OPEN-SOURCE SCRIPT

JW Momentum Indicator

JW Momentum Indicator

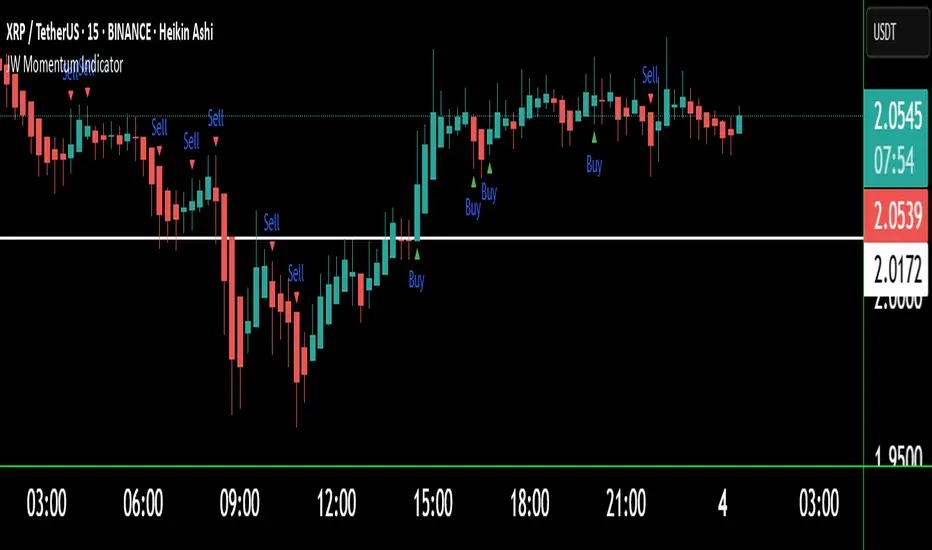

This indicator provides clear and actionable buy/sell signals based on a combination of volume-enhanced momentum, divergence detection, and volatility adjustment. It's designed to identify potential trend reversals and momentum shifts with a focus on high-probability setups.

Key Features:

Volume-Enhanced Momentum: The indicator calculates a custom oscillator that combines momentum with volume, giving more weight to momentum when volume is significant. This helps to identify strong momentum moves.

Divergence Detection: It detects bullish and bearish divergences using pivot highs and lows, highlighting potential trend reversals.

Volatility-Adjusted Signals: The indicator adjusts signal sensitivity based on the Average True Range (ATR), making it more reliable in varying market conditions.

Clear Visuals: Buy and sell signals are clearly indicated with up and down triangles, while divergences are highlighted with distinct labels.

How to Use:

Buy Signals: Look for green up triangles or bullish divergence labels.

Sell Signals: Look for red down triangles or bearish divergence labels.

Oscillator and Thresholds: Use the plotted oscillator and thresholds to confirm signal strength.

Parameters:

Momentum Period: Adjusts the length of the momentum calculation.

Volume Average Period: Adjusts the length of the volume average calculation.

Volatility Period: Adjusts the length of the ATR calculation.

Volatility Multiplier: Adjusts the sensitivity of the volatility-adjusted signals.

Disclaimer:

This indicator is for informational purposes only and should not be considered financial advice. Always conduct 1 thorough research and use appropriate risk management techniques when trading.

This indicator provides clear and actionable buy/sell signals based on a combination of volume-enhanced momentum, divergence detection, and volatility adjustment. It's designed to identify potential trend reversals and momentum shifts with a focus on high-probability setups.

Key Features:

Volume-Enhanced Momentum: The indicator calculates a custom oscillator that combines momentum with volume, giving more weight to momentum when volume is significant. This helps to identify strong momentum moves.

Divergence Detection: It detects bullish and bearish divergences using pivot highs and lows, highlighting potential trend reversals.

Volatility-Adjusted Signals: The indicator adjusts signal sensitivity based on the Average True Range (ATR), making it more reliable in varying market conditions.

Clear Visuals: Buy and sell signals are clearly indicated with up and down triangles, while divergences are highlighted with distinct labels.

How to Use:

Buy Signals: Look for green up triangles or bullish divergence labels.

Sell Signals: Look for red down triangles or bearish divergence labels.

Oscillator and Thresholds: Use the plotted oscillator and thresholds to confirm signal strength.

Parameters:

Momentum Period: Adjusts the length of the momentum calculation.

Volume Average Period: Adjusts the length of the volume average calculation.

Volatility Period: Adjusts the length of the ATR calculation.

Volatility Multiplier: Adjusts the sensitivity of the volatility-adjusted signals.

Disclaimer:

This indicator is for informational purposes only and should not be considered financial advice. Always conduct 1 thorough research and use appropriate risk management techniques when trading.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.