OPEN-SOURCE SCRIPT

Clarix Trailing Master

Clarix Trailing Master

Advanced Manual Entry Trailing Stop Strategy

Purpose:

Clarix Trailing Master is designed to give traders precise control over trade exits with a customizable trailing stop system. It combines manual entry inputs with dynamic and static trailing stop options, empowering users to protect profits while minimizing premature stop-outs.

How It Works:

Key Features:

Usage Tips:

Advanced Manual Entry Trailing Stop Strategy

Purpose:

Clarix Trailing Master is designed to give traders precise control over trade exits with a customizable trailing stop system. It combines manual entry inputs with dynamic and static trailing stop options, empowering users to protect profits while minimizing premature stop-outs.

How It Works:

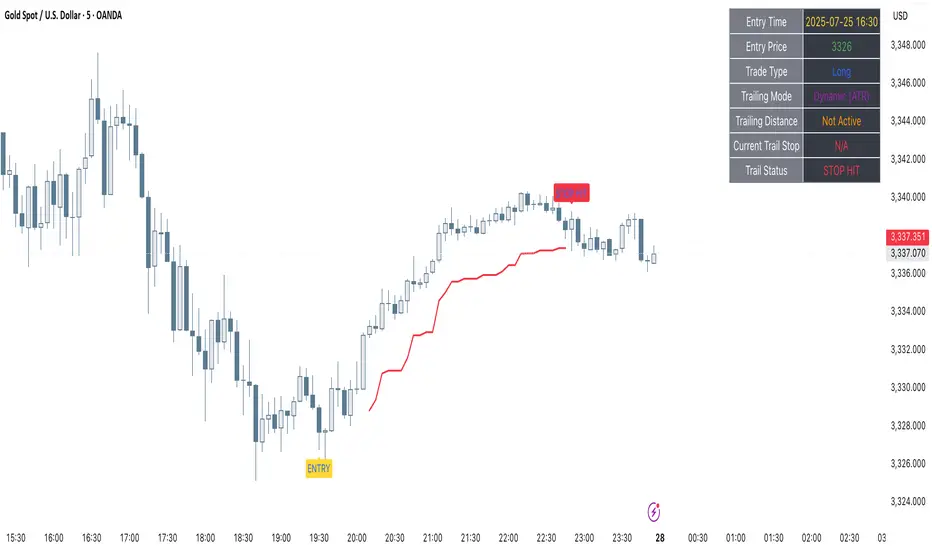

- You manually input your trade entry price and specify the trade direction (Long or Short).

- The strategy activates the trailing stop only after the price moves favorably by a configurable profit threshold. This helps avoid early stop losses during initial market noise.

- You can choose between a dynamic trailing stop based on Average True Range (ATR) or a fixed static trailing distance. The ATR can also be computed on a higher timeframe for enhanced stability.

- Once active, the trailing stop updates live with price movements, ensuring your gains are locked in progressively.

- If the price crosses the trailing stop, a clear alert triggers, and the stop-hit status displays visually on the chart.

Key Features:

- Manual entry with exact price and timestamp input for precise trade tracking.

- Supports both Long and Short trades.

- Choice between dynamic ATR-based trailing or static trailing stops.

- Configurable profit threshold before trailing stop activation to avoid early exits.

- Visual markers for entry and stop-hit points (yellow and red respectively).

- Live dashboard displaying entry details, trade status, trailing mode, and current stop level.

- Works on all asset classes and timeframes, adaptable to various trading styles.

- Built-in audio alert notifies you immediately when the trailing stop is hit.

Usage Tips:

- Adjust the profit threshold and ATR settings based on your asset’s volatility and timeframe. For example, use higher ATR multipliers for more volatile markets like crypto.

- Consider using higher timeframe ATR values for smoother trailing stops in fast-moving markets.

- Ideal for swing trading or position trading where precise stop management is crucial.

- Always backtest and paper trade before applying to live markets.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.