OPEN-SOURCE SCRIPT

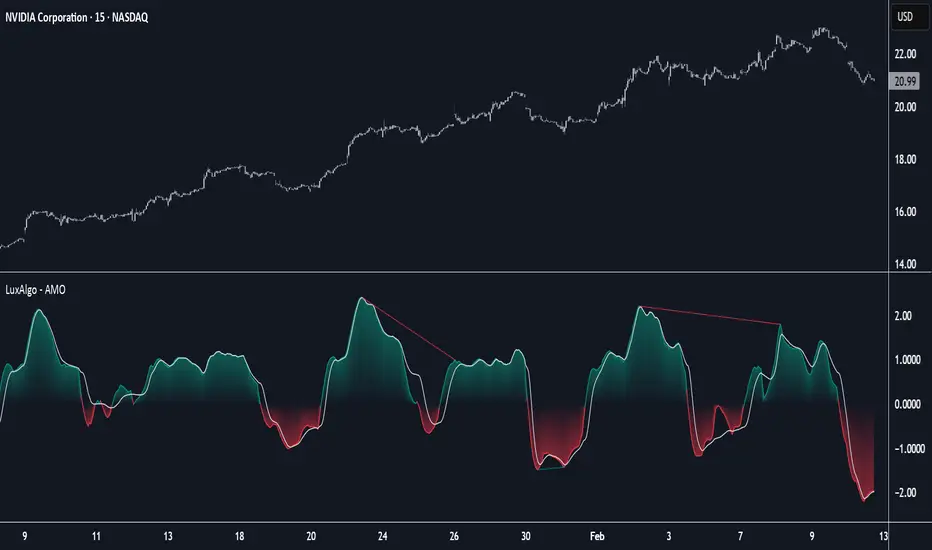

Adaptive Momentum Oscillator [LuxAlgo]

The Adaptive Momentum Oscillator tool allows traders to measure the current relative momentum over a given period using the maximum delta in price.

It features a histogram with gradient color, divergences, and an adaptive moving average that allows traders to clearly see the smoothed trend direction.

🔶 USAGE

This unbounded oscillator has positive momentum when values are above 0 and negative momentum when values are below 0. The adaptive moving average is used as a minimum lag smoothing tool over the momentum histogram.

🔹 Signal Line

There are two main uses for the signal line drawn on the chart above.

🔹 Data Length

On the chart above, we can compare different length sizes and how the tool values change, allowing traders to get a shorter or longer-term view of current market strength.

🔹 Smoothing Length

In the previous figure, we can compare how different Smoothing Length values affect the oscillator output.

🔹 Divergences

The divergence detector is disabled by default. Traders can enable it and adjust the divergence length from the settings panel.

As we can see in the chart above, by changing the length of the divergences, traders can fine-tune their detection, a small number will detect smaller divergences, and use a larger number for larger divergences.

🔶 SETTINGS

It features a histogram with gradient color, divergences, and an adaptive moving average that allows traders to clearly see the smoothed trend direction.

🔶 USAGE

This unbounded oscillator has positive momentum when values are above 0 and negative momentum when values are below 0. The adaptive moving average is used as a minimum lag smoothing tool over the momentum histogram.

🔹 Signal Line

There are two main uses for the signal line drawn on the chart above.

- Momentum crosses above or below the signal line: acceleration in momentum.

- Signal line crosses the 0 value: positive or negative momentum.

🔹 Data Length

On the chart above, we can compare different length sizes and how the tool values change, allowing traders to get a shorter or longer-term view of current market strength.

🔹 Smoothing Length

In the previous figure, we can compare how different Smoothing Length values affect the oscillator output.

🔹 Divergences

The divergence detector is disabled by default. Traders can enable it and adjust the divergence length from the settings panel.

As we can see in the chart above, by changing the length of the divergences, traders can fine-tune their detection, a small number will detect smaller divergences, and use a larger number for larger divergences.

🔶 SETTINGS

- Data: Select data source, close price by default

- Data Length: Select the length for data gathering

- Smoothing Length: Select the length for data smoothing

- Divergences: Enable/Disable divergences detection and length

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Get access to our exclusive tools: luxalgo.com

Join our 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Join our 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Get access to our exclusive tools: luxalgo.com

Join our 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Join our 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.