OPEN-SOURCE SCRIPT

Updated Volatility Meter

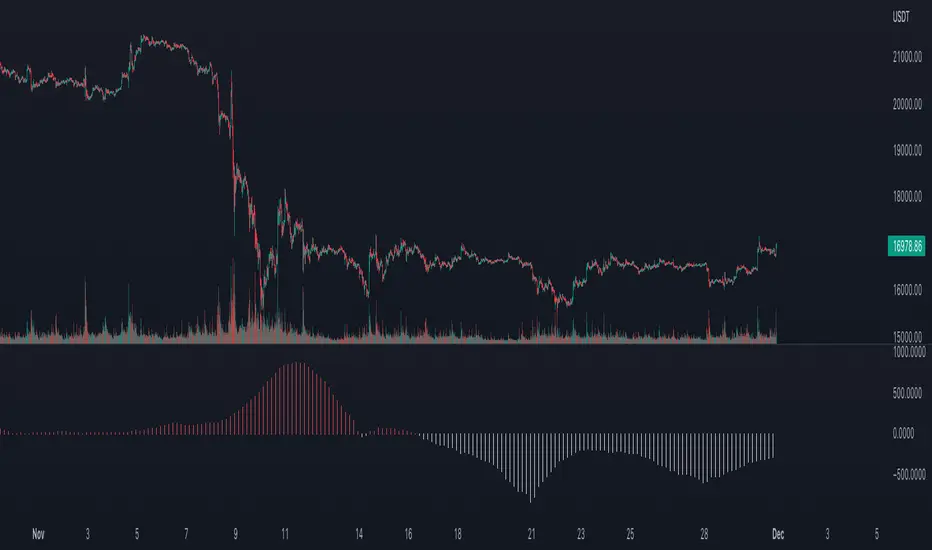

The title is quite self explanatory. It is a Volatility Meter based on Bollinger Bands Width and MA.

These parameters can be selected by users in settings tab:

- Basic Bollinger Bands Parameters: length, standart deviation and source

- Timeframes: 1h, 2h, 3h and 4h

If the indicator is red it means volatility is high in the market. If it is white, it means that market is not volatile right now.

These parameters can be selected by users in settings tab:

- Basic Bollinger Bands Parameters: length, standart deviation and source

- Timeframes: 1h, 2h, 3h and 4h

If the indicator is red it means volatility is high in the market. If it is white, it means that market is not volatile right now.

Release Notes

The title is self-explanatory. It is a Volatility Meter based on Bollinger Bands Width and Moving Averages. It also uses the concept of multi-time frame analysis.You can decide the options below on the settings tab:

- Basic Bollinger Bands Parameters: length, standart deviation and source

- Timeframes: 1h, 2h, 3h and 4h

If the indicator is red, it means volatility is high in the market. If it is white, it means the market is not volatile right now. If you use it in a smaller timeframe than it is calculated then you will get the multi-timeframe analysis of the volatility. As could be seen on the chart above, if it is red it usually means that big market moves are expected.

Use it on 4H or smaller time frames to get the multi-time frame volatility insight. If you use it on the time frame greater than 4H please select the calculated time frame accordingly. (NOTE: credits on the source code is removed.)

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.