OPEN-SOURCE SCRIPT

Neural Adaptive VWAP

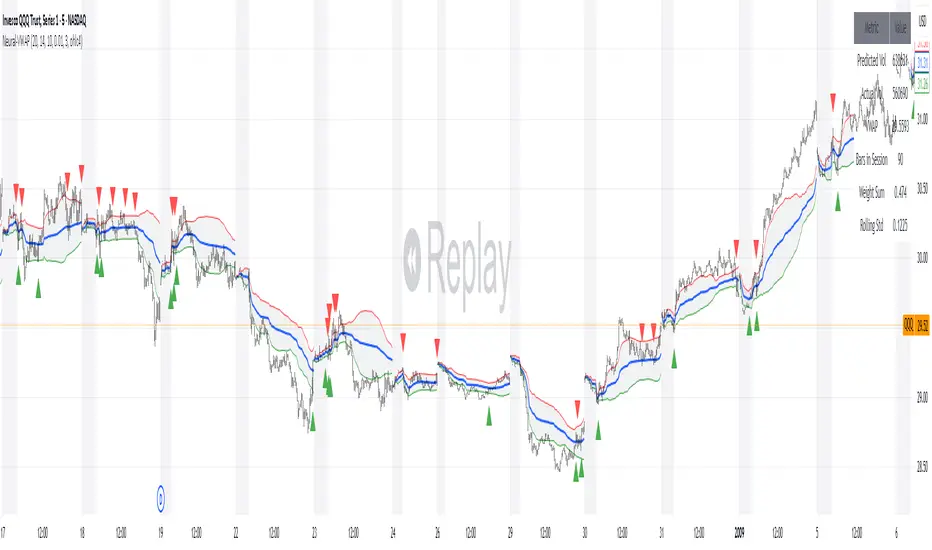

Neural Adaptive VWAP with ML Features is an advanced trading indicator that enhances traditional Volume Weighted Average Price (VWAP) calculations through machine learning-inspired adaptive algorithms and predictive volume modeling.

🌟 Key Features:

🧠 Machine Learning-Inspired Adaptation

Dynamic weight adjustment system that learns from prediction errors

Multi-feature volume prediction using time-of-day patterns, price momentum, and volatility

Adaptive learning mechanism that improves accuracy over time

📊 Enhanced VWAP Calculation

Combines actual and predicted volume for forward-looking VWAP computation

Session-based reset with proper daily anchoring

Confidence bands based on rolling standard deviation for dynamic support/resistance

🎯 Advanced Signal Generation

Volume-confirmed crossover signals to reduce false entries

Color-coded candle visualization based on VWAP position

Multi-level strength indicators (strong/weak bullish/bearish zones)

⚙️ Intelligent Feature Engineering

Normalized volume analysis with statistical z-score

Time-series pattern recognition for intraday volume cycles

Price momentum and volatility integration

Sigmoid activation functions for realistic predictions

📈 How It Works:

The indicator employs a sophisticated feature engineering approach that extracts meaningful patterns from:

Volume Patterns: Normalized volume analysis and historical comparisons

Temporal Features: Time-of-day and minute-based cyclical patterns

Market Dynamics: Price momentum, volatility, and rate of change

Adaptive Learning: Error-based weight adjustment similar to neural network training

Unlike static VWAP indicators, this system continuously adapts its calculation methodology based on real-time market feedback, making it more responsive to changing market conditions while maintaining the reliability of traditional VWAP analysis.

🔧 Customizable Parameters:

VWAP Length (1-200 bars)

Volume Pattern Lookback (5-50 periods)

Learning Rate (0.001-0.1) for adaptation speed

Prediction Horizon (1-10 bars ahead)

Adaptation Period for weight updates

📊 Visual Elements:

Blue Line: Adaptive VWAP with predictive elements

Red/Green Bands: Dynamic confidence zones

Colored Candles: Position-based strength visualization

Signal Arrows: Volume-confirmed entry points

Info Table: Real-time performance metrics and weight distribution

🎯 Best Use Cases:

Intraday Trading: Enhanced execution timing with volume prediction

Institutional-Style Execution: Improved VWAP-based order placement

Trend Following: Adaptive trend identification with confidence zones

Support/Resistance Trading: Dynamic levels that adjust to market conditions

🌟 Key Features:

🧠 Machine Learning-Inspired Adaptation

Dynamic weight adjustment system that learns from prediction errors

Multi-feature volume prediction using time-of-day patterns, price momentum, and volatility

Adaptive learning mechanism that improves accuracy over time

📊 Enhanced VWAP Calculation

Combines actual and predicted volume for forward-looking VWAP computation

Session-based reset with proper daily anchoring

Confidence bands based on rolling standard deviation for dynamic support/resistance

🎯 Advanced Signal Generation

Volume-confirmed crossover signals to reduce false entries

Color-coded candle visualization based on VWAP position

Multi-level strength indicators (strong/weak bullish/bearish zones)

⚙️ Intelligent Feature Engineering

Normalized volume analysis with statistical z-score

Time-series pattern recognition for intraday volume cycles

Price momentum and volatility integration

Sigmoid activation functions for realistic predictions

📈 How It Works:

The indicator employs a sophisticated feature engineering approach that extracts meaningful patterns from:

Volume Patterns: Normalized volume analysis and historical comparisons

Temporal Features: Time-of-day and minute-based cyclical patterns

Market Dynamics: Price momentum, volatility, and rate of change

Adaptive Learning: Error-based weight adjustment similar to neural network training

Unlike static VWAP indicators, this system continuously adapts its calculation methodology based on real-time market feedback, making it more responsive to changing market conditions while maintaining the reliability of traditional VWAP analysis.

🔧 Customizable Parameters:

VWAP Length (1-200 bars)

Volume Pattern Lookback (5-50 periods)

Learning Rate (0.001-0.1) for adaptation speed

Prediction Horizon (1-10 bars ahead)

Adaptation Period for weight updates

📊 Visual Elements:

Blue Line: Adaptive VWAP with predictive elements

Red/Green Bands: Dynamic confidence zones

Colored Candles: Position-based strength visualization

Signal Arrows: Volume-confirmed entry points

Info Table: Real-time performance metrics and weight distribution

🎯 Best Use Cases:

Intraday Trading: Enhanced execution timing with volume prediction

Institutional-Style Execution: Improved VWAP-based order placement

Trend Following: Adaptive trend identification with confidence zones

Support/Resistance Trading: Dynamic levels that adjust to market conditions

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.