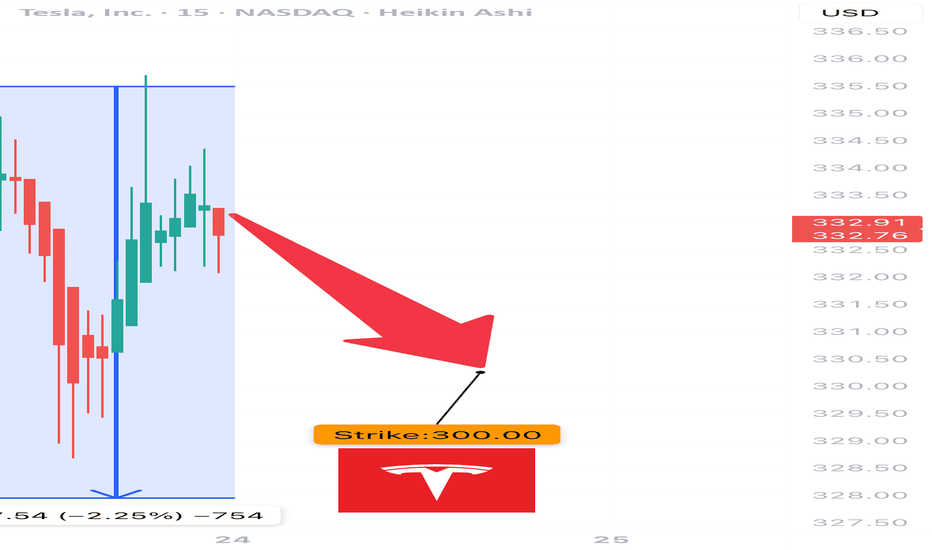

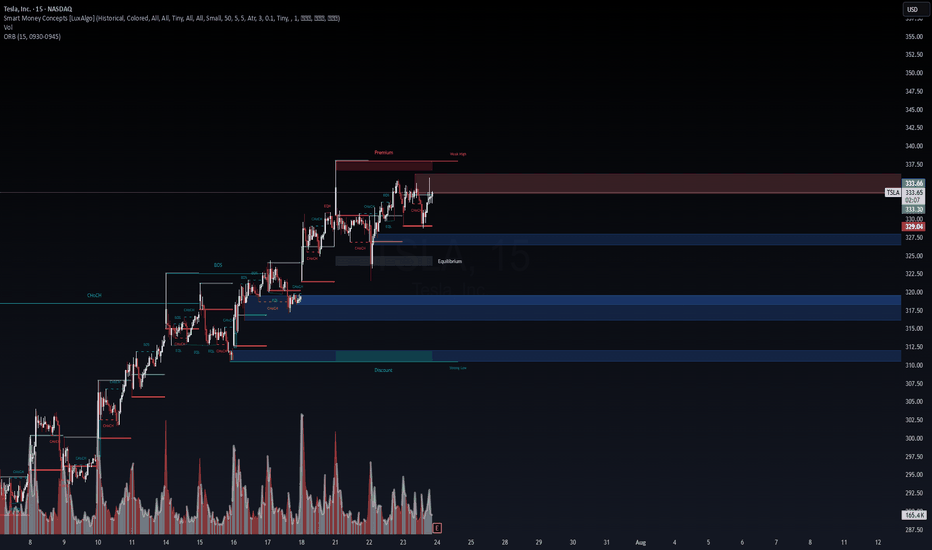

TSLA Earnings Play (Bearish Bias)

🚨 TSLA Earnings Play (Bearish Bias) 🚨

Earnings Date: July 23, 2025 (AMC)

🧠 Confidence: 75% Bearish | 🎯 Target Move: -10%

⸻

🔍 Key Takeaways:

• 📉 TTM Revenue Growth: -9.2% → EV demand weakness

• 🧾 Margins Under Pressure: Gross 17.7%, Operating 2.5%, Net 6.4%

• ❌ EPS Beat Rate: Only 25% in last 8 quarters

• 🐻 Options Flow: High put volume at $330 strike

• 🧊 Low Volume Drift: Trading above 20/50MA but losing steam

• 📉 Sector Macro: EV competition + cyclical headwinds

⸻

🧨 Earnings Trade Setup:

{

"instrument": "TSLA",

"direction": "put",

"strike": 300,

"expiry": "2025-07-25",

"entry_price": 2.02,

"confidence": 75,

"profit_target": 6.06,

"stop_loss": 1.01,

"entry_timing": "pre_earnings_close",

"expected_move": 7.1,

"iv_rank": 0.75

}

⸻

🛠️ Trade Details:

Parameter Value

🎯 Strike Price $300 PUT

💰 Premium Paid $2.02

📅 Expiry Date 2025-07-25

🛑 Stop Loss $1.01

🚀 Profit Target $6.06

📏 Size 1 Contract

⏱ Entry Timing Pre-Earnings

📊 IV Rank 75%

🕒 Signal Time 7/23 @ 14:14 EDT

⸻

📈 Strategy Notes:

• 🧯 IV Crush Risk: Exit within 2 hours post-earnings

• 🎲 Risk/Reward: 1:3 setup | Max Loss: $202 | Max Gain: $606+

• 🧭 Volume Weakness & put/call skew signal downside

• 🧩 Macro + Tech + Flow Alignment = Tactical bearish play

⸻

🧠 “Not all dips are worth buying — this might be one to short.”

📢 Drop your thoughts — would you take the trade or fade it?

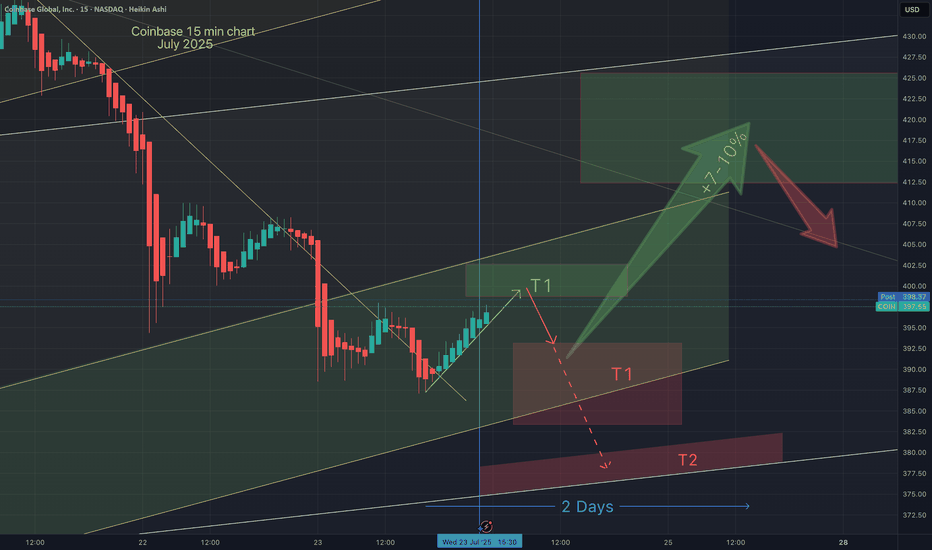

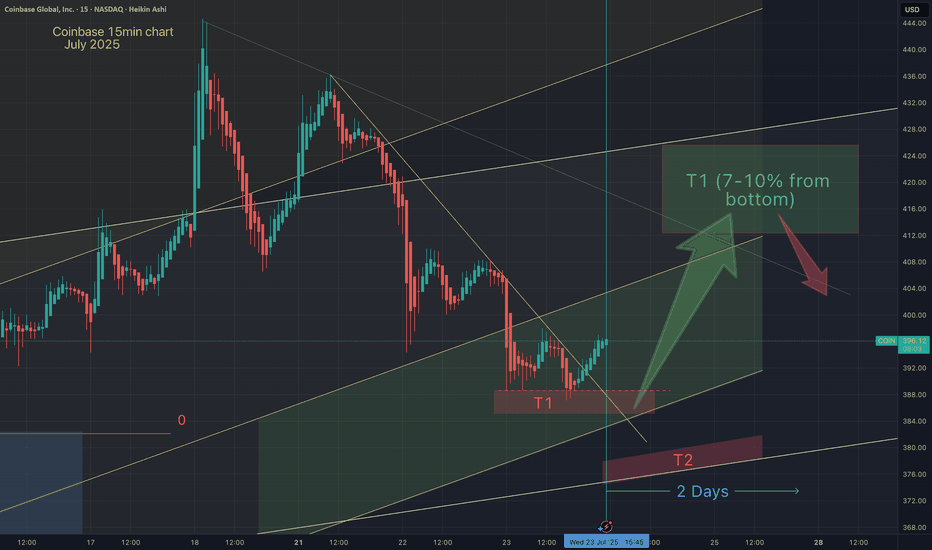

Coinbase targetsI'm confident that coinbase has more upside after this recent retracement. I have zoomed in (on 15 min timeframe), on what I believe may be the bottom of this dip. As Coinbase dips, we note that Alt coins are also retracing. I believe Alts and Coinbase will soon see a reversal to the upside. This chart shows my entry points and how I anticipate price action to unfold.

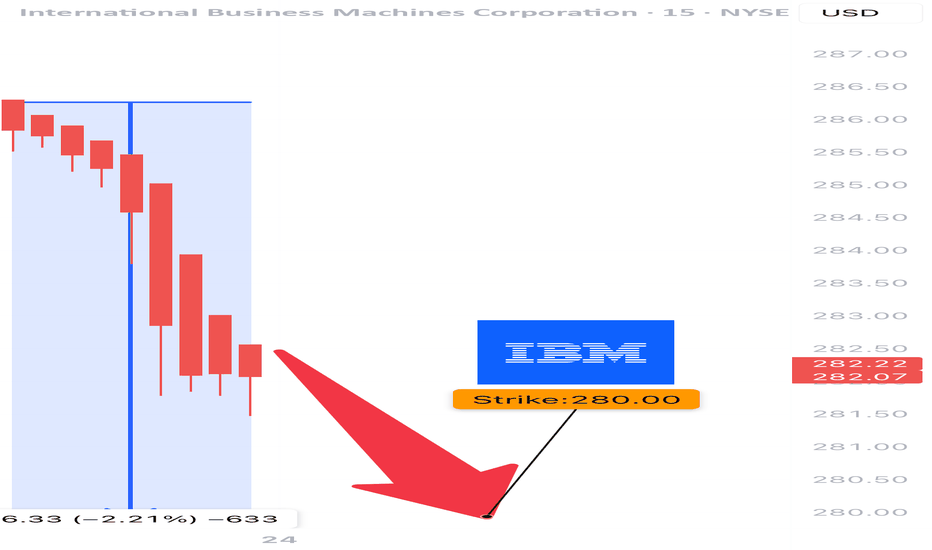

IBM EARNINGS TRADE IDEA — BEARISH SETUP INTO EARNINGS

⚠️ IBM EARNINGS TRADE IDEA — BEARISH SETUP INTO EARNINGS ⚠️

📅 Report Date: July 25, 2025 (AMC)

🔎 Confidence Level: 70% Bearish Bias

🧠 Thesis: Fundamentals weak | Options market hedging | Price below key MA | Guidance risk elevated

⸻

🔍 Quick Breakdown:

• IBM is lagging in growth: TTM revenue up just 0.5%, margins OK but under pressure from high debt (D/E 248).

• 100% EPS beat history, BUT current price ($281.96) > analyst target ($273.36) → room for downside surprise.

• Heavy OTM Put flow ($275 & $255 strikes) + Put/Call skew suggests big-money hedging.

• Trading below 20DMA ($287.55) = bearish drift.

⸻

📉 OPTIONS TRADE IDEA (SHORT SETUP)

🛠 Play: Buy $280 Puts (Exp. July 25)

💵 Entry Price: ~$6.30

🎯 Profit Target: ~$12.00

🛑 Stop Loss: ~$3.15

⚖️ Risk/Reward: ~1:2.5

📦 Size: 2 contracts

📊 Expected Move: ±$5

📉 Support to Watch: $270 (Break = flush potential)

📈 IV Rank: 60 — juicy enough, but not extreme.

⸻

📍 Exit Plan:

• 🟢 Sell if premium hits $12+

• 🔴 Cut loss at 50% drawdown ($3.15)

• ⏱ Auto-exit 2 hours post ER if theta crush hits

⸻

📊 TL;DR (FOR THE CHART GANG):

{

"ticker": "IBM",

"direction": "PUT",

"strike": 280,

"expiry": "2025-07-25",

"entry": 6.30,

"target": 12.00,

"stop": 3.15,

"confidence": 70,

"iv_rank": 0.60,

"expected_move": 5,

"earnings_time": "AMC"

}

⸻

💬 Drop your thoughts — are you playing NYSE:IBM into earnings?

📉 Tag someone who loves short setups.

🔁 Repost if you like clean risk/reward with macro + tech + options alignment.

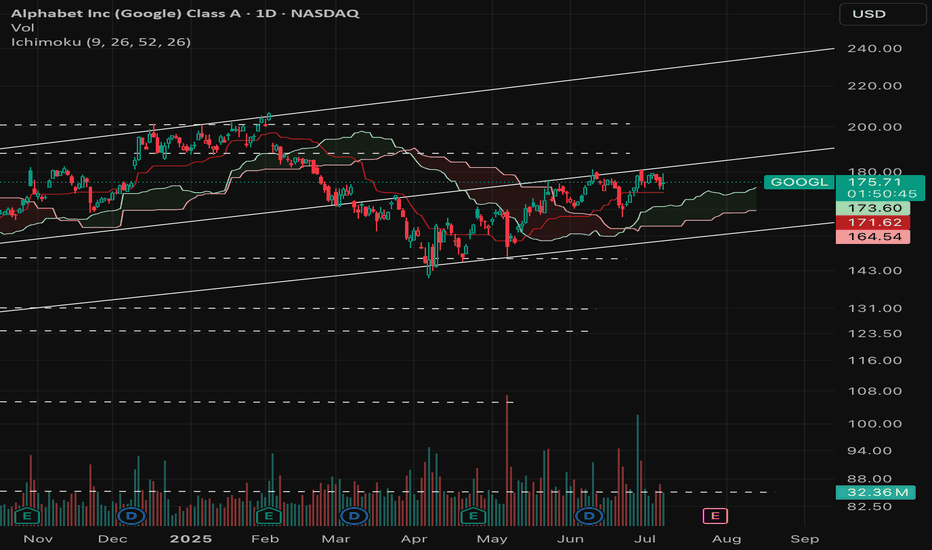

Open AI building it's own Browser- Open AI building it's own Browser. They have the talent to build it.

- Apple buying Perplexity AI

- MARKETSCOM:GOOGLE chrome isn't the best. I find Firefox better than Chrome but that's subjective. There's no stickiness in web browsers honestly. It's just that there are no good options.

- Recently, Google chrome added some weird looking AI summarizer on top which must be reducing number of organic hits to the website.

- I'm bullish long term but bearish short term. Open AI is really disruptor and has strong talent density better than Google in my opinion.

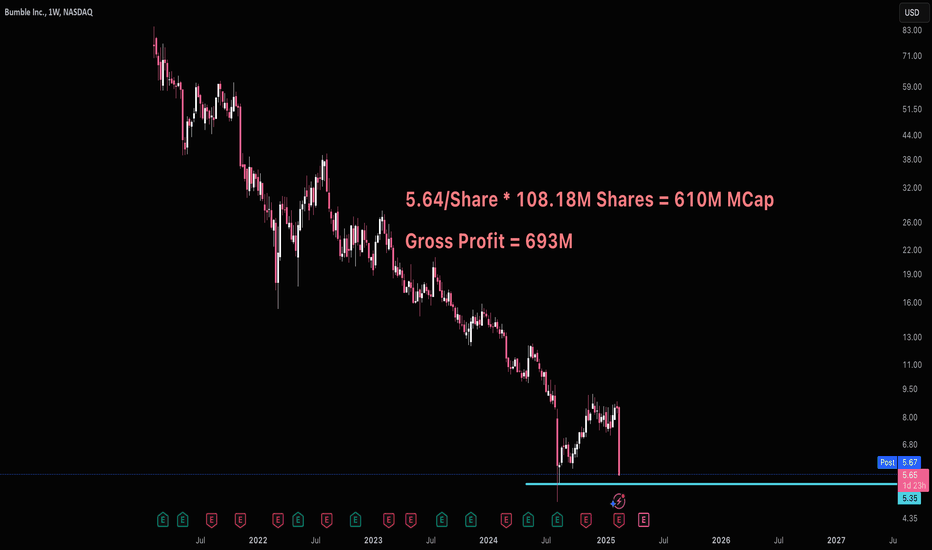

The Case For BumbleBumble has a yearly gross profit of 693M. Last year they repurchased 310M worth of stock.

Bumble at 5.64/share means it's entire market cap would be 610M or 80M less than one year's worth of profit. I don't understand how anyone could sell BMBL this low.

So while I'm not in love with BMBL's revenue growth, it's pretty clear this stock is significantly undervalued. 5.35 would be my buy target on support.

I'm interested to hear anyone else's take.

Good luck!

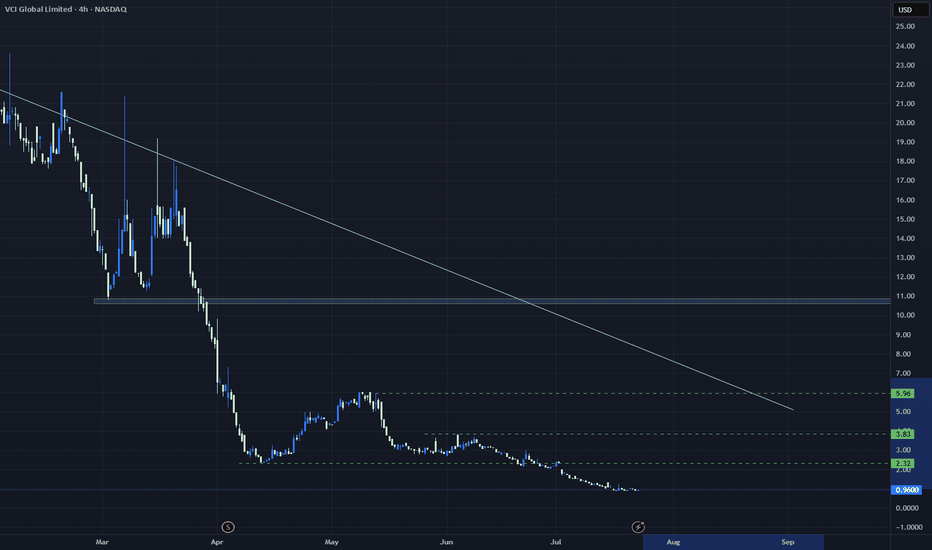

Bullish Thesis for VCIG – Path Back to $6.00VCIG is a microcap play that exploded in 2023 due to aggressive speculation around its AI, Web3, and consulting ventures — and while it retraced heavily, the foundation for a sharp rebound to $6+ exists if the company delivers even modest traction or sentiment returns to risk-on.

1. Low Float + History of Spikes = Ideal Setup

VCIG’s float remains tiny (under 10M shares), meaning it doesn’t take institutional interest or retail momentum to push this stock hard. In early 2023, it ran from sub-$1 to over $6 on narrative and volume alone — showing the playbook is already written. If the company repeats any form of headline momentum (partnerships, earnings surprise, AI/IP monetization), it can squeeze hard and fast.

2. Sector Sentiment Rotation

With renewed interest in AI, data security, and blockchain-adjacent services, VCIG can benefit from being a speculative proxy in those buckets. Microcap traders are cycling through beaten-down names looking for asymmetric payoffs — VCIG fits the bill and sits well below prior highs, giving it "catch-up" appeal among momentum traders.

3. Short-Term Catalyst Potential

VCIG’s history of PR-heavy runs suggests management is familiar with capitalizing on media cycles. A single announcement — an AI SaaS pilot, a Southeast Asia expansion, or a tech platform relaunch — could send the name parabolic, especially if timed with a squeeze or promoted visibility.

4. Technical Targeting:

Major resistance at $1.25–$1.50, then a clean air gap toward $3.00 and $6.00 from the prior run.

Back to $6.00 = ~600% upside from the current base — highly speculative, but achievable based on historical chart behavior.

Lines, Boxes etc that fade out by distanceIt would be cool to have drawing Elements that fade out by a distance. Like trend lines that last just a few days. Zones with a gradient fade out in one direction, like up or down. Especially horizontal lines could have a center point, from where they fade in both directions.

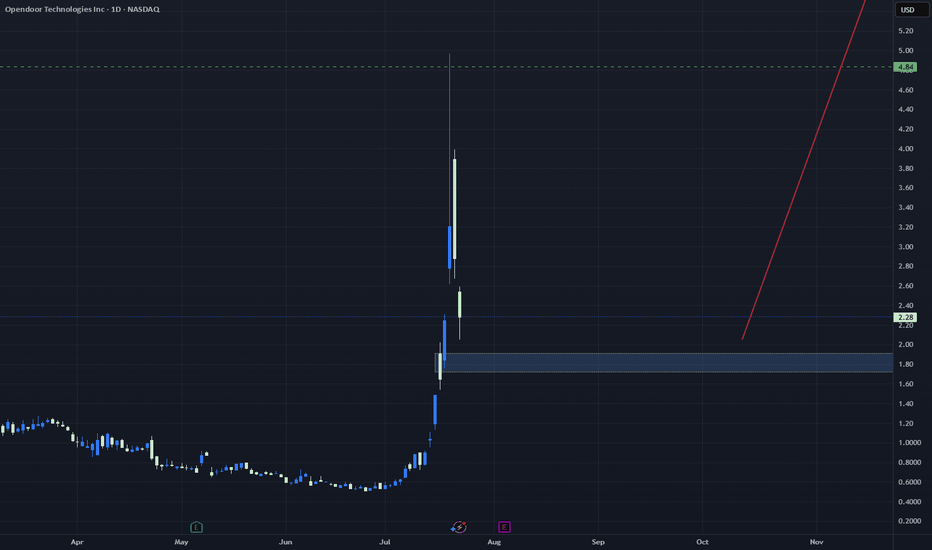

OPEN (Opendoor Technologies)Opendoor (OPEN) is emerging from a brutal real estate cycle with a leaner, smarter operation and a business model that could thrive as the housing market finds footing. While the company is still working toward consistent profitability, the current setup offers asymmetric upside due to improving fundamentals and a high short interest that could fuel a sustained rally.

1. Positioned to Ride the Next Real Estate Cycle

OPEN's iBuyer model was stress-tested through the worst of 2022–2023’s housing headwinds: rising rates, low volume, and margin compression. But now, with mortgage rates potentially peaking and homebuyer demand gradually returning, OPEN is well-positioned to scale again. Inventory controls, smarter pricing algorithms, and a lower cost basis mean they’re entering this phase with greater discipline than during the 2021 boom.

2. Short Interest is a Powder Keg

With short interest hovering above 25–30% of float, OPEN has the structural setup for a squeeze. Any catalyst — like a Fed pivot, surprising earnings beat, Zillow partnership expansion, or a positive housing data print — could trigger aggressive short covering. The stock has already shown it can move 10–20% intraday on relatively modest news. If bulls start leaning in, the technical chase higher could be violent.

3. Cost-Cutting + Tech Moat = Path to Profitability

Management has aggressively cut costs and moved toward a "marketplace" model, including its Opendoor Exclusives platform, which reduces inventory risk. While still early, the company's tech-driven pricing and transaction platform remains years ahead of traditional agents. In a sector that still relies on phone calls and paperwork, Opendoor has a chance to be the Amazon of home transactions.

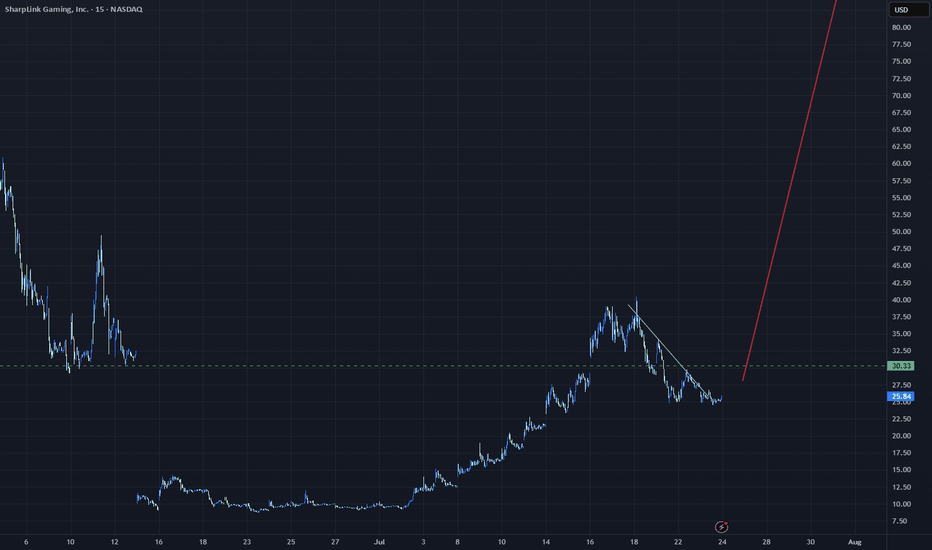

SBET Break Out!SharpLink Gaming (SBET) is an under-the-radar play in the evolving sports betting and iGaming infrastructure sector, and while it's a micro-cap with high risk, the upside is significant if the company continues to execute. My bullish case rests on three pillars:

1. Niche Focus in Affiliate Conversion

SBET is positioning itself not as a sportsbook, but as the tech bridge between sports content and betting platforms. Its proprietary platform, C4, uses behavioral data to optimize how users are funneled toward legal betting operators. As regulatory clarity grows in more U.S. states, that funnel becomes more valuable — and scalable. I'm betting that affiliate efficiency and direct-response performance marketing will become critical differentiators, and SBET has a first-mover advantage in this niche.

2. Possible Acquisition Target

Given the trend of consolidation in the sports betting ecosystem (e.g., PointsBet/Fanatics, Penn/Barstool/ESPN), I see SBET as a low-cost acquisition candidate for a mid-size sportsbook or media operator looking to vertically integrate conversion tools. A buyout at even modest valuation multiples could offer 5x–10x upside from current levels.

3. Improved Balance Sheet & Strategic Refocus

SBET recently completed divestitures and restructurings that reduced liabilities and sharpened its operational focus. With a cleaner cap table and more targeted business model, I believe the risk-reward profile has meaningfully shifted. Any uptick in licensing agreements, user metrics, or affiliate revenues could catalyze a re-rate from the current sub-$10M market cap.

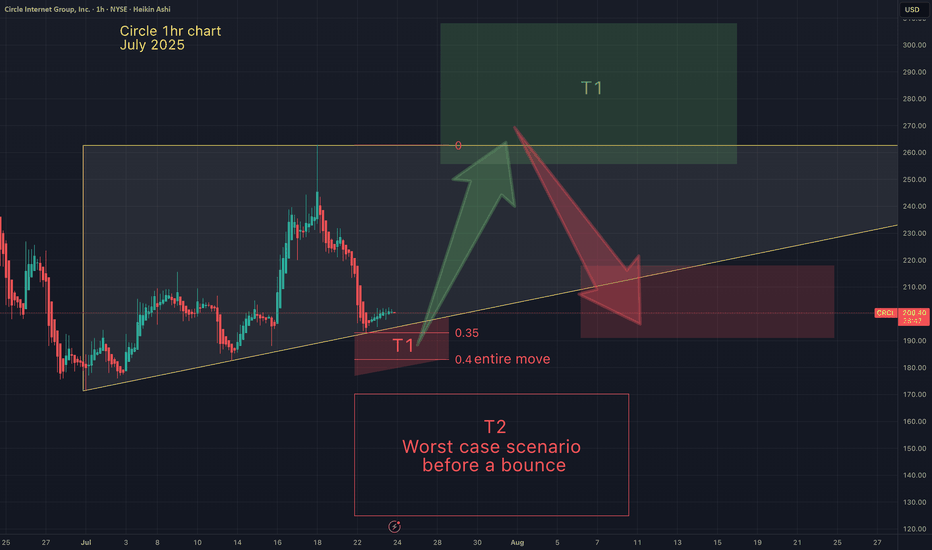

Circle - next targetsIn a bull market the average retrace

is between .2 -.4 Fib from the bottom

of that run.

Several factors of confluence lead me

to believe Circle will hit my red T1 target,

bounce to the top of the triangle (green T1)

then drop to my next red target (or lower).

Then return back to my green T1.

There may be one more retracement after that. Then

Circle may break through the green bar to the upside.

I believe stable coins are the wave of the future.

So I want to be a part of Circle's USDC

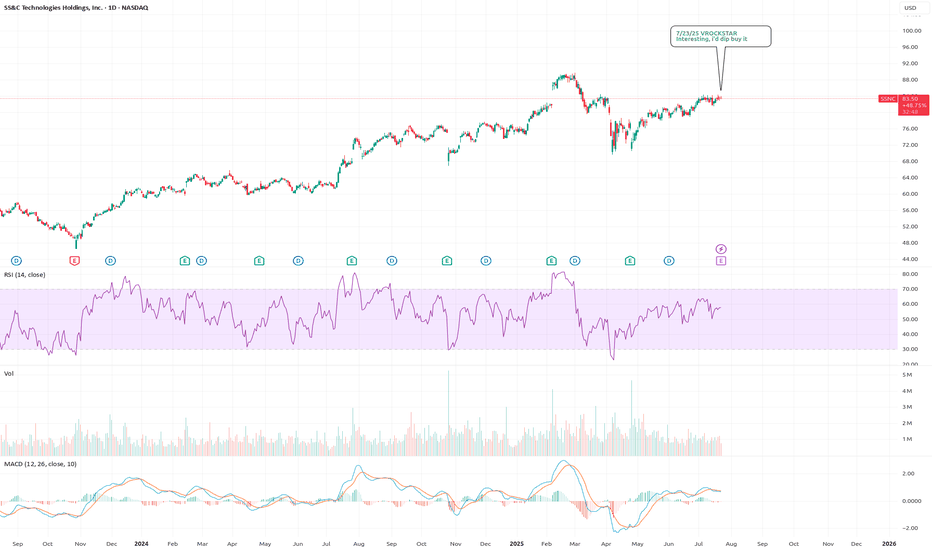

7/23/25 - $ssnc - Interesting, i'd dip buy it7/23/25 :: VROCKSTAR :: NASDAQ:SSNC

Interesting, i'd dip buy it

- 5% fcf yield

- ez does it top line growth, nothing stellar MSD

- mid teens PE

- software-esque ebitda mgns

- nothing that i know well and it's HC, so honestly the fact it's bid, doesn't run similar risks as insurers but ultimately (as my pea brain understands it) is probably a net +ve on MLR stuffs

- if this thing has any relevant dip on emotional w/e e.g. BOATS:FI this morning, it might be a solid dip buy, but i'd require probably mid to low 70s to be interested.

- that being said, stock will probs work/ continue to go up and i'd even expect a green reaction hence the "buy" even tho i'm not buying it here

V

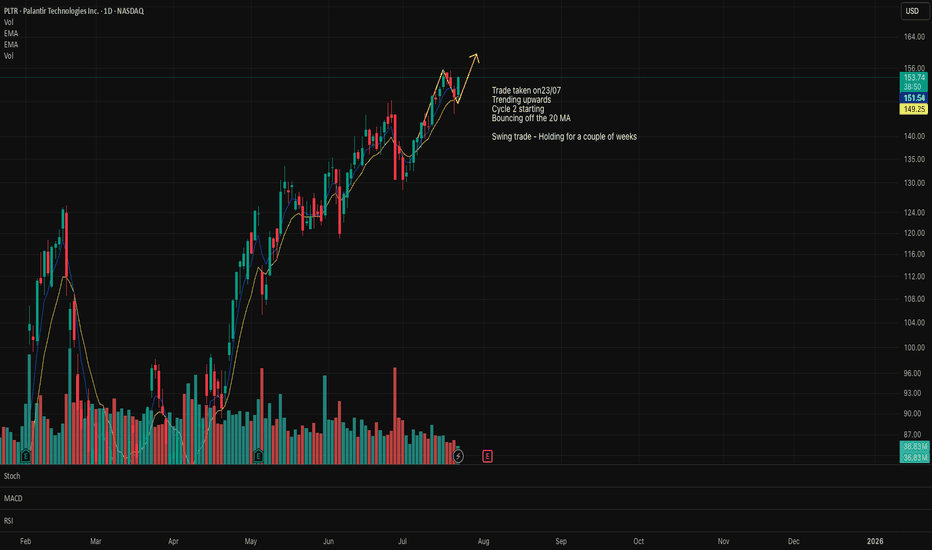

PLTR moving higherPLTR expected to move higher.

The price is bouncing off the 20MA and respecting it.

Making new higher/highs and higher lows.

Earnings is due shortly, which could have a negative impact to the price.

However, the long term outlook for the company is still strong.

Anyone else have thoughts on this stock?

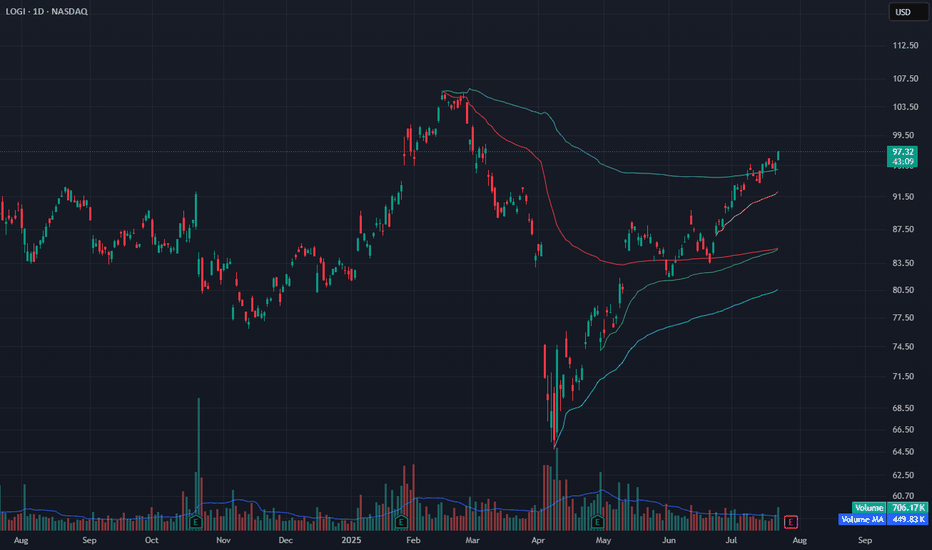

LOGI Approaching Breakout – Riding Upper VWAP ChannelLOGI continues to grind higher along the upper anchored VWAP band, trading just under $99. Volume is healthy, and price action has been clean since reclaiming the red VWAP zone in June.

The yellow VWAP (from recent swing low) is acting as dynamic support, while the upper Bollinger Band is expanding — signaling possible continuation.

If price breaks above the current range, next resistance is near $103. Downside remains protected as long as it holds above the $93 area.

Indicators used:

Anchored VWAP (support tracking)

Bollinger Bands (volatility expansion)

Volume vs. Volume MA (momentum confirmation)

Entry idea: Breakout above $98.50

Target: $103–105

Stop: Below $93.50 or trailing yellow VWAP

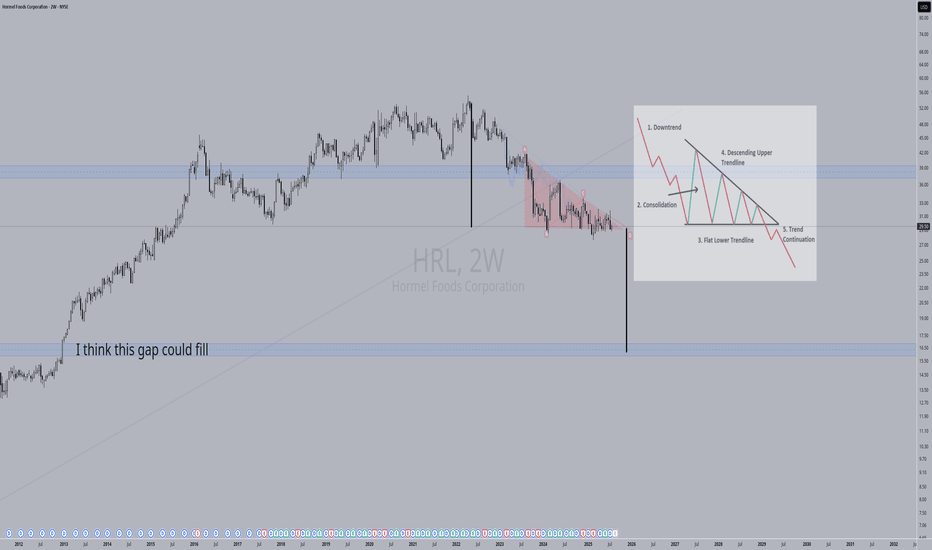

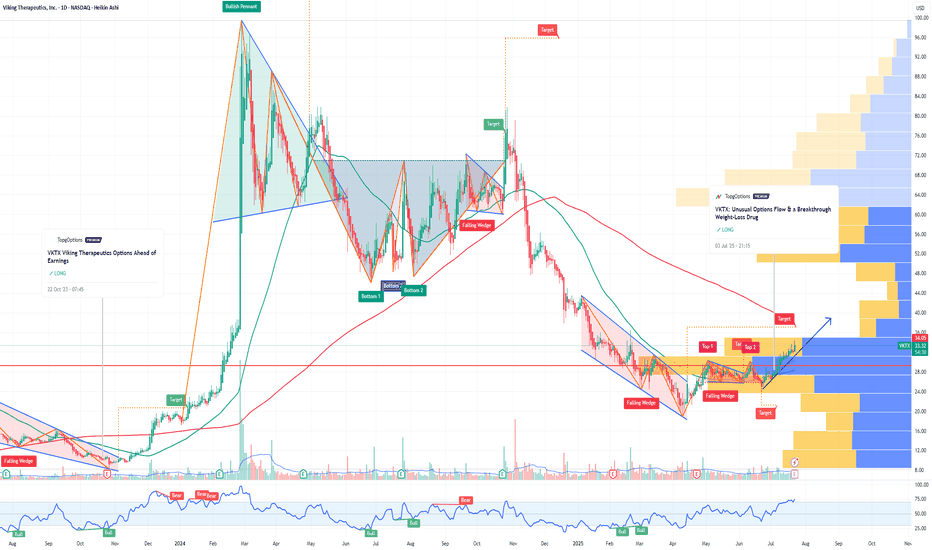

VKTX Viking Therapeutics Options Ahead of EarningsIf you haven`t bought VKTX before the breakout:

Now analyzing the options chain and the chart patterns of VKTX Viking Therapeutics prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

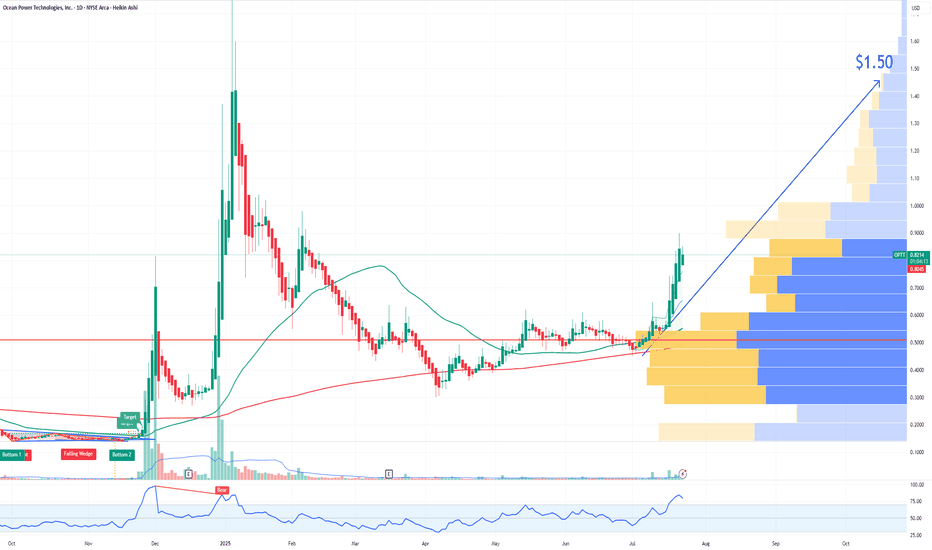

OPTT Ocean Power Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OPTT Ocean Power Technologies prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

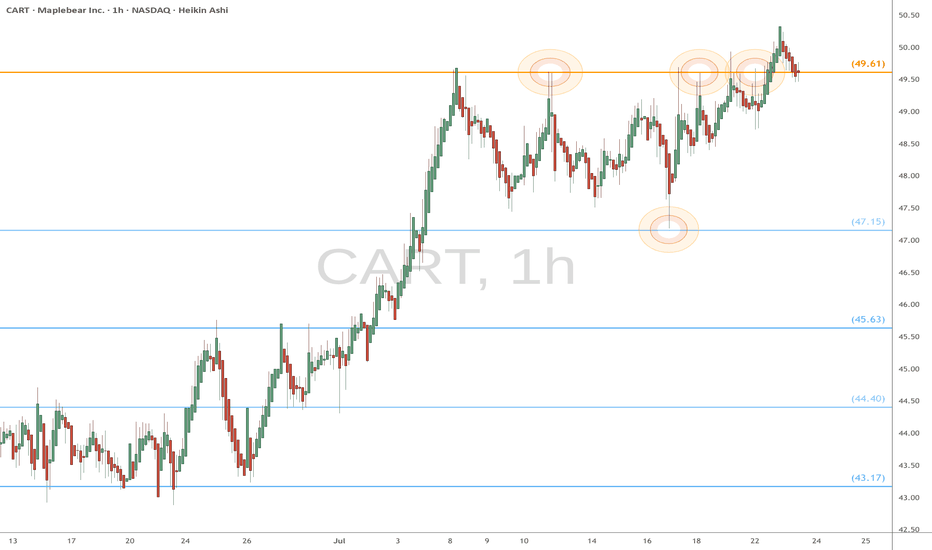

CART watch $49.61: Proven Golden Genesis fib holding up new ATHCART has been struggling against a Golden Genesis at $49.61

Many PINGs have made it clearly visible to the whole world.

If the Break-n-Retest holds, it should start next major leg up.

.

Previous Analysis that NAILED this exact fib for a MASSIVE short:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.