OPEN-SOURCE SCRIPT

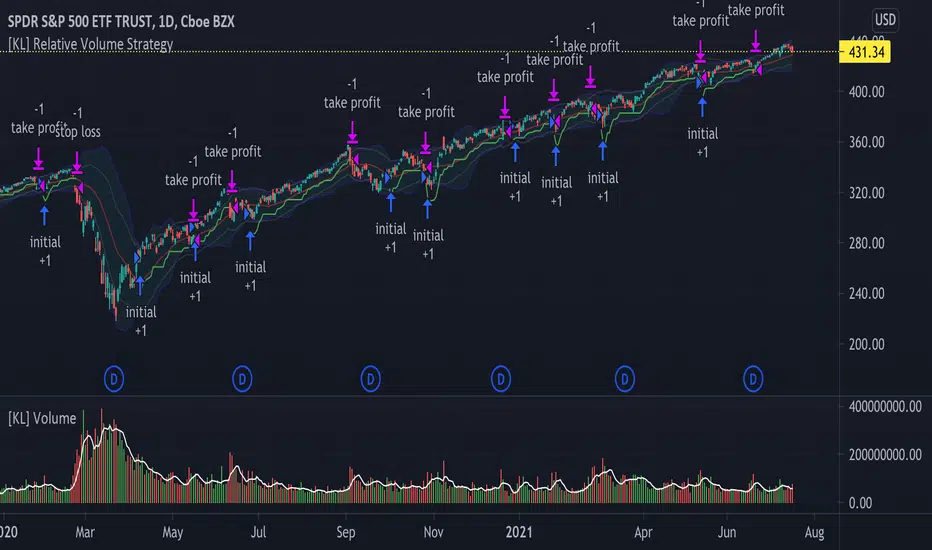

Updated [KL] Relative Volume Strategy

This strategy will Long when:

It exits when either (a) stop loss limit is reached, or when (b) price actions suggest trend is bearish.

<Note 1> Measuring price volatility to assume consolidation:

For each candlestick, we quantify price volatility by referring to the value of standard deviations (2x) of closing prices over a look-back period of 20 candles. This is exactly what the Bollinger Band (“BOLL”) indicates by default.

Knowing the value of standard deviation (2x) of prices (aka the width of lower/upper BOLL bands), we then compare it with ATR (x2) over a user-defined length (can be configured in settings). Volatility is considered to be low, relatively, when the standard deviation (x2) of prices is less than ATR (2x).

- Confirmation #1: when volume is relatively high

- Confirmation #2: during periods of price consolidation (See <Note 1>)

It exits when either (a) stop loss limit is reached, or when (b) price actions suggest trend is bearish.

<Note 1> Measuring price volatility to assume consolidation:

For each candlestick, we quantify price volatility by referring to the value of standard deviations (2x) of closing prices over a look-back period of 20 candles. This is exactly what the Bollinger Band (“BOLL”) indicates by default.

Knowing the value of standard deviation (2x) of prices (aka the width of lower/upper BOLL bands), we then compare it with ATR (x2) over a user-defined length (can be configured in settings). Volatility is considered to be low, relatively, when the standard deviation (x2) of prices is less than ATR (2x).

Release Notes

Bug fixed (exit message showing "stop loss" or "take profit")Release Notes

Improved conditional statements to determine bearish engulfing candlesticks.Release Notes

- improved price action indicators- modified entry condition, requires the current candlestick to be strong in support, or at least not work as bare minimum (as per price action indicators)

Release Notes

Fixed bugs, and refactored codes.Release Notes

Values of parameters can now be further customized in settings.Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.