OPEN-SOURCE SCRIPT

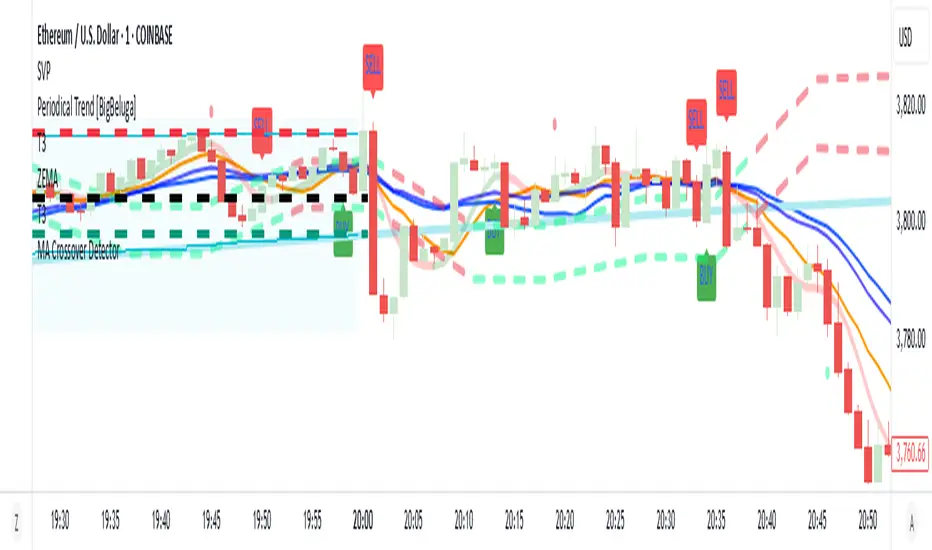

MA Crossover Detector

The Moving Average Crossover Detector is a custom indicator that visually shows buy and sell signals clearly on the chart. based on the crossing of two moving averages — a popular and beginner-friendly tool in technical analysis.

It plots two moving averages — One fast (short period) and one slow (long period) — and highlights crossover points:

✅ Buy Signal (Golden Cross) – When the fast MA crosses above the slow MA.

❌ Sell Signal (Death Cross) – When the fast MA crosses below the slow MA.

✅ Features

Visual: Clearly shows crossovers on the chart.

Customizable: Choose periods, types, styles, etc.

Alert-ready: You can set alerts for crossovers.

The Moving Average (MA) Crossover Strategy is one of the simplest and most widely used strategies in technical analysis for trading stocks, forex, crypto, and other markets. It relies on the interaction between two moving averages to generate buy and sell signals.

Core Components

Short-Term Moving Average (Fast MA): Reacts quickly to price changes (e.g., 9-period or 20-period).

Long-Term Moving Average (Slow MA): Reacts more slowly to price changes (e.g., 21-period or 200-period).

How the Strategy Works

Bullish Crossover (Golden Cross):

Occurs when the fast MA crosses above the slow MA. Interpreted as a buy signal, indicating a potential uptrend.

Bearish Crossover (Death Cross):

Occurs when the fast MA crosses below the slow MA. Interpreted as a sell signal, indicating a potential downtrend.

Common Variants

Short-term trading

9 EMA

21 EMA

Swing trading

20 SMA

50 SMA

Long-term investing

50 SMA

200 SMA

Pros

Easy to understand and implement

Works well in trending markets

Can be automated for backtesting and execution

Cons

Lagging indicator: MAs are based on past prices, so signals come after the move has started.

Choppy markets = whipsaws: Generates false signals in sideways/range-bound conditions.

May underperform in volatile or mean-reverting environments

Tips for Improvement

Use confirmation tools: e.g., RSI, MACD, volume analysis, price action

Add filters: Trend filter (ADX), volatility filter (ATR), or time filter (session-based)

Combine with price structure: Support/resistance, breakouts, pullbacks

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.