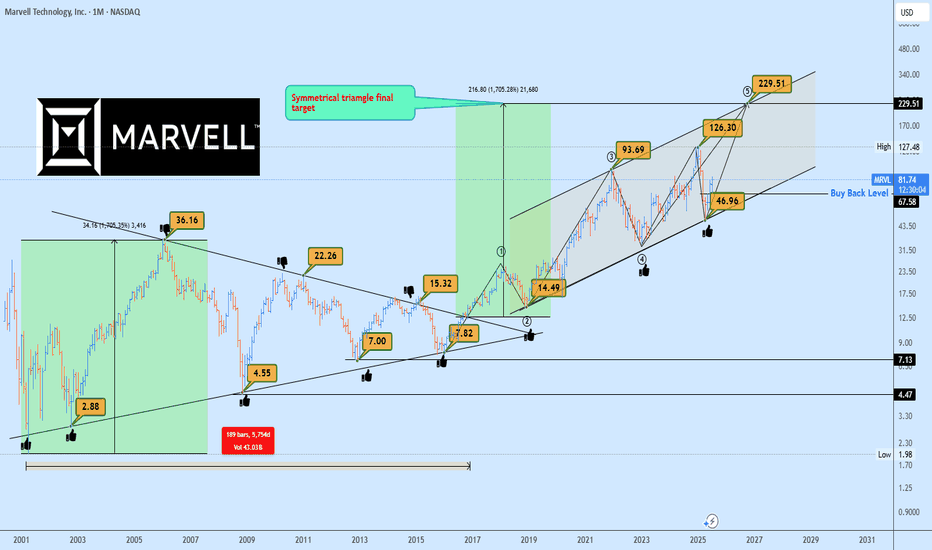

MRVL Massive 15-Years Symmetrical Breakout Targets AheadMarvell Technology (MRVL) has just completed a monumental breakout from a 15-years symmetrical triangle, a rare and powerful long-term accumulation structure. This type of macro consolidation typically precedes a major directional expansion, and in this case, the breakout confirmed bullish continuat

Apple (AAPL) Shares Jump Following Earnings ReportApple (AAPL) Shares Jump Following Earnings Report

Yesterday, after the close of the regular trading session, Apple released its earnings report, which surpassed analysts’ expectations:

→ Earnings per share: actual = $1.57, forecast = $1.43;

→ Revenue: actual = $94.04 billion, forecast = $89.35

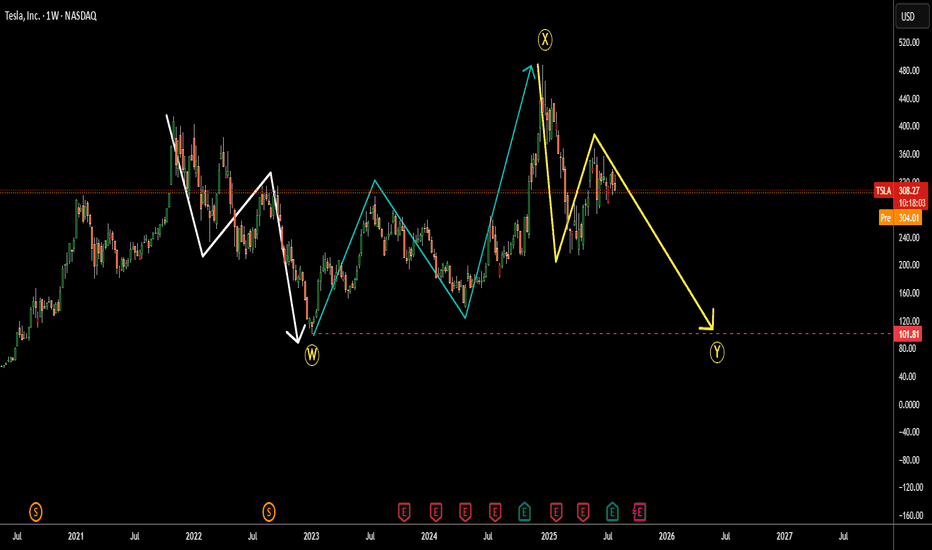

Tesla (TSLA) Crash Ahead? $101.81 Retest in SightThe Tesla price chart appears to show a large flat correction labeled W-X-Y.

Wave W consists of three downward waves from 2021 to 2023. (white)

Wave X shows a three-wave upward retracement from 2023 to 2024, which even overshot the start of wave W. (blue)

Now, we seem to be in the final leg of th

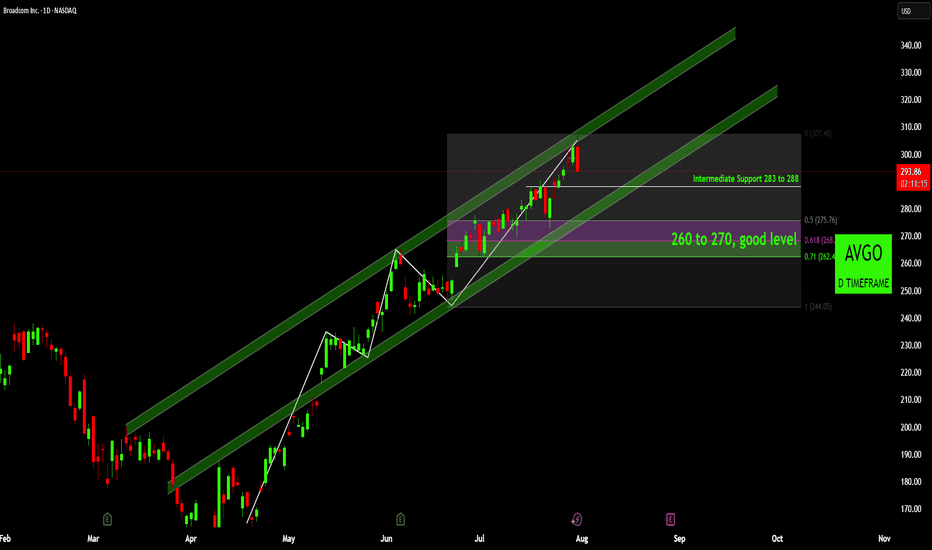

Broadcom (AVGO): Is This the Dip You've Been Waiting For?Broadcom (AVGO) has been demonstrating a remarkably strong bullish trend since early April, carving out a clear path of higher highs and higher lows. This robust upward momentum is well-defined by a series of ascending channels.

Trend and Channel Dynamics:

Initially, we observed price action mov

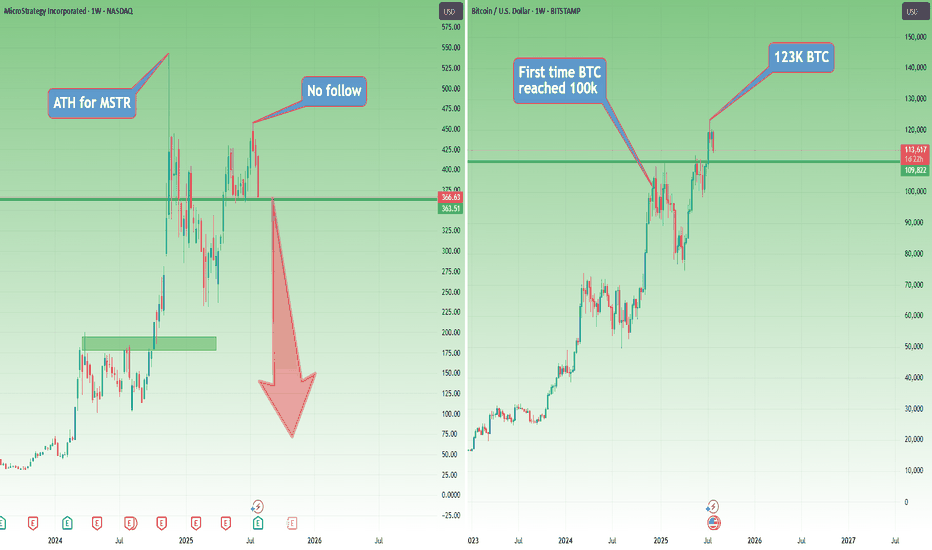

Why Pay $250K for a $115K Bitcoin? Welcome to Strategy (MSTR)This is already the third article I’ve written about Strategy (formerly MicroStrategy), and for good reason.

You don’t need to be a financial expert to ask: why buy a stock that simply mirrors Bitcoin’s price — but at a massive premium?

No matter how sophisticated the explanations may sound, or how

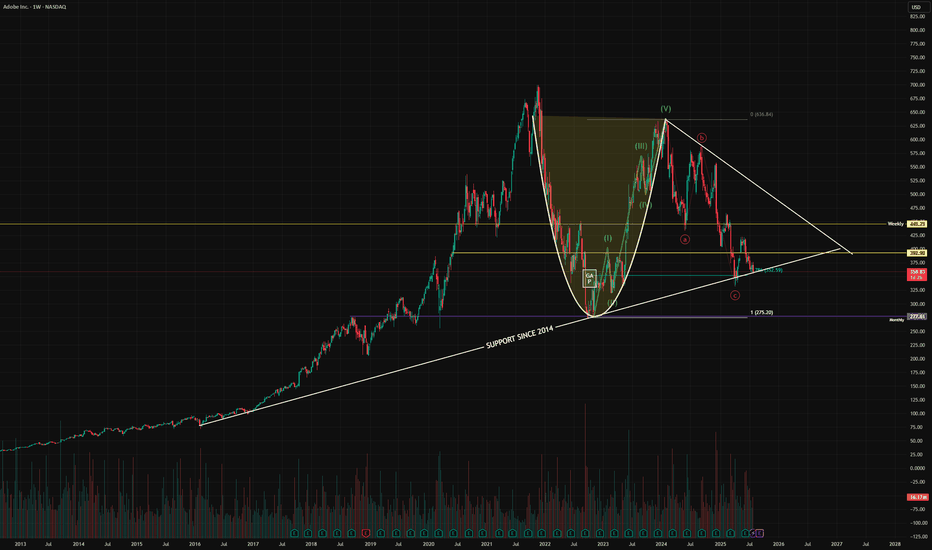

Bottom Feeding - Opportunity?Adobe is sitting on two areas of support - an 11 year old trendline and the 0.786 Fibonacci. It looks like it's coiling up in a giant triangle. This is a steadily growing business with a very sticky product suite. Whilst everyone is falling over themselves to buy Figma at $110, I think it's time to

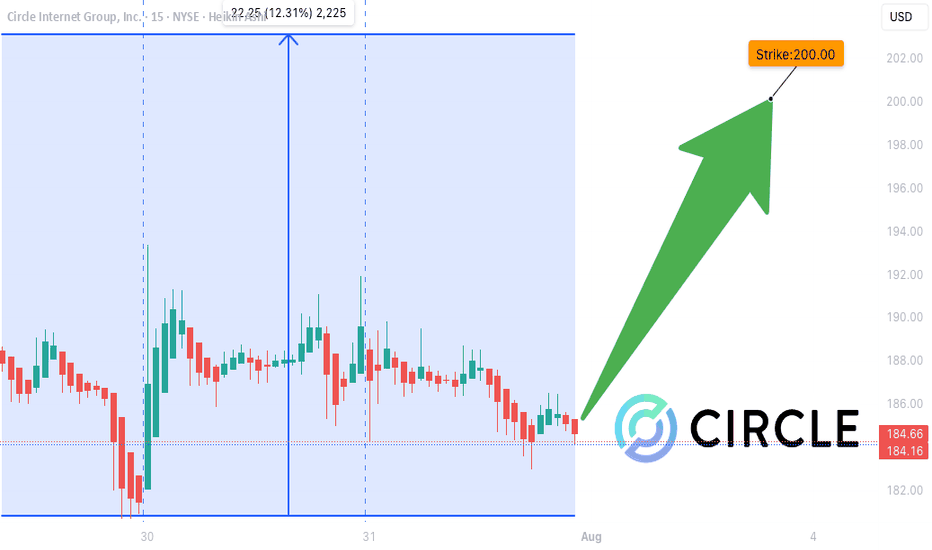

CRCL WEEKLY TRADE SIGNAL (JULY 31)

### 🚨 CRCL WEEKLY TRADE SIGNAL (JULY 31) 🚨

**Call Option Setup – Based on Multi-Model Consensus**

📈 **Momentum**:

🟡 RSI Daily: 46.7 (Neutral)

🟥 Volume: 0.4x last week = 🚨 Weak participation

🟢 Options Flow: Bullish (C/P Ratio = 1.42)

🌤️ VIX: Low (15.4) → Low volatility = 💰 opportunity

🔍 **Model S

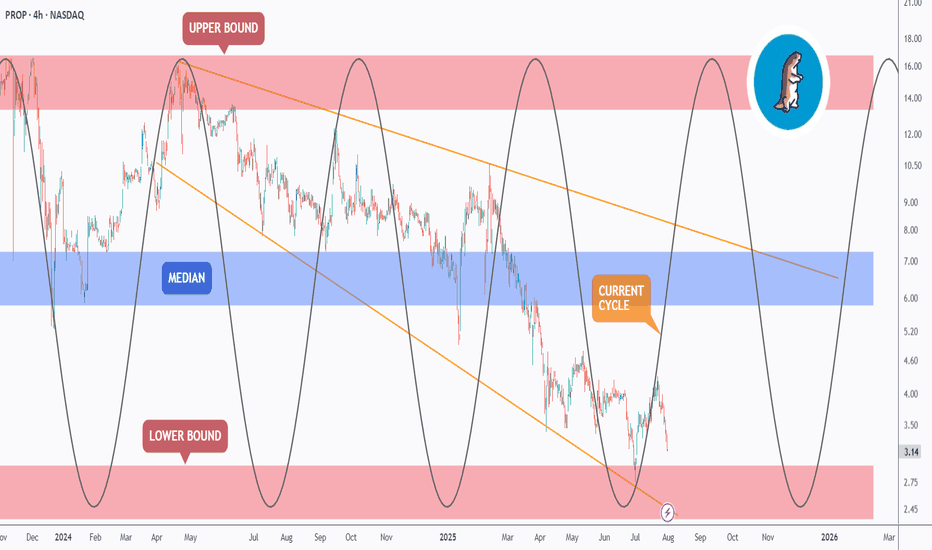

PROP - Riding the Cycle? The Next Wave May Just Be Starting!Markets move in cycles; and PROP is no exception.

If you’ve been following our previous analyses, you’ll recognize the accumulation zone we highlighted earlier. Well, this updated chart adds another layer: the cyclical rhythm of price action.

🔁As shown, PROP has been moving in clearly defined wa

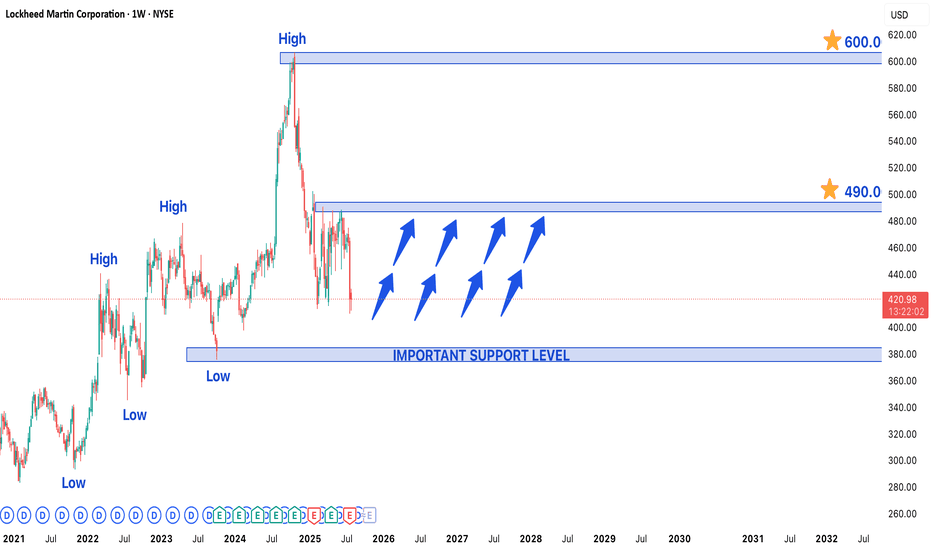

Lockheed Martin Stock in Bullish Trend - Key Levels to watchLockheed Martin (LMT) Stock in Strong Bullish Trend - Key Levels to Watch

Lockheed Martin's (LMT) stock is currently exhibiting a well-defined bullish trend, trading near a recent higher low that may serve as a crucial support level for the next upward move. The defense giant continues to benefit f

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activePre-market gainersPre-market losersPre-market most activePre-market gapAfter-hours gainersAfter-hours losersAfter-hours most activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksPink sheetOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Aug 4

WATWaters Corporation

Actual

—

Estimate

2.94

USD

Aug 4

LLoews Corporation

Actual

—

Estimate

—

Aug 4

CNACNA Financial Corporation

Actual

—

Estimate

0.97

USD

Aug 4

FRPTFreshpet, Inc.

Actual

—

Estimate

0.10

USD

Aug 4

IDXXIDEXX Laboratories, Inc.

Actual

—

Estimate

3.30

USD

Aug 4

ENREnergizer Holdings, Inc.

Actual

—

Estimate

0.62

USD

Aug 4

BCRXBioCryst Pharmaceuticals, Inc.

Actual

—

Estimate

0.01

USD

Aug 4

BRKRBruker Corporation

Actual

—

Estimate

0.41

USD

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Technology Services | ||||||||

| Electronic Technology | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Retail Trade | ||||||||

| Consumer Non-Durables | ||||||||

| Producer Manufacturing | ||||||||

| Energy Minerals | ||||||||

| Consumer Services | ||||||||

| Consumer Durables |