OPEN-SOURCE SCRIPT

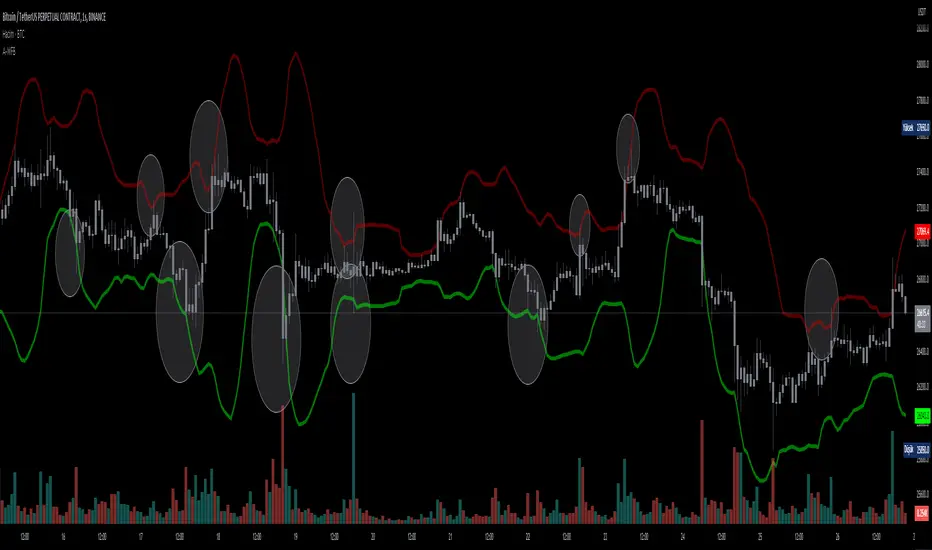

Alpha Fractal Bands

Williams fractals are remarkable support and resistance levels used by many traders. However, it can sometimes be challenging to use them frequently and get confirmation from other oscillators and indicators. With the new "Alpha Fractal Bands", a unique blend of Williams Fractals and Bollinger Bands emerges, offering a fresh perspective. Extremes can be utilized as price reversals or for taking profits. I look forward to hearing your thoughts. Best regards... Happy trading!

An easy solution for long positions is to:

Identify a bullish trend or a potential entry point for a long position.

Set a stop-loss order to limit potential losses if the trade goes against you.

Determine a target price or take-profit level to lock in profits.

Consider using technical indicators or analysis tools to confirm the strength of the bullish trend.

Regularly monitor the trade and make necessary adjustments based on market conditions.

An easy solution for short positions could be to follow these steps:

Identify a bearish trend or a potential entry point for a short position.

Set a stop-loss order to limit potential losses if the trade goes against you.

Determine a target price or take-profit level to lock in profits.

Consider using technical indicators or analysis tools to confirm the strength of the bearish trend.

Regularly monitor the trade and make necessary adjustments based on market conditions.

Remember, it's important to conduct thorough research and analysis before entering any trade and to manage your risk effectively.

To stay updated with the content, don't forget to follow and engage with it on TV, my friends. Remember to leave comments as well :)

An easy solution for long positions is to:

Identify a bullish trend or a potential entry point for a long position.

Set a stop-loss order to limit potential losses if the trade goes against you.

Determine a target price or take-profit level to lock in profits.

Consider using technical indicators or analysis tools to confirm the strength of the bullish trend.

Regularly monitor the trade and make necessary adjustments based on market conditions.

An easy solution for short positions could be to follow these steps:

Identify a bearish trend or a potential entry point for a short position.

Set a stop-loss order to limit potential losses if the trade goes against you.

Determine a target price or take-profit level to lock in profits.

Consider using technical indicators or analysis tools to confirm the strength of the bearish trend.

Regularly monitor the trade and make necessary adjustments based on market conditions.

Remember, it's important to conduct thorough research and analysis before entering any trade and to manage your risk effectively.

To stay updated with the content, don't forget to follow and engage with it on TV, my friends. Remember to leave comments as well :)

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.