OPEN-SOURCE SCRIPT

ATR % Line from LoD/HoD

ATR % Line Trading Indicator - Entry Filter Tool

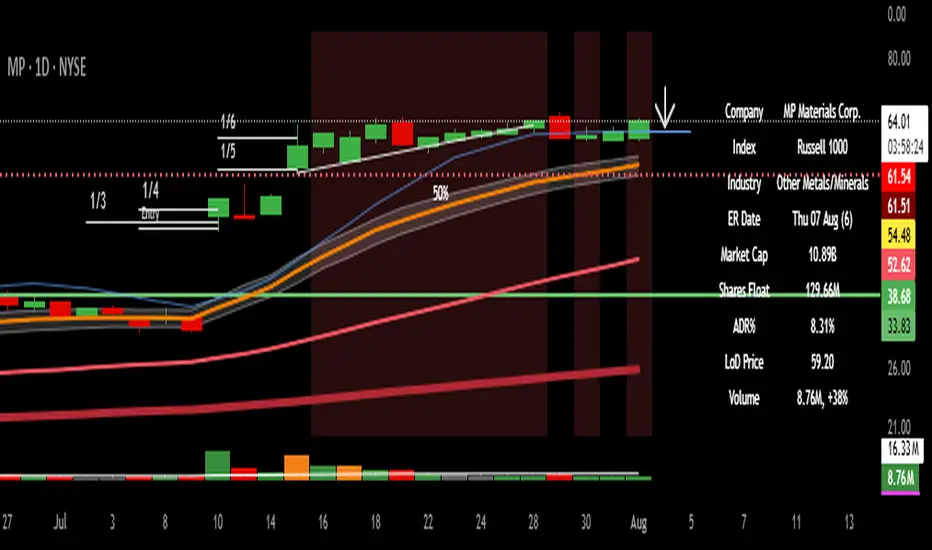

This Pine Script creates a sophisticated ATR (Average True Range) percentage-based entry filter indicator for TradingView that helps traders avoid buying overextended stocks and identify optimal entry zones based on volatility.

Core Functionality - Entry Discipline

The script calculates a maximum entry threshold by taking a percentage of the Average True Range (ATR) and projecting it from the current day's low. This creates a dynamic "no-buy zone" that adapts to market volatility, helping traders avoid purchasing stocks that have already moved too far from their daily base.

Key Calculation:

Measures the ATR over a specified period (default: 14 bars)

Takes a user-defined percentage of that ATR (default: 25%)

Projects this distance from the day's low to establish a maximum entry threshold

Entry Rule: Avoid buying when price exceeds this ATR% level from the daily low or high.

Visual Features

Entry Threshold Line:

Draws a horizontal line at the calculated maximum entry level

Line extends forward for clear visualization of the "no-buy zone"

Red zones above this line indicate overextended conditions

Fully customizable appearance with color, width, and style options

Smart Entry Alerts:

Optional labels show the ATR percentage threshold and exact price level

Visual confirmation when stocks are trading in acceptable entry zones vs. extended areas

Real-Time Monitoring Table:

Displays current distance from daily low as ATR percentage

Shows whether current price is in "safe entry zone" or "extended territory"

Customizable display options for clean chart analysis

Practical Applications for Entry Management

Avoiding Extended Entries:

Primary Use: Don't initiate long positions when price is more than X% ATR from the daily low

Prevents buying stocks that have already made their daily move

Reduces risk of buying at temporary tops within the trading session

Entry Zone Identification:

Price trading below the ATR% line = potential entry opportunity

Price trading above the ATR% line = wait for pullback or skip the trade

Combines volatility analysis with momentum discipline

Risk Management Benefits:

Improved Entry Timing: Enter closer to daily support levels

Better Risk/Reward: Shorter distance to stop loss (daily low)

Reduced Chasing: Systematic approach prevents FOMO-driven entries

Volatility Awareness: Higher volatility stocks get wider acceptable entry ranges

Configuration for Entry Filtering

Key Settings for Entry Management:

ATR Percentage: Set your maximum acceptable extension (15-30% common for day trading)

Reference Point: Use "Low" to measure extension from daily base

Line Style: Make highly visible to clearly see entry threshold

Alert Integration: Visual confirmation of entry-friendly zones

Typical Usage Scenarios:

Conservative Entries: 15-20% ATR from daily low

Moderate Extensions: 25-35% ATR for stronger momentum plays

Aggressive Setups: 40%+ ATR for breakout situations (use with caution)

Entry Strategy Integration

Pre-Market Planning:

Set ATR% threshold based on stock's typical volatility

Identify key levels where entries become unfavorable

Plan alternative entry strategies for extended stocks

Intraday Execution:

Monitor real-time ATR% extension from daily low

Avoid new long positions when threshold is exceeded

Wait for pullbacks to re-enter acceptable entry zones

This tool transforms volatility analysis into practical entry discipline, helping traders maintain consistent entry standards and avoid the costly mistake of chasing overextended stocks. By respecting ATR-based extension limits, traders can improve their entry timing and overall trade profitability.

This Pine Script creates a sophisticated ATR (Average True Range) percentage-based entry filter indicator for TradingView that helps traders avoid buying overextended stocks and identify optimal entry zones based on volatility.

Core Functionality - Entry Discipline

The script calculates a maximum entry threshold by taking a percentage of the Average True Range (ATR) and projecting it from the current day's low. This creates a dynamic "no-buy zone" that adapts to market volatility, helping traders avoid purchasing stocks that have already moved too far from their daily base.

Key Calculation:

Measures the ATR over a specified period (default: 14 bars)

Takes a user-defined percentage of that ATR (default: 25%)

Projects this distance from the day's low to establish a maximum entry threshold

Entry Rule: Avoid buying when price exceeds this ATR% level from the daily low or high.

Visual Features

Entry Threshold Line:

Draws a horizontal line at the calculated maximum entry level

Line extends forward for clear visualization of the "no-buy zone"

Red zones above this line indicate overextended conditions

Fully customizable appearance with color, width, and style options

Smart Entry Alerts:

Optional labels show the ATR percentage threshold and exact price level

Visual confirmation when stocks are trading in acceptable entry zones vs. extended areas

Real-Time Monitoring Table:

Displays current distance from daily low as ATR percentage

Shows whether current price is in "safe entry zone" or "extended territory"

Customizable display options for clean chart analysis

Practical Applications for Entry Management

Avoiding Extended Entries:

Primary Use: Don't initiate long positions when price is more than X% ATR from the daily low

Prevents buying stocks that have already made their daily move

Reduces risk of buying at temporary tops within the trading session

Entry Zone Identification:

Price trading below the ATR% line = potential entry opportunity

Price trading above the ATR% line = wait for pullback or skip the trade

Combines volatility analysis with momentum discipline

Risk Management Benefits:

Improved Entry Timing: Enter closer to daily support levels

Better Risk/Reward: Shorter distance to stop loss (daily low)

Reduced Chasing: Systematic approach prevents FOMO-driven entries

Volatility Awareness: Higher volatility stocks get wider acceptable entry ranges

Configuration for Entry Filtering

Key Settings for Entry Management:

ATR Percentage: Set your maximum acceptable extension (15-30% common for day trading)

Reference Point: Use "Low" to measure extension from daily base

Line Style: Make highly visible to clearly see entry threshold

Alert Integration: Visual confirmation of entry-friendly zones

Typical Usage Scenarios:

Conservative Entries: 15-20% ATR from daily low

Moderate Extensions: 25-35% ATR for stronger momentum plays

Aggressive Setups: 40%+ ATR for breakout situations (use with caution)

Entry Strategy Integration

Pre-Market Planning:

Set ATR% threshold based on stock's typical volatility

Identify key levels where entries become unfavorable

Plan alternative entry strategies for extended stocks

Intraday Execution:

Monitor real-time ATR% extension from daily low

Avoid new long positions when threshold is exceeded

Wait for pullbacks to re-enter acceptable entry zones

This tool transforms volatility analysis into practical entry discipline, helping traders maintain consistent entry standards and avoid the costly mistake of chasing overextended stocks. By respecting ATR-based extension limits, traders can improve their entry timing and overall trade profitability.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.