OPEN-SOURCE SCRIPT

Updated Shaved Candle Identifier

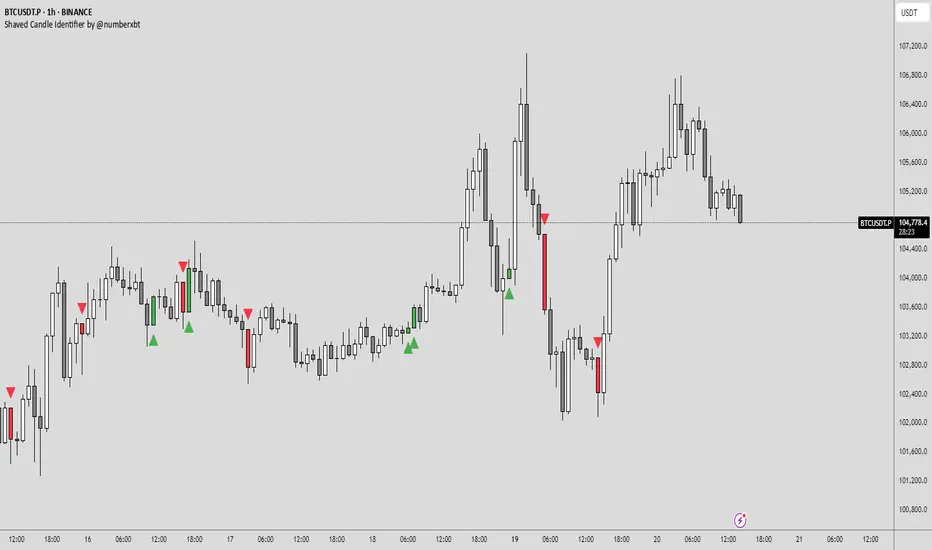

This script is different because it actually highlights the candle and is not just an icon. It will identify bars that have no wick. Each color represents a different type of candle.

Shaved candles represent major liquidity zones, and tend to get swept in the future.

Shaved candles are useful for spotting reversals and as price targets.

There is 0 tolerance for any deviation, if the price is 0.001 off, it will not be identified. Only absolutely shaved candles will be identified.

Shaved candles represent major liquidity zones, and tend to get swept in the future.

Shaved candles are useful for spotting reversals and as price targets.

- Green is when open = low

- Red is when open = high

- Blue is when close = high

- Orange is when close = low

There is 0 tolerance for any deviation, if the price is 0.001 off, it will not be identified. Only absolutely shaved candles will be identified.

Release Notes

This script is different because it actually highlights the candle and is not just an icon. It will identify bars that have no wick, or you can set a threshold for how large you want the wick to be, this is measured in ticks.Shaved candles represent major liquidity zones, and tend to get swept in the future, especially when they are on a higher time frame.

Shaved candles are useful for spotting reversals and as price targets.

Green is when open = low

Red is when open = high

The user may define a tolerance for the wick size defined in tick size.

--Patch notes--

1. Added a threshold that the user can define.

2. Removed shaved closes.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.