OPEN-SOURCE SCRIPT

Updated vol_bracket

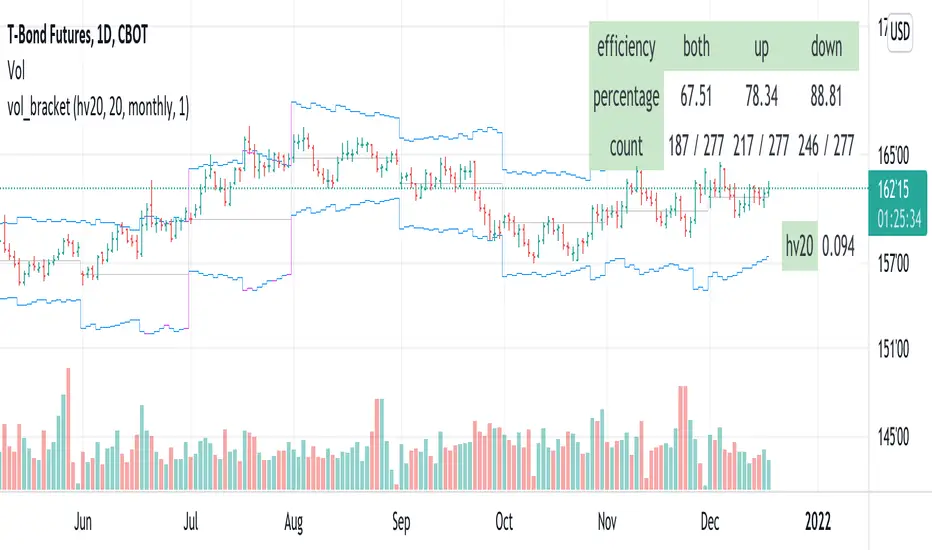

This simple script shows an "N" standard deviation volatility bracket, anchored at the opening price of the current month, week, or quarter. This anchor is meant to coincide roughly with the expiration of options issued at the same interval. You can choose between a manually-entered IV or the hv30 volatility model.

Unlike my previous scripts, which all show the volatility bracket as a rolling figure, the anchor helps to visualize the volatility estimate in relation to price as it ranges over the (approximate) lifetime of a single, real contract.

Unlike my previous scripts, which all show the volatility bracket as a rolling figure, the anchor helps to visualize the volatility estimate in relation to price as it ranges over the (approximate) lifetime of a single, real contract.

Release Notes

- Fixed a bug where the monthly bracket started one day late for instruments with an overnight session.- Added a daily bracket.

Release Notes

Added an "efficiency" table. Efficiency is the ratio of periods in which price closed within the period's bracket (both), below the top bound (up), or above the bottom bound (down), to those in which it did not.Release Notes

- added table to display current vol and modelRelease Notes

to make the script more readable:- color brackets "blue" if close is inside, "fuchsia" if outside

- changed the bracket to "circles" style on the daily chart... stepline style is too messy

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.