OPEN-SOURCE SCRIPT

Updated BTC Power Law Valuation Bands

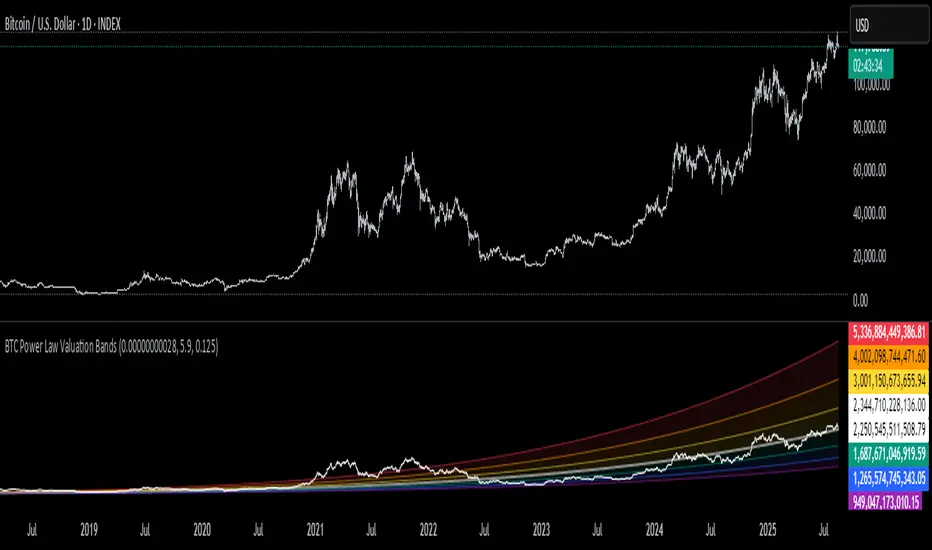

BTC Power Law Rainbow

A long-term valuation framework for Bitcoin based on Power Law growth — designed to help identify macro accumulation and distribution zones, aligned with long-term investor behavior.

🔍 What Is a Power Law?

A Power Law is a mathematical relationship where one quantity varies as a power of another. In this model:

Price ≈ a × (Time)^b

It captures the non-linear, exponentially slowing growth of Bitcoin over time. Rather than using linear or cyclical models, this approach aligns with how complex systems, such as networks or monetary adoption curves, often grow — rapidly at first, and then more slowly, but persistently.

🧠 Why Power Law for BTC?

Bitcoin:

Has finite supply and increasing adoption.

Operates as a monetary network, where Metcalfe’s Law and power laws naturally emerge.

Exhibits exponential growth over logarithmic time when viewed on a log-log chart.

This makes it uniquely well-suited for power law modeling.

🌈 How to Use the Valuation Bands

The central white line represents the modeled fair value according to the power law.

Colored bands represent deviations from the model in logarithmic space, acting as macro zones:

🔵 Lower Bands: Deep value / Accumulation zones.

🟡 Mid Bands: Fair value.

🔴 Upper Bands: Euphoria / Risk of macro tops.

📐 Smart Money Concepts (SMC) Alignment

Accumulation: Occurs when price consolidates near lower bands — often aligning with institutional positioning.

Markup: As price re-enters or ascends the bands, we often see breakout behavior and trend expansion.

Distribution: When price extends above upper bands, potential for exit liquidity creation and distribution events.

Reversion: Historically, price mean-reverts toward the model — rarely staying outside the bands for long.

This makes the model useful for:

Cycle timing

Long-term DCA strategy zones

Identifying value dislocations

Filtering short-term noise

⚠️ Disclaimer

This tool is for educational and informational purposes only. It is not financial advice. The power law model is a non-predictive, mathematical framework and does not guarantee future price movements.

Always use additional tools, risk management, and your own judgment before making trading or investment decisions.

A long-term valuation framework for Bitcoin based on Power Law growth — designed to help identify macro accumulation and distribution zones, aligned with long-term investor behavior.

🔍 What Is a Power Law?

A Power Law is a mathematical relationship where one quantity varies as a power of another. In this model:

Price ≈ a × (Time)^b

It captures the non-linear, exponentially slowing growth of Bitcoin over time. Rather than using linear or cyclical models, this approach aligns with how complex systems, such as networks or monetary adoption curves, often grow — rapidly at first, and then more slowly, but persistently.

🧠 Why Power Law for BTC?

Bitcoin:

Has finite supply and increasing adoption.

Operates as a monetary network, where Metcalfe’s Law and power laws naturally emerge.

Exhibits exponential growth over logarithmic time when viewed on a log-log chart.

This makes it uniquely well-suited for power law modeling.

🌈 How to Use the Valuation Bands

The central white line represents the modeled fair value according to the power law.

Colored bands represent deviations from the model in logarithmic space, acting as macro zones:

🔵 Lower Bands: Deep value / Accumulation zones.

🟡 Mid Bands: Fair value.

🔴 Upper Bands: Euphoria / Risk of macro tops.

📐 Smart Money Concepts (SMC) Alignment

Accumulation: Occurs when price consolidates near lower bands — often aligning with institutional positioning.

Markup: As price re-enters or ascends the bands, we often see breakout behavior and trend expansion.

Distribution: When price extends above upper bands, potential for exit liquidity creation and distribution events.

Reversion: Historically, price mean-reverts toward the model — rarely staying outside the bands for long.

This makes the model useful for:

Cycle timing

Long-term DCA strategy zones

Identifying value dislocations

Filtering short-term noise

⚠️ Disclaimer

This tool is for educational and informational purposes only. It is not financial advice. The power law model is a non-predictive, mathematical framework and does not guarantee future price movements.

Always use additional tools, risk management, and your own judgment before making trading or investment decisions.

Release Notes

Updated title for a more accurate description of intended functionality. Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.