OPEN-SOURCE SCRIPT

Updated Overnight vs Intra-day Performance

█ STRATEGY OVERVIEW

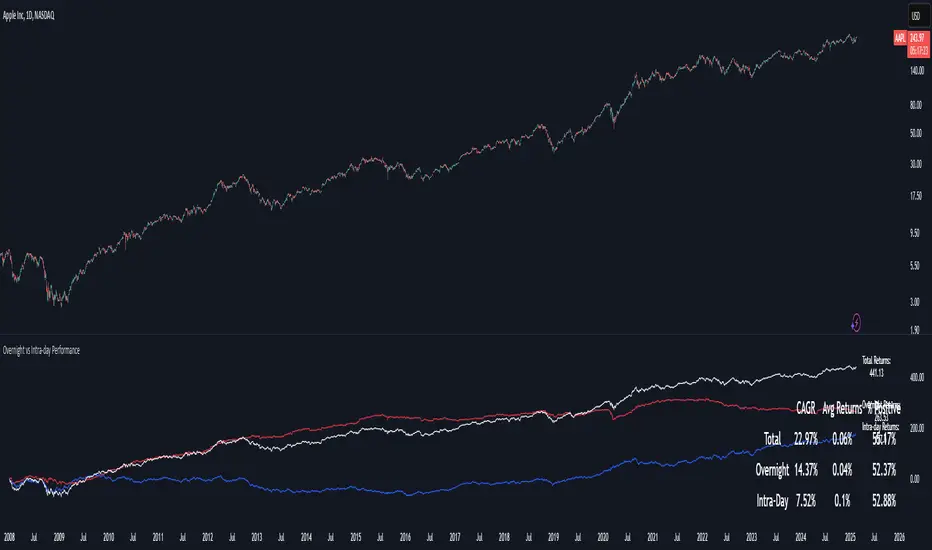

The "Overnight vs Intra-day Performance" indicator quantifies price behaviour differences between trading hours and overnight periods. It calculates cumulative returns, compound growth rates, and visualizes performance components across user-defined time windows. Designed for analytical use, it helps identify whether returns are primarily generated during market hours or overnight sessions.

█ USAGE

Use this indicator on Stocks and ETFs to visualise and compare intra-day vs overnight performance

█ KEY FEATURES

█ VISUALIZATION SYSTEM

1. Time-Series

2. Summary Table

3. Price Chart Labels

█ PURPOSE

█ IDEAL USERS

1. Portfolio Managers

2. Quantitative Researchers

3. Market Microstructure Analysts

4. Day Traders

The "Overnight vs Intra-day Performance" indicator quantifies price behaviour differences between trading hours and overnight periods. It calculates cumulative returns, compound growth rates, and visualizes performance components across user-defined time windows. Designed for analytical use, it helps identify whether returns are primarily generated during market hours or overnight sessions.

█ USAGE

Use this indicator on Stocks and ETFs to visualise and compare intra-day vs overnight performance

█ KEY FEATURES

- Return Segmentation: Separates total returns into overnight (close-to-open) and intraday (open-to-close) components

Growth Tracking: Shows simple cumulative returns and compound annual growth rates (CAGR)

█ VISUALIZATION SYSTEM

1. Time-Series

- Overnight Returns (Red)

- Intraday Returns (Blue)

- Total Returns (White)

2. Summary Table

- Displays CAGR

3. Price Chart Labels

- Floating annotations showing absolute returns and CAGR

- Color-coded to match plot series

█ PURPOSE

- Quantify market behaviour disparities between active trading sessions and overnight positioning

- Provide institutional-grade attribution analysis for returns generation

- Enable tactical adjustment of trading schedules based on historical performance patterns

- Serve as foundational research for session-specific trading strategies

█ IDEAL USERS

1. Portfolio Managers

- Analyse overnight risk exposure across holdings

- Optimize execution timing based on return distributions

2. Quantitative Researchers

- Study market microstructure through time-segmented returns

- Develop alpha models leveraging session-specific anomalies

3. Market Microstructure Analysts

- Identify liquidity patterns in overnight vs daytime sessions

- Research ETF premium/discount mechanics

4. Day Traders

- Align trading hours with highest probability return windows

- Avoid overnight gaps through informed position sizing

Release Notes

Added average returns and percent positiveOpen-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.