PINE LIBRARY

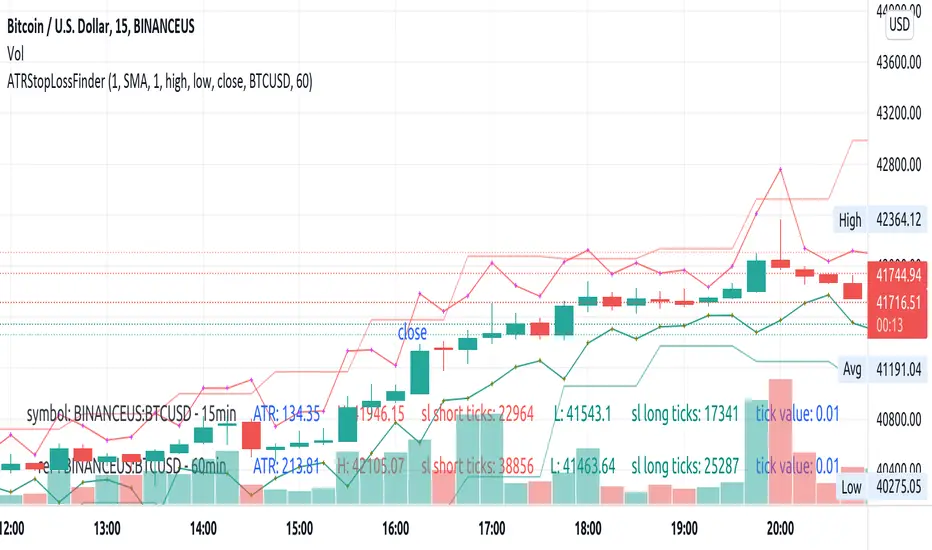

Updated ATRStopLossFinder

Library "ATRStopLossFinder"

Average True Range Stop Loss Finder

credits to tradingview.com/u/veryfid/ for the initial version

stopLossFinder(length, smoothing, multiplier, refHigh, refLow, refClose) Returns the stop losses for an entry on this candle, depending on the ATR

Parameters:

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossLong, series float stopLossShort, series float atr

Average True Range Stop Loss Finder

credits to tradingview.com/u/veryfid/ for the initial version

stopLossFinder(length, smoothing, multiplier, refHigh, refLow, refClose) Returns the stop losses for an entry on this candle, depending on the ATR

Parameters:

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossLong, series float stopLossShort, series float atr

Release Notes

v2Added:

atr(length, smoothing, multiplier, refHigh, refLow, refClose) Returns the ATR

Parameters:

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossLong, series float stopLossShort, series float atr

long(length, smoothing, multiplier, refHigh, refLow, refClose) Returns only the stop loss for a long entry on this candle, depending on the ATR

Parameters:

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossLong

short(length, smoothing, multiplier, refHigh, refLow, refClose) Returns only the stop loss for a short entry on this candle, depending on the ATR

Parameters:

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossShort

Release Notes

v3Added:

stopLossTicksFinder(tickValue, length, smoothing, multiplier, refHigh, refLow, refClose) Returns the stop losses for an entry on this candle in ticks, depending on the ATR

Parameters:

tickValue: simple float tick value (use getTickValueSymbol)

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossLong, series float stopLossShort, series float atr

longTicks(tickValue, length, smoothing, multiplier, refHigh, refLow, refClose) Returns only the stop loss for a long entry on this candle, depending on the ATR

Parameters:

tickValue: simple float tick value (use getTickValueSymbol)

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossLong

shortTicks(tickValue, length, smoothing, multiplier, refHigh, refLow, refClose) Returns only the stop loss for a short entry on this candle, depending on the ATR

Parameters:

tickValue: simple float tick value (use getTickValueSymbol)

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossShort

Release Notes

v4Added:

stopLossTicks(tickValue, length, smoothing, multiplier, refHigh, refLow, refClose) Returns the stop losses for an entry on this candle in ticks, depending on the ATR

Parameters:

tickValue: simple float tick value (use getTickValueSymbol)

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossTicks

Removed:

stopLossTicksFinder(tickValue, length, smoothing, multiplier, refHigh, refLow, refClose) Returns the stop losses for an entry on this candle in ticks, depending on the ATR

Release Notes

v5Added:

atrTicks(tickValue, length, smoothing, multiplier, refHigh, refLow, refClose) Returns the ATR

Parameters:

tickValue: simple float tick value (use getTickValueSymbol)

length: simple int optional to select the lookback amount of candles

smoothing: string optional to select the averaging method, options=["RMA", "SMA", "EMA", "WMA"]

multiplier: simple float optional if you want to tweak the speed the trend changes.

refHigh: series float optional if you want to use another timeframe or symbol, pass it's 'high' series here

refLow: series float optional if you want to use another timeframe or symbol, pass it's 'low' series here

refClose: series float optional if you want to use another timeframe or symbol, pass it's 'close' series here

Returns: series float stopLossLong, series float stopLossShort, series float atr

Removed:

long(length, smoothing, multiplier, refHigh, refLow, refClose) Returns only the stop loss for a long entry on this candle, depending on the ATR

short(length, smoothing, multiplier, refHigh, refLow, refClose) Returns only the stop loss for a short entry on this candle, depending on the ATR

longTicks(tickValue, length, smoothing, multiplier, refHigh, refLow, refClose) Returns only the stop loss for a long entry on this candle, depending on the ATR

shortTicks(tickValue, length, smoothing, multiplier, refHigh, refLow, refClose) Returns only the stop loss for a short entry on this candle, depending on the ATR

Release Notes

v6Pine library

In true TradingView spirit, the author has published this Pine code as an open-source library so that other Pine programmers from our community can reuse it. Cheers to the author! You may use this library privately or in other open-source publications, but reuse of this code in publications is governed by House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Pine library

In true TradingView spirit, the author has published this Pine code as an open-source library so that other Pine programmers from our community can reuse it. Cheers to the author! You may use this library privately or in other open-source publications, but reuse of this code in publications is governed by House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.