OPEN-SOURCE SCRIPT

Updated Cap's Dual Auto Fib Retracement

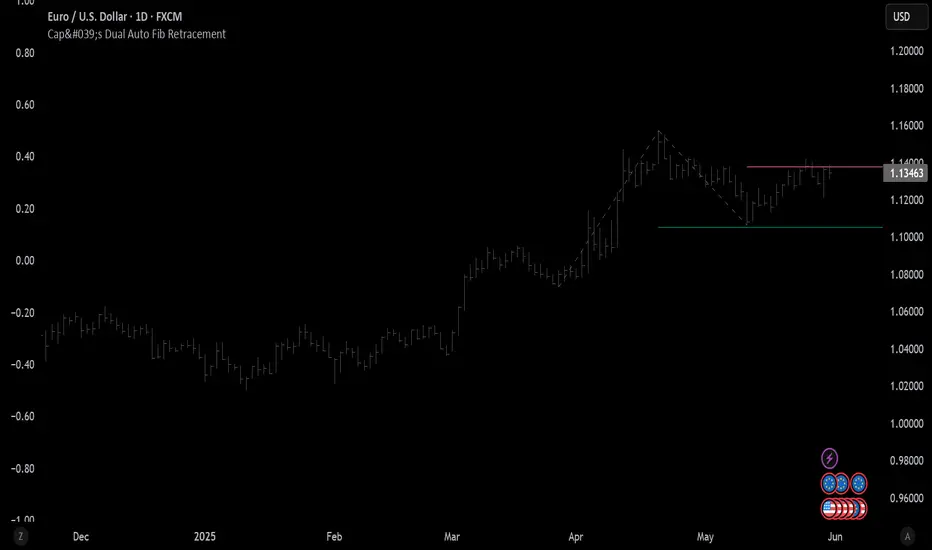

This will draw both a bullish retracement and a bearish retracement. It's defaulted to just show the 0.618 level as I feel like this is the "make or break" level.

- A close below the bullish 0.618 retracement would be considered very bearish.

- A close above the bearish 0.618 would be considered very bullish.

(You can still configure whichever levels you want, however.)

This script was removed by TradingView last time it was published. I couldn't find another script that would provide both bearish/bullish retracements, so I'm assuming this is "original" enough. Maybe it was removed because the description wasn't long enough, so...

Detailed Description:

This indicator automatically plots Fibonacci retracement levels based on zigzag pivot points for both bullish (low-to-high) and bearish (high-to-low) price movements. It identifies key pivot points using a customizable deviation multiplier and depth setting, then draws Fibonacci levels (0, 0.236, 0.382, 0.5, 0.618, 0.786, 1) with user-defined visibility and colors for each level.

Features:

Deviation: Adjusts sensitivity for detecting pivots (default: 2).

Depth: Sets minimum bars for pivot calculation (default: 10).

Extend Lines: Option to extend lines left, right, or both.

Show Prices/Levels: Toggle price and level labels, with options for value or percentage display.

Labels Position: Choose left or right label placement.

Background Transparency: Customize fill transparency between levels.

Alerts: Triggers when price crosses any Fibonacci level.

Usage: Apply to any chart to visualize potential support/resistance zones. Adjust settings to suit your trading style. Requires sufficient data; use lower timeframes or reduce depth if pivots are not detected.

Note: This is a technical analysis tool and does not provide trading signals or financial advice. Always conduct your own research.

- A close below the bullish 0.618 retracement would be considered very bearish.

- A close above the bearish 0.618 would be considered very bullish.

(You can still configure whichever levels you want, however.)

This script was removed by TradingView last time it was published. I couldn't find another script that would provide both bearish/bullish retracements, so I'm assuming this is "original" enough. Maybe it was removed because the description wasn't long enough, so...

Detailed Description:

This indicator automatically plots Fibonacci retracement levels based on zigzag pivot points for both bullish (low-to-high) and bearish (high-to-low) price movements. It identifies key pivot points using a customizable deviation multiplier and depth setting, then draws Fibonacci levels (0, 0.236, 0.382, 0.5, 0.618, 0.786, 1) with user-defined visibility and colors for each level.

Features:

Deviation: Adjusts sensitivity for detecting pivots (default: 2).

Depth: Sets minimum bars for pivot calculation (default: 10).

Extend Lines: Option to extend lines left, right, or both.

Show Prices/Levels: Toggle price and level labels, with options for value or percentage display.

Labels Position: Choose left or right label placement.

Background Transparency: Customize fill transparency between levels.

Alerts: Triggers when price crosses any Fibonacci level.

Usage: Apply to any chart to visualize potential support/resistance zones. Adjust settings to suit your trading style. Requires sufficient data; use lower timeframes or reduce depth if pivots are not detected.

Note: This is a technical analysis tool and does not provide trading signals or financial advice. Always conduct your own research.

Release Notes

updating chart picture with other indicators removed to make the mods happy.Release Notes

updating with clean chart image (all other drawings/text/indicators) removed.Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.