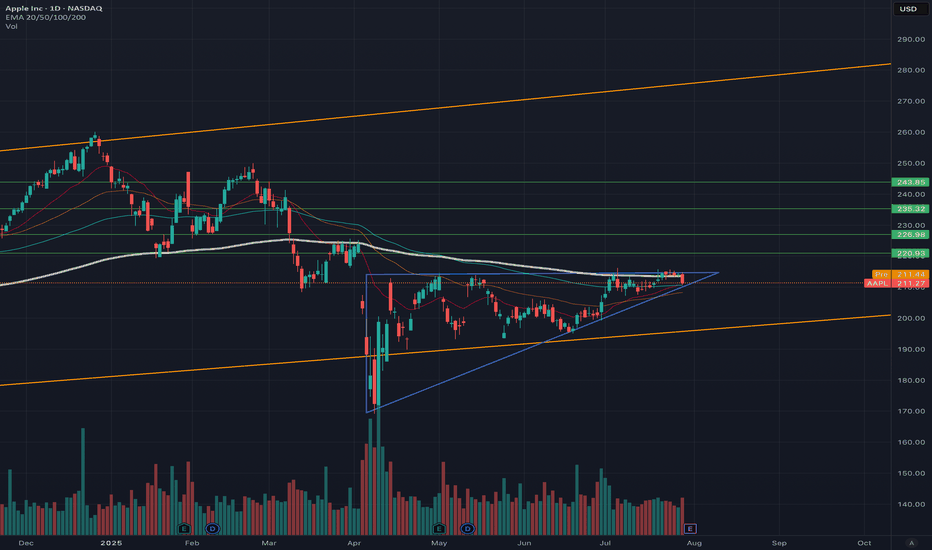

Ascending Triangle APPLE! Could be a big move up soon?!Very short technical idea. Apple could be forming a massive Ascending Triangle Pattern, which would be super bullish for this Magnificent 7 stock. It could also be looking to break soon!

It's a bullish continuation pattern, which usually indicates that an existing upward trend will persist once the pattern is completed.

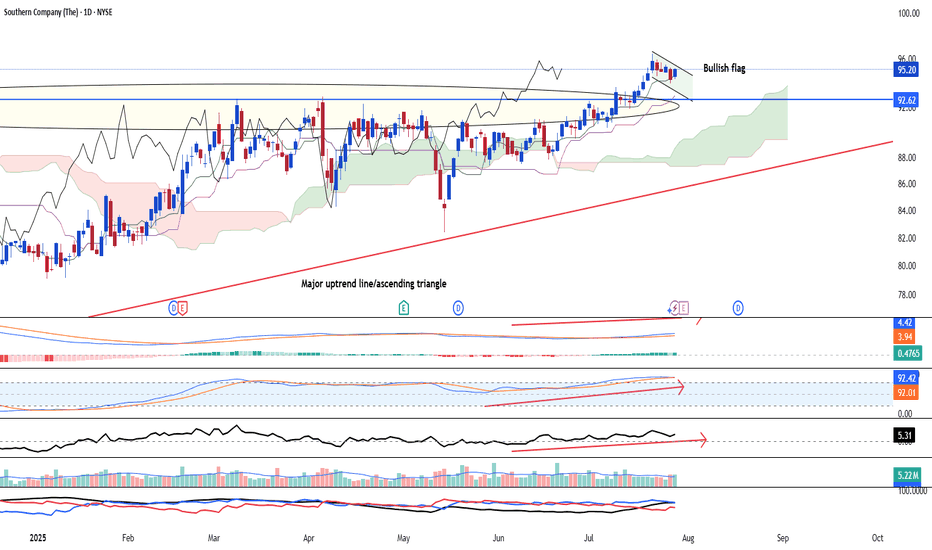

Southern Company - Bullish trend remain strong and sturdySouthern Company NYSE:SO uptrend remain intact and after breaking above the ascending triangle, the stock's uptrend has been cemented. Currently, the bullish flag is likely coming to past after a bullish candle was seen opening higher and above the 9-period conversion line of the ichimoku.

This stock is definitely a trend-following darling. Volume remains steady, long-term MACD is positive and signal line has been on a steady rise.

Strategy:

Buy spot @ 95.20 OR buy stop above 96.00. Buy limit @ 92.05 in the event of a correction.

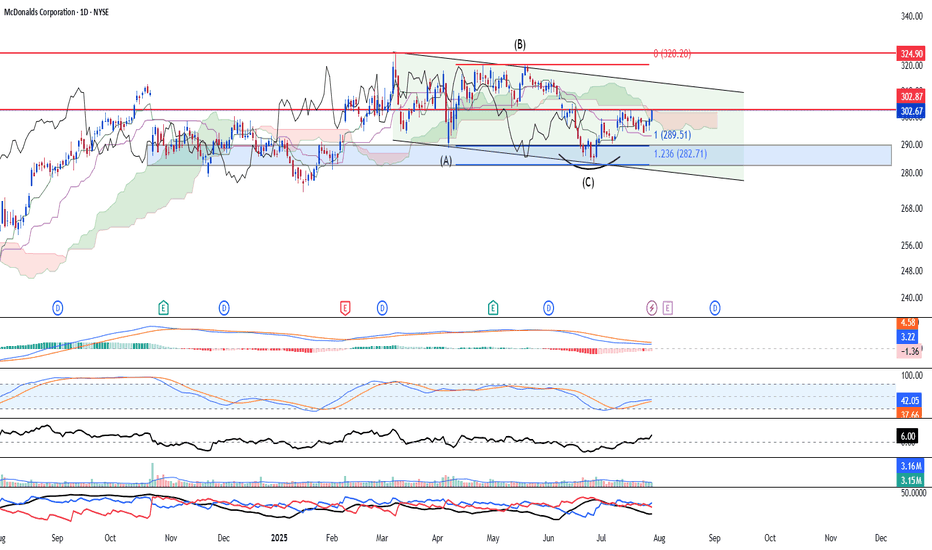

MCD - Expanded flat likely completed Mcdonald's NYSE:MCD is looking at a resumption of the uptrend after price action indicates a strong bullish rebound at 123.6% extension of wave A-B (US$282.71). We believe further upside is likely to continue as Stochastic has shown clear oversold confirmation signal. Volume is also in a healthy position.

Strategy

Buy spot @ 302.67 or buy stop above 303.00. Limit buy @ 286.04 support in the event of a correction.

1st Target is at 311.50 (Est 1 month)

2nd Target is at 341.00 (Est 2-5 months)

3rd Target is at 360.00 (6 months and beyond)

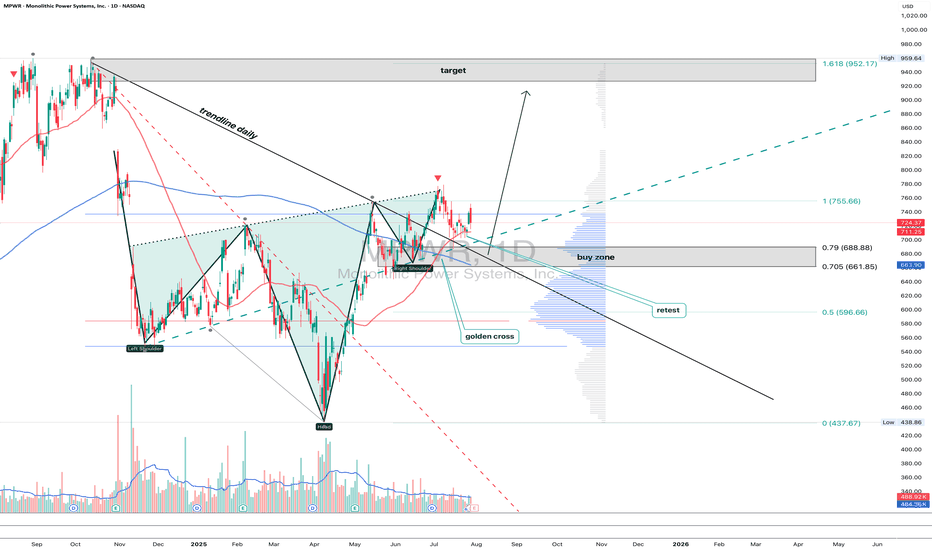

MPWR 1D: shoulders are squared and the battery's still fullMonolithic Power Systems broke out of a long-term descending trendline after completing a clean inverse head and shoulders. Now the price is pulling back into the 705–688 zone — a textbook retest area that combines the neckline, the 0.705–0.79 Fib levels, and a major volume shelf. Add to that a golden cross (EMA50 crossing EMA200 from below) and we have a solid technical foundation for continuation. Volume on the pullback is low, indicating no panic, just rotation. If 688 holds, the next levels to watch are 755.66 and 952.17 — the latter being the 1.618 Fib extension. Tactical setup: look for a reversal signal between 705–688, with a stop just below 661. As long as price holds this zone, the bullish structure remains intact.

Fundamentally, MPWR remains one of the strongest names in the semiconductor space. With over $1.5B in annual revenue and industry-leading margins, the company continues to see strong demand from data center and EV sectors. In its latest report, management highlighted accelerating orders from Tier‑1 manufacturers. The balance sheet is clean, with zero debt, and ongoing buybacks provide downside support. In a sector full of volatility, MPWR stands out with both structural reliability and technical clarity - making it a strong candidate for long-term positioning.

If this textbook pattern plays out, the train’s just leaving the station. The best seat is usually the one taken before the doors close.

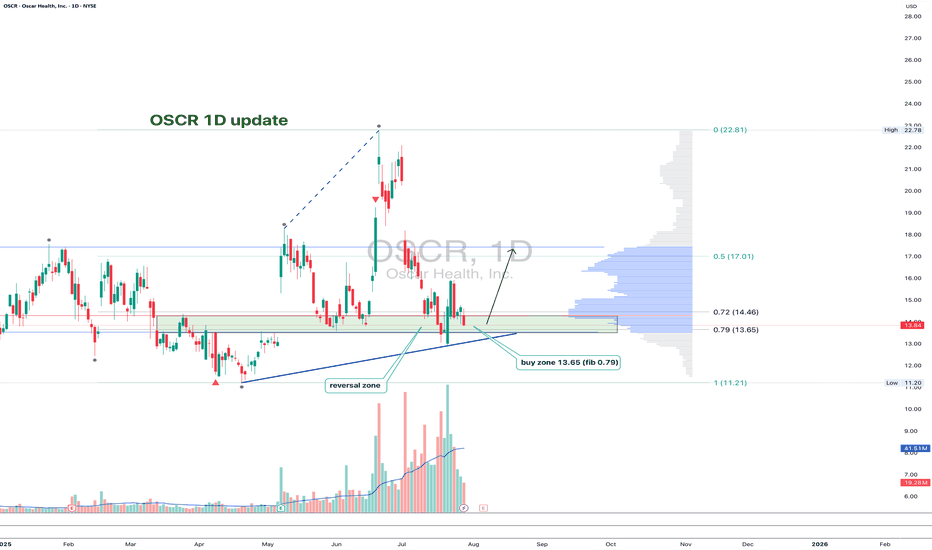

OSCR: back to support and now it’s decision timeAfter the recent impulse move, OSCR has pulled back to a key support zone around 13.65. That area aligns with the 0.79 Fib retracement, a horizontal level from spring, and a rising trendline that has already triggered reversals in the past. The structure is still intact, and buyers are testing the level again. If support holds and we get a bullish confirmation, the next target is 17.01, followed by a potential breakout toward the high at 22.81.

Volume remains elevated, the overall structure is healthy, and the correction is controlled. A break below 13.00 would invalidate the setup - until then, it’s a clean, high-reward zone with tight risk.

Fundamentally, Oscar Health has revised its 2025 guidance: revenue is expected in the $12–12.2B range, with operating losses projected between $200M and $300M. Despite softening topline growth, earnings per share are improving, and investor sentiment has been shifting. Technical strength is also reflected in the recent rise in RS Rating to 93, confirming that the stock is showing relative leadership even as the market cools.

This is one of those setups where both technicals and narrative are aligning - now we just need confirmation from the chart.

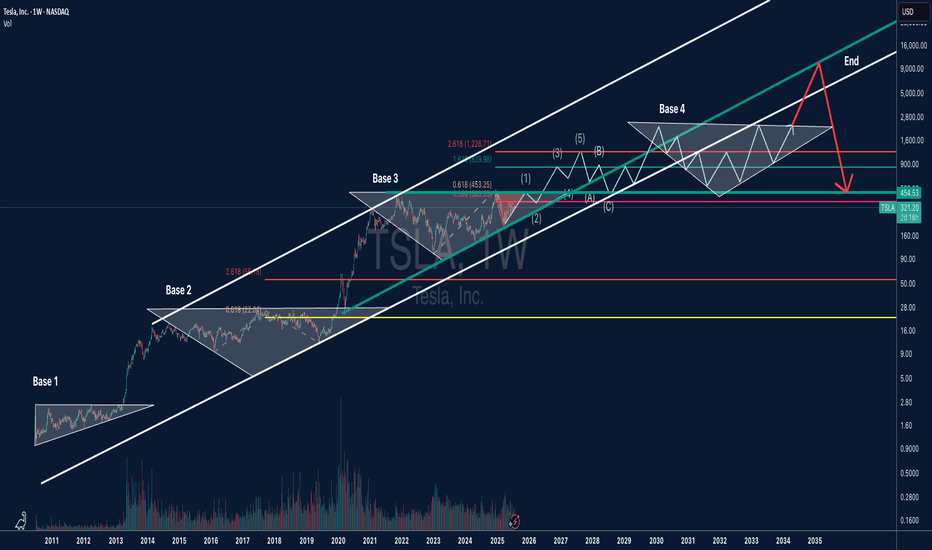

TSLA Long-Term Bold Projection (2025-2035)This is a long-term analysis of Tesla (TSLA) stock on the weekly timeframe, combining Elliott Wave Theory, Fibonacci extensions, and price structure (base formations) within a broad logarithmic trend channel.

Key Highlights:

🔹 Base Formations:

Base 1 (2010–2013): First consolidation before TSLA’s breakout.

Base 2 (2014–2019): A wide triangle structure leading to explosive growth.

Base 3 (2021–2024): Ongoing range suggesting wave (2) correction.

Base 4 (2026–2032): Projected future range before a possible euphoric blow-off phase.

🔹 Elliott Wave Structure:

Current wave count suggests TSLA is finishing wave (2) of a larger 5-wave structure.

Bullish impulse expected with wave (3), (4), and (5) leading to new ATHs, potentially into the $8,000–$10,000+ range.

A corrective ABC phase may follow, bringing price back toward key support (~$450 zone), aligned with Fibonacci retracements and channel support.

🔹 Fibonacci Levels:

0.618 and 2.618 extensions align with historical breakout points and future resistance zones.

Long-term projection targets include $1,226, $4,400, and potentially $8,000+, with eventual reversion to the mean.

🔹 Log Channel:

Price has respected a long-term ascending channel.

Midline and upper resistance bands guide potential future resistance zones.

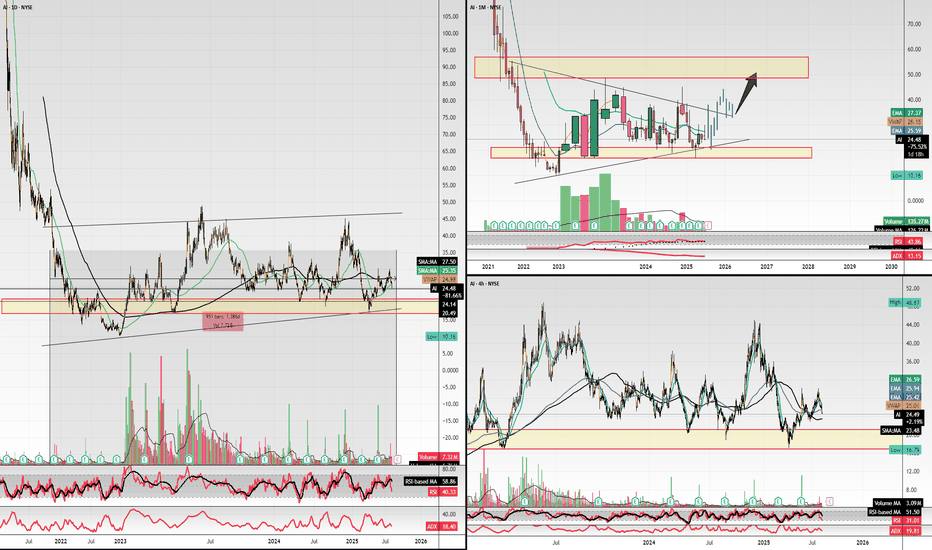

$AI they sleep, i eat. Quiet danger..Hello,

Name has been on my watch for a week or so now, finally just sitting back and getting to a multi analytical chart.

To begin: Yes, I see the head and shoulders pattern forming, scary, I know. Aside from that just zoom out, this name has traded in this range for 1,200 days... the range of $20 to $30 with some bumps in the $40's and low $20's with taps in the teens. This name is quiet, not a loud player like other AI tickers. Something smells fun here. I'm going to be gearing in some $40 calls for 2026. I may risk 20% of my port here. I feel confident in this one, I do. The name is holding good support in the low $20 range and there are a lot more green candles than red. I know other names are getting more attractive like BBAI, you still have SMCI, CRWV, NVDA and so forth, which is fine, means nothing. This was a meme name type of stock about a year ago. I believe this will go on a run towards $50. If you have patience, $50 calls for 2027 would be appropriate and at a fair price for a swing and a possible short squeeze. For those who want to play the shorter term volatility $40 calls for Jan. 2026.

Good luck.

WSL.

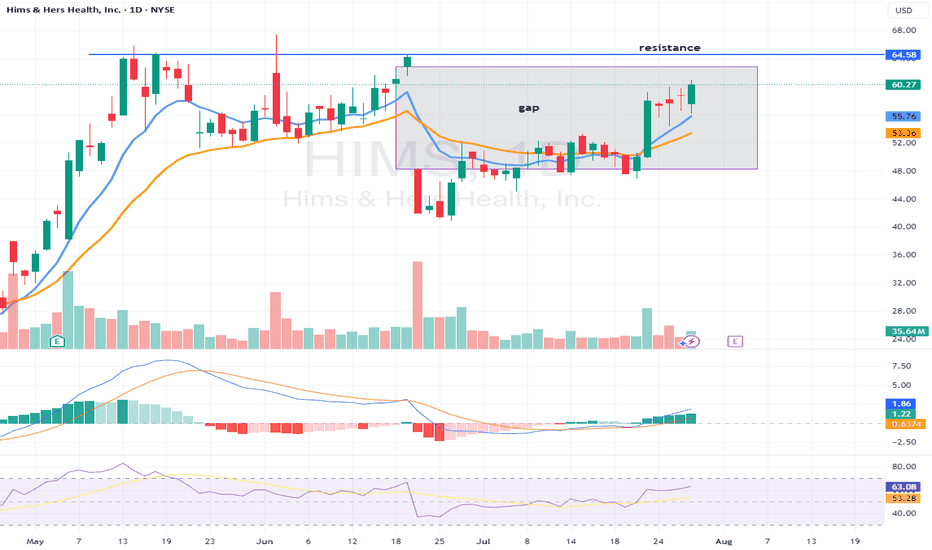

$HIMS - stock going for gap fill plus key resistance level. HIMS - Stock on the way to gap fill to $62.96. calls added in the group. Stock has been failing to hold after breaking $65 level. ON high watch if that level breaks for a move to the upside. Company to report earnings next week. Could see a move towards $65 pre earnings.

BP Breakout in Motion! – Triangle Sends a Signal”

📈 Trade Snapshot:

BP breaks above resistance with rising volume, forming higher lows on a clean ascending triangle. Breakout above $32.96 opens the door toward $34.04.

🎯 Setup Details:

→ Entry: $32.96

→ SL: ~$32.30

→ Target: $34.04

→ Resistance to clear: $33.47

📌 Pattern strength + structure breakout = potential momentum run.

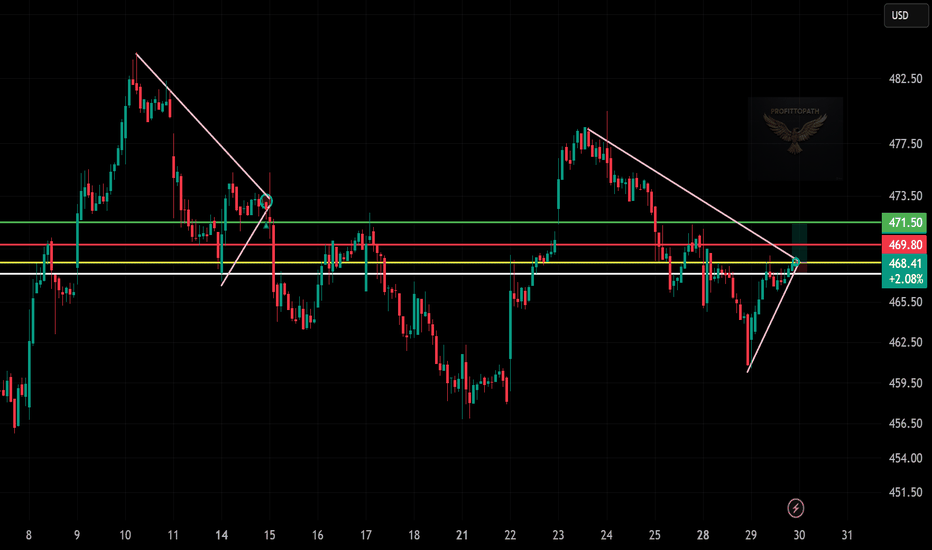

NH SWING TRADE IDEA (2025-07-29)

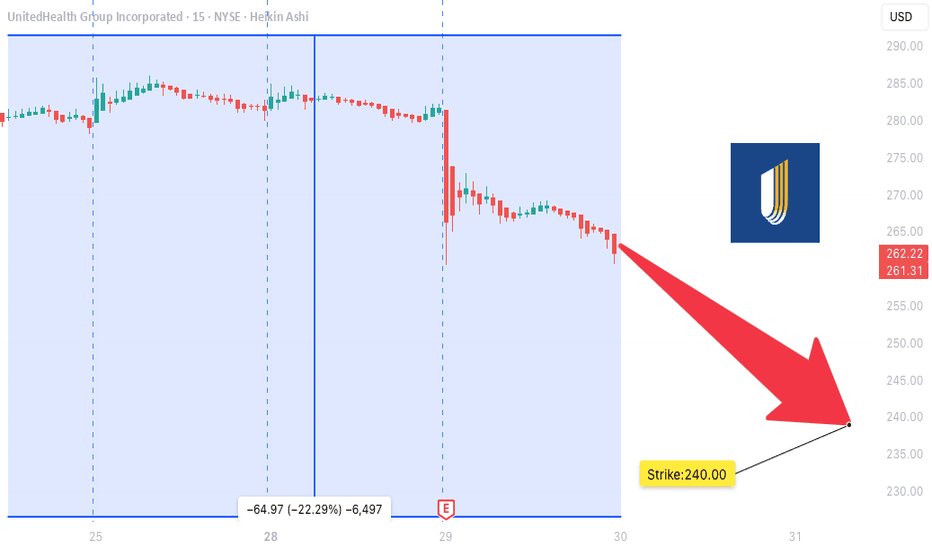

### 🩻 UNH SWING TRADE IDEA (2025-07-29)

**UnitedHealth Group – Bearish Setup**

📉 **Sentiment:** Moderately Bearish

📊 **Daily RSI:** 28.9 (Oversold!)

📉 **Momentum:** 5D/10D bearish

🔇 **Volume:** Weak (1.0x avg = low conviction)

💬 **Options Flow:** Neutral (C/P = 1.00)

🌬️ **VIX:** 15.71 — calm, tradable

---

### 🔻 Trade Setup

* **Play Type:** Naked PUT

* **Strike:** \$240.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.85

* **Target:** \$1.35

* **Stop:** \$0.60

* **Risk Size:** 1 contract

* **Entry Timing:** Market Open

* **Confidence:** 75% 📉

---

### 🤖 Model Consensus (5 Models)

✅ All agree: **Bearish RSI + Downward Momentum**

⚠️ Disagree on *strength* of the trend: moderate vs strong

💡 Models: Claude, Grok, Gemini, LLaMA, DeepSeek

---

### ⚠️ Key Risks

* Neutral options flow = no crowd confirmation

* Weak volume = price may stall or fake out

* Watch for VIX spikes — could flip sentiment fast

---

### 🔎 Summary for Swing Traders

**UNH \$240P → \$0.85 → \$1.35**

🧠 RSI confirms downside

⛔ Low volume = trade light, manage risk

📅 Target expiry: Aug 15

🧲 Key level: \$247.13 — if broken, ride lower

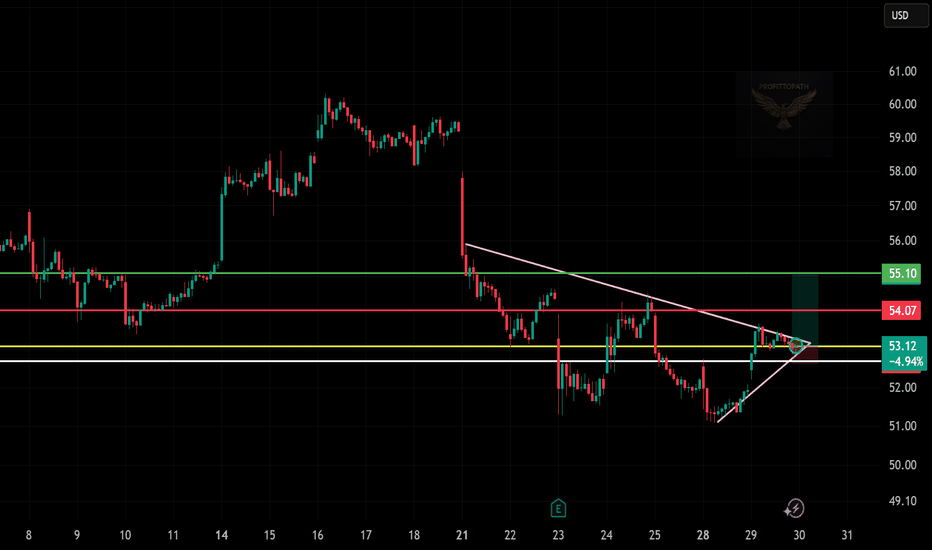

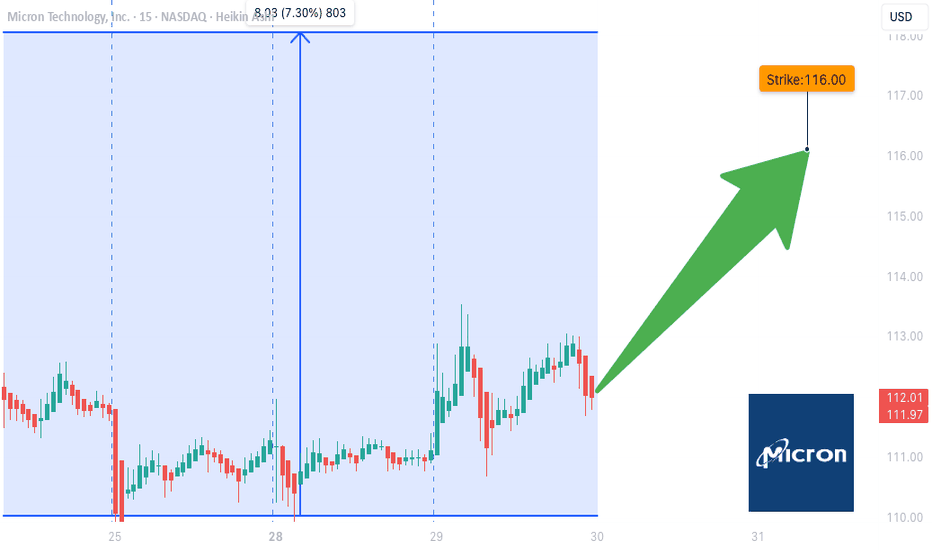

MU WEEKLY TRADE IDEA (2025-07-29)

### 🚀 MU WEEKLY TRADE IDEA (2025-07-29)

**Micron Technology (MU) – Bullish Call Play**

🔹 **Sentiment:** Moderate Bullish

🔹 **C/P Ratio:** 2.91 (Bullish Flow)

🔹 **RSI (Weekly):** 53.6 📈

🔹 **Volume:** Weak (⚠️ caution — low conviction)

---

### 🎯 Trade Setup

* **Strike:** \$116.00

* **Type:** CALL (LONG)

* **Expiry:** 2025-08-01

* **Entry:** \$0.62

* **Target:** \$0.89

* **Stop:** \$0.31

* **Risk:** 2–4% of account

* **Confidence:** 65% 🧠

* **Entry Timing:** Market Open

---

### 🤖 Multi-Model Consensus

5 AI Engines Agree:

✅ Buy \$114–\$116 Calls

🧠 Models: Grok, Gemini, Claude, Llama, DeepSeek

📉 Main Risk: Weak volume divergence despite strong options flow

---

### ⚠️ Key Notes

* 📊 Institutional call buying ✅

* ⚠️ Low volume = reduced confirmation

* 🎯 Play is short-dated — gamma spikes expected

* 💥 Manage exits actively near target zones

---

### 🧠 Quick Recap (for speed-readers)

**MU 116C ➜ \$0.62 → \$0.89**

💥 Weekly flow supports upside

⚠️ Volume = weak, but RSI rising

⏱️ Hold short-term with stops

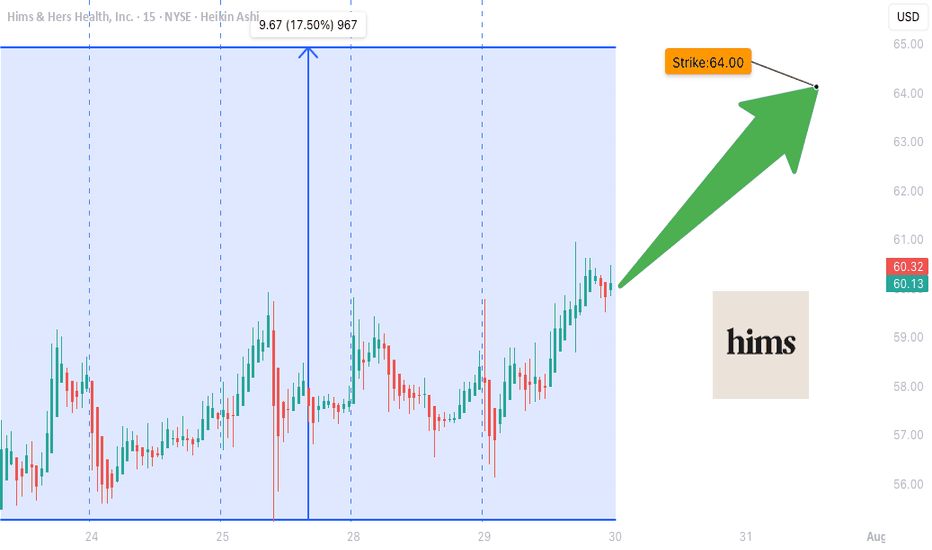

HIMS WEEKLY TRADE IDEA (7/29/25)*

**💊 HIMS WEEKLY TRADE IDEA (7/29/25)**

**🔥 Bullish Flow + Rising RSI + Institutional Volume**

**📈 Trade Setup**

• **Stock**: \ NYSE:HIMS

• **Direction**: CALL (LONG)

• **Strike**: \$64.00

• **Entry**: \$0.92

• **Target**: \$1.38

• **Stop**: \$0.46

• **Size**: 2 contracts

• **Expiry**: Aug 1, 2025 (3DTE)

• **Confidence**: 80%

• **Entry Timing**: Market Open

---

**🧠 Why This Trade?**

✅ **Call/Put Ratio = 1.37** → Bullish sentiment

✅ **RSI Daily: 65.2 / Weekly: 61.3** → Momentum building

✅ **1.8x Weekly Volume Surge** → Institutional accumulation

✅ **\$64C OI = 2,616** → High liquidity + interest

⚠️ **Gamma Risk + Fast Decay** → Time-sensitive play

---

**🎯 Strategy**

→ Play the momentum spike into expiry

→ Exit quickly on profit target or 50% stop

**#OptionsTrading #HIMS #SwingTrade #EarningsPlay #TradingViewSetup #FlowTrade**

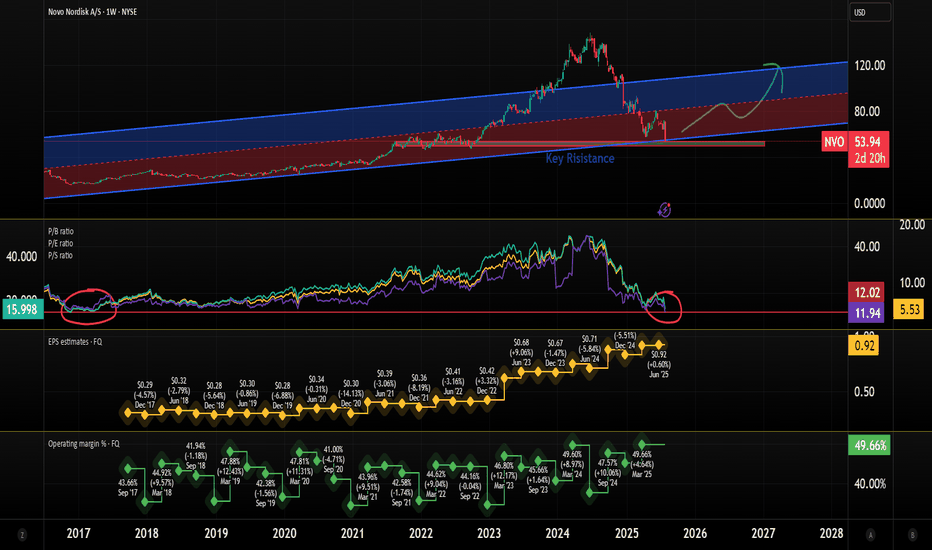

Is Novo Nordisk a buy? Novo Nordisk $NYSE: NVO plummets 22% on July 29, wiping out $57.5B in market value!

Here's what's happening and how I see it.

Here’s the breakdown on why the stock hit its lowest since Nov 2022:

Slashed 2025 Guidance: Sales growth cut to 8–14% from 13–21%, operating profit to 10–16% from 16–24%. Weak U.S. demand for Wegovy & Ozempic, plus competition from cheaper compounded GLP-1 drugs (i.e. grey market), cited as key issues.

CEO Shake-Up: Lars Fruergaard Jørgensen out, Maziar Doustdar in as CEO effective Aug 7. Investors worry Doustdar’s limited U.S. experience could hurt Novo’s edge in its biggest market (57% of sales).

Competition: Eli Lilly’s Zepbound (20.2% weight loss vs. Wegovy’s 13.7%) & Mounjaro are stealing market share. Compounded GLP-1s from Hims & Hers add pricing pressure.

Here's what I see:

There's a strong bearish sentiment, but the stock is very underpriced.

Considering the current stock price, EPS is at an all-time high. This means investors get more earnings for their stock.

P/B, P/E, and P/S ratios are at the lowest level since 2017! This is despite revenue growth of 25%+ for 3 consecutive years.

Operating margins are still quite healthy.

The company still has a very significant share (over 50%) of the GLP1 drugs worldwide.

The valuation of this company is now at the best level of the last 7-8 years.

There might be more volatility ahead, but I see the recent price drop as an opportunity to buy a pharma giant at a big discount, giving investors a margin of safety.

Quick note: I'm just sharing my journey - not financial advice! 😊