OPEN-SOURCE SCRIPT

Updated Volatility Contraction

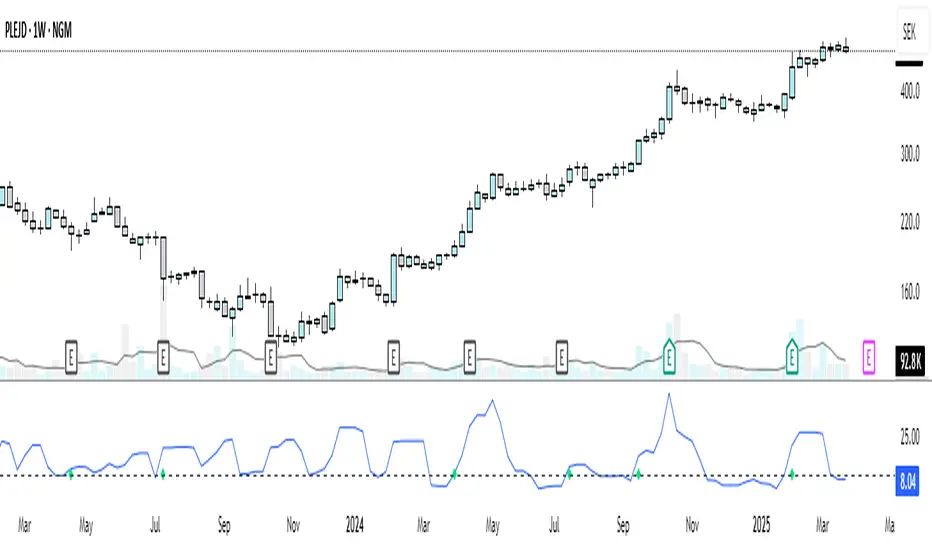

A very simple indicator which calculates the range of a definable period (the default is 5 bars) using a percentage range between the highest and lowest prices calculated from the candle bodies (i.e. open and close values). The plotted line makes it easy to see when price movement is tightening (volatility contraction). The dashed threshold line (default 10%) provides a reference point for setting alerts, helping to identify periods of low volatility (e.g. for stocks in your watchlist) that could signal upcoming market action.

Release Notes

A very simple indicator which calculates the range of a definable period (the default is 5 bars) using a percentage range between the highest and lowest prices calculated from the candle bodies (i.e. open and close values). The plotted line makes it easy to see when price movement is tightening (volatility contraction). The dashed threshold line (default 10%) provides a reference point for setting alerts, helping to identify periods of low volatility (e.g. for stocks in your watchlist) that could signal upcoming market action. Also included is an option to plot breakouts above the range threshold when there is an accompanying spike in volume.Release Notes

Fixed breakout codeRelease Notes

naRelease Notes

naRelease Notes

naRelease Notes

naOpen-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.