OPEN-SOURCE SCRIPT

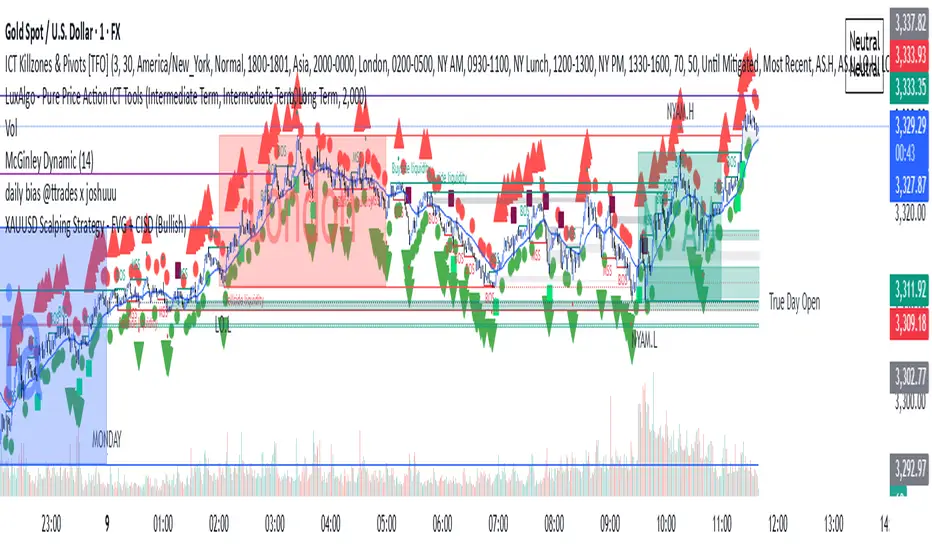

XAUUSD Scalping Strategy - FVG + CISD

📈 XAUUSD Scalping Strategy – FVG + CISD (3M/5M)

This strategy is designed for high-probability scalping on gold (XAU/USD) using a blend of Smart Money Concepts (SMC) and momentum-based price action. It works best on the 3-minute and 5-minute charts with bias from the 15M or 1H timeframe.

🔍 Core Concepts:

Fair Value Gaps (FVGs): Price inefficiencies created when strong displacement candles leave behind imbalanced zones. Used as retracement entry points.

CISD (Change in State of Delivery): Detects momentum shifts using strong displacement candles following a liquidity sweep or market structure break.

Liquidity Sweeps: Identifies stops being taken above recent highs or below recent lows, often leading to a reversal.

Market Structure Break (MSB): Confirms the change in directional bias after a liquidity sweep and displacement.

🧠 Strategy Logic:

Buy Conditions:

Bias is set to “Bullish”

Price sweeps a recent swing low (liquidity grab)

A strong bullish displacement candle confirms momentum (CISD)

A bullish Fair Value Gap forms

A bullish Market Structure Break occurs

Sell Conditions:

Bias is set to “Bearish”

Price sweeps a recent swing high

A strong bearish displacement candle confirms reversal

A bearish Fair Value Gap forms

A bearish Market Structure Break occurs

🎯 Entry & Risk Management:

Entry: Upon retracement into the Fair Value Gap (FVG)

Stop-Loss: Below swing low (for buys) or above swing high (for sells)

Take-Profit: 2x Reward-to-Risk ratio (adjustable)

Alerts: Configurable alerts notify you of qualified trade setups in real time

✅ Best Use Practices:

Use only during high-volume sessions (London/NY open)

Confirm direction using M15 or H1 bias

Avoid ranging markets or choppy sessions

Combine with liquidity zones or higher timeframe supply/demand for stronger confluence

This strategy is designed for high-probability scalping on gold (XAU/USD) using a blend of Smart Money Concepts (SMC) and momentum-based price action. It works best on the 3-minute and 5-minute charts with bias from the 15M or 1H timeframe.

🔍 Core Concepts:

Fair Value Gaps (FVGs): Price inefficiencies created when strong displacement candles leave behind imbalanced zones. Used as retracement entry points.

CISD (Change in State of Delivery): Detects momentum shifts using strong displacement candles following a liquidity sweep or market structure break.

Liquidity Sweeps: Identifies stops being taken above recent highs or below recent lows, often leading to a reversal.

Market Structure Break (MSB): Confirms the change in directional bias after a liquidity sweep and displacement.

🧠 Strategy Logic:

Buy Conditions:

Bias is set to “Bullish”

Price sweeps a recent swing low (liquidity grab)

A strong bullish displacement candle confirms momentum (CISD)

A bullish Fair Value Gap forms

A bullish Market Structure Break occurs

Sell Conditions:

Bias is set to “Bearish”

Price sweeps a recent swing high

A strong bearish displacement candle confirms reversal

A bearish Fair Value Gap forms

A bearish Market Structure Break occurs

🎯 Entry & Risk Management:

Entry: Upon retracement into the Fair Value Gap (FVG)

Stop-Loss: Below swing low (for buys) or above swing high (for sells)

Take-Profit: 2x Reward-to-Risk ratio (adjustable)

Alerts: Configurable alerts notify you of qualified trade setups in real time

✅ Best Use Practices:

Use only during high-volume sessions (London/NY open)

Confirm direction using M15 or H1 bias

Avoid ranging markets or choppy sessions

Combine with liquidity zones or higher timeframe supply/demand for stronger confluence

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.