OPEN-SOURCE SCRIPT

Updated LaCrazy Smash Candle

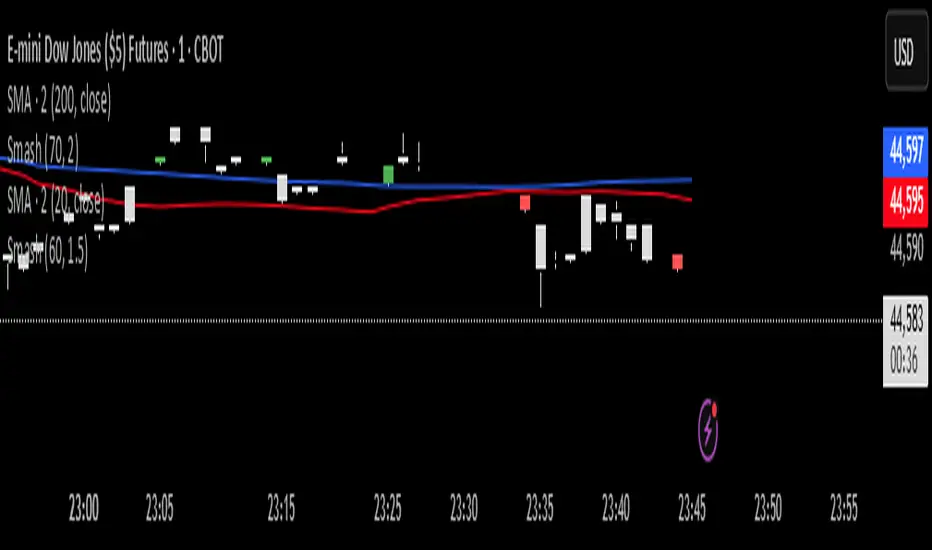

LaCrazy Smash Candle highlights powerful engulfing candles that signal potential momentum reversals or breakout continuation.

Smash Long: The candle's low touches or dips below the prior candle's low, then closes above the previous high with a strong body (minimum % of the candle range).

Smash Short: The candle's high touches or exceeds the prior high, then closes below the previous low with a strong body.

These “Smash” moves often occur at key pivot points, signaling decisive rejections or trend continuation. Customize the body strength filter to match your strategy needs.

Smash Long: The candle's low touches or dips below the prior candle's low, then closes above the previous high with a strong body (minimum % of the candle range).

Smash Short: The candle's high touches or exceeds the prior high, then closes below the previous low with a strong body.

These “Smash” moves often occur at key pivot points, signaling decisive rejections or trend continuation. Customize the body strength filter to match your strategy needs.

Release Notes

This indicator highlights powerful engulfing candles with strong body momentum and range expansion — what I call a "Smash Candle."It’s specifically optimized for the 1-minute timeframe, and designed to be used in conjunction with the 2-minute 20 and 200 SMAs to determine whether price is in a range or expanding into trend.

Strategy Use Case

I use this tool for 1-minute scalping, with trade direction determined by price structure and context — particularly the behavior of price relative to recent swing highs/lows and the 2-minute SMAs.

At the Edges of a Range:

When price breaks a previous swing high or low and immediately prints a strong Smash Candle, I trade with the direction of that candle.

For example, if a bearish Smash Candle forms after taking out a swing high at the top of a range, I will enter short with momentum, anticipating a move back down to take out the opposite swing low.

Inside Consolidation (Chop Zone):

When price is moving sideways and Smash Candles appear without breaking a recent swing, I often take counter-trend trades, expecting a full retracement of the candle.

If the retracement occurs quickly, I will scale in, expecting price to reverse and take out the opposite wick from the Smash Candle.

SMAs for Context:

The 2-minute 20 SMA helps identify whether price is ranging (flat slope) or trending (angled slope).

The 2-minute 200 SMA provides longer-term trend bias and helps avoid fakeouts when price is overextended.

Smash Candle Logic

Candle must break the prior high (for longs) or low (for shorts)

Candle body must be at least 60% of the total range

Total candle range must be at least 1.5× the range of the previous candle

Long and short Smash Candles are color-coded for quick visual reference

This tool is part of my broader LaCrazy Scalper Pro system. It continues to evolve as I refine my scalping playbook and structure-based setups.

Let me know if this script helps with your trading.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.