OPEN-SOURCE SCRIPT

Vix FIX / StochRSI Strategy

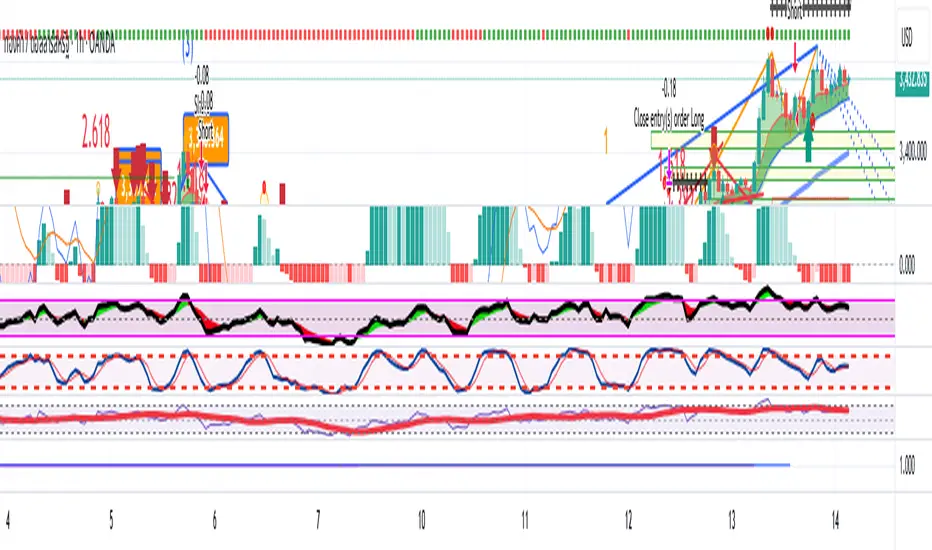

Vix FIX / StochRSI Strategy — Smart Gold Trading with Market Fear Detection

Pine Script Version 6 | Timeframe: 1H | Supports Long & Short

🔍 Strategy Overview:

This strategy is designed for trading gold and other highly volatile assets. It combines three powerful components:

Williams VIX Fix (WVF) – A fear-based volatility indicator inspired by the CBOE VIX Index, adapted for non-index assets.

Stochastic RSI – Measures overbought and oversold momentum, used as an exit trigger.

Price Action Filters – Confirms strong bullish or bearish bars to trigger high-conviction entries.

📌 Entry Conditions:

✅ Long Entry

WVF indicates the end of fear (mean reversion signal).

Bullish momentum bar (upRange).

Price is higher than n bars ago but still below medium/long-term recent highs.

✅ Short Entry

WVF indicates the market just cooled down from fear.

Bearish momentum bar (downRange).

Price is lower than n bars ago but still above recent lows.

📌 Exit Conditions:

🔴 Exit Long when Stochastic Overbought + %K cross below %D

🔵 Exit Short when Stochastic Oversold + %K cross above %D

📊 Key Features:

Dual-side entries (Long & Short)

Timeframe-limited to 1 Hour (60 minutes) for consistent signal quality

Ideal for gold and volatile assets (crypto, index CFDs)

Backtested with strong performance across major pairs

Pine Script Version 6 | Timeframe: 1H | Supports Long & Short

🔍 Strategy Overview:

This strategy is designed for trading gold and other highly volatile assets. It combines three powerful components:

Williams VIX Fix (WVF) – A fear-based volatility indicator inspired by the CBOE VIX Index, adapted for non-index assets.

Stochastic RSI – Measures overbought and oversold momentum, used as an exit trigger.

Price Action Filters – Confirms strong bullish or bearish bars to trigger high-conviction entries.

📌 Entry Conditions:

✅ Long Entry

WVF indicates the end of fear (mean reversion signal).

Bullish momentum bar (upRange).

Price is higher than n bars ago but still below medium/long-term recent highs.

✅ Short Entry

WVF indicates the market just cooled down from fear.

Bearish momentum bar (downRange).

Price is lower than n bars ago but still above recent lows.

📌 Exit Conditions:

🔴 Exit Long when Stochastic Overbought + %K cross below %D

🔵 Exit Short when Stochastic Oversold + %K cross above %D

📊 Key Features:

Dual-side entries (Long & Short)

Timeframe-limited to 1 Hour (60 minutes) for consistent signal quality

Ideal for gold and volatile assets (crypto, index CFDs)

Backtested with strong performance across major pairs

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.