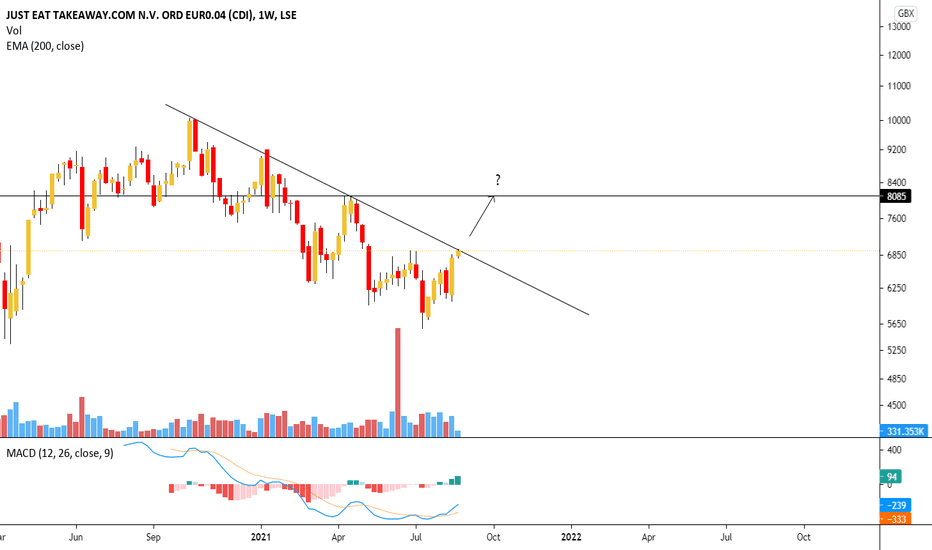

Will Just Eat break diagonal resistance ?Will Just Eat break diagonal resistance and head for a bottoming pattern and subsequent trend reversal?

Possible completion head after left shoulder and neckline at 81?

Time will tell.

#ZIOC – great opportunity after reaching area of sig value#ZIOC – After the cost of a iron ore breached $100 today, we are looking for opportunities to improve supply of iron ore globally… Zanaga is setup to start capitalising on its 2.1bn ore reserve, with a staged development about to happen that will see 30Mtpa in operation.

Strong buy…

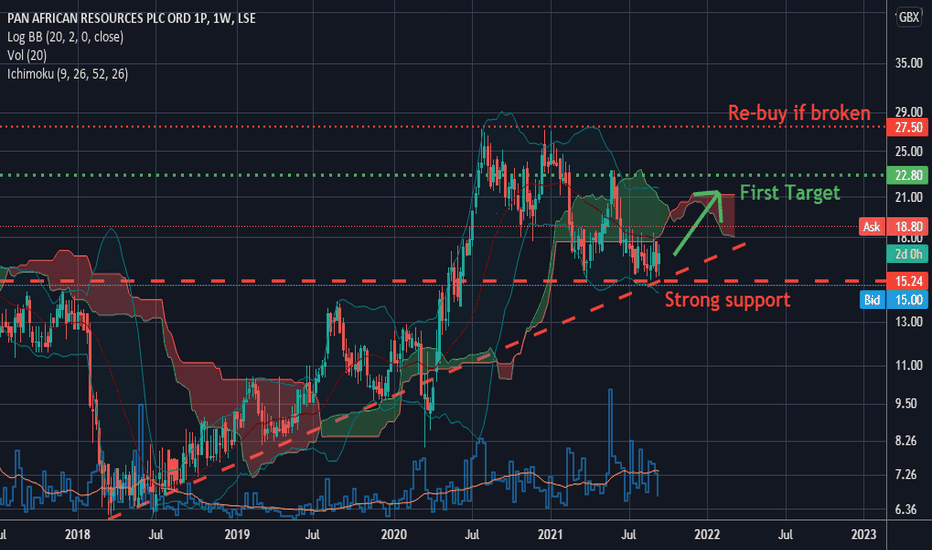

Annual report released. This stock is undervaluedPAF released their annual report today.

Positive

Yearly earnings up 63% , now PER is at about 4. This is incredible !!!

Insiders (CEO and financial executive) bought a lot of shares recently

Dividend will increase 28.5% (vote in November)

Stock buy-back announced (to be precised later)

Awaiting a lot of infrastructure developments and prospection results (incredibly huge gold concentration vein investigated since 1 year)

Strong graphical position, just above unbroken support (only momentarily broken by COVID crash)

Gold leverage

Penny stock that is at the moment not bought by big fish due to small market cap.

Negative

Yields forecast to increase ? But PAF has an incredibly low PER and reduced his debt a lot.

Operates in South Africa (country has inherent risk)

All in sustainable price for gold increased by 9% at $1260/oz

My target is graphical only (so medium term target), the true value of PAF (long term) is above 50 GBX.

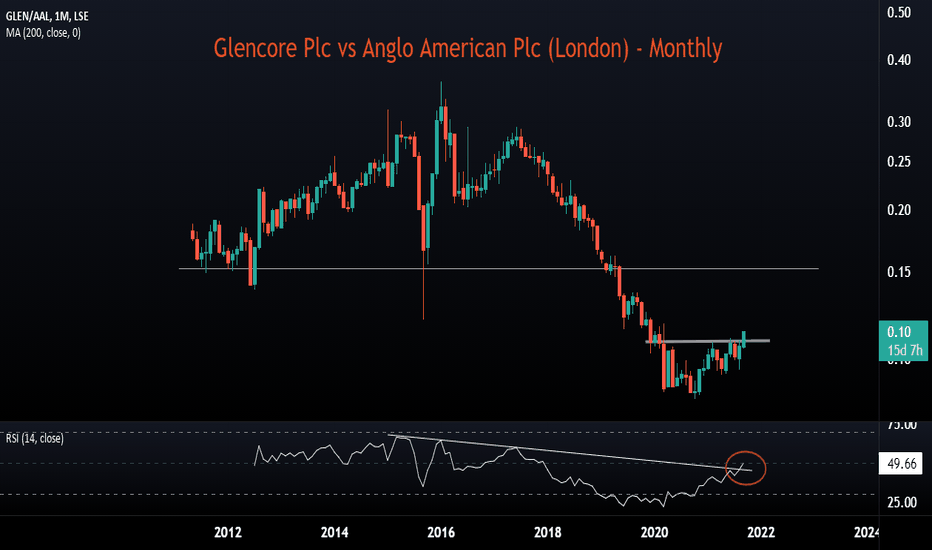

Glencore Plc vs Anglo American Plc (London)Late last week on the trading desk, I presented a technical chart highlighted my perspective of the monthly chart for Glencore relative to Anglo American Plc on the London Stock Exchange (LSE), with the comment as follows:

The relative monthly chart for GLEN vs AAL is suggesting the potential for a long-term shift, where GLEN could outperform AAL.

I've overlayed Albermarle (one of the world's biggest lithium producers) and Piedmont Lithium highlighting how the relative ratio chart could 'catch up'.

Glencore's portfolio is well-positioned to benefit from the EV revolution which is in its infancy.

Note the base having developed, with the price now having pushed up to a 17-month high.

In addition, the 14-month RSI is attempting a 6-year downward trend line breakout.

Note: For the sake of clarity, the chart presented here is without Albermarle and Pidemont.

So far we have seen the relative price rebound twice off the 200-day and has advanced by +4% so far this week. Can it continue?

For more insights, perspectives and real-time trade ideas, get in touch today.

TCS Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

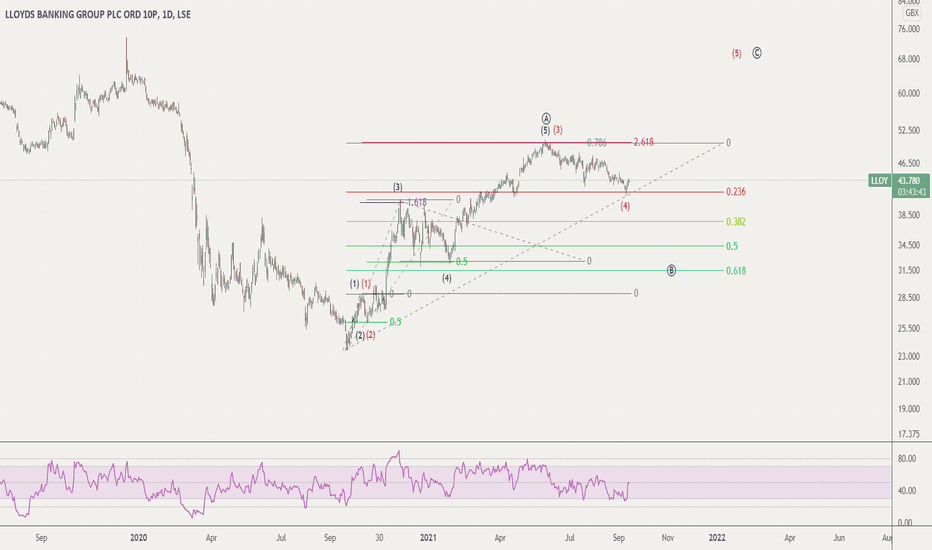

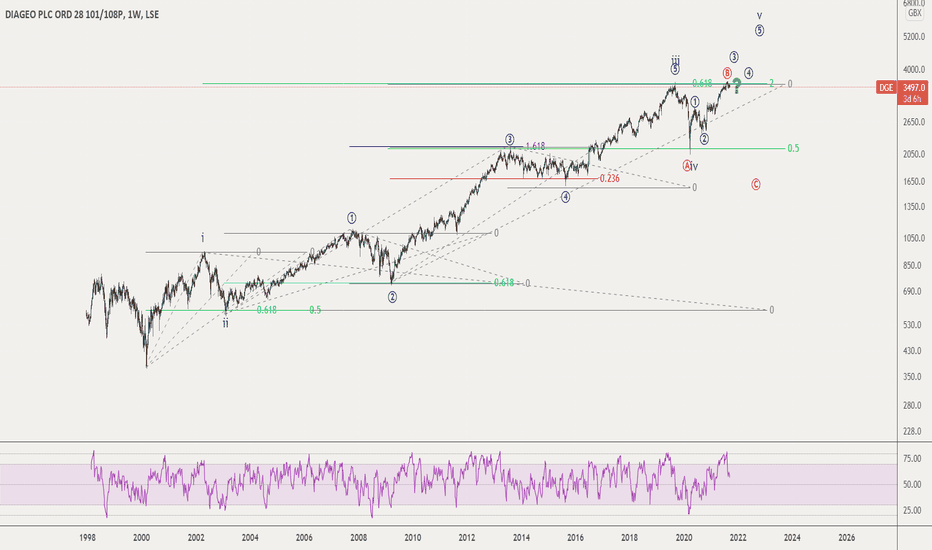

Diageo - decision timeIn my opinion, this stock is at an interesting juncture. Is about to begin a C wave decline to complete a flat correction or was the bottom in March 2020 already the completion of a wave 4? I'm leaning towards a decent correction as it is difficult (for me anyway) to count the upward move from 2020 in 5 waves. As always, time will tell but it might provide a decent opportunity one way or the other.

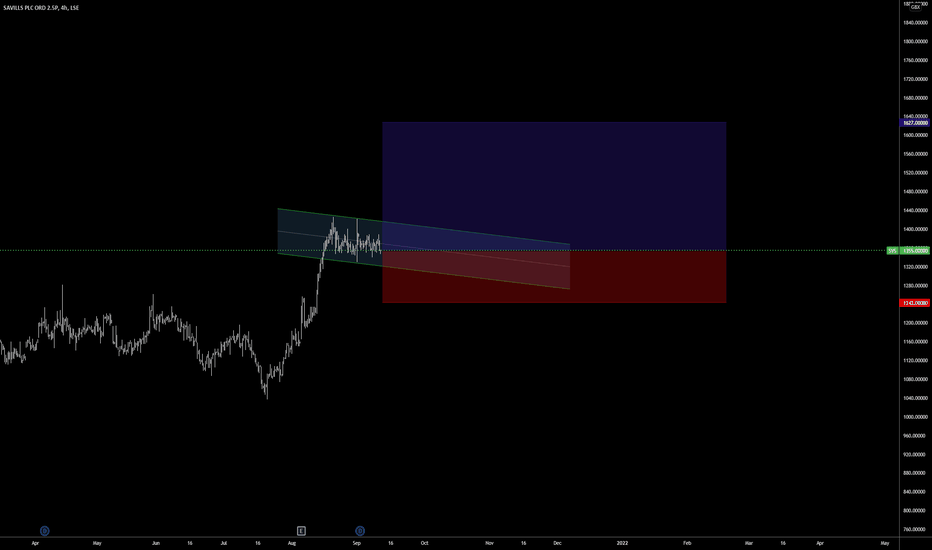

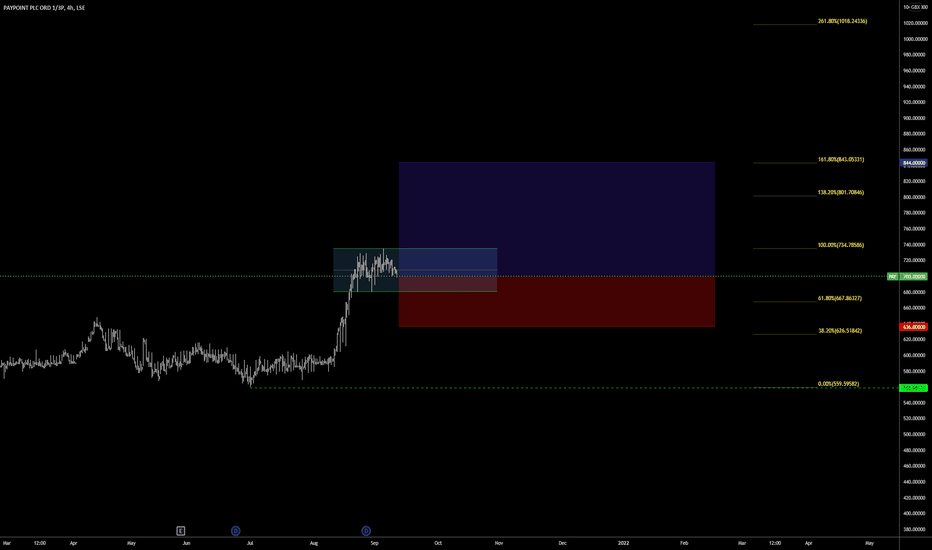

Paypoint LongPaypoint Plc Ord 1/3P is listed on the London Stock Exchange,

trading with ticker code PAY. It has a market capitalisation of £481m,

with approximately 69m shares in issue.

Over the last year, Paypoint share price has been traded in a range of 252, hitting a high of 735, and a low of 483.

Old Mutual LongOld Mutual Limited Ord Npv (Di) is listed on the London Stock Exchange,

trading with ticker code OMU. It has a market capitalisation of £3,711m,

with approximately 4,709m shares in issue. Over the last year,

Old Mutual Lim. share price has been traded in a range of 41.3, hitting a high of 84.65, and a low of 43.35.

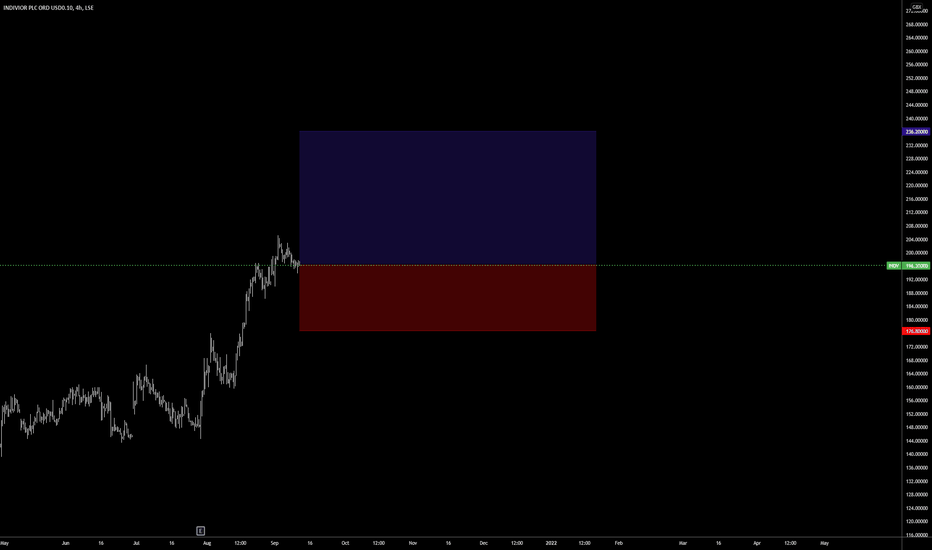

INDV LongBull flag forming. Next impulse as continuation.

Indivior is listed in the FTSE 250, FTSE All-Share, FTSE 350, FTSE 350 Low Yield indices.

Indivior is part of the Medicine and Biotech sector.

Indivior Plc Ord Usd0.10 is listed on the London Stock Exchange, trading with ticker code INDV.

It has a market capitalisation of £1,429m, with approximately 728m shares in issue.

Over the last year, Indivior share price has been traded in a range of 138.2, hitting a high of 205.2, and a low of 67.

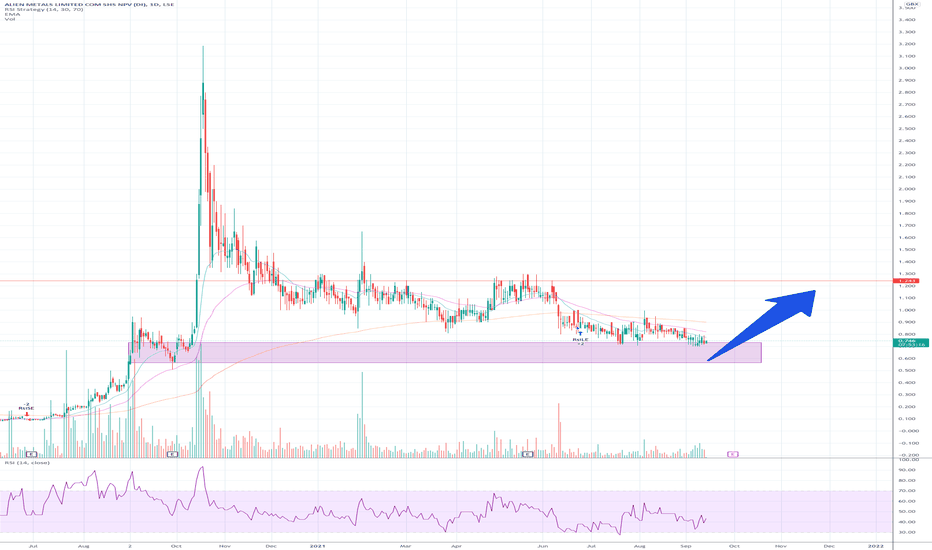

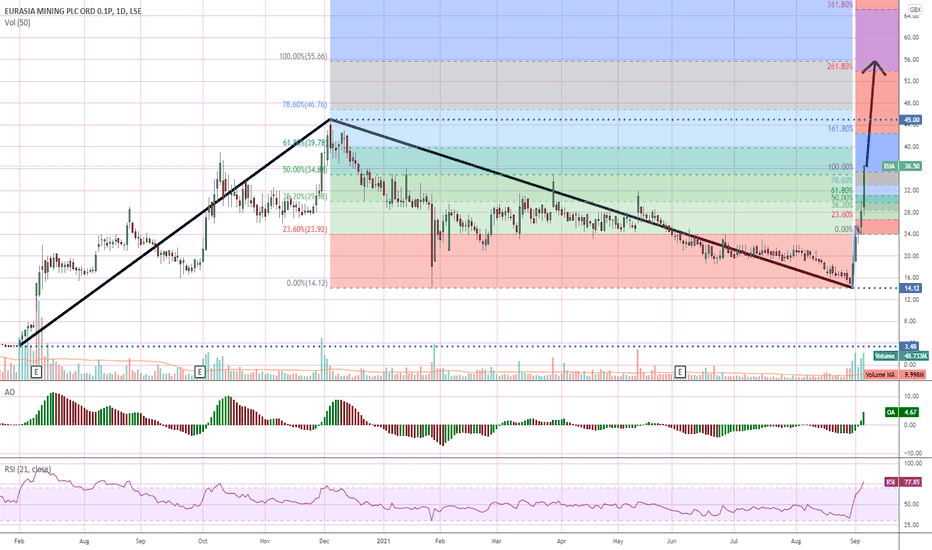

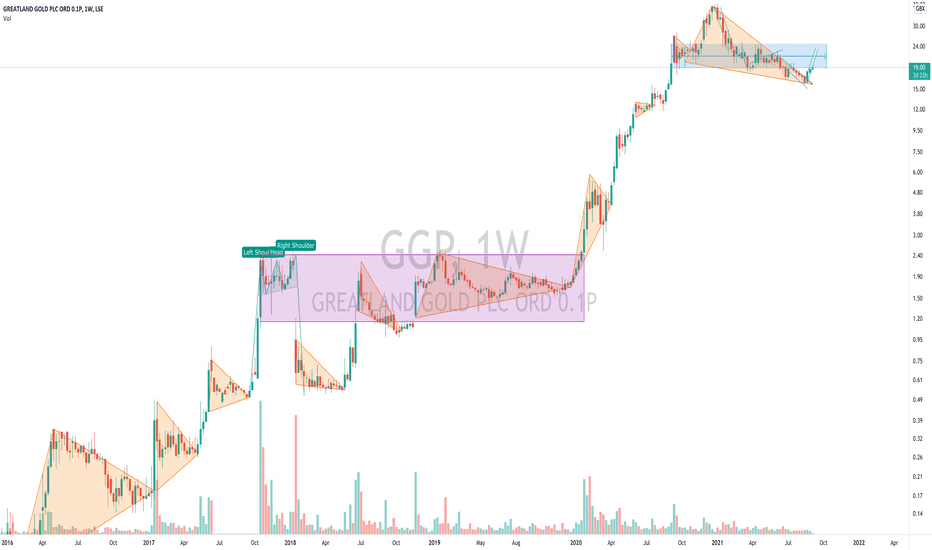

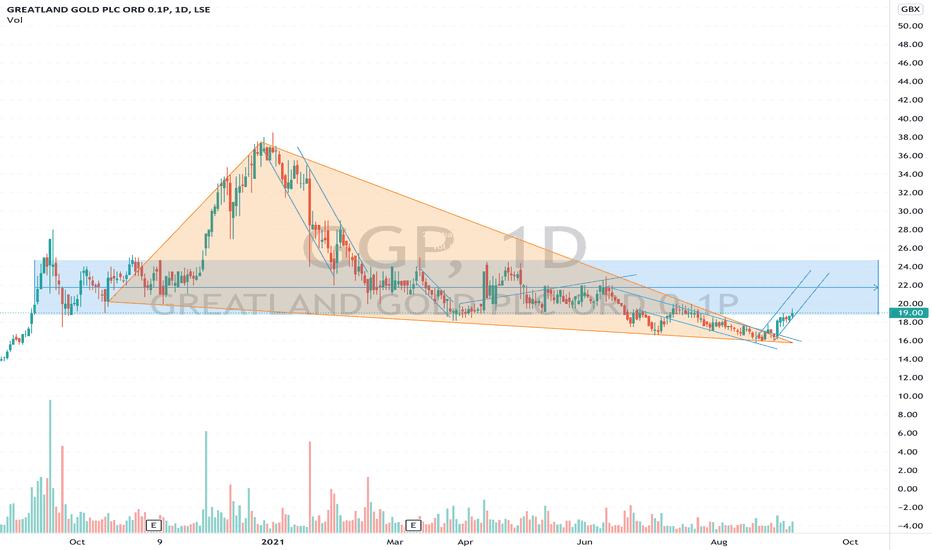

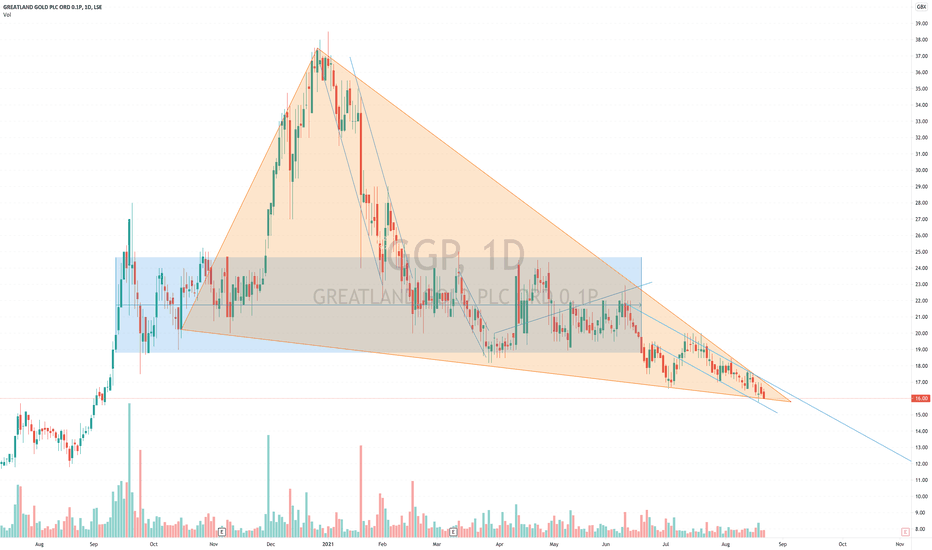

Forward trend Fib Analysis - can 100% gain be repeated.Long term forward Fibonacci trend analysis based on the rise from 3.5p and the retracement from intraday ATH 45p down to 14p floor.

Similar analysis on a bull flag that recently emerged 14 > 25.5 > 23 has so far yielded 100% on the fib scale.

Awesome Oscillator and vanilla RSI showing that this rally has some longer legs and has momentum to continue.

If the long term trend follows the shorter term bull flag scenario, 100% fib gives a target of 55.66p

Not investment advice - always do your own research.

Thanks for reading. I welcome your thoughts.

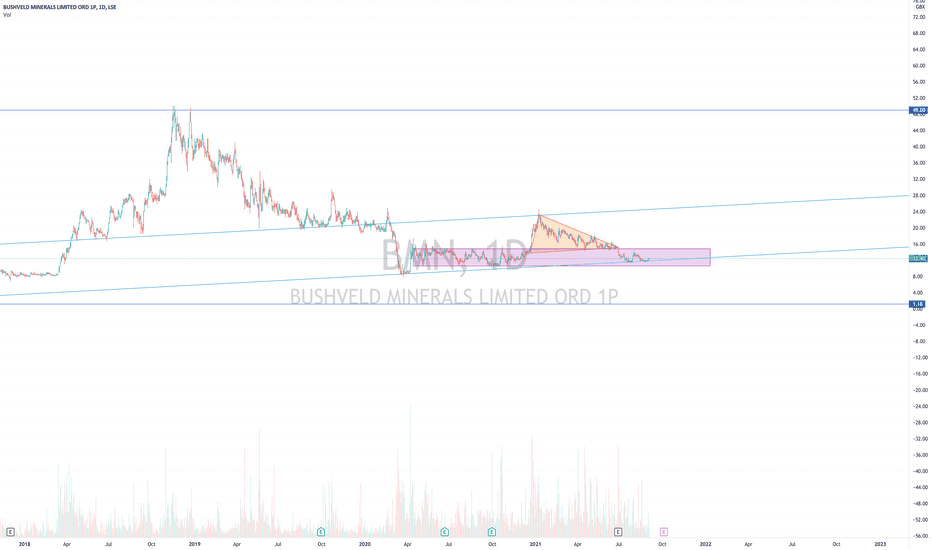

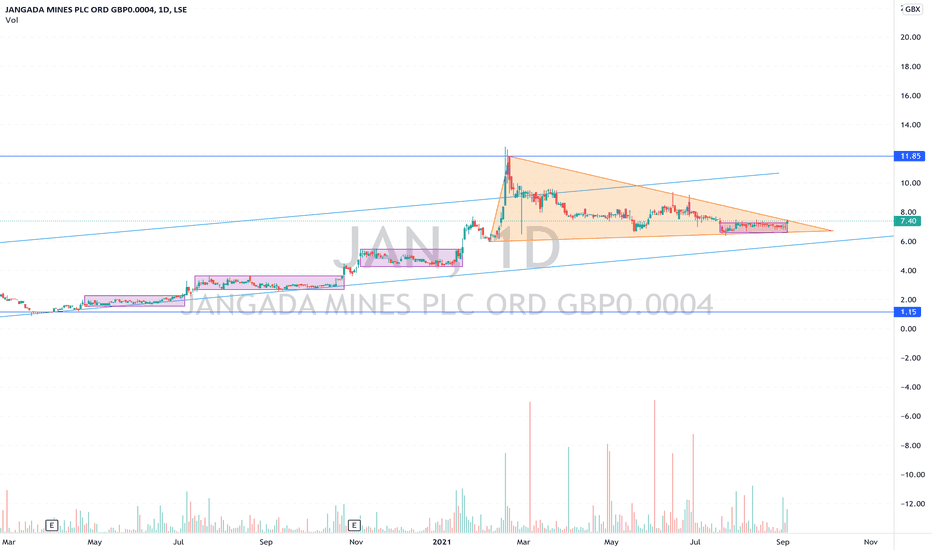

BMN in consolidation zone or upward channel?BMN in consolidation zone or upward channel?

please reply with opinions

I can't guess the next one but looks sollid

no advice given

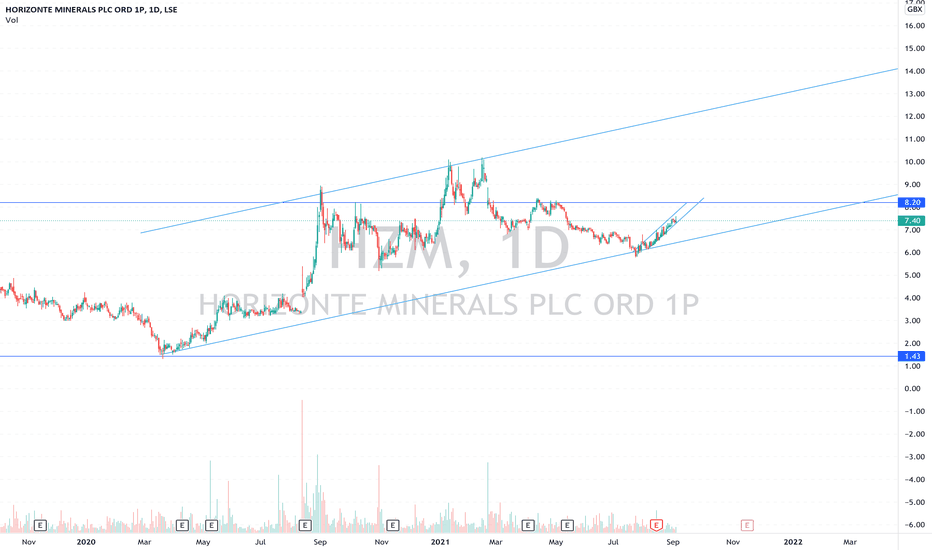

HZM a bit messy but looking positiveHZM looks good but a bit messy

no advice given

narrow upward channel in a general positive trend