ARK Invest scoops up Coinbase, BitMine shares amid stock dips

ARK Invest has seized the recent stock market dip to boost its stakes in major US crypto exchange Coinbase and Bitcoin miner BitMine Immersion Technologies.

The Cathie Wood-led firm added a total of 94,678 shares of Coinbase (COIN) across three of its funds, including the ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF), according to trade notifications seen by Cointelegraph.

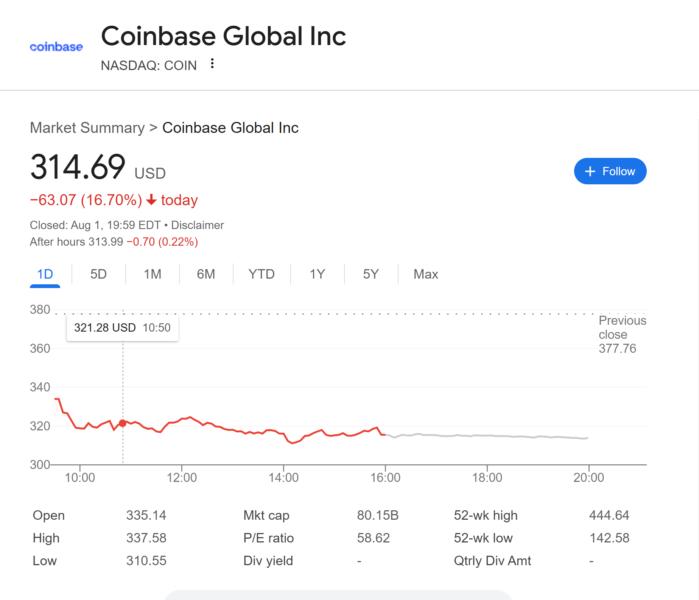

The purchase, worth around $30 million, came as Coinbase stock plunged 16.7% on Friday, closing at $314.69, its worst single-day performance in recent months. COIN hit an intraday low of $310.55, significantly below its 52-week high of $444.64, according to data from Google Finance.

ARK Invest’s renewed buying of Coinbase shares comes after a period of steady selling. On Monday, ARKW sold 18,204 shares of Coinbase, worth nearly $7 million based on Monday’s closing price of $379.49.

ARK Invest acquires more BitMine shares

ARK Invest also ramped up its position in BitMine Immersion Technologies (BMNR), purchasing 540,712 shares across ARKK, ARKW, and ARKF, an estimated $17 million buy.

The buying came as BMNR stock tumbled 8.55% to close at $31.68, hitting an intraday low of $30.30 during a choppy trading session, according to data from Google Finance.

Notably, ARK Invest has been consistently adding BitMine. The firm purchased over $20 million worth of BMNR shares across three of its actively managed ETFs on Monday, which followed a $182 million BitMine buy last week.

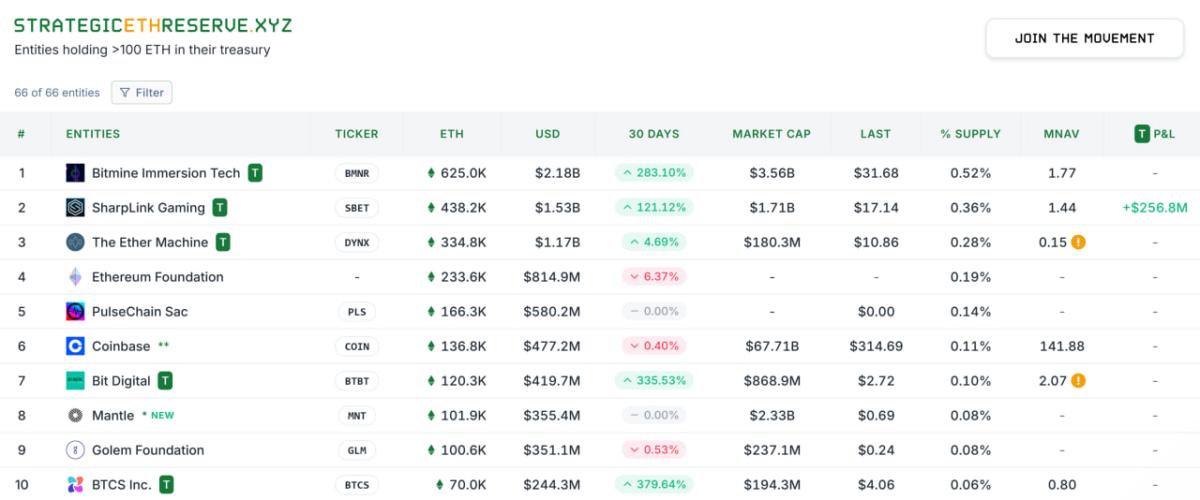

The buying spree comes on the heels of BitMine’s aggressive pivot into Ether. StrategicEtherReserves shows BitMine as the largest Ether treasury firm with 625,000 Ether (ETH), followed by SharpLink Gaming with 438,200 ETH.