OPEN-SOURCE SCRIPT

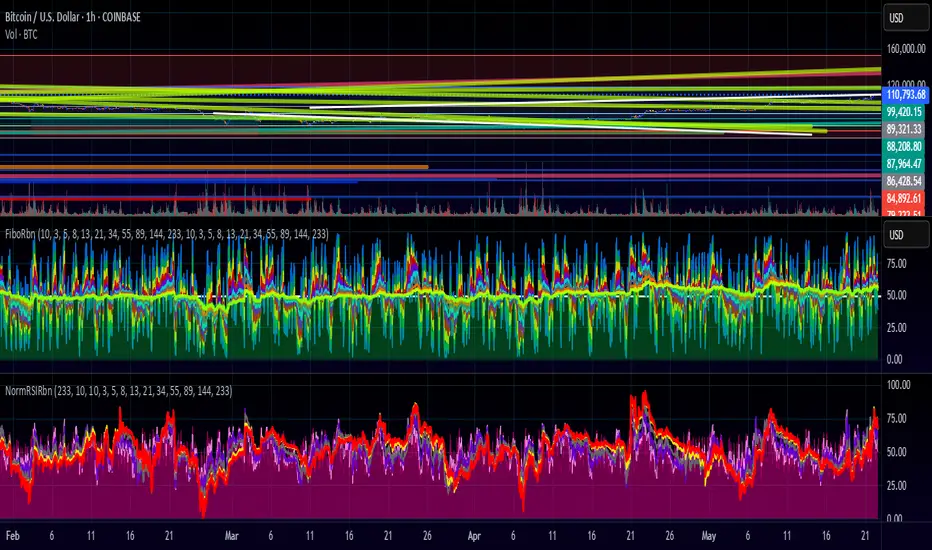

Fibo Normalized RSI & RSI Ribbon

Plots both standard and Z-score normalized RSI ribbons using Fibonacci-based periods. Supports adjustable normalization, optional 0–100 scaling, and multi-line visualizations for momentum and deviation analysis.

This tool is designed for traders who want to go beyond standard RSI by adding:

Statistical normalization (Z-score)

Multi-period analysis (Fibonacci structure)

Advanced divergence and exhaustion detection

It gives you both classical momentum context and mathematically rigorous deviation insight, making it ideal for:

Swing traders

Quant-inclined discretionary traders

Multi-timeframe analysts

Trend Confirmation

When both RSI and normalized RSI across short and long periods are stacked in the same direction (e.g., above 50 or with high Z-scores), the trend is likely strong.

Disagreement between the two ribbons (e.g., RSI high but normalized RSI flat) may indicate late-stage trend or false strength.

Mean Reversion Trades

Look for normalized RSI values > +2 or < -2 (i.e., ~2 standard deviations).

Cross-check with standard RSI to see if the move aligns with a traditional overbought/oversold level.

Great for fade/reversal setups when Z-score RSI is extreme but classic RSI is just beginning to turn.

Divergence Detection

Compare the slope of RSI vs. normalized RSI over same period:

If RSI is rising but normalized RSI is falling → momentum is fading despite apparent strength.

Excellent for early warnings before reversals.

Multi-Timeframe Confluence

Use short-period ribbons (e.g., 3–13) for tactical entries/exits.

Use long-period ribbons (e.g., 55–233) for macro trend bias.

Alignment across both = high-confidence zone.

This tool is designed for traders who want to go beyond standard RSI by adding:

Statistical normalization (Z-score)

Multi-period analysis (Fibonacci structure)

Advanced divergence and exhaustion detection

It gives you both classical momentum context and mathematically rigorous deviation insight, making it ideal for:

Swing traders

Quant-inclined discretionary traders

Multi-timeframe analysts

Trend Confirmation

When both RSI and normalized RSI across short and long periods are stacked in the same direction (e.g., above 50 or with high Z-scores), the trend is likely strong.

Disagreement between the two ribbons (e.g., RSI high but normalized RSI flat) may indicate late-stage trend or false strength.

Mean Reversion Trades

Look for normalized RSI values > +2 or < -2 (i.e., ~2 standard deviations).

Cross-check with standard RSI to see if the move aligns with a traditional overbought/oversold level.

Great for fade/reversal setups when Z-score RSI is extreme but classic RSI is just beginning to turn.

Divergence Detection

Compare the slope of RSI vs. normalized RSI over same period:

If RSI is rising but normalized RSI is falling → momentum is fading despite apparent strength.

Excellent for early warnings before reversals.

Multi-Timeframe Confluence

Use short-period ribbons (e.g., 3–13) for tactical entries/exits.

Use long-period ribbons (e.g., 55–233) for macro trend bias.

Alignment across both = high-confidence zone.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.