OPEN-SOURCE SCRIPT

Updated RESISTANCE & SUPPORT

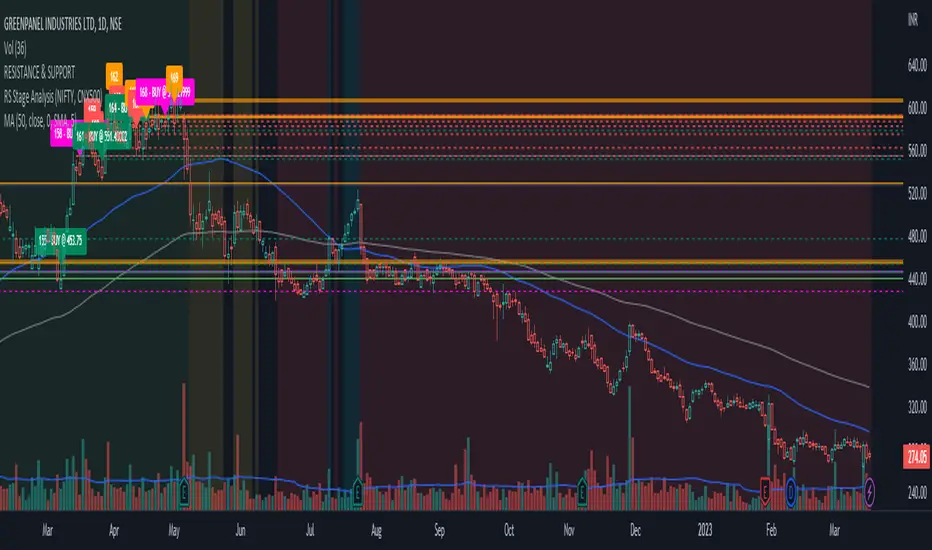

This script is generate multiple types of resistance line which later work as support too on daily time frame.

this is not final breakout line but give you approx. idea about the support and resistance using this script.

No of lines are below

1) Pullback Line

this line is generated when close[2] >= close[1] and close[1] >= close

means 2 days straight todays close is below its previous days close, with rising volume.

2) Rising Line

this line is generated when close > close[1] and close[1] > close[2]

means 2 days straight todays close > previous days close, with rising volume.

3) Vshape Line

this line is generated when close > close[1] and close[1] < close[2]

means todays close above previous days close and previous days close is below its previous days close, with rising volume.

4) 2 Bar Fail Line

this line is generated when close < open and close[1] >= open[1] and open >= close[1] and close < close[1]

means todays close < open and previous day close >= previous day open and todays open >= previous day close and todays close < previous days close, with decreasing in volume.

this is not final breakout line but give you approx. idea about the support and resistance using this script.

No of lines are below

1) Pullback Line

this line is generated when close[2] >= close[1] and close[1] >= close

means 2 days straight todays close is below its previous days close, with rising volume.

2) Rising Line

this line is generated when close > close[1] and close[1] > close[2]

means 2 days straight todays close > previous days close, with rising volume.

3) Vshape Line

this line is generated when close > close[1] and close[1] < close[2]

means todays close above previous days close and previous days close is below its previous days close, with rising volume.

4) 2 Bar Fail Line

this line is generated when close < open and close[1] >= open[1] and open >= close[1] and close < close[1]

means todays close < open and previous day close >= previous day open and todays open >= previous day close and todays close < previous days close, with decreasing in volume.

Release Notes

removed extra codes * with rising volume. = with falling volume for 2 days.

there is typo in description its generated line on decreasing volume and not increasing volume.

Release Notes

added label counter for the line so you can easily identified the order of the line.Release Notes

set the lable to the price instead of above bar position.Release Notes

Added 2 new breakout line1) 2 Reversal Bar

this is generated when in 2 days row close below its previous day close.

and on 3rd day close cross above previous day high.

buy signal only generate if todays close cross above previous day high. ideal stoploss is previous day low which is crossed today.

1) Inside Bar Breakout

for this its check upto 10 days inside bar.

buy signal only generate if todays close cross above previous day high. ideal stoploss is previous day low which is crossed today.

Release Notes

increased no of linesRelease Notes

Rounded buy value to 2 decimal point.Important Note :

For Best Result to use this script is to use only 2 different types of lines at a single time and hide others.

which gives you better levels.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.