OPEN-SOURCE SCRIPT

Updated Improved Weinstein Stage Analysis

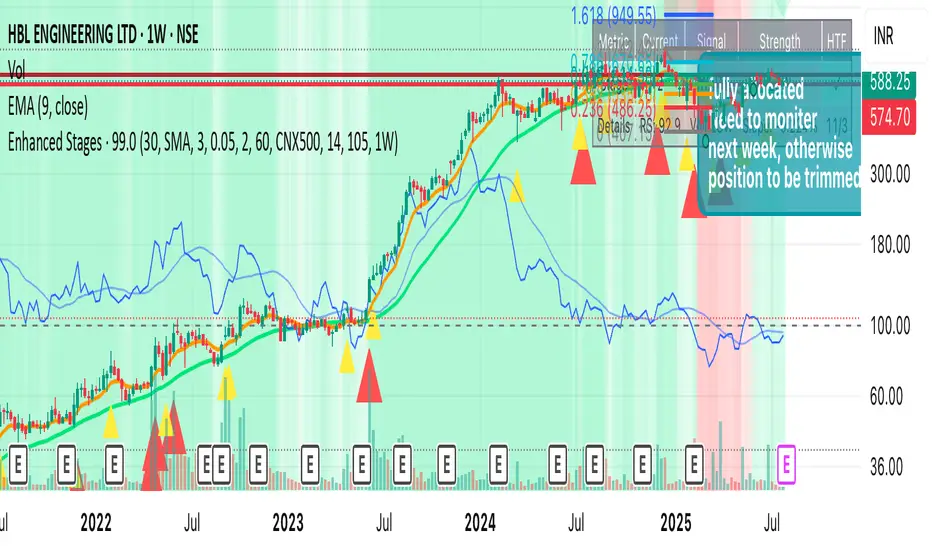

The code provides an actionable, disciplined, and visually informative implementation of the “Stage Analysis” approach pioneered by Stan Weinstein, with enhancements to modernize, automate, and clarify the methodology for today’s traders using TradingView. It faithfully follows the workflow recommended: identify long-term cycles, confirm with volume and relative strength, and only engage aggressively with the market during the advancing (bullish) stage with all “clues” aligned.

Release Notes

Key Enhancements Implemented1. Advanced Stage Logic

Percentage-based MA slope calculation for better sensitivity

Multi-condition stage determination with improved accuracy

Dynamic confirmation system to reduce false signals

2. Sophisticated Volume Analysis

Multi-period volume averages (20 & 50 SMA)

Percentile ranking for context-aware volume spikes

Separate strong vs moderate volume classifications

3. Enhanced Relative Strength

Improved error handling for security data

Momentum-based RS strength detection

Customizable outperformance thresholds

4. Multi-Timeframe Support

Optional higher timeframe confirmation

Stage alignment validation

Visual indicators for timeframe conflicts

5. Advanced Visual Features

Dynamic transparency based on trend strength

Enhanced color coding system

Comprehensive information table with signal strength scoring

6. Improved Alert System

Multi-condition signal validation

Strength-based alert prioritization

Detailed alert messages with context

This enhanced version provides significantly more robust signal generation while maintaining the core Weinstein methodology principles.

Release Notes

minor updatesOpen-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.