OPEN-SOURCE SCRIPT

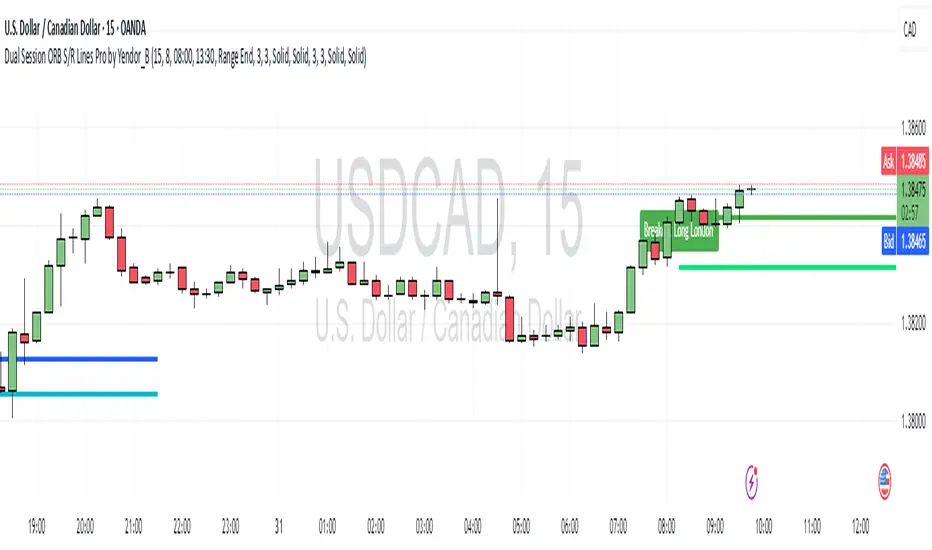

Dual Session ORB S/R Lines Pro by Yendor_B

Short description:

Clean opening-range breakout support/resistance lines for London and US sessions with confirmed breakout labels and alert-ready signals. UTC-based, adjustable start point, customizable styling, minimal clutter.

Detailed description:

What it does:

Captures the Opening Range (default first 15 minutes) for London and New York (US) sessions in UTC, plots the high and low as support/resistance lines, and marks confirmed breakouts when price closes beyond those levels. Lines can begin at either the range end or session start and persist for the configured session length.

Key Features:

ORB defined over the first N minutes after session open (configurable, default 15).

Two sessions: London and US (New York) with separate start times.

High/low support & resistance lines per session:

Selectable start point: Range End or Session Start.

Independently customizable color, width, and style (solid/dashed/dotted) for each high and low.

Confirmed breakout labels: only on the first candle that closes beyond the ORB high or low after the range completes (prior close must be inside).

Alerts and alertconditions for breakout long/short per session, usable in TradingView’s alert dialog.

Fully UTC-based. Works on any timeframe; 1-minute or 5-minute recommended for precision.

Minimal visual clutter; no persistent shaded boxes in this version.

Inputs explained:

ORB Duration (minutes): Length of the opening range used to calculate session high and low.

Session Length (hours): How long the S/R lines remain active (typically full session).

London / US Start (UTC): Session open times in UTC.

Line Start Point: Choose whether the lines begin at the range end or at the session start.

High/Low Styling: Independent color, thickness, and style for each session’s high and low.

Breakout Labels: Toggle one-time confirmed breakout annotations.

Alerts: Enable breakout alert messages.

Example workflows:

Monitor the first 15 minutes of the London session.

After the range, wait for a candle to close beyond the high or low for a confirmed breakout.

Use the label or alert to trigger entry logic (retest, continuation, etc.).

Repeat for the US session; compare overlaps for higher conviction.

Alert setup:

Open the Alerts panel. Choose one of the built-in alertconditions: London Breakout Long, London Breakout Short, US Breakout Long, US Breakout Short. Set frequency to Once Per Bar Close. Customize notification/webhook payload if automating.

Preset suggestions:

Standard London ORB: 15 minute range, lines from range end, green high / lime low.

Standard US ORB: 15 minute range, lines from range end, blue high / aqua low.

Overlap Bias: Both sessions active, lines start from session start, differentiated styles.

Tips & best practices:

Combine with external volume or volatility filters to reduce false breakouts. Use on correlated pairs to observe consistent session structure. Treat broken ORB levels as flipped support/resistance on revisit. Prefer confirmed closes beyond lines rather than wick touches.

Limitations / disclaimer:

Provides structural visualization and breakout signaling; does not guarantee profitability. Always apply proper risk management and confirm with additional context. Backtest settings before live use.

Tags:

#ORB #OpeningRangeBreakout #SessionTrading #LondonSession #NewYorkSession #SupportResistance #Breakout #Intraday #Pinev6 #TradingView #Forex #TrendStructure #Alerts #USD #EURUSD #TradingSignals #UTCBased #PriceAction #MarketStructure #IntradayBreakouts

Clean opening-range breakout support/resistance lines for London and US sessions with confirmed breakout labels and alert-ready signals. UTC-based, adjustable start point, customizable styling, minimal clutter.

Detailed description:

What it does:

Captures the Opening Range (default first 15 minutes) for London and New York (US) sessions in UTC, plots the high and low as support/resistance lines, and marks confirmed breakouts when price closes beyond those levels. Lines can begin at either the range end or session start and persist for the configured session length.

Key Features:

ORB defined over the first N minutes after session open (configurable, default 15).

Two sessions: London and US (New York) with separate start times.

High/low support & resistance lines per session:

Selectable start point: Range End or Session Start.

Independently customizable color, width, and style (solid/dashed/dotted) for each high and low.

Confirmed breakout labels: only on the first candle that closes beyond the ORB high or low after the range completes (prior close must be inside).

Alerts and alertconditions for breakout long/short per session, usable in TradingView’s alert dialog.

Fully UTC-based. Works on any timeframe; 1-minute or 5-minute recommended for precision.

Minimal visual clutter; no persistent shaded boxes in this version.

Inputs explained:

ORB Duration (minutes): Length of the opening range used to calculate session high and low.

Session Length (hours): How long the S/R lines remain active (typically full session).

London / US Start (UTC): Session open times in UTC.

Line Start Point: Choose whether the lines begin at the range end or at the session start.

High/Low Styling: Independent color, thickness, and style for each session’s high and low.

Breakout Labels: Toggle one-time confirmed breakout annotations.

Alerts: Enable breakout alert messages.

Example workflows:

Monitor the first 15 minutes of the London session.

After the range, wait for a candle to close beyond the high or low for a confirmed breakout.

Use the label or alert to trigger entry logic (retest, continuation, etc.).

Repeat for the US session; compare overlaps for higher conviction.

Alert setup:

Open the Alerts panel. Choose one of the built-in alertconditions: London Breakout Long, London Breakout Short, US Breakout Long, US Breakout Short. Set frequency to Once Per Bar Close. Customize notification/webhook payload if automating.

Preset suggestions:

Standard London ORB: 15 minute range, lines from range end, green high / lime low.

Standard US ORB: 15 minute range, lines from range end, blue high / aqua low.

Overlap Bias: Both sessions active, lines start from session start, differentiated styles.

Tips & best practices:

Combine with external volume or volatility filters to reduce false breakouts. Use on correlated pairs to observe consistent session structure. Treat broken ORB levels as flipped support/resistance on revisit. Prefer confirmed closes beyond lines rather than wick touches.

Limitations / disclaimer:

Provides structural visualization and breakout signaling; does not guarantee profitability. Always apply proper risk management and confirm with additional context. Backtest settings before live use.

Tags:

#ORB #OpeningRangeBreakout #SessionTrading #LondonSession #NewYorkSession #SupportResistance #Breakout #Intraday #Pinev6 #TradingView #Forex #TrendStructure #Alerts #USD #EURUSD #TradingSignals #UTCBased #PriceAction #MarketStructure #IntradayBreakouts

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.