OPEN-SOURCE SCRIPT

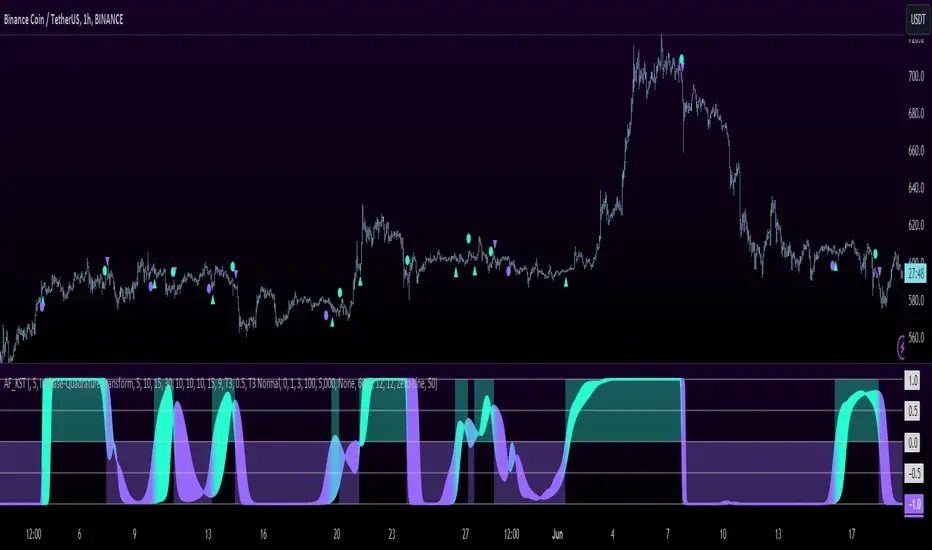

Updated Adaptive Fisherized KST

Introduction

Heyo guys, here is a new adaptive fisherized indicator of me.

I applied Inverse Fisher Transform, Ehlers dominant cycle analysis,

smoothing and divergence analysis on the Know Sure Thing (KST) indicator.

Moreover, the indicator doesn't repaint.

Usage

I didn't backtest the indicator, but I recommend the 5–15 min timeframe.

It can be also used on other timeframs, but I have no experience with that.

The indicator has no special filter system, so you need to find an own combo in order to build a trading system.

A trend filter like KAMA or my Adaptive Fisherized Trend Intensity Index could fit well.

If you find a good combo, let me know it in the comments pls.

Signals

Zero Line

KST crossover 0 => Enter Long

KST crossunder 0 => Enter Short

Cross

KST crossover KST MA => Enter Long

KST crossunder KST MA => Enter Short

Cross Filtered

KST crossover KST MA and KST above 0 => Enter Long

KST crossunder KST MA and KST under 0 => Enter Short

KST crossunder 0 => Exit Long

KST crossover 0 => Exit Short

More to read: KST Explanation

Enjoy and let me know your opinion!

--

Credits to

- tista

- blackcat1402

- DasanC

- cheatcountry

Heyo guys, here is a new adaptive fisherized indicator of me.

I applied Inverse Fisher Transform, Ehlers dominant cycle analysis,

smoothing and divergence analysis on the Know Sure Thing (KST) indicator.

Moreover, the indicator doesn't repaint.

Usage

I didn't backtest the indicator, but I recommend the 5–15 min timeframe.

It can be also used on other timeframs, but I have no experience with that.

The indicator has no special filter system, so you need to find an own combo in order to build a trading system.

A trend filter like KAMA or my Adaptive Fisherized Trend Intensity Index could fit well.

If you find a good combo, let me know it in the comments pls.

Signals

Zero Line

KST crossover 0 => Enter Long

KST crossunder 0 => Enter Short

Cross

KST crossover KST MA => Enter Long

KST crossunder KST MA => Enter Short

Cross Filtered

KST crossover KST MA and KST above 0 => Enter Long

KST crossunder KST MA and KST under 0 => Enter Short

KST crossunder 0 => Exit Long

KST crossover 0 => Exit Short

More to read: KST Explanation

Enjoy and let me know your opinion!

--

Credits to

- tista

- blackcat1402

- DasanC

- cheatcountry

Release Notes

Removed superflous Kalman filter, because it ripped the calculation.Release Notes

Removed VIDYA, ZLSMA and COVWMARemoved superflous code

Made a bug fix in the vwma function which prevented consuming volume of other timeframes

Release Notes

Updated the default valuesRelease Notes

Avoided that adaptive length caps the period in the core algorithmAdded gradient

NET and Hann Window Smoothing can now be applied at the same time, because it is not a classic way to smooth and this allows you to better experiment with it.

Added JMA and T3 and removed a lot of deprecated MAs

Reworked input groups

Improved indicator core calculation logic (where the different techniques get applied)

Removed one ma in the calculation of KST to make it more responsive (somehow the original calculation uses two times the SMA)

Release Notes

Added signal label overlay optionFixed signal logic bug

Did some minor refactoring

Release Notes

Adder upper, lower and breakout bandsRestructured inputs

Release Notes

Restructured inputsUsed MA of ROC instead of pure ROC, too stick closer to the original KST

Added inputs for the 4 MAs of the 4 ROCs used in KST

Optimized adaptive lengths

Fixed bar_index bug

Instead of normalization, I simply divide KST through 100 to get it on 1 to -1 scale

Fixed wrong signal order bug

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.