OPEN-SOURCE SCRIPT

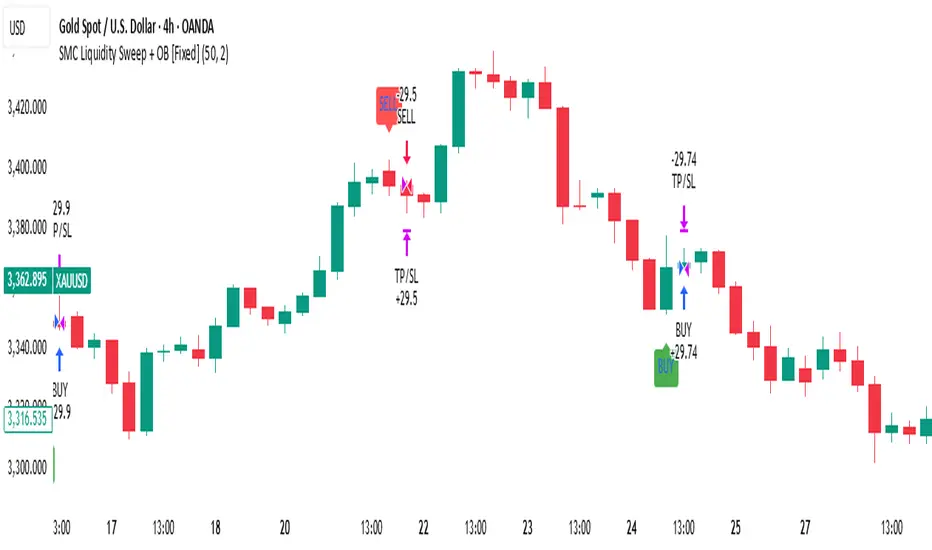

SMC Liquidity Sweep + OB [Fixed]

This is a Smart Money Concept (SMC) backtest-ready strategy built to identify high-probability reversal points using two key institutional principles: liquidity sweep and order block confirmation. Designed specifically for pairs like XAUUSD, this system detects where the market sweeps resting liquidity (e.g., stop hunts above recent highs or below recent lows) and looks for a clean reversal candle (order block) to confirm the trap and trigger precise entries.

Unlike BOS or FVG-based models, this version focuses purely on stop-hunt logic and clean price action to simulate institutional behavior—ideal for Smart Money and ICT-style traders who want clear, non-repainting, high-RR setups.

🔍 How the Strategy Works

Liquidity Sweep Detection

The strategy monitors the chart for price breaking above recent swing highs or below recent swing lows (based on a customizable lookback window). This acts as a trigger for a potential trap or liquidity raid.

Order Block Confirmation

After a sweep is detected, the system waits for a confirming candle — a reversal (engulfing-type) candle that acts as an order block:

For longs: a bullish candle that closes higher than the previous bearish candle’s high

For shorts: a bearish candle that closes lower than the previous bullish candle’s low

Entry & Risk Management

Once confirmation is valid, a market entry is placed:

Stop Loss (SL): A fixed pip distance below/above the entry candle

Take Profit (TP): Calculated based on a user-defined Risk-Reward Ratio (e.g., 1:2, 1:3)

Trades are managed automatically and logged into the Strategy Tester with full visibility

🔧 Strategy Parameters

Setting Description

Stop Loss (Pips) Fixed SL distance from entry to protect capital

Risk/Reward Ratio Dynamically calculates TP relative to SL (e.g., RR 2.0 = TP 2x SL)

Liquidity Lookback How many candles back to evaluate swing highs/lows for potential sweeps

Order Block Filter Validates entry only after candle confirmation post-sweep

Direction Filter Supports both long and short signals or one-sided entry filters

📈 Use Case & Optimization

This strategy works best when applied to:

XAUUSD, NAS100, BTCUSD, US30, and high-volatility pairs

Timeframes like 5m, 15m, 1H, where sweeps and reversals are more visible

Traders who follow ICT, SMC, or price action frameworks

Reversal or continuation traders looking for clean execution after liquidity grabs

Because it uses pure price action and logical candle structures, it avoids lag and repainting found in indicator-based systems.

💡 Smart Money Concept Logic Used

Liquidity Grab: Detects stop hunts above recent highs/below lows

Order Block Entry: Entry confirmed only after strong reversal candle at sweep zone

High RR Control: SL and TP customizable to reflect real trading plans

Non-Repainting Structure: All entries are based on confirmed candle closes

📊 Built-in Backtesting Features

Plots trades visually with entry arrows and signal labels

Uses strategy.entry() and strategy.exit() for full testing accuracy

Outputs full performance metrics: win rate, profit factor, drawdown, etc.

All parameters tunable from the settings panel

📎 Release Notes

v1.0

Core SMC strategy with liquidity sweep + OB entry logic

Fully backtestable with fixed SL & dynamic TP

Plots buy/sell signals visually

Optimized for metals, indices, and crypto

⚠️ Disclaimer

This TradingView script is intended for educational and research purposes only. It is not financial advice or a live signal system. Always backtest on your own charts, confirm entries with your personal analysis, and apply strict risk management.

Unlike BOS or FVG-based models, this version focuses purely on stop-hunt logic and clean price action to simulate institutional behavior—ideal for Smart Money and ICT-style traders who want clear, non-repainting, high-RR setups.

🔍 How the Strategy Works

Liquidity Sweep Detection

The strategy monitors the chart for price breaking above recent swing highs or below recent swing lows (based on a customizable lookback window). This acts as a trigger for a potential trap or liquidity raid.

Order Block Confirmation

After a sweep is detected, the system waits for a confirming candle — a reversal (engulfing-type) candle that acts as an order block:

For longs: a bullish candle that closes higher than the previous bearish candle’s high

For shorts: a bearish candle that closes lower than the previous bullish candle’s low

Entry & Risk Management

Once confirmation is valid, a market entry is placed:

Stop Loss (SL): A fixed pip distance below/above the entry candle

Take Profit (TP): Calculated based on a user-defined Risk-Reward Ratio (e.g., 1:2, 1:3)

Trades are managed automatically and logged into the Strategy Tester with full visibility

🔧 Strategy Parameters

Setting Description

Stop Loss (Pips) Fixed SL distance from entry to protect capital

Risk/Reward Ratio Dynamically calculates TP relative to SL (e.g., RR 2.0 = TP 2x SL)

Liquidity Lookback How many candles back to evaluate swing highs/lows for potential sweeps

Order Block Filter Validates entry only after candle confirmation post-sweep

Direction Filter Supports both long and short signals or one-sided entry filters

📈 Use Case & Optimization

This strategy works best when applied to:

XAUUSD, NAS100, BTCUSD, US30, and high-volatility pairs

Timeframes like 5m, 15m, 1H, where sweeps and reversals are more visible

Traders who follow ICT, SMC, or price action frameworks

Reversal or continuation traders looking for clean execution after liquidity grabs

Because it uses pure price action and logical candle structures, it avoids lag and repainting found in indicator-based systems.

💡 Smart Money Concept Logic Used

Liquidity Grab: Detects stop hunts above recent highs/below lows

Order Block Entry: Entry confirmed only after strong reversal candle at sweep zone

High RR Control: SL and TP customizable to reflect real trading plans

Non-Repainting Structure: All entries are based on confirmed candle closes

📊 Built-in Backtesting Features

Plots trades visually with entry arrows and signal labels

Uses strategy.entry() and strategy.exit() for full testing accuracy

Outputs full performance metrics: win rate, profit factor, drawdown, etc.

All parameters tunable from the settings panel

📎 Release Notes

v1.0

Core SMC strategy with liquidity sweep + OB entry logic

Fully backtestable with fixed SL & dynamic TP

Plots buy/sell signals visually

Optimized for metals, indices, and crypto

⚠️ Disclaimer

This TradingView script is intended for educational and research purposes only. It is not financial advice or a live signal system. Always backtest on your own charts, confirm entries with your personal analysis, and apply strict risk management.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

✅JOIN FREE SIGNALS t.me/frankfxforextrade

✅ AUTOMATED BOT: bot.frankfxx.com

✅AI CRYPTO SIGNAL:crypto.frankfxx.com

✅STORE:selar.com/m/ukwuezefrankfx

✅AI GOLD INDICES AND FOREX SIGNALS

trade.frankfxx.com

✅ AUTOMATED BOT: bot.frankfxx.com

✅AI CRYPTO SIGNAL:crypto.frankfxx.com

✅STORE:selar.com/m/ukwuezefrankfx

✅AI GOLD INDICES AND FOREX SIGNALS

trade.frankfxx.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

✅JOIN FREE SIGNALS t.me/frankfxforextrade

✅ AUTOMATED BOT: bot.frankfxx.com

✅AI CRYPTO SIGNAL:crypto.frankfxx.com

✅STORE:selar.com/m/ukwuezefrankfx

✅AI GOLD INDICES AND FOREX SIGNALS

trade.frankfxx.com

✅ AUTOMATED BOT: bot.frankfxx.com

✅AI CRYPTO SIGNAL:crypto.frankfxx.com

✅STORE:selar.com/m/ukwuezefrankfx

✅AI GOLD INDICES AND FOREX SIGNALS

trade.frankfxx.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.