OPEN-SOURCE SCRIPT

FVG [TakingProphets]

🧠 Purpose

This indicator is built for traders applying Inner Circle Trader (ICT) methodology. It detects and manages Fair Value Gaps (FVGs) — price imbalances that often act as future reaction zones. It also highlights New Day Opening Gaps (NDOGs) and New Week Opening Gaps (NWOGs) that frequently play a role in early-session price behavior.

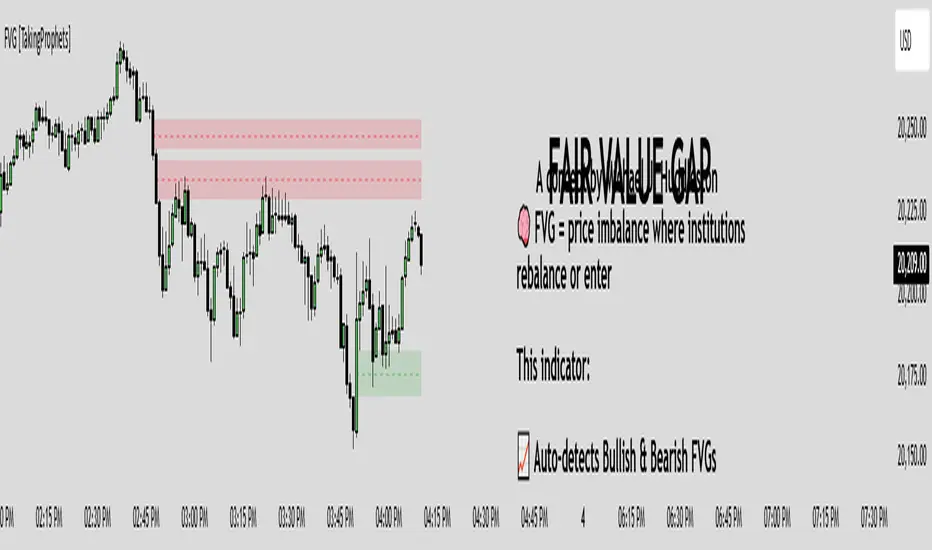

📚 What is a Fair Value Gap?

A Fair Value Gap forms when price moves rapidly, skipping over a portion of the chart between three candles — typically between the high of the first candle and the low of the third. These zones are considered inefficient, meaning institutions may return to them later to:

-Rebalance unfilled orders

-Enter or scale into positions

-Engineer liquidity with minimal slippage

In ICT methodology, FVGs are seen as both entry zones and targets, depending on market structure and context.

⚙️ How It Works

-This script automatically identifies and manages valid FVGs using the following logic:

-Bullish FVGs: When the low of the current candle is above the high from two candles ago

-Bearish FVGs: When the high of the current candle is below the body of two candles ago

-Minimum Gap Filter: Gaps must be larger than 0.05% of price

-Combine Consecutive Gaps (optional): Merges adjacent gaps of the same type

-Consequent Encroachment Line (optional): Plots the midpoint of each gap

-NDOG/NWOG Tracking: Labels gaps created during the 5–6 PM session transition

-Automatic Invalidation: Gaps are removed once price closes beyond their boundary

🎯 Practical Use

-Use unmitigated FVGs as potential entry points or targets

-Monitor NDOG and NWOG for context around daily or weekly opens

-Apply the midpoint (encroachment) line for precise execution decisions

-Let the script handle cleanup — only active, relevant zones remain visible

🎨 Customization

-Control colors for bullish, bearish, and opening gaps

-Toggle FVG borders and midpoint lines

-Enable or disable combining of consecutive gaps

-Fully automated zone management, no manual intervention required

✅ Summary

This tool offers a clear, rules-based approach to identifying price inefficiencies rooted in ICT methodology. Whether used for intraday or swing trading, it helps traders stay focused on valid, active Fair Value Gaps while filtering out noise and maintaining chart clarity.

This indicator is built for traders applying Inner Circle Trader (ICT) methodology. It detects and manages Fair Value Gaps (FVGs) — price imbalances that often act as future reaction zones. It also highlights New Day Opening Gaps (NDOGs) and New Week Opening Gaps (NWOGs) that frequently play a role in early-session price behavior.

📚 What is a Fair Value Gap?

A Fair Value Gap forms when price moves rapidly, skipping over a portion of the chart between three candles — typically between the high of the first candle and the low of the third. These zones are considered inefficient, meaning institutions may return to them later to:

-Rebalance unfilled orders

-Enter or scale into positions

-Engineer liquidity with minimal slippage

In ICT methodology, FVGs are seen as both entry zones and targets, depending on market structure and context.

⚙️ How It Works

-This script automatically identifies and manages valid FVGs using the following logic:

-Bullish FVGs: When the low of the current candle is above the high from two candles ago

-Bearish FVGs: When the high of the current candle is below the body of two candles ago

-Minimum Gap Filter: Gaps must be larger than 0.05% of price

-Combine Consecutive Gaps (optional): Merges adjacent gaps of the same type

-Consequent Encroachment Line (optional): Plots the midpoint of each gap

-NDOG/NWOG Tracking: Labels gaps created during the 5–6 PM session transition

-Automatic Invalidation: Gaps are removed once price closes beyond their boundary

🎯 Practical Use

-Use unmitigated FVGs as potential entry points or targets

-Monitor NDOG and NWOG for context around daily or weekly opens

-Apply the midpoint (encroachment) line for precise execution decisions

-Let the script handle cleanup — only active, relevant zones remain visible

🎨 Customization

-Control colors for bullish, bearish, and opening gaps

-Toggle FVG borders and midpoint lines

-Enable or disable combining of consecutive gaps

-Fully automated zone management, no manual intervention required

✅ Summary

This tool offers a clear, rules-based approach to identifying price inefficiencies rooted in ICT methodology. Whether used for intraday or swing trading, it helps traders stay focused on valid, active Fair Value Gaps while filtering out noise and maintaining chart clarity.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.