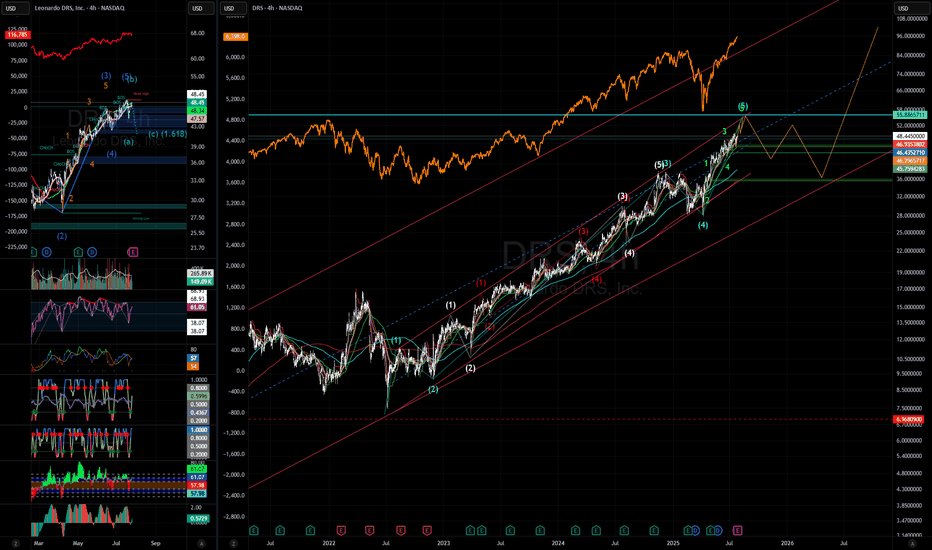

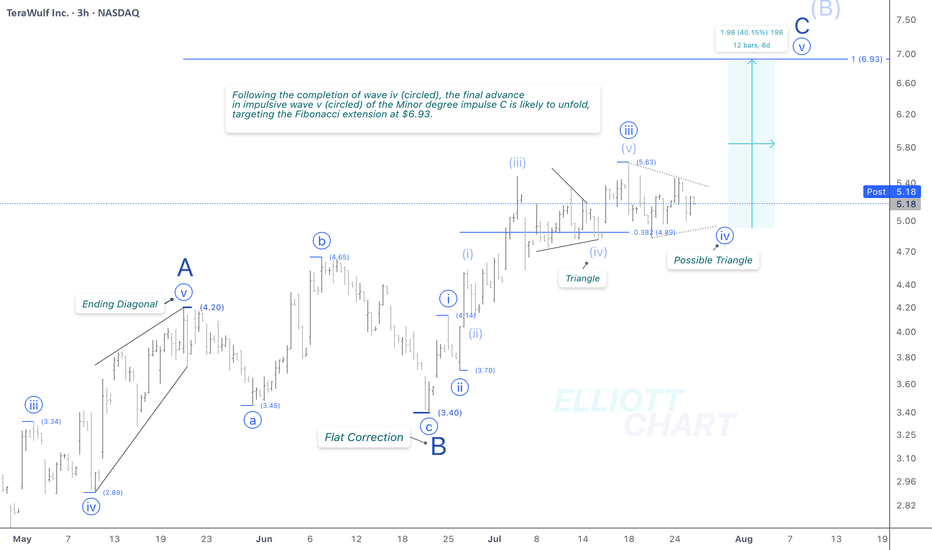

WULF / 3hWave Analysis >> While the overall outlook on NASDAQ:WULF remains consistent with the previous analysis, the ongoing sideways volatility suggests a need to reassess the wave count on the final stages of Minor degree impulsive advance in wave C.

The Fib extension target remains intact >> 6.93

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

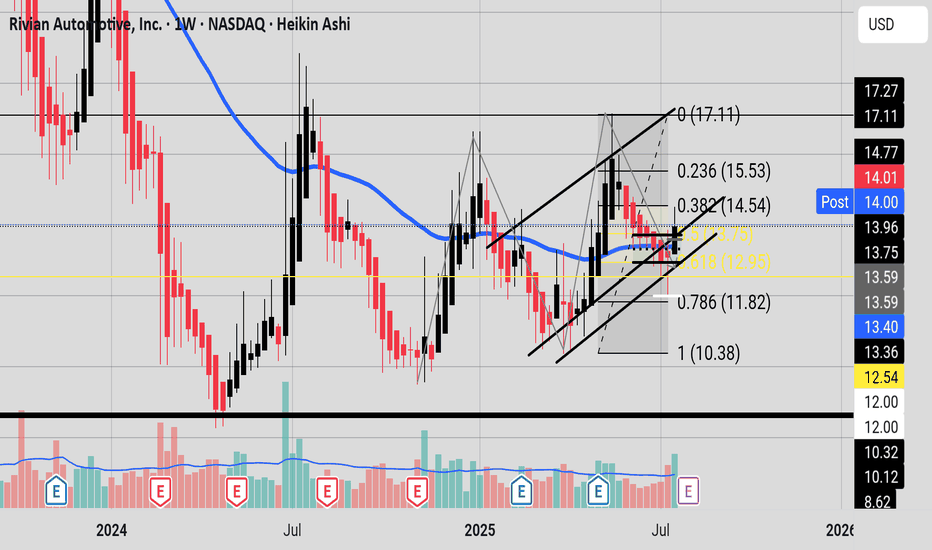

Heiken Ashi CandlesThis week Heiken Ashi candle gave a bullish close above the DOJI Heiken Ashi candle from last week. RSI is above 50. MACD (Chris Moody) look like it may have a bullish cross over soon. Stochastic RSI is getting ready to curl up. What do you think team? do you think the bulls maybe entering their season? Next few days are going to be interesting. If the buyers and investors can maintain the parallel structure the asset will go bullish however if it breaks it, the bears will celebrate. Keep your eyes on the Fibonacci levels, bulls want to see movement toward 14.54 and out of the Fibonacci golden zone.

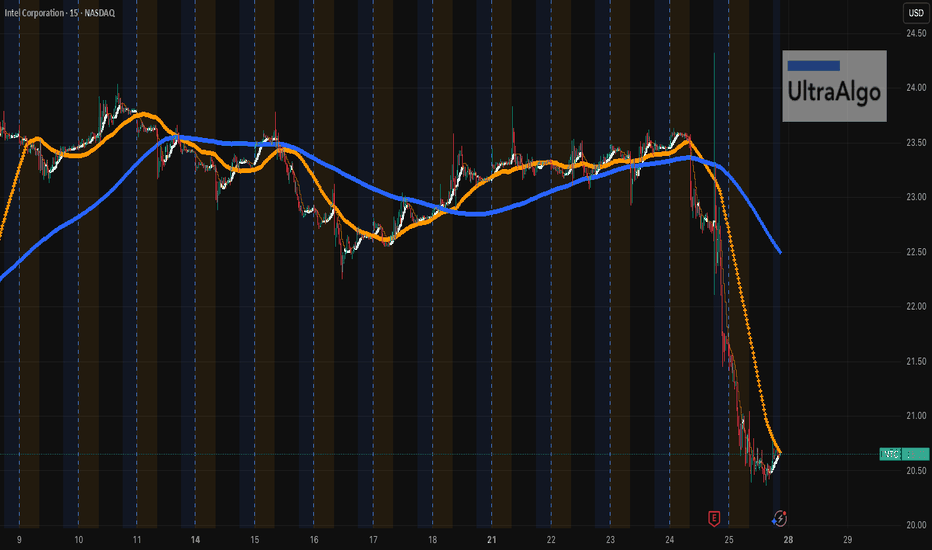

$INTC Got Smacked. Relief Bounce or Trap?Yikes. NASDAQ:INTC just faceplanted from $23.50 straight down to $20.50. It’s peeking its head up now. If you’re playing the bounce, be nimble — this thing’s still bleeding on the higher timeframes. Don't get in unless you see more pickup and buy signal.

UltraAlgo caught the drop early. If it crosses $20 could go down deeper.

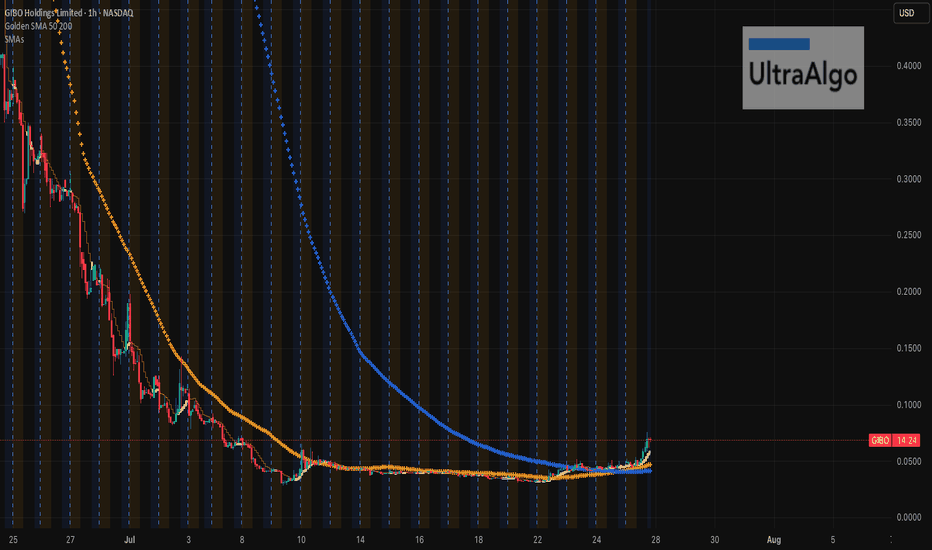

$GIBO Finally Woke Up…MaybeNASDAQ:GIBO has been on life support for weeks, just bleeding out with zero pulse. But looks like someone finally shocked it back to life with that BUY trigger flashing. If this isn’t a dead cat, we might see a nice pop. Just remember to get out while in profit! Still, don’t be the last one holding the bag.

UltraAlgo caught the early buy signal… first green glimmer we’ve seen in a bit. Keep it in the back pocket.

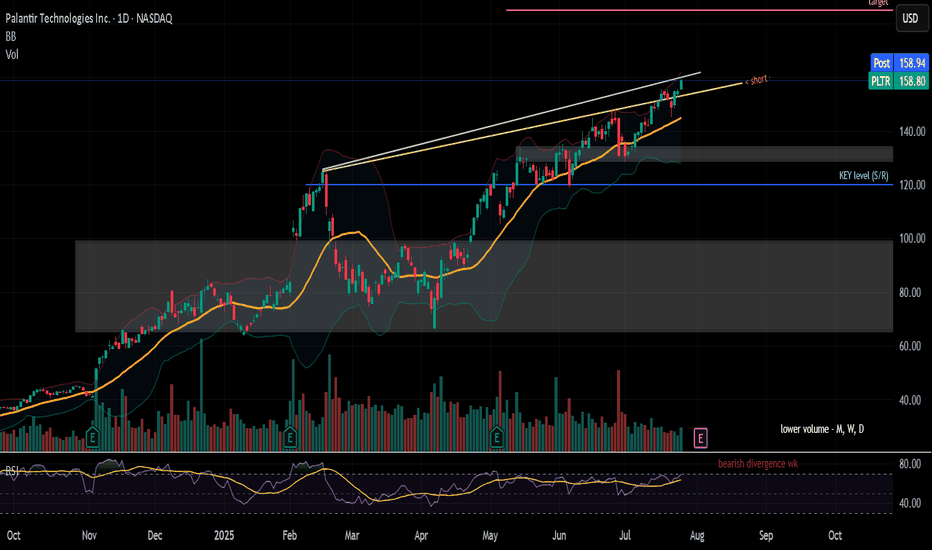

PLTR is doing it... pullback honeyThis video has my thoughts about PLTR and a trading view tip... the data window!!! Who knew?

Hope the talk inspires you as you decide on future investments; especially when it's stalling or pulling back.

My short term bias is bearish for a pullback on PLTR. Not sure when it will happen, but <155 is my trigger to see what I see.

What do you see?

**>162... slow your roll to see if 160 holds.

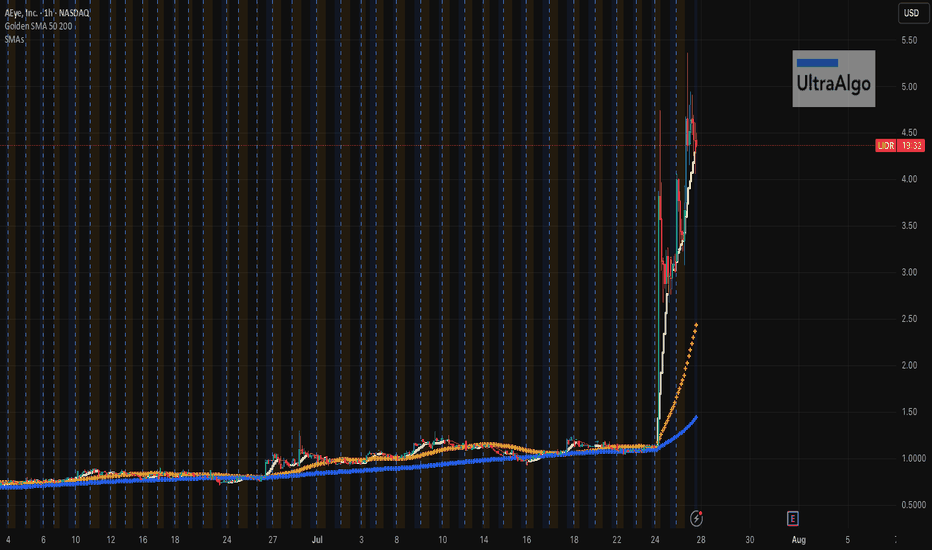

$LIDR Breakout Fueled by Ultra Bull...but it will likely fall NASDAQ:LIDR just unleashed a massive breakout from months of tight coiling — and it all sparked off an Ultra Bull signal near $1.00. Momentum exploded with back-to-back green surges, turning this sleeper into a rocket. Have a strong feeling that this will fall hard (just like every other time). Maybe pick-up on the way down as this spike will likely happen soon! Keep this puppy in your favs!

UltraAlgo flagged 3 Ultrabulls before the spike....it's too expensive now, but def one time keep an eye on X3-4!

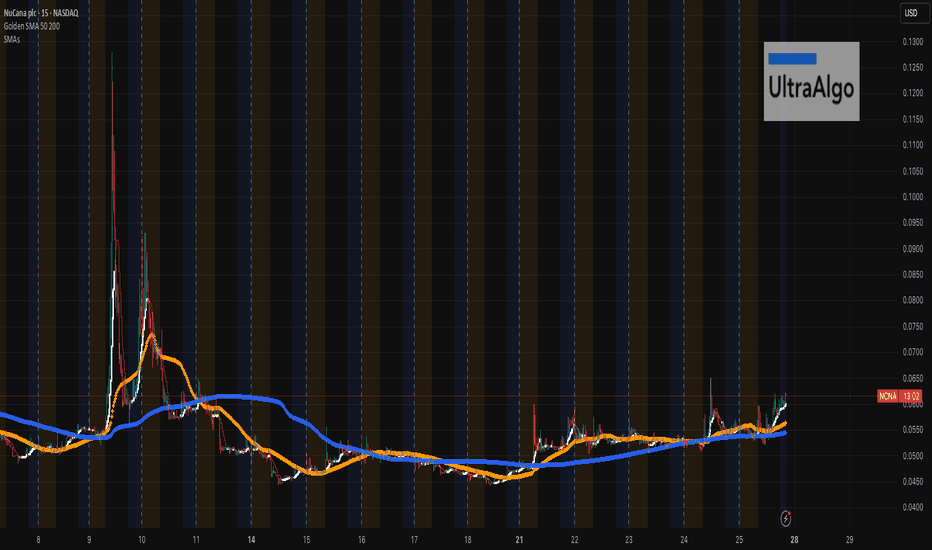

$NCNA Breakout Fueled by Ultra BullNASDAQ:NCNA just snapped out of its low-volume drift with a clean breakout after dual Ultra Bull signals stacked near consolidation support. Prior Ultra Bull triggers delivered explosive upside — could history repeat? Momentum’s building fast — keep it on your radar.

UltraAlgo flagged it early – super easy to track setups like this. Spike (buy) in the works. Not a fan of penny stocks, but if you get into this one use trailing stop loss!

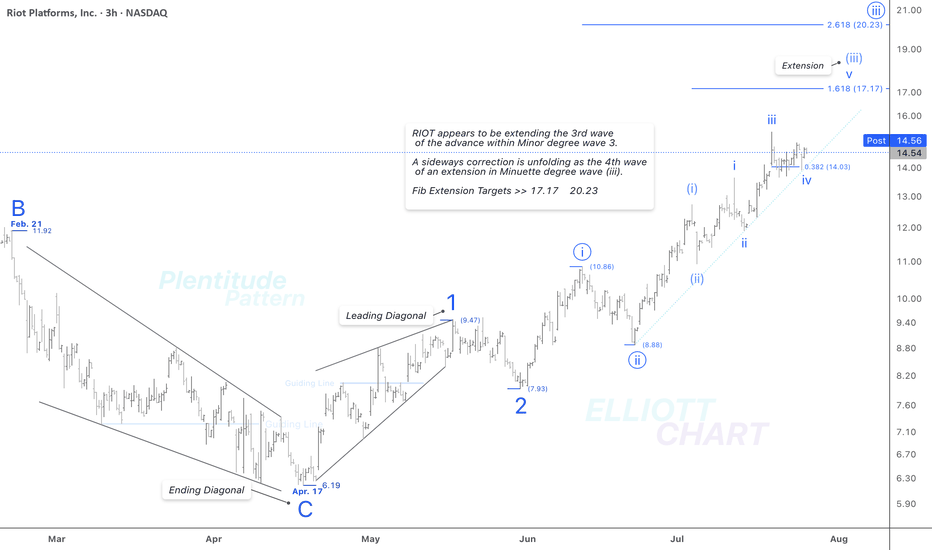

RIOT / 3hAs illustrated on the 3-hour chart above, NASDAQ:RIOT appears to be extending the third wave of an impulsive advance within Minor degree wave 3.

And as anticipated, a sideways correction is unfolding as the fourth wave of the ongoing extension in Minuette degree wave (iii).

Fib Extension Targets >> 17.17 & 20.23.

>>> In this timeframe, I'm analyzing the initial rising tide within the ongoing Intermediate degree wave (1), where a nested series of waves have quite well revealed: 1, 2 → i (circled), ii (circled) → (i), (ii) → i, ii. The extreme high of this impulsive sequence lies beyond the visible range of the current chart.

NASDAQ:RIOT CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

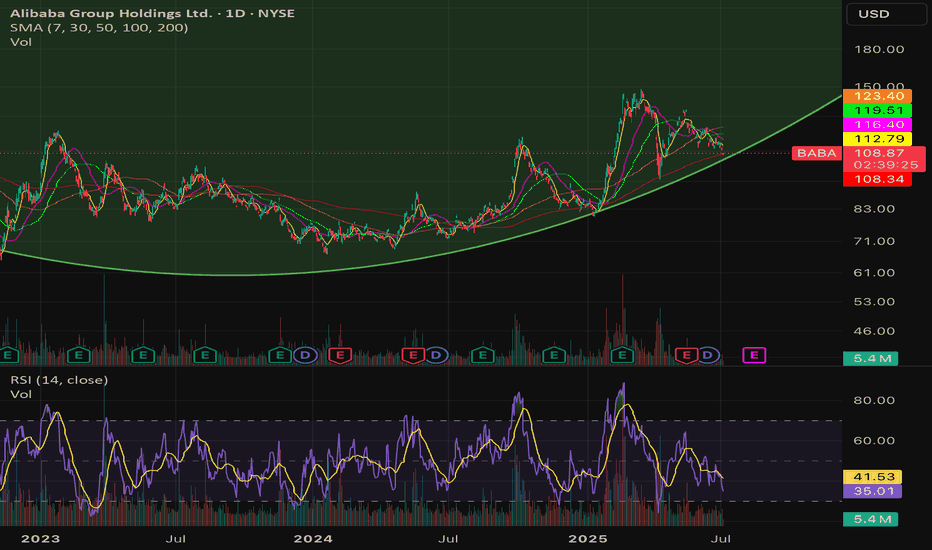

Long $BABA - NYSE:BABA is testing 200 SMA

- NYSE:BABA moves are explodes higher then cools then retest support then explodes higher than the last high. It's called trading with higher wavelength

-> Move 1: Started April 2024 when the trend reversal started. $68 -> $89 with around +30% then retraced $90 -> $72 ( -20% )

-> Move 2: July 2024, $72 -> $116 (+61%) then retraced $116 -> $80 ( -31% )

-> Move 3: Jan 2025, $80 -> $146 (+ 82.5%) then retraced $146 -> $108?? ( correction underway ) ~ -26% so far

-> Move 4: Likely from $100-105 to $180-200

2025 Is a Big Year for Bitcoin Miners—Who’s Winning the Hash War

Bitcoin’s resurgence in 2025 has reignited the mining race. The halving came and went, hashprice bounced from the abyss, and a fresh wave of capital is pouring into the space. So we figured: time to catch you up on who’s making real moves and pulling ahead — both in market cap and megawatts.

⚡ CleanSpark (CLSK): The Sharpshooter

If Bitcoin mining were a sport, CleanSpark would be the athlete that trains all year, eats clean, and shows up for every match. No drama, just execution.

In 2025, CleanSpark continues to grow fast — but smart. It’s acquiring distressed sites, upgrading facilities with immersion cooling, and pushing its fleet beyond 50 EH/s. Its Tennessee expansion (a deal scooped up for pennies on the dollar) was classic CLSK: low cost, renewable-powered, and ready to scale.

In Q1 2025, CleanSpark posted $162.3 million in revenue, up a blistering +120% YoY, and delivered $246.8 million in net income, or $0.85 per share. It's one of the few miners that’s profitable and expanding — at the same time.

The stock is up 25–30% YTD, trading around $12. While it’s been volatile like the rest of the sector, CLSK remains the benchmark for cost-effective, execution-focused Bitcoin mining. If you’re looking for a fundamentals-backed growth story, this is it.

🏗️ Iris Energy (IREN): The AI-Ready Dark Horse

Iris Energy may have flown under the radar in past cycles, but in 2025 it’s turning heads — not just because of Bitcoin, but because of data infrastructure.

While IREN runs a lean BTC mining operation powered by 100% renewable energy in Australia and Canada, the real story is its pivot toward modular data centers. It’s one of the few miners actively positioning itself for GPU workloads and AI compute as a hedge against mining volatility.

The upside? Flexibility. If BTC mining margins compress again, IREN has the facilities and roadmap to reconfigure its power-hungry machines for AI hosting. The market likes the optionality. The stock’s up ~70% this year and may still be cheap if the data center thesis catches on.

🔥 BitFuFu (FUFU): The Challenger

BitFuFu came in hot after its 2024 IPO — vertically integrated, Bitmain-backed, and global from day one. It’s the largest cloud mining provider in the mining space. It provides cloud mining, sells miners, hosts them, runs its own mining pool (BitFuFuPool), and operates a global fleet clocking over 36 EH/s under management.

While others focused on HPC & AI business, BitFuFu doubled down on mining scale and infrastructure. It aims to own over 1 GW of power capacity and launched its own mining operating system.

The post-halving reality has been rough. Q1 2025 revenue came in at $78 million, down 46% YoY, with self-mining revenue dropping 70.7%. But the company has a track record of being profitable every year since founded, plus its P/S is only 1.6, well below other mining giants such as Mara and Riot.

Watch this one. Especially if BTC pushes above $150K.

🐋 Marathon Digital (MARA): The Goliath, Still Standing

Marathon is the largest public miner by market cap — and has been the face of institutional mining exposure for years. It’s also the most debated name in the game.

On one hand, MARA controls a monster fleet with over 75 EH/s expected by year-end, global mining operations from the U.S. to the UAE, and a budding software business for managing hashrate.

On the other, critics argue it’s bloated, overly reliant on third-party infrastructure, and too slow to pivot in a fast-moving landscape.

Still, when Bitcoin’s hot, Marathon runs. The company holds a large BTC treasury of over 50,000 BTC, is adding immersion-cooled sites, and remains a proxy trade for many traditional investors wanting in on mining without picking niche plays.

Love it or hate it, MARA isn’t going anywhere. And if BTC moons in Q4, it’ll be one of the first tickers to feel the heat.

🧊 Cipher Mining (CIFR): The Quiet Killer

Cipher isn’t flashy. It doesn’t dominate headlines or make bold predictions. What it does do: mine Bitcoin efficiently, at low cost, with minimal dilution and maximum discipline.

Based in Texas, CIFR locked in long-term power contracts at enviably low rates and steadily grew its fleet past 13.5 EH/s. It has some of the best cost-per-BTC metrics in the industry and avoids unnecessary spending or debt.The Texas-based miner produced 602 BTC in Q1, and benefits from low power contracts and disciplined growth.

The market loves it: CIFR is up ~35% YTD, trading at $6.52. It’s becoming a favorite among investors who want hash exposure with less volatility and more transparency. The monthly production updates are clear, consistent, and confidence-building.

👀 Trends to Watch in H2 2025

1. Hashprice Rollercoaster: Hashprice (BTC earned per TH/s per day) has bounced from $39 post-halving lows to nearly $60. If BTC rallies again, miners with fixed-cost power will reap the upside.

2. GPU Hosting Pivot: With AI demand surging, some miners are repurposing infrastructure to host GPUs — think IREN.

3. M&A Season: Expect smaller players with weak cash flow to get scooped up.

4. Regulatory Shifts: Crypto Week laws passed in the U.S. provide more clarity. But ESG pressure and power usage scrutiny will remain part of the narrative.

💭 Final Thought

Bitcoin mining stocks aren’t just about Bitcoin anymore.

They’re about infrastructure. Data. Energy. Efficiency. Optionality. And in 2025, the winners will be those who can balance raw hashpower with strategic foresight.

Whether you’re team CLSK, FUFU, IREN, MARA, or CIFR — the landscape is shifting fast. And with BTC momentum building again, this might just be the beginning.

So — which miner are you backing this cycle?

Tarriff help BGS has built a base at $4. U.S. tariffs = pricier Mexican imports. U.S. producers may gain

less competition, ability to raise prices, potential for better margins and more demand from buyers shifting away from imports. Call flow has seen some interest recently with a 20.47 short float I added JAN 5C at .40. Overall, insiders bought 219,570 shares for $1.7 million and sold 8,000 shares for $67,000 in the last 12 months, indicating net buying activity. These transactions reflect confidence from insiders, particularly Sherrill, whose purchases were significant and pre-arranged under Rule 10b5-1 plans

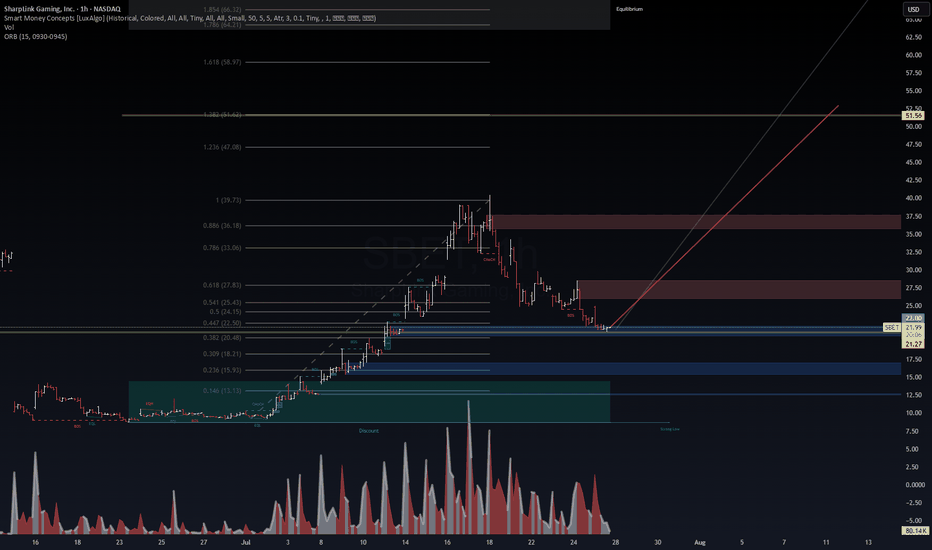

SBET – Holding the Key Zone for a Potential SqueezeSBET – Holding the Key Zone for a Potential Squeeze 🚀🔥

SBET is sitting at a critical support zone (21.0–21.3), right inside the 0.382 Fibonacci retracement. VolanX signals accumulation as volume cools down, setting up for a possible next leg higher.

Key Levels to Watch

Support: 21.0 – 21.3 (Fib 0.382 + structure base) 🛡️

Breakout Zone: 24.8 – 27.8 (Fib 0.5 – 0.618) ⚡

Targets: 33.0 – 36.0 🎯 | Long-term squeeze zone: 51.5 – 64.0 🏆

VolanX Signal

Bullish Bias: As long as 21 holds, liquidity favors upside.

Volume Clue: High spikes suggest prior distribution is cooling, potentially loading for a run.

Momentum Trigger: Close above 24.8 confirms buyers stepping in.

Risk Management

Stop-Loss: 20.4 (below structure) ⛔

Scale Strategy: Add on confirmation above 24.8 and 27.8 to ride the trend.

Profit Zones: 27.8 (TP1) → 33–36 (TP2) → 51+ (runner target).

Question: Are we seeing a base for another SBET explosion or just a pause before deeper discount?

#SBET #Fibonacci #VolanX #TradingView #BreakoutWatch #LiquidityFlow 🚀📊

SBET – VolanX Probabilistic Targets (1–3 week horizon)

For informational/educational purposes only. Not financial advice.

📈 Bullish Paths

P1: Bounce to 24.8–25.5 (Fib 0.5 / structure reclaim) → 58%

Trigger: 21.0–21.3 holds + momentum close above intraday VWAP.

P2: Extension to 27.8 (0.618) / first supply → 38%

Trigger: Clean acceptance >24.8 with rising volume & improving tape.

P3: Squeeze into 33–36 (0.786–0.886 + supply) → 24%

Trigger: Options/flow flip long (OTM calls clustering) + BOS over 27.8.

P4: Parabolic leg to 51.6–64.2 (1.382–1.786) → 10%

Trigger: Narrative + liquidity vacuum (low float + IV expansion).

(Probabilities are conditional—each higher target assumes confirmation of the one before it.)

📉 Bearish Paths

N1: Slip under 21 → 18.2–19.0 (0.309/discount shelf) → 27%

Trigger: Failure to defend 21 with increasing sell volume.

N2: Deeper flush to 16.6 (0.236) zone → 17%

Trigger: Persistent risk-off / liquidity drain, IV spike without demand.

N3: Capitulation toward 13.1 (0.146) / prior demand → 6%

Trigger: Macro shock or failed financing/newsflow, liquidity gap.

🧠 VolanX Read (today)

Bias slightly bullish as long as 21.0–21.3 holds. The engine scores Path P1 > P2 > N1. Expect chop → impulsive move once 24.8 is cleanly reclaimed or 20.4 is lost.

🛡️ Risk Management

Invalidation (swing): Daily close < 20.4.

Sizing: 0.5–1.0% account risk; micro-cap jump risk.

TP ladder: 24.8 ➜ 27.8 ➜ 33–36 ➜ leave runner for 51+.

Adjust: Move to BE after 24.8 reclaim; trail under last 4h HLs.

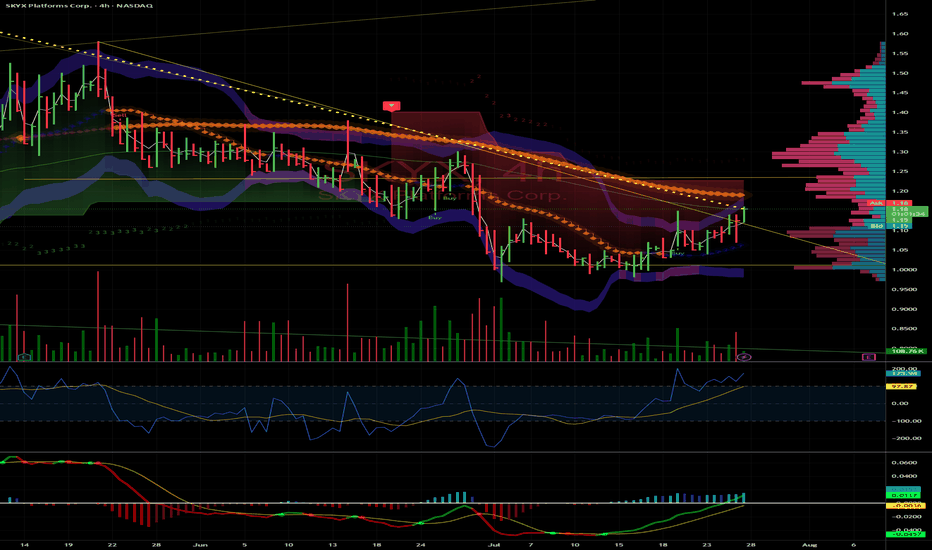

SKYX: Breakout to $1.58 and Potential Triple on Small-Cap Surge

SKYX Platforms Corp. (NASDAQ: SKYX) is primed for a run to $1.58 and could triple to $3.30 by year-end, driven by small-cap strength, e-commerce demand, and strong fundamentals. Here’s why SKYX is a must-watch.

Technicals: Clear Shot to $1.58

Trading at $1.10 , SKYX is coiling for a breakout. Resistance at $1.25 (psychological) and $1.40 (prior high) should fall easily with rising volume and a bullish MACD crossover. $1.58 is achievable by August, with $3.30 (200%+ gain) in sight if momentum holds.

Fundamentals: Smart Home Leader

With 97 patents and 60+ e-commerce websites, SKYX’s plug-and-play smart home platform is gaining traction. Their $3B Miami smart city deal (500,000+ units) and Profab Electronics partnership signal scalability . E-commerce sales, projected to hit $8T globally by 2027 , fuel SKYX’s growth.

Market Tailwind

The Russell 2000, which SKYX joined in June 2025, is breaking out, up 10% YTD . TNA’s 30% spikes amplify this . With a $138.61M market cap and 38 institutions adding shares (e.g., Susquehanna, 478,024 shares) , SKYX is set to ride this wave.

Risks

SKYX isn’t cash flow positive until H2 2025, and Q1 revenue missed ($20.1M vs. $21.15M). Small-cap volatility is a factor, but 12.4% YOY growth and the Russell breakout mitigate risks.The Play

SKYX hits $1.58 soon, clearing $1.25 and $1.40, then triples to $3.30+ by December on e-commerce, smart city deals, and small-cap momentum. I’m buying—thoughts, board?

Summary: Targets: $1.58 near-term, $3.30+ year-end.

Resistances: $1.25, $1.40.

Catalysts: Russell 2000/TNA breakout, e-commerce, smart city deal.

Risks: Cash flow, revenue misses, volatility.

Disclaimer: Not financial advice. Do your own DD. Stocks are volatile.

~Sherwood Coast's Group

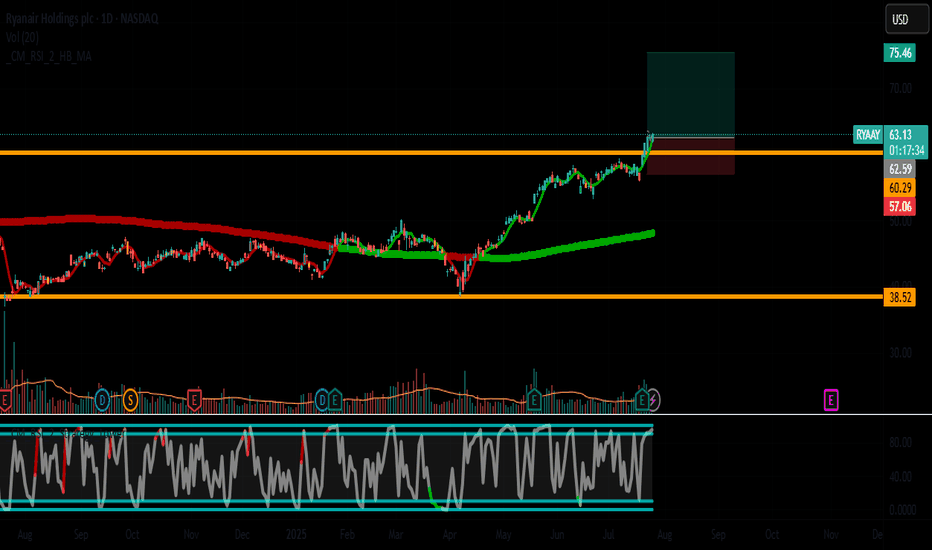

RYAAY (Ryanair Holdings) - Bullish Reversal Play🚀 Trade Idea: RYAAY (Ryanair Holdings) - Bullish Reversal Play

Entry: $63.00 | Stop Loss: $57.00 | Take Profit: $75.50

Risk/Reward Ratio: ~1:2.5

📈 Technical Setup

Trend Structure:

Breaking out from a 3-month consolidation range ($57-$63)

Daily chart shows higher highs forming after basing pattern

20 EMA ($60.50) crossing above 50 EMA ($59.20)

Key Levels:

Support: $57.00 (swing low & psychological level)

Resistance: $63.00 (breakout level) → $75.50 (2024 highs)

Momentum Indicators:

RSI(14): 58 and rising (room to run before overbought)

MACD: Bullish crossover with histogram expanding

Volume: 20% above average on breakout

✈️ Fundamental Catalyst

✅ Strong Summer Travel Demand:

Record Q2 passenger numbers (18.7m, +12% YoY)

Fuel costs stabilizing while fares remain elevated

✅ Valuation Case:

Trading at 12x forward P/E (below 5-yr avg of 15x)

35% EPS growth projected for FY2025

✅ Sector Tailwinds:

Jet fuel prices down 18% from Q1 peaks

EU travel recovery accelerating

🎯 Trade Management

Entry Strategies:

Aggressive: $63.00 (breakout entry)

Conservative: $61.50 (pullback to breakout level)

Profit Targets:

T1: $68.00 (partial 50%)

T2: $75.50 (full position)

Stop Placement:

Hard stop: $57.00 (-9.5%)

Trailing stop: Move to $60 after $68 reached

⚠️ Risk Considerations

Monitor oil prices (key cost driver)

Watch EUR/USD (currency exposure)

Next earnings: August 29 (event risk)

Alternative Scenario:

If $63 holds as resistance, wait for deeper pullback to $60 support

📌 What's Your Take?

Like if you're bullish on airlines! Any other levels you're watching?

#Airlines #Breakout #RYAAY #TravelStocks

(Chart shows clean breakout with volume confirmation. Trade with proper risk management!)

📢 Disclaimer:

This post and the information contained herein are for educational and entertainment purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy/sell securities. Trading stocks, options, and other financial instruments carries substantial risk of loss and is not suitable for all investors.

Do your own research (DYOR) before making any investment decisions.

Past performance is not indicative of future results.

The author may hold positions in mentioned securities at the time of writing.

Always consult a licensed financial advisor before making investment decisions.

By engaging with this content, you agree that you are solely responsible for your own trading decisions.

Trade at your own risk. 🚨

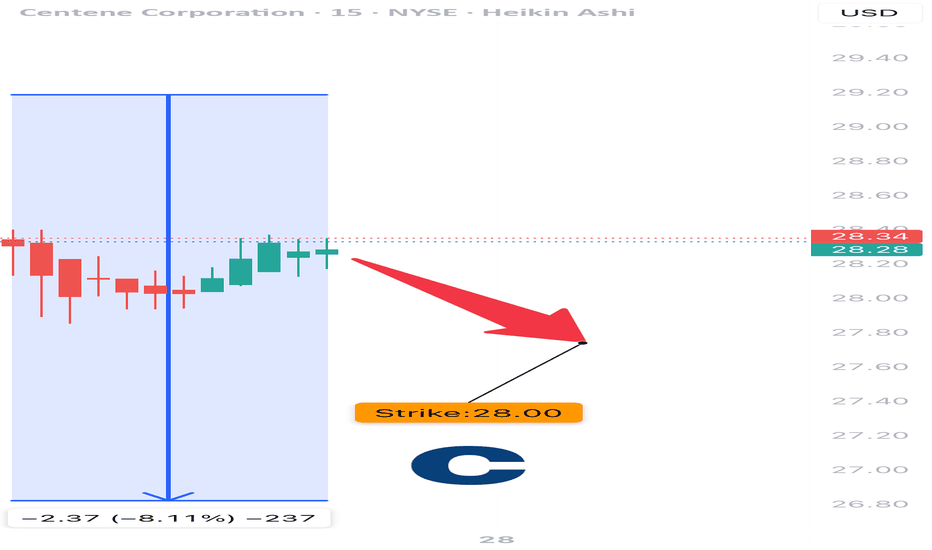

CNC EARNINGS TRADE IDEA – JULY 25, 2025

⚠️ CNC EARNINGS TRADE IDEA – JULY 25, 2025 ⚠️

💊 Healthcare Pressure + Missed Guidance = Bearish Setup for AMC

⸻

📉 Sentiment Snapshot:

• 🚨 Last quarter: Broke 100% beat streak

• 📉 Thin margins + rising medical costs

• 💬 Analyst bias: Neutral to Negative

• 🧮 Fundamentals Score: 4/10

⸻

📊 Technical Breakdown:

• 📍 Price: $26.76 (below 50DMA of $48.12)

• 📉 RSI: 32.4 = Oversold but still trending down

• 🛑 Testing 52W Low @ $26.25

• 🔻 Volume = 2.67x Avg → Heavy Distribution

⸻

🧠 Options Flow Insight:

• 🛡️ Heavy institutional put activity @ $28

• ⚠️ Weak call interest = bearish skew

• 📉 IV crush possible post-earnings

• Options Score: 6/10

⸻

🧬 MACRO CONTEXT:

• Rising sector costs crushing providers

• VIX < 15 = complacent market, sharp reactions possible

⸻

✅ TRADE IDEA:

🎯 CNC $28 PUT (0DTE)

💵 Entry: $0.20

🎯 Profit Target: $0.60 (3x 💥)

🛑 Stop Loss: $0.10

📅 Expiry: Today (July 25, 2025)

📈 Confidence: 70%

⏰ Entry Timing: Before earnings (AMC)

📆 Close trade within 2 hours post-earnings

⸻

📍 RISK REMINDER:

• Theta decay will be brutal if flat

• Watch for volatility and potential IV crush

• Ideal exit zone = stock retests $26 support

⸻

💡 Weak guide = collapse risk.

👍 Like & repost if you’re tracking CNC puts tonight!

#CNC #EarningsPlay #PutOptions #HealthcareStocks #OptionsTrading #0DTE #EarningsTrade #TradingView #SPX #GammaRisk