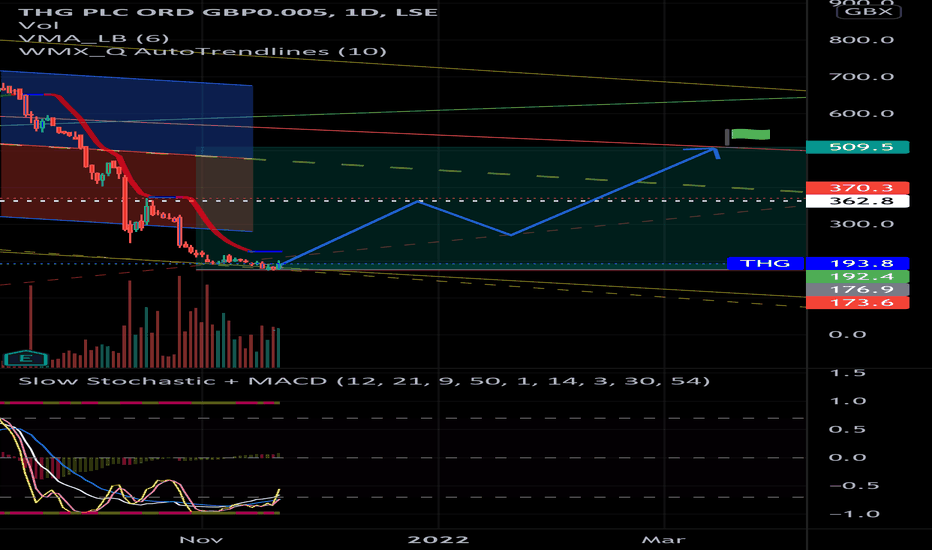

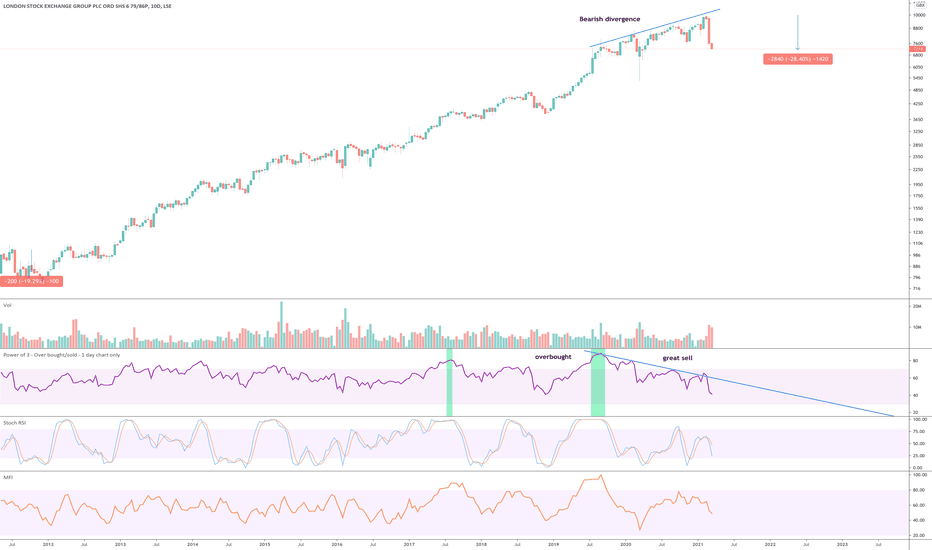

London Stock Exchange**This is a re-post of the London Stock Exchange (now LSEG, LSE previously) idea (below). Tradingview help-desk were unable to attach the idea to the new ticker symbol. So far price action is down almost 30% since original post in January.**

A 2300% gain and following overbought condition (green column) there now exists a 16 month bearish divergence between price action & RSI on the above 10-day chart. Time to collect profits. Sell out between current price action until 10.5k, no rush.

Target price? For as long as the RSI resistance exists price action will likely fall through and until 2023.

1st target 4400

2nd target 2000

Fundamentally as a business LSE provides a variety of financial services. Many of them to EU located individuals and businesses. Since the UK left the EU much of that trading business has and/or will continue to move to another EU country. As the UK opted for self inflicted economic sanctions (a world first?), charts are now showing a number of EU owned UK based businesses with similar divergences. Most notable within Financial services and Engineering businesses.

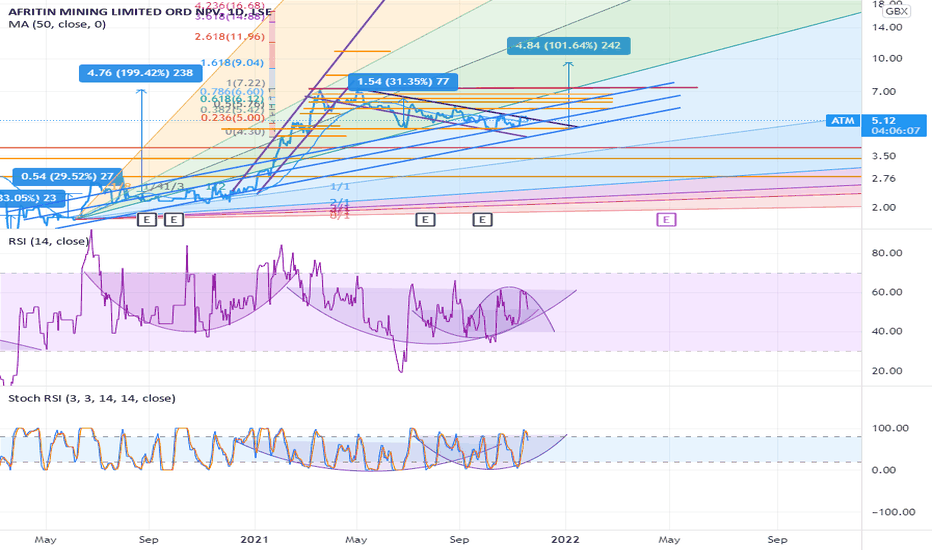

ARGO Blockchain , ARB , LSE, WYCKOFF ACCUMULATION BULLISH In my opinion , we are inside the beginning of the phase D of the Wyckoff accumulation,

Waiting for the confirmation whenever there is a breakthrough the main resistances at: £ 1.70 and £ 2.00.

The main Support areas are at: £ 1.25 , £ 1.15 and £ 1.10.

Remember to make always your own research and plan your risk management! =)

Please leave a comment or a like to support me.

Good luck all !

Peace.

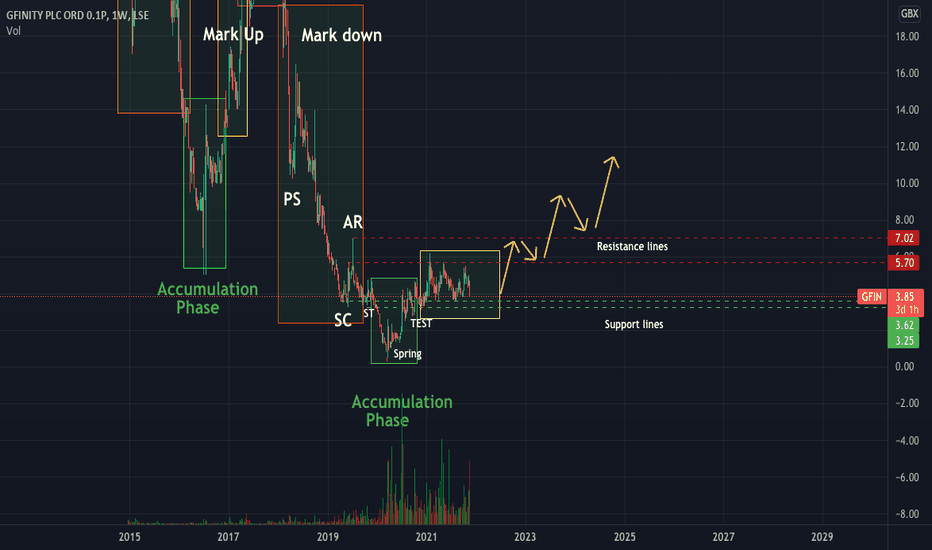

GFIN , Gfinity , LSE, Wyckoff full cycle Looking at a weekly time frame It's noticeable what GFIN is doing since 2015 alternating an accumulation phase , mark up, distribution , mark down and back to accumulation phase.

We had the Spring ( Lowest price in March 2020 with £0.30) followed by the accumulation phase until now.

The main supports I've identified are at: £3.30 and £3.60 ( where possibly the price is going now and than bounce back and try to go through the main resistances that are at: £5.70 and £7.00 as shown by the arrows .

to support me please leave a like or a comment !!

( if you want any specific analysis leave a comment below )

Thanks

Good luck all

Peace

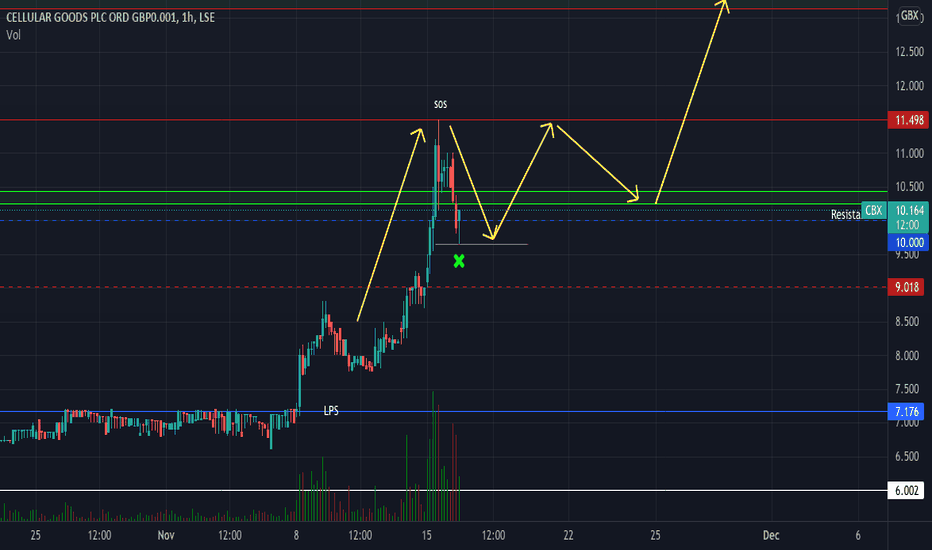

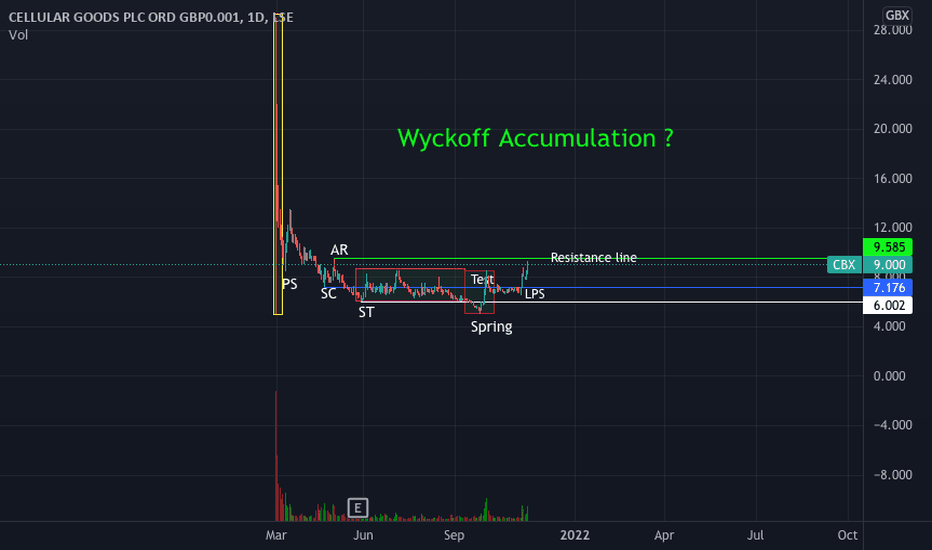

CBX Cellular Good bullish pattern ! LSE:CBX

Confirmed wyckoff accumulation phase D , bullish !! next target 13£

Leave me like or a comment to support me LSE:CBX

Good luck all !!

Peace!

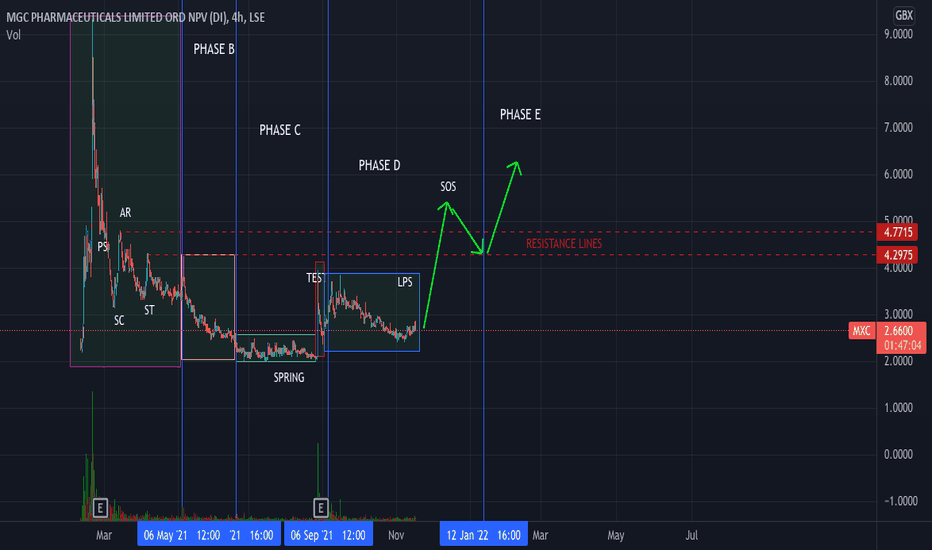

MXC , MGC PHARMA, LSE WYCKOFF accumulation phase DFollowing this analysis we are during PHASE D of the WYCKOFF accumulation schematic#2

( check it out on google or here in TradingView)

I'm waiting here for a breakout upwards to have the confirmation.

(You can find my related idea regarding (CBX , Cellular Good) where this analysis has been confirmed in the other published ideas. )

Let me know what you think in the comments !

Good luck all!

Peace

CBX , Cellular Good, LSE , Wyckoff accumulation ? It seems to be that we are at the beginning of Phase D of Accumulation Schematic #1 of the Wyckoff accumulation phase?

Let me know your view .

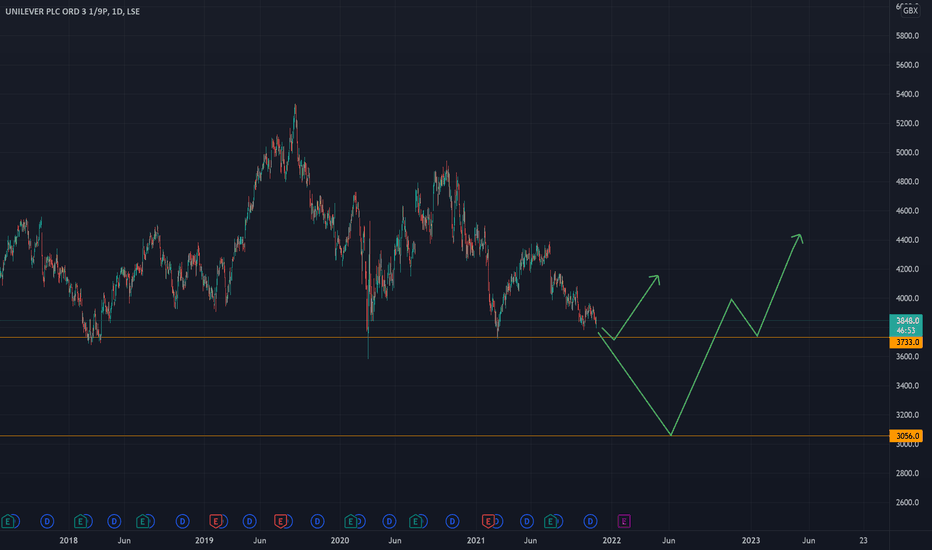

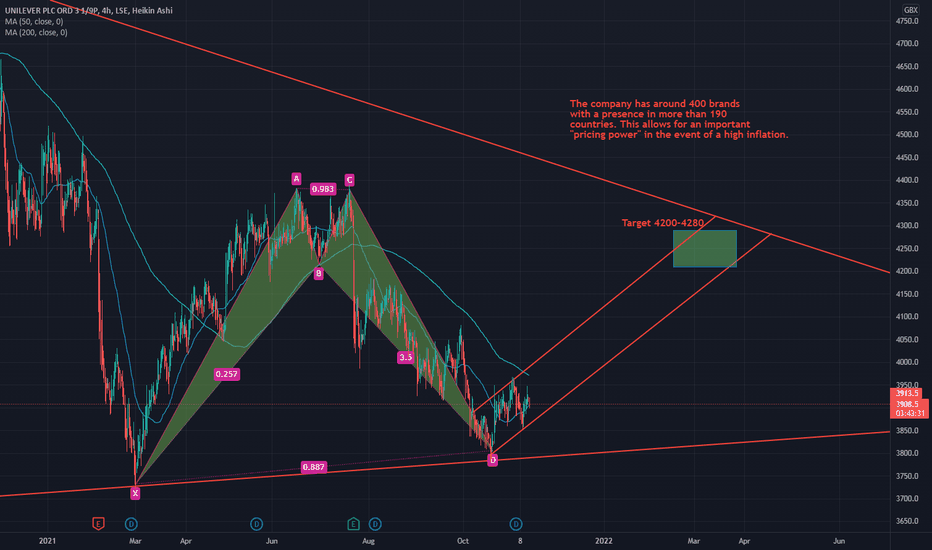

Unilever Plc (ULVR)Unilever on Thursday reported higher-than-expected third quarter underlying sales growth, as it hiked prices in response to cost inflation. The consumer goods and food maker said underlying sales rose 2.5% for the three months to September 30, beating the 2.2% of analysts' forecasts. Growth was boosted by good demand in the US, India, China and Turkey, while a 4.1% increase in prices offset a 1.5% volume decline.

The Company reiterated its guidance for full-year 2021 operating margins to be "around flat" year-on-year thanks to multiple factors. Those included revenue growth management initiatives, savings from efficiencies, some benefit from the unwinding of the Covid-19 on costs and mix and from adjusting Brand and Marketing investments. But Unilever might lose some market share after several large fast-moving consumer goods rivals, such P&G, Loreal or Nestle, had flagged their intention to ramp-up marketing spend.

The company could be a mega-merger target.

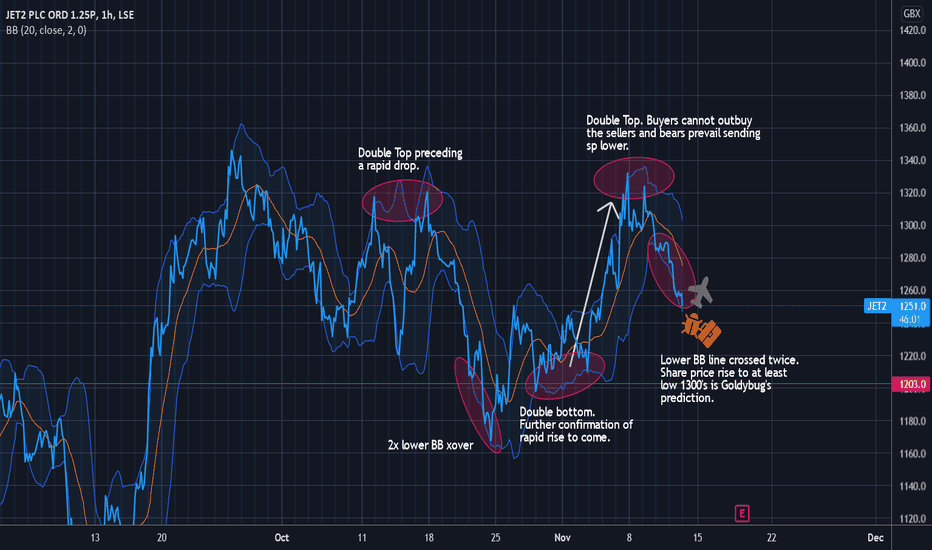

JET2 - history repeating itselfGoldybug always travels with JET2. He likes the certainty of knowing what the holiday will be like so he books the same resort, hotel and even room every time he goes away. Same with his share price predictions. That is why he is so pleased to see yet another double lower Bolinger Band crossover which he predicts will precede another period of rapid rise. Good Luck everyone. As ever do your own research to confirm prior to making any buy or sell decisions.

Idea for trade analysis on Trakm8 stockMarket Cap trend with market price

Testing

Testing

Testing

Testing

Testing

Testing

Testing

Testing

Testing

Testing

Testing