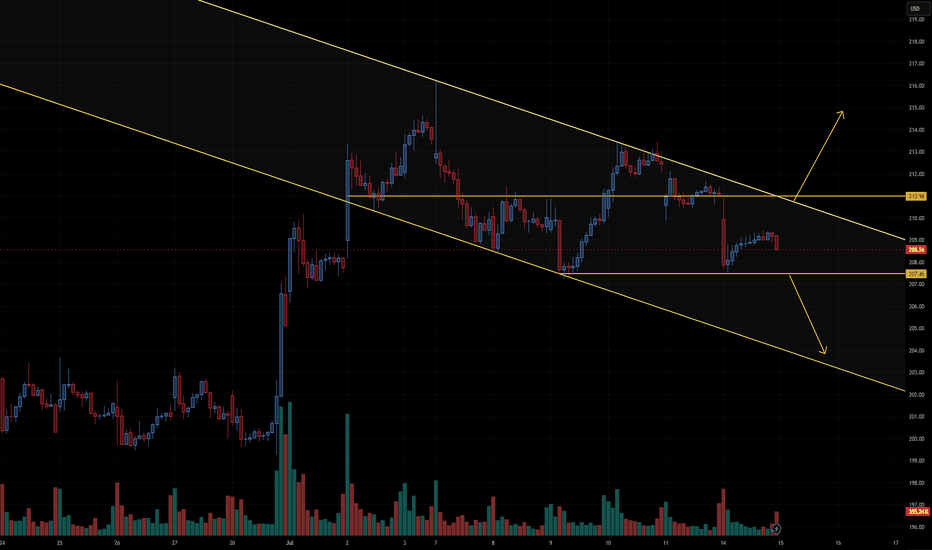

AAPL PREPARING FOR A LARGER MOVEAAPL clearly shows a descending channel pattern, marked by two parallel downward-sloping yellow trendlines. Within that broader structure, the price is currently consolidating in a narrow range between two horizontal yellow lines:

Resistance around $210.98

Support around $207.46

🔍 Current Technical Setup

Consolidation Range

AAPL is moving sideways in a tight range between $207.46 and $210.98. This narrow trading zone within a broader descending channel is typical of compression before a breakout.

Descending Channel Context

The channel suggests a longer-term downtrend bias, but the compression at these levels can lead to a breakout in either direction, especially when volume starts to increase.

Support Zone ($207.46)

This level has been tested and held, making it a key line to watch. A breakdown below this support would likely trigger a sharper selloff toward the lower channel boundary, near $203–$204.

Resistance Zone ($210.98)

This level lines up with the upper boundary of the current consolidation and the midline of the descending channel. A breakout above would invalidate the local downtrend and could send price to test the top of the channel (~$214+).

Volume Clues

Volume is relatively low during this sideways movement, which often precedes a high-volume breakout as indecision resolves.

📈 Scenarios to Watch

Bullish Breakout

Above $210.98 and the descending trendline.

Likely target: $214–$216

Confirmation: Volume spike + strong bullish candle

Bearish Breakdown

Below $207.46 support.

Target: $203 or lower, testing channel support.

Confirmation: Increasing red volume + bearish momentum

🧠 Summary

AAPL is in a compressed state, with a tight horizontal range forming inside a broader downward-sloping channel. This often sets the stage for a powerful directional move. Traders should closely monitor breaks of $210.98 or $207.46 to catch the next leg — either a reversal toward higher levels or continuation of the downtrend.

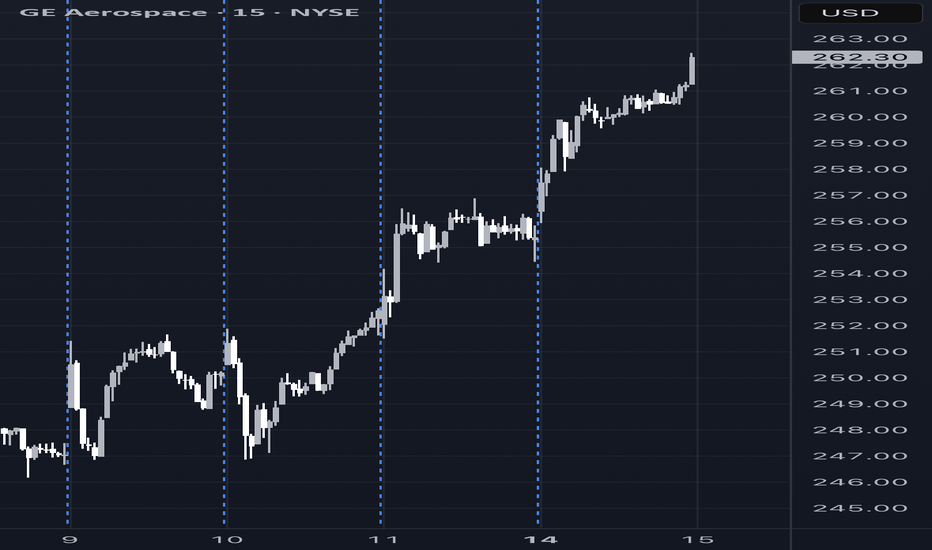

GE Weekly Options Trade Setup – 07/14/2025 $290C | Exp. July 18

📈 GE Weekly Options Trade Setup – 07/14/2025

$290C | Exp. July 18 | Bullish Catalyst In Play

⸻

🔥 BULLISH MOMENTUM CONFIRMED

✅ All 5 major AI models (Grok, Claude, Gemini, Llama, DeepSeek) agree:

GE just broke out — strong momentum, price above MAs, MACD bullish.

📰 Catalyst: Citigroup Upgrade 💥

Low implied volatility + analyst boost = ideal environment for calls.

⚠️ Caution: RSI is overbought, signaling possible short-term pullback. This is a fast trade, not a swing.

⸻

🎯 Trade Plan – High Conviction Setup

Entry at open, ride breakout continuation 🚀

{

"ticker": "GE",

"type": "CALL",

"strike": 290,

"exp": "2025-07-18",

"entry": 0.89,

"target": 1.78,

"stop": 0.45,

"size": 1,

"confidence": "70%",

"entry_timing": "market open"

}

🔹 Entry: $0.89

🎯 Target: $1.78 (+100%)

🛑 Stop: $0.45 (-50%)

📅 Expiry: 07/18/25

📈 Confidence: 70%

💼 Strategy: Naked Call

⸻

📌 Why $290C?

High strike = low cost, great R/R. High OI, and supported by breakout levels from DeepSeek & Grok models.

🧠 Model Sentiment:

“Moderately Bullish” – All point to upside, but suggest smart risk management due to hot RSI.

⸻

💡 Quick Notes

⚠️ Overbought ≠ reversal — just be quick.

📊 Citigroup news is driving flows — but don’t hold into chop.

💬 Tag someone who’s been sleeping on GE 👇

#GE #OptionsTrading #BreakoutPlay #CallOption #AITrading #WeeklySetup #FlowWatch #0DTE #tradingview

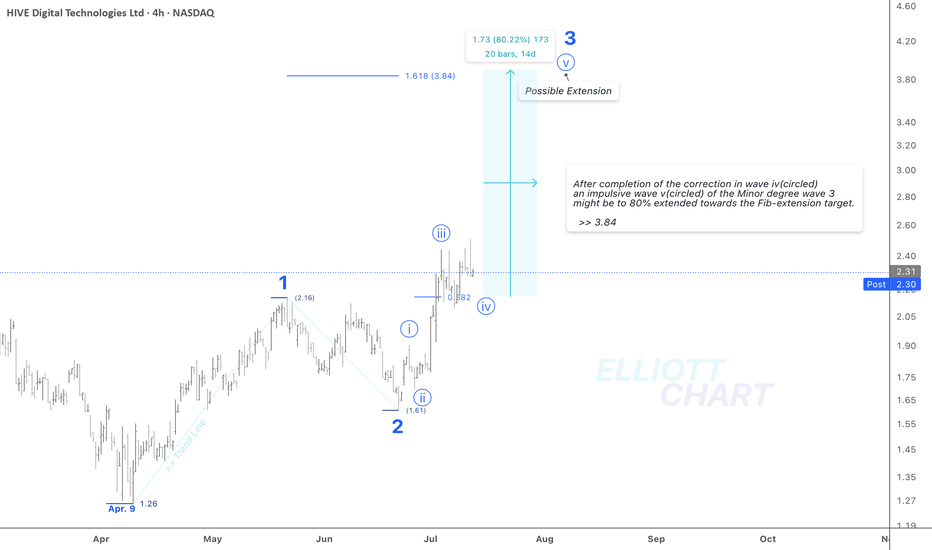

$HIVE / 4hAs depicted in the 4h-frame above, NASDAQ:HIVE may have developed a sequence of Minor degree waves upward >> 1, 2, and an impulse 3, which remains in progress, since April 9.

Wave Analysis >> After completion of the ongoing correction in wave iv(circled), an impulsive wave v(circled) of the Minor degree wave 3 might be to 80% extended towards the Fib-extension target >> 3.84.

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC

NASDAQ:HIVE CRYPTOCAP:BTC MARKETSCOM:BITCOIN

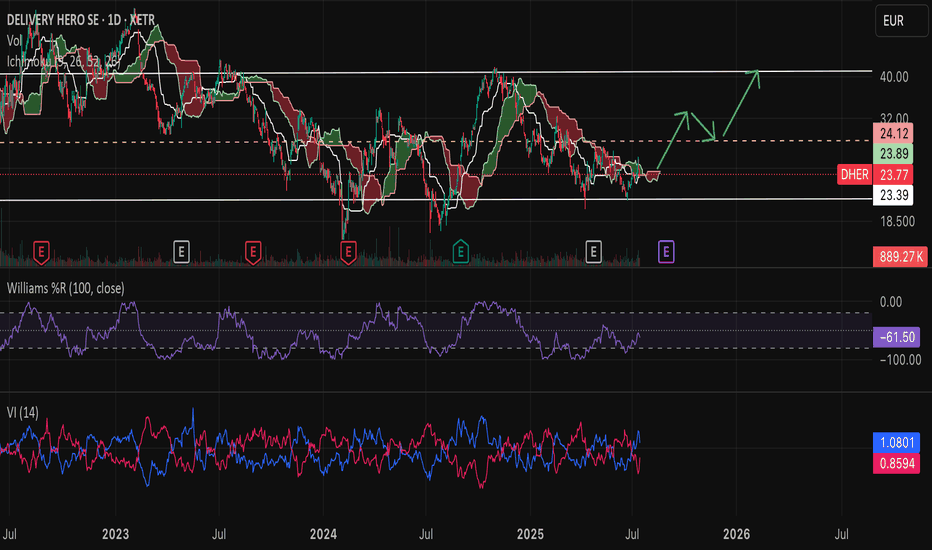

$DHER to $40- XETR:DHER i.e Delivery Hero is working towards profitability and exiting markets where it doesn't want to burn on operations.

- Company is becoming leaner, meaner and strategic in areas where it operates and dominates.

- Region MENA is growing (31% YoY)

- It has nice free cash flow per share growth. XETR:DHER posted ~227% YoY growth in free cash flow, putting it in the top 10% of its peers, well above its 3‑year average of ~32% .

WULF / 3hNASDAQ:WULF

According to the bearish alternative in my weekly frame (not the chart below and not posted recently), the entire countertrend rally, which has developed in an ABC zigzag sequence as anticipated in the analysis which I posted on May 12, may have reached a very late stage where an adjusted expanding diagonal as the thorough Minor degree wave C remains at the start point of a final advance as its 5th subdivision. It will conclude the entire correction upward since April 9.

NASDAQ:WULF 's Bearish Alternative :

Wave Analysis >> As depicted on this 3h-frame above, the structure of the entire countertrend advance, which has developed since April 9, may be considered in a thorough ABC zigzag correction, in which Minor degree wave C should have diagonally reached its very late stage now. It would likely achieve its expansion target >> 5.55.

And it would be a 170% gain of a countertrend rally at the end!!

Now, 8.6% of the advance remains to complete a possible ending expanding diagonal upward as the Minor degree wave C.

Trend Analysis >> The countertrend upward as Intermediate degree wave (B) will probably change to decline in the same degree wave (C) very soon!! And it'll likely last until the end of the year.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN

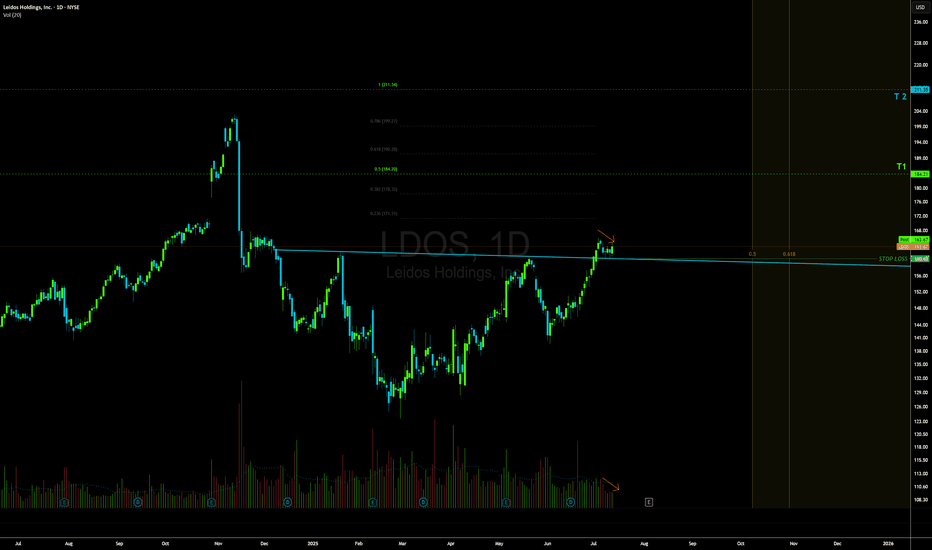

LDOS LONG🚀 NYSE:LDOS – Breakout Setup After Months of Accumulation

NYSE:LDOS is showing a high-conviction breakout setup after six months of tight accumulation. Here's what I'm seeing:

🔹 Flagging on the 8EMA with low volume – classic bullish continuation

🔹 Clean structure with higher lows and controlled pullbacks

🔹 Volume drying up during the recent consolidation = potential energy building

🔹 Breakout in progress with RSI staying strong but not overbought

🔹 Accumulation range forming a solid launchpad

📈 With earnings due Aug 5 (BMO) and strong fundamental backing, I expect volume to come in soon and fuel the next leg higher.

🟢 Targets:

$184 short-term

$211 by year-end

🔴 Stop:

$159 – below the accumulation base and prior support zone

Why I Like It:

✅ EPS growth +325% YoY

✅ Forward P/E only 14.1

✅ Strong ROE (31%) + institutional accumulation

✅ Momentum without overextension

✅ Positioned in a defensive-growth sector with macro tailwinds (defense, cybersecurity, AI)

📊 Looks like smart money has been accumulating – and it's almost time to move.

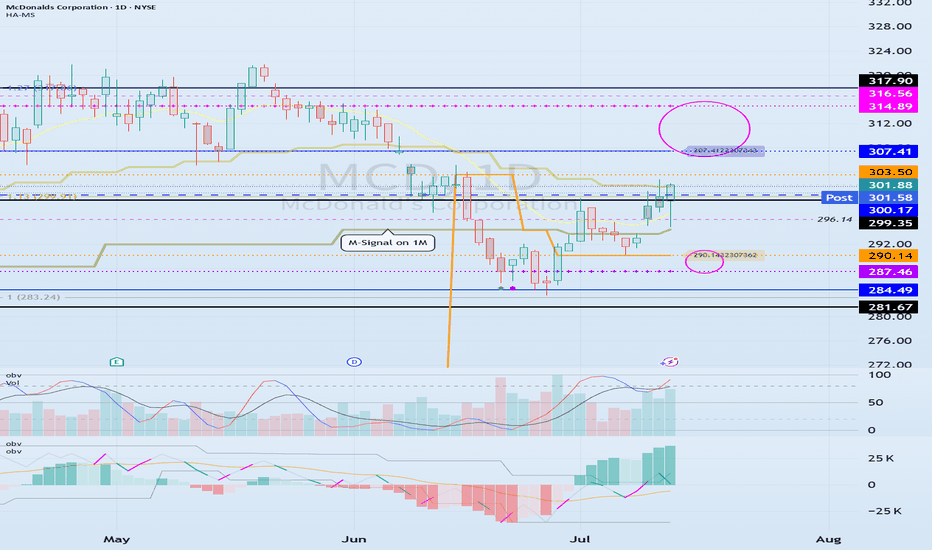

The key is whether it can be supported and rise near 300.17

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(MCD 1D chart)

Before following the basic trading strategy, the first thing to check is whether the current price is above or below the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, there is a possibility that it will turn into a medium- to long-term downtrend.

Therefore, if possible, it is recommended to trade stocks whose prices are above the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, you should respond quickly and briefly using the short-term trading (day trading) method.

-

The support and resistance zones can be seen as the 287.46-290.14 zone and the 307.41-314.89 zone.

The 287.46-290.14 zone is the DOM(-60) ~ HA-Low zone, and the 307.41-314.89 zone is the HA-High ~ DOM(60) zone.

These two zones are likely to form a trend depending on how they break through, so they can be seen as support and resistance zones.

-

The 300.17-316.56 zone is the HA-High ~ DOM(60) zone on the 1W chart.

Therefore, we need to check whether it can receive support and rise in the 300.17-316.56 zone.

Therefore, if it falls near the 307.41-314.89 range, you should check for support near 300.17.

-

If it rises above the HA-High ~ DOM(60) range, it is likely to show a step-up trend, and if it falls in the DOM(-60) ~ HA-Low range, it is likely to show a step-down trend.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

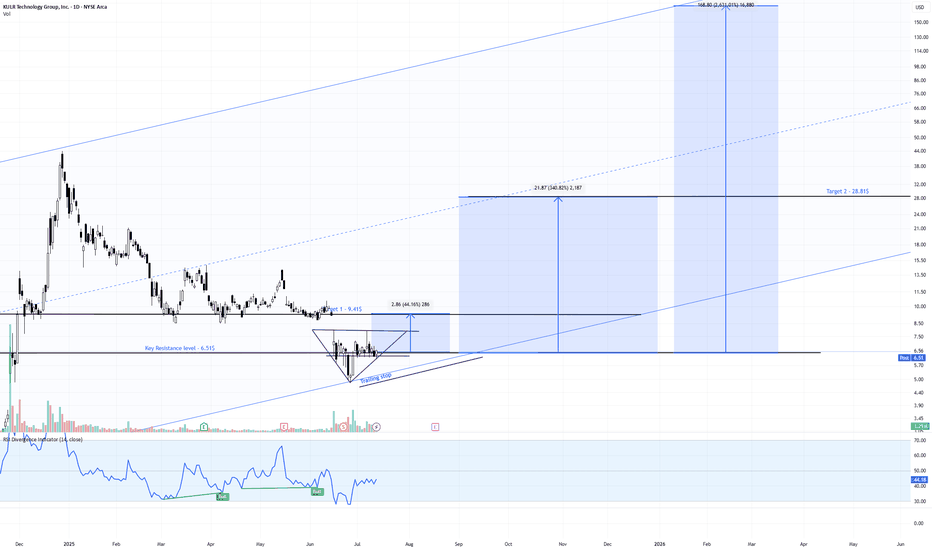

KULR Daily Watch – Triangle Squeeze Loading📍 Price Action:

Sitting tight at $6.50, coiling inside a clean symmetrical triangle. Last fake-out under support didn’t confirm → bulls still holding the line.

📊 Pattern Probabilities (Bulkowski):

Symmetrical triangles break ~54–60% in trend direction. Post-breakout moves hit ~60–75% of measured height → decent odds for upside here.

✅ Volume contracting = typical pre-breakout behavior

✅ RSI divergence still bullish

✅ Channel since 2023 intact, macro structure supports trend-following

🎯 Targets & RR Setup:

Trigger zone: $7.20–$7.50

Target 1: $9.45 (+31% | RR ~2.5:1)

Target 2: $28.81 (+298% | RR ~12:1)

Target 3 (channel top): $168.12 (+2,368% | moonshot 🌙)

⏳ Next Step:

Break over $7.50 = green light for Target 1. We’re trailing stops below the rising trendline to lock in gains without killing the move early.

#KULR #TrianglePattern #BreakoutWatch #TargetTraders #StockMarket

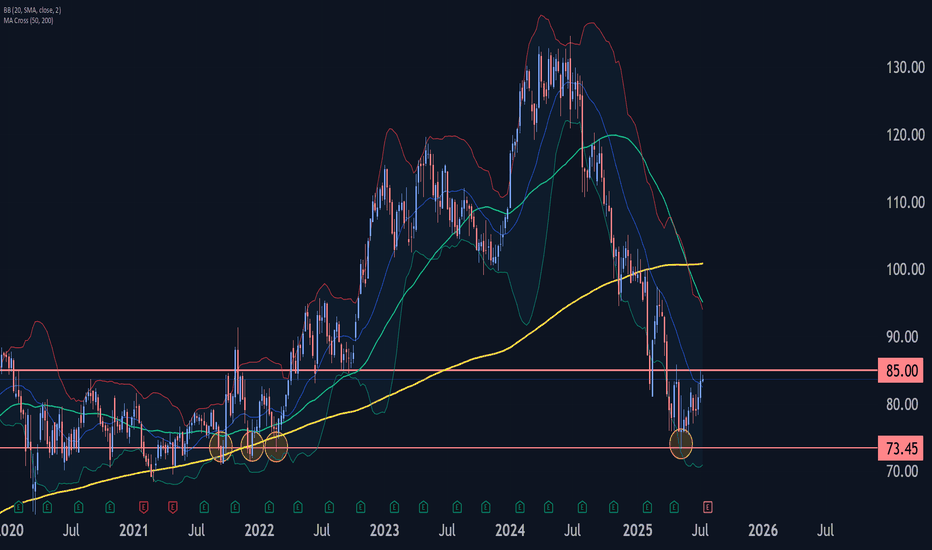

MRK Wave Analysis – 14 July 2025- MRK reversed from the support zone

- Likely to rise to resistance level 85.00

MRK recently reversed up from the support zone surrounding the long-term support level 73.45 (which has been reversing the price from the start of 2020, as can be seen from the weekly MRK chart below).

The upward reversal from the support level 73.45 started the active long-term impulse wave III.

MRK can be expected to rise to the next resistance level 85.00 (former top of wave (4) from May) – from where the price is likely to correct down.

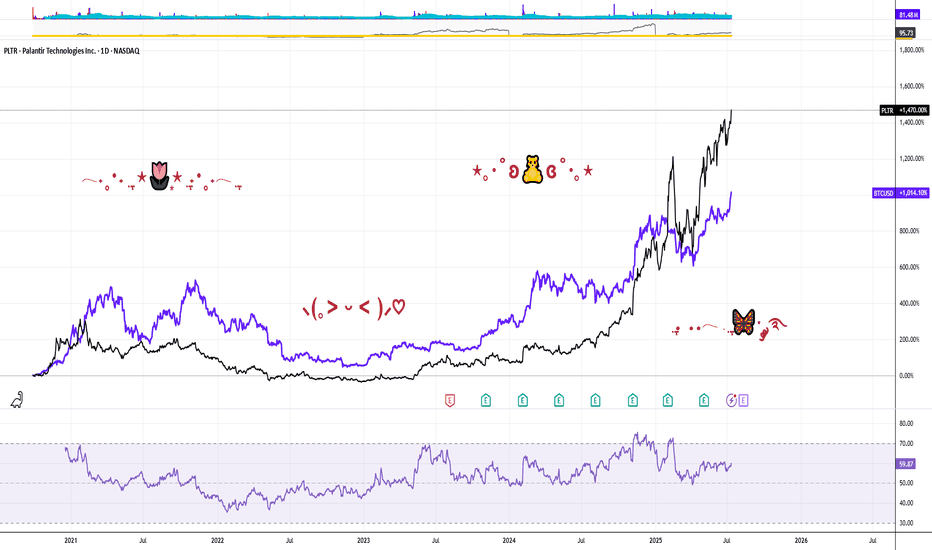

PALANTIR REMAINS YOUR TRADING GOAL, DOUBLING IN PRICE IN 2025In the Faraway Kingdom... In the Thirtieth Realm....

Somewhere in another Galaxy.. in late December, 2024 (yet before The Second Coming of Trump), @TradingView asked at it awesome Giveaway: Happy Holidays & Merry Christmas .

1️⃣ What was your best trade this year?

2️⃣ What is your trading goal for 2025?

Here's what we answered:

1️⃣ What was your best trade this year?

- Surely Palantir NASDAQ:PLTR 💖

I followed Palantir all the year since January, 2024, from $16 per share, watch here .

Current result is 5X, to $80 per share.

Also I added more Palantir after SP500 Index inclusion in September 2024 watch here .

Current result is 2.6X, from $30 to $80 per share.

2️⃣ What is your trading goal for 2025?

- Once again, surely Palantir NASDAQ:PLTR 💖

It's gone 7 months or so... (Wow... 7 months really? 😸😸😸)

Let see what's happened next at the main graph of Palantir stock, to LEARN WHY PALANTIR REMAINS THE TRADING GOAL, DOUBLING IN PRICE IN 2025...

Palantir stock remains an attractive trading goal for several compelling reasons rooted in its strong market performance, innovative technology, and robust growth prospects, particularly in the artificial intelligence (AI) sector.

1. Exceptional Stock Performance and Momentum.

Palantir Technologies has been one of the best-performing stocks in 2025, surging over 80% in the first half of the year alone, vastly outperforming the S&P 500’s modest 5.5% gain. The stock recently hit all-time highs around $149, reflecting a nearly 400% increase year-over-year, underscoring its strong momentum and investor enthusiasm. This surge positions Palantir as a top AI stock to watch, attracting both retail and institutional investors, including conservative entities like the Czech National Bank.

2. Leadership in AI and Data Analytics.

Palantir is not just a data analytics company; it has transformed into a major AI software provider with its Artificial Intelligence Platform (AIP). This platform extends beyond government contracts into commercial sectors such as healthcare, energy, and automotive, fueling significant revenue growth. The company reported a 39% revenue increase to $883.9 million in Q1 2025, driven largely by AI adoption. Its AI platform is gaining traction globally, with many companies rapidly adopting Palantir’s software through short training bootcamps, demonstrating scalable and fast integration.

3. Strong Government and Commercial Contracts.

Palantir’s roots in government intelligence and defense continue to be a significant revenue driver. The U.S. government division alone generated $373 million in Q1 2025, with overall government revenue up 45% year-over-year. Strategic partnerships, such as with Accenture to streamline federal operations and projects like the U.S. Navy’s ‘Warp Speed for Warships,’ highlight Palantir’s expanding footprint in critical government sectors. Simultaneously, the commercial segment is booming, with revenue soaring 71% to $255 million in Q1 and projected to reach $1.178 billion in 2025.

4. Financial Health and Growth Outlook.

Palantir’s financials are strengthening, with no debt and adjusted free cash flow more than doubling to $370.4 million in the recent quarter. Analysts forecast the company’s revenue to exceed $3.5 billion in 2025, up from $2.23 billion the previous year, and project potential revenue of $7 billion by 2028. Operating margins are improving, with a recent quarter reporting a 26% margin, the highest in company history. This solid financial foundation supports further investment in AI innovation and market expansion.

5. Market Position and Competitive Edge.

While Palantir competes with tech giants like Microsoft, Amazon, and Google in the AI and data analytics space, it has carved out a unique niche with its specialized government contracts and AI-driven software solutions. Its ability to integrate complex datasets for real-world operational use distinguishes it from competitors, fostering a loyal investor base and a "cult-like" following among retail investors.

6. High Valuation Reflects Growth Expectations.

Despite a high price-to-earnings ratio (PE around 621), reflecting elevated expectations, many analysts remain optimistic about Palantir’s long-term potential due to its rapid growth and expanding AI capabilities. The company’s market capitalization has soared above $330 billion, surpassing many established corporations, signaling strong market confidence.

7. Palantir stock is a compelling trading goal because it combines robust growth, cutting-edge AI technology, strong government and commercial contracts, and solid financial health.

8. In conclusion, Palantir remarkable stock performance and strategic positioning in the booming AI sector make it a promising investment for traders seeking exposure to transformative technology with significant upside potential.

9. ...and yet, Palantir performance since inception (It ultimately went public on the New York Stock Exchange through a direct public offering on September 30, 2020) is better, rather then Bitcoin.

--

Best wishes,

@PandorraResearch Team 😎

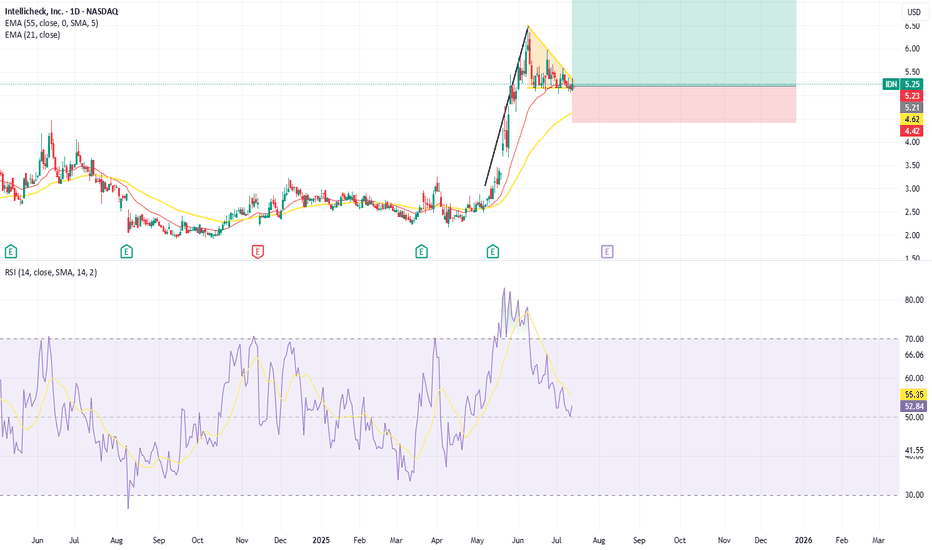

IDN Bullish Pennant FlagNASDAQ:IDN has had a huge run up in the last two month and a Bullish Pennant flag is starting to form with support at 5.16. Below this we saw some support at 4.80. Using a Stop Loss just below this level and a target set at the next resistance level established in 2022 yields a R:R of 1:3.5.

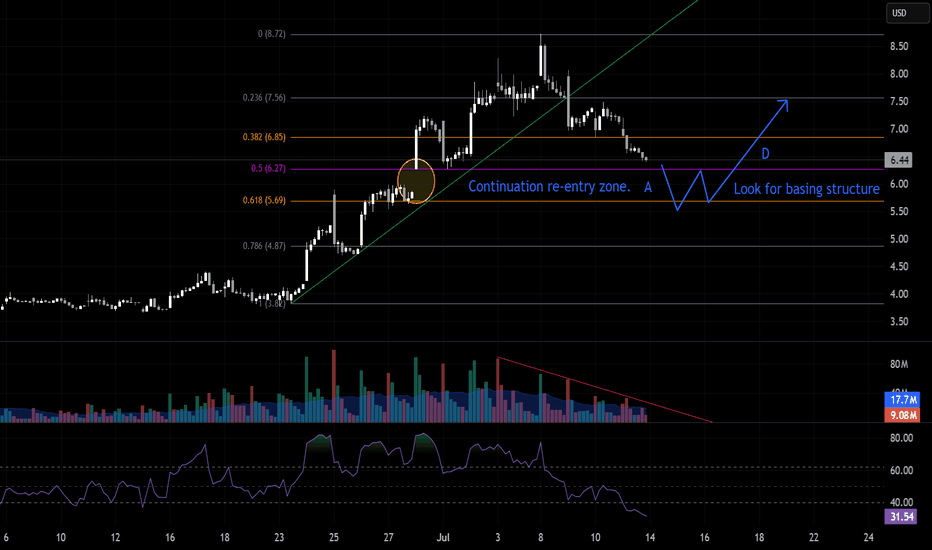

Mapping Out a Probable Basing Structure for ContinuationI’m tracking price as it retraces into the 0.5–0.618 Fibonacci zone, where I expect a potential base to form. With declining volume confirming the pullback is losing momentum, I’ll look for a clear basing pattern or double-bottom on lower timeframes before entering long. If confirmed, the plan is to position for a continuation move back toward previous highs.

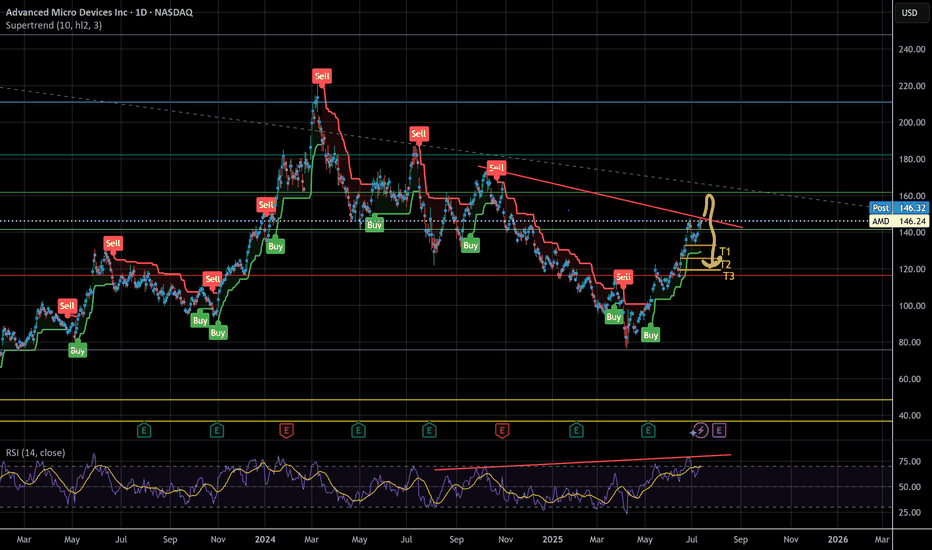

Must go down to go upI think AMD needs to cool off before it continues further, possibly tapping $160 first before a serious correction. Targets are listed at the strong support ending at $120. RSI printing bearish divergence on multiple time frames

Look at the red line, look at the direction of price. It's still a downtrend.

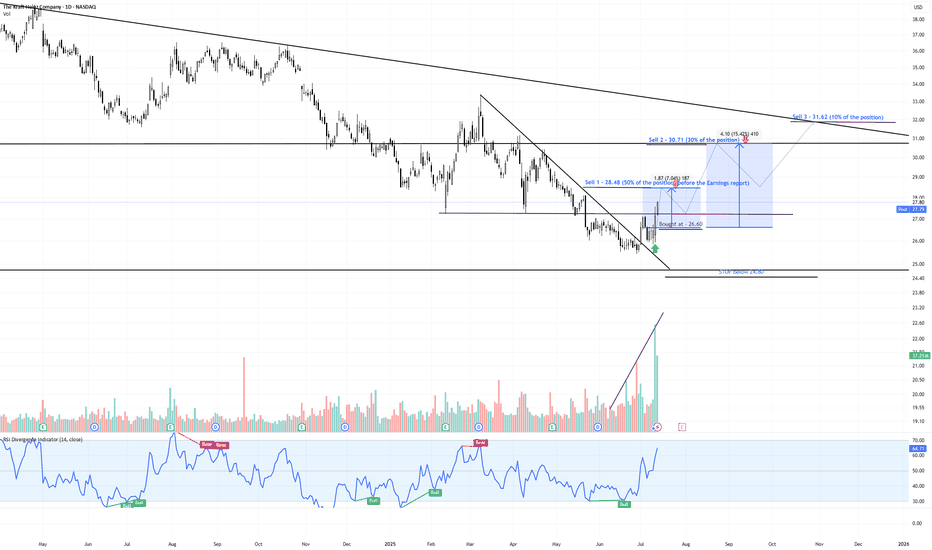

KHC – Momentum Reversal with Volume Surge & Tactical Exit Plan📈 Ticker: NASDAQ:KHC (The Kraft Heinz Company – NASDAQ)

📆 Timeframe: 1D (Daily)

💵 Current Price: $27.80

📊 Pattern: Falling Wedge Breakout + Volume & RSI Divergence

📌 Trade Setup:

✅ Our Entry: $26.60

⛔ Stop-Loss: Below $24.80

🔰 Confirmation Signals:

Bullish volume divergence: Selling pressure diminished while price made lower lows

Explosive green volume bar on breakout — strongest in 12+ months

RSI breakout above 60, confirming strong momentum and trend shift

💰 Profit-Taking Strategy:

📍Sell Zone Price Level % of Position Rationale

🥇 Sell 1 $28.48 50% Pre-earnings resistance – lock early profit

🥈 Sell 2 $30.71 30% Next strong resistance area

🥉 Sell 3 $31.62 10% Long-term descending trendline — potential reversal point

🔄 Remaining 10%: Optional trail with stop-loss raised, if momentum continues

📊 Technical Confidence & Probabilities:

🧠 Pattern: Falling Wedge

Bulkowski probability of breakout upward: ~68%

Average gain post-breakout: ~38%, though current targets are more conservative (15–19%)

📈 Volume breakout + prior divergence = strong institutional signal

📉 Risk clearly defined with stop at $24.80

📈 Target Gains vs Entry ($26.60):

🎯 Target Price Gain from Entry

Target 1 $28.48 +7.06%

Target 2 $30.71 +15.47%

Target 3 $31.62 +18.89%

🧾 Summary:

This is a high-probability breakout play, combining:

✅ Bulkowski-validated falling wedge

✅ Volume-based confirmation

✅ Clear stop and tiered exit strategy

✅ Strong risk/reward profile

“Our Entry Price: $26.60 – Breakout Backed by Big Money”

#KHC #TargetTraders #VolumeSpike #BreakoutTrade #TechnicalAnalysis #Bulkowski #StockMarket #Investing

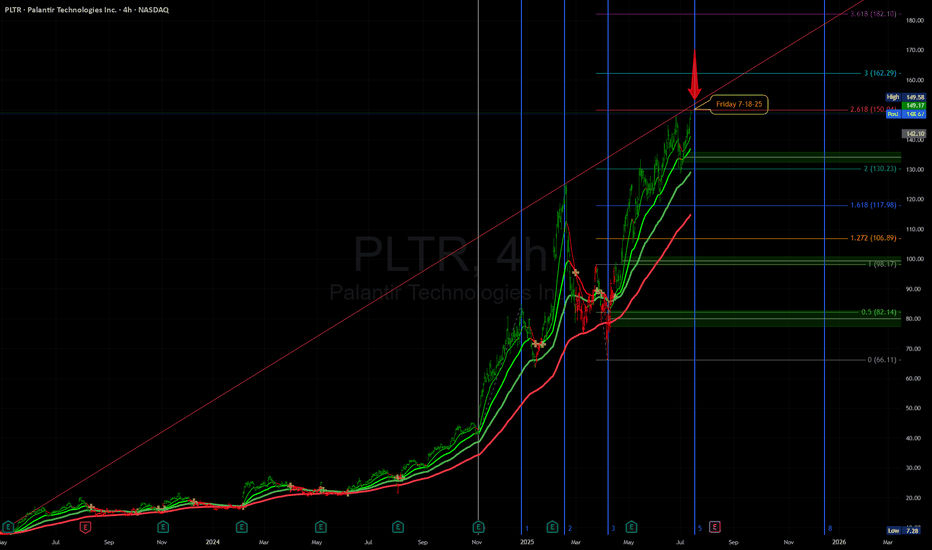

PLTR local top $150Palantir has has a nice run but this could be a local top. Reasons include hitting peak Trendline + hitting 2.618 fib + plus hitting #5 fib time zone. Also BTC appears to hit it's ATH Trendline today as well. So is everything hitting its local top before Trumps Liberation Day II on Aug 1? This week starts off with inflation data tomorrow, VIXEX on Wednesday, Mercury Retrograde starts Thursday, and we have OPEX on Friday. Stay tuned lets see what happens

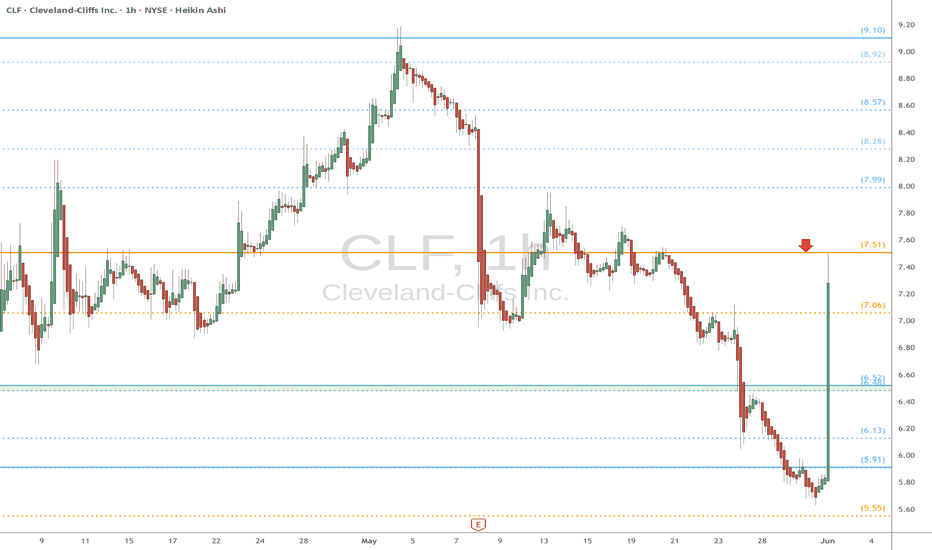

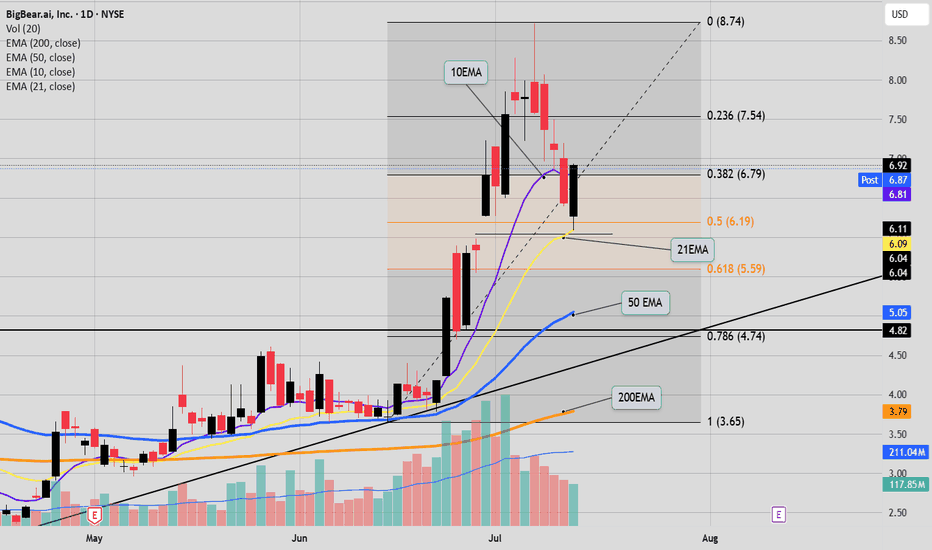

Piercing Candle?Do we have a Piercing candle around the golden zone 0.5 Fibonacci level 6.19$, also this candlestick pattern is resting at the moment on top of the 21 EMA? Will the bulls continue the march? is the pull back over? We need to close a bullish candle above the halfway candle of today's candle this week for the bulls to keep the 21 EMA and march on to victory.

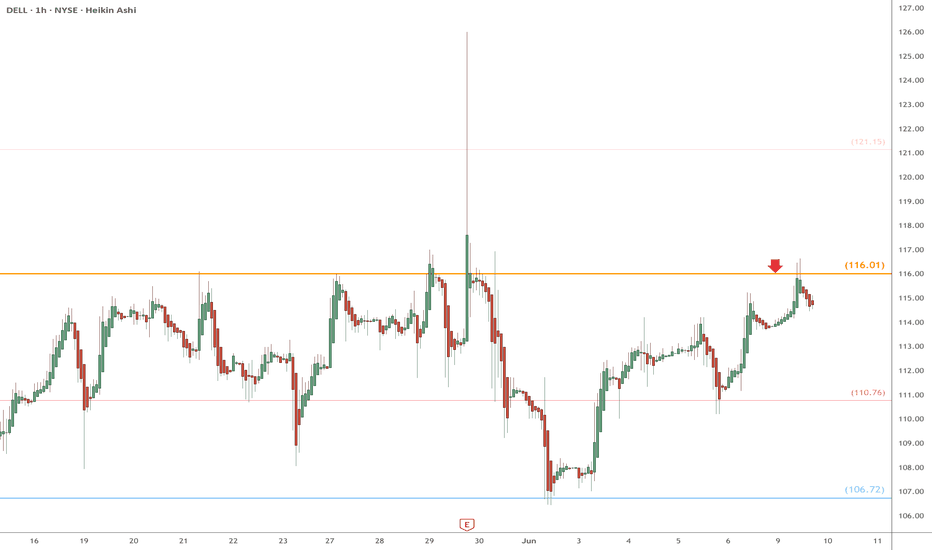

DELL eyes on $116.10: Golden Genesis fib will determine TrendDELL has been a sleepy stock with mixed earnings.

Now testing a proven Golden Genesis at $116.01

Look for a Break-and-Retest to start an Uptrend.

.

See "Related Publications" for other plots ---------------------->>>>>>>

This one in particular is caught the BOTTOM exaclty:

===================================================

.

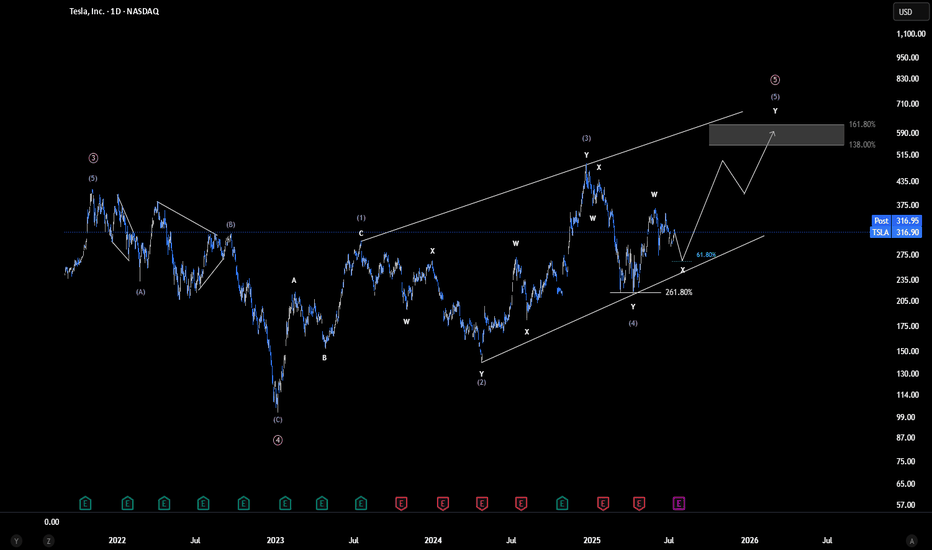

TSLA - Explosive Bounce TSLA Before the Drop? | EW Analysis My primary view is that we’re in the final stages of an ending diagonal, which could lift the price to new all-time highs, potentially between $460 and $650. Wave 4 of this structure appears to have completed after precisely tagging key Fibonacci support, and since then, we've already seen a strong bounce from that low. I’m now watching for the development of the final wave in this pattern, which could deliver gains of over 100% from current levels.

However, I’m not fully convinced by the internal shape of the diagonal so far. That’s why I’m also have an alternative scenario: in this case, the recent low may have marked the end of Wave 2 within a much larger diagonal. If true, this opens the door to a much more extended rally potentially reaching $1,000 before we see a major correction.

That said, this second scenario is not my preferred one, and a decisive break below the recent lows would invalidate both counts.

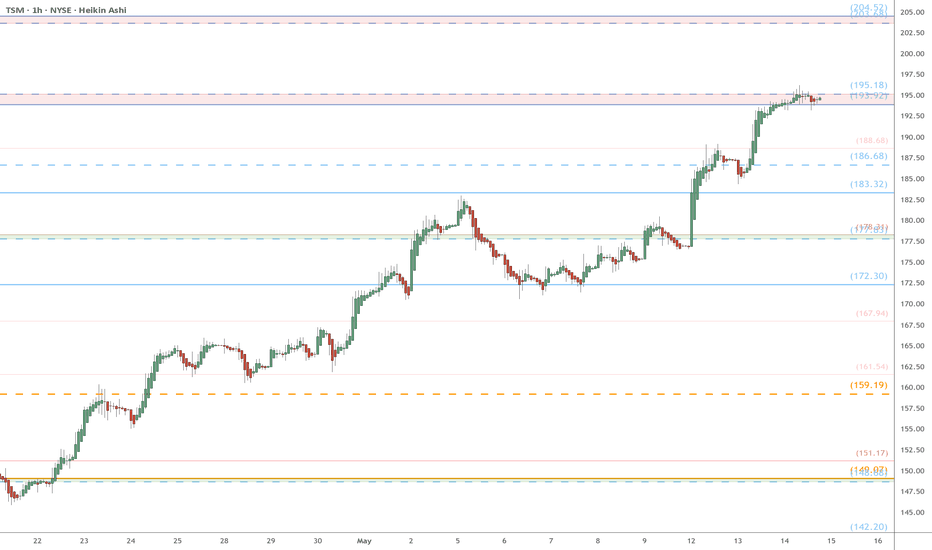

TSM eyes on $194: Major Resistance to Break-n-Run or Dip-to-Buy TSM has been recovering with the chip sector.

Currently testing a Major Resistance zone.

Look for a Dip-to-Buy or Break-n-Retest entry.

$193.92-195.18 is the exact zone of concern.

$177.83-178.31 is the first major support.

$203.68-204.56 is the first resistance above.

========================================

.

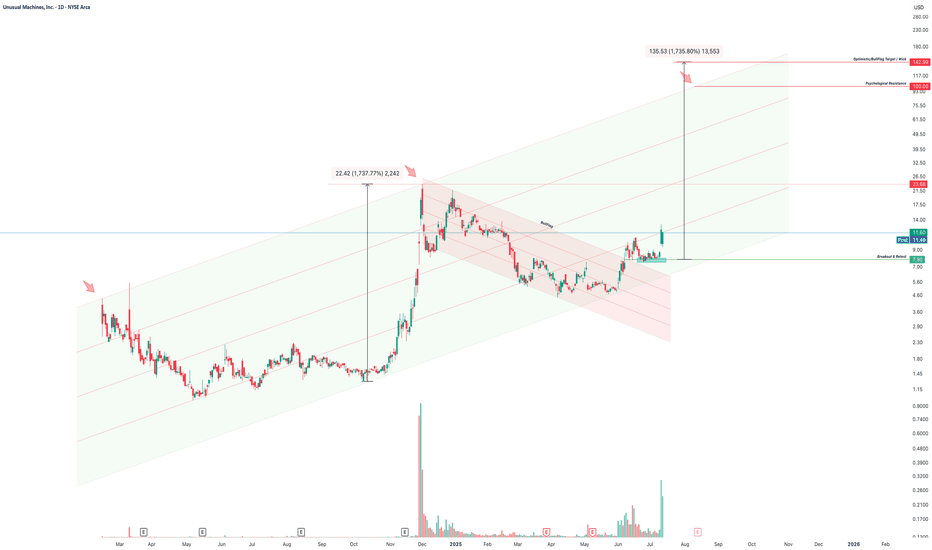

UMAC To the Moon The daily chart of Unusual Machines, Inc. (UMAC) reinforces a bullish breakout continuation setup, A Bullish flag within its rising channel .

🧠 Technical Highlights

Initial Surge: The stock launched from consolidation to a high near $24.00 in late 2024, gaining +1,737% during the move.

Consolidation Phase: The price corrected within a bull flag/descending channel structure (highlighted in red), followed by a breakout above channel resistance.

Breakout & Retest: Price broke out above the $7.80 resistance zone, tested it, and bounced — confirming support conversion. Current price: $11.60.

📏 Measured Move & Channel Analysis

Measured Move: Using the height of the initial rally (22.42 points) and projecting from the breakout zone ($7.80), a bullish price target of $143.34 is calculated — a 1,735% upside.

Bullish Regression Channel: A broader green ascending channel suggests the long-term trend structure remains intact and price may climb along the mid- to upper-channel lines.

📌 Key Resistance Levels

Zone Price Notes

Local Resistance $21.50–$23.68 Former high area from late 2024

Psychological Levels $50 / $100 Round-number zones where traders often react

Optimism/Bull Trap Zone $142.99 Target area where parabolic move may exhaust

✅ Validation Checklist

✔ Breakout above flag/channel with increasing volume

✔ Successful retest of breakout zone (~$7.80)

✔ Trend confirmation with higher highs and volume spike

✔ Clear structure supporting measured move thesis

🧭 Strategy Thoughts

Entry Confirmation: Ideal entry occurred around the breakout/retest near $7.80–$9.00

Risk Management: Protective stop could be placed under $7.00 if newly initiated

Profit Zones: Consider scaling out at $23, $50, $100, and holding a moonshot tranche toward $143

Current market cap = 230M .

A surge to estimated levels would bring this stock up to 5B.

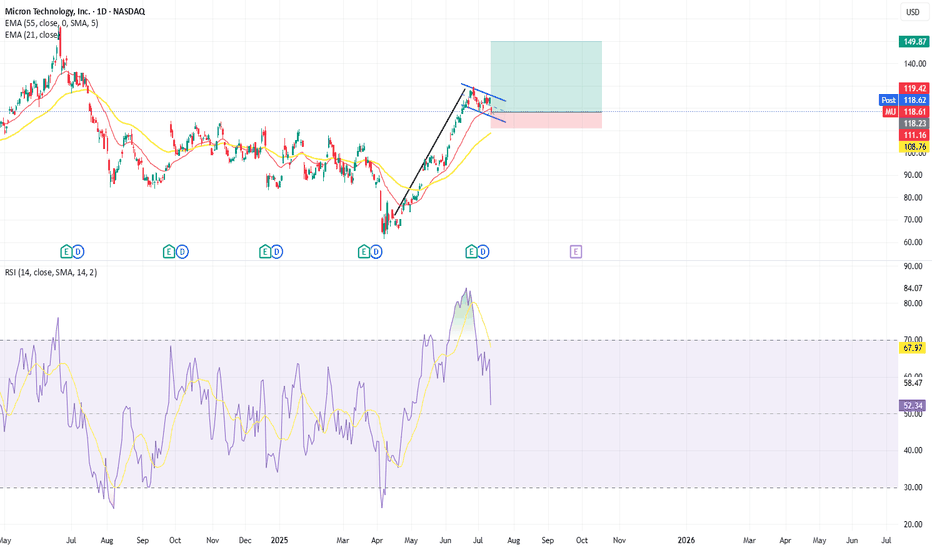

Bullish flag Pattern on MUIt appears there is a Bull flag occurring in MU. Weve seen an 82% rise since the lows caused by the market drop in April and our now seeing a slight retraction back into the 21 EMA. Price is currently at 118.6 with some support at the 114 level. Using a Stop Loss just below this support level should it break and using the first target of 150, just below all time highs yields a risk reward ratio of 1:4.5.