OPEN-SOURCE SCRIPT

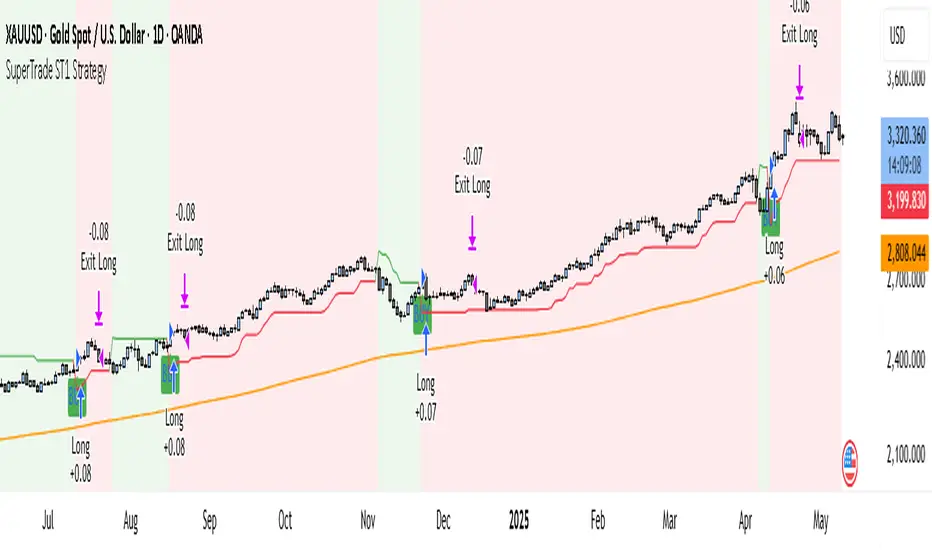

SuperTrade ST1 Strategy

Overview

The SuperTrade ST1 Strategy is a long-only trend-following strategy that combines a Supertrend indicator with a 200-period EMA filter to isolate high-probability bullish trade setups. It is designed to operate in trending markets, using volatility-based exits with a strict 1:4 Risk-to-Reward (R:R) ratio, meaning that each trade targets a profit 4× the size of its predefined risk.

This strategy is ideal for traders looking to align with medium- to long-term trends, while maintaining disciplined risk control and minimal trade frequency.

How It Works

This strategy leverages three key components:

Supertrend Indicator

200-period Exponential Moving Average (EMA) Filter

ATR-Based Stop Loss and Take Profit

Entry Conditions

A long trade is triggered when:

Exit Logic

Once a long position is entered:

Backtest Settings

This strategy is configured for realistic backtesting, including:

These settings aim to simulate real-world conditions and avoid overly optimistic results.

How to Use

Important Notes

The SuperTrade ST1 Strategy is a long-only trend-following strategy that combines a Supertrend indicator with a 200-period EMA filter to isolate high-probability bullish trade setups. It is designed to operate in trending markets, using volatility-based exits with a strict 1:4 Risk-to-Reward (R:R) ratio, meaning that each trade targets a profit 4× the size of its predefined risk.

This strategy is ideal for traders looking to align with medium- to long-term trends, while maintaining disciplined risk control and minimal trade frequency.

How It Works

This strategy leverages three key components:

Supertrend Indicator

- A trend-following indicator based on Average True Range (ATR).

- Identifies bullish/bearish trend direction by plotting a trailing stop line that moves with price volatility.

200-period Exponential Moving Average (EMA) Filter

- Trades are only taken when the price is above the EMA, ensuring participation only during confirmed uptrends.

- Helps filter out counter-trend entries during market pullbacks or ranges.

ATR-Based Stop Loss and Take Profit

- Each trade uses the ATR to calculate volatility-adjusted exit levels.

- Stop Loss: 1× ATR below entry.

- Take Profit: 4× ATR above entry (1:4 R:R).

- This asymmetry ensures that even with a lower win rate, the strategy can remain profitable.

Entry Conditions

A long trade is triggered when:

- Supertrend flips from bearish to bullish (trend reversal).

- Price closes above the Supertrend line.

- Price is above the 200 EMA (bullish market bias).

Exit Logic

Once a long position is entered:

- Stop loss is set 1 ATR below entry.

- Take profit is set 4 ATR above entry.

- The strategy automatically exits the position on either target.

Backtest Settings

This strategy is configured for realistic backtesting, including:

- $10,000 account size

- 2% equity risk per trade

- 0.1% commission

- 1 tick slippage

These settings aim to simulate real-world conditions and avoid overly optimistic results.

How to Use

- Apply the script to any timeframe, though higher timeframes (1H, 4H, Daily) often yield more reliable signals.

- Works best in clearly trending markets (especially in crypto, stocks, indices).

- Can be paired with alerts for live trading or analysis.

Important Notes

- This version is long-only by design. No short positions are executed.

- Ideal for swing traders or position traders seeking asymmetric returns.

- Users can modify the ATR period, Supertrend factor, or EMA filter length based on asset behavior.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.