OPEN-SOURCE SCRIPT

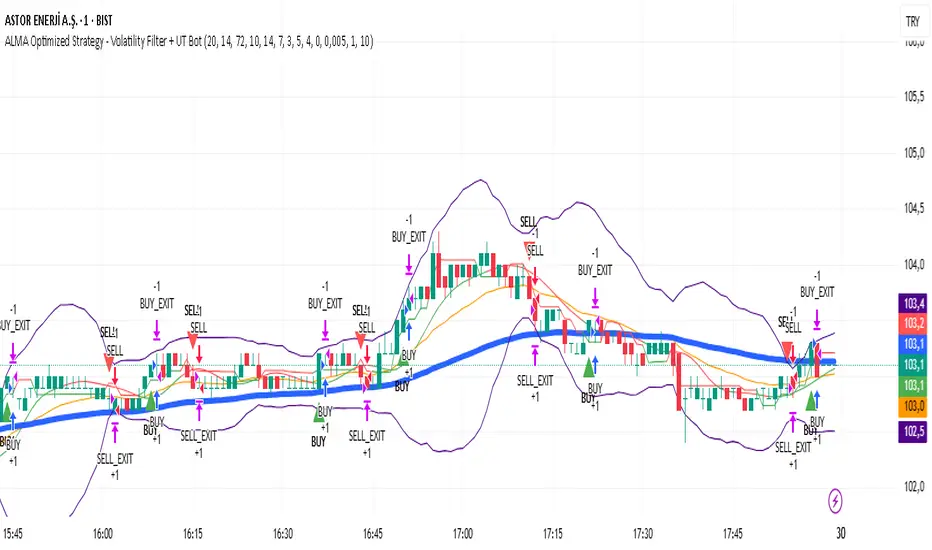

Updated ALMA Optimized Strategy - Volatility Filter + UT Bot

The strategy you provided is an ALMA Optimized Strategy implemented in Pine Script™ version 5 for TradingView. Here is a brief English summary of what it is and how it works:

It is a trend-following strategy combining multiple technical indicators to optimize trade entries and exits.

The core moving average used is the ALMA (Arnaud Legoux Moving Average), known for smoother and less lagging price smoothing compared to traditional EMAs or SMAs.

The strategy also uses other indicators:

Fast EMA (Exponential Moving Average)

EMA 50

ATR (Average True Range) for volatility measurement and dynamic stop loss and take profit levels

RSI (Relative Strength Index) for momentum with overbought/oversold levels

ADX (Average Directional Index) for confirming trend strength

Bollinger Bands as a volatility filter

Buy signals trigger when volatility is sufficient (ATR filter), price is above EMA 50 and ALMA, RSI indicates bullish momentum, ADX confirms trend strength, price is below the upper Bollinger Band, and there is a cooldown period to prevent repeated buys within a short time.

Sell signals are generated when price crosses below the fast EMA.

The strategy manages position entries and exits dynamically, applying ATR-based stop loss and take profit levels, and optionally a time-based exit.

Additionally, the script integrates the UT Bot, an ATR-based trailing stop and signal system, enhancing trade exit precision.

Buy and sell signals are visually marked on the chart with colored triangles for easy identification.

In essence, this strategy blends advanced smoothing (ALMA) with volatility filters and trend/momentum indicators to generate reliable buy and sell signals, while managing risk dynamically through ATR-based stops and profit targets. It aims to adapt to changing market conditions by filtering noise and confirming trends before entering trades.

It is a trend-following strategy combining multiple technical indicators to optimize trade entries and exits.

The core moving average used is the ALMA (Arnaud Legoux Moving Average), known for smoother and less lagging price smoothing compared to traditional EMAs or SMAs.

The strategy also uses other indicators:

Fast EMA (Exponential Moving Average)

EMA 50

ATR (Average True Range) for volatility measurement and dynamic stop loss and take profit levels

RSI (Relative Strength Index) for momentum with overbought/oversold levels

ADX (Average Directional Index) for confirming trend strength

Bollinger Bands as a volatility filter

Buy signals trigger when volatility is sufficient (ATR filter), price is above EMA 50 and ALMA, RSI indicates bullish momentum, ADX confirms trend strength, price is below the upper Bollinger Band, and there is a cooldown period to prevent repeated buys within a short time.

Sell signals are generated when price crosses below the fast EMA.

The strategy manages position entries and exits dynamically, applying ATR-based stop loss and take profit levels, and optionally a time-based exit.

Additionally, the script integrates the UT Bot, an ATR-based trailing stop and signal system, enhancing trade exit precision.

Buy and sell signals are visually marked on the chart with colored triangles for easy identification.

In essence, this strategy blends advanced smoothing (ALMA) with volatility filters and trend/momentum indicators to generate reliable buy and sell signals, while managing risk dynamically through ATR-based stops and profit targets. It aims to adapt to changing market conditions by filtering noise and confirming trends before entering trades.

Release Notes

The strategy you provided is an ALMA Optimized Strategy implemented in Pine Script™ version 5 for TradingView. Here is a brief English summary of what it is and how it works:It is a trend-following strategy combining multiple technical indicators to optimize trade entries and exits.

The core moving average used is the ALMA (Arnaud Legoux Moving Average), known for smoother and less lagging price smoothing compared to traditional EMAs or SMAs.

The strategy also uses other indicators:

Fast EMA (Exponential Moving Average)

EMA 50

ATR (Average True Range) for volatility measurement and dynamic stop loss and take profit levels

RSI (Relative Strength Index) for momentum with overbought/oversold levels

ADX (Average Directional Index) for confirming trend strength

Bollinger Bands as a volatility filter

Buy signals trigger when volatility is sufficient (ATR filter), price is above EMA 50 and ALMA, RSI indicates bullish momentum, ADX confirms trend strength, price is below the upper Bollinger Band, and there is a cooldown period to prevent repeated buys within a short time.

Sell signals are generated when price crosses below the fast EMA.

The strategy manages position entries and exits dynamically, applying ATR-based stop loss and take profit levels, and optionally a time-based exit.

Additionally, the script integrates the UT Bot, an ATR-based trailing stop and signal system, enhancing trade exit precision.

Buy and sell signals are visually marked on the chart with colored triangles for easy identification.

In essence, this strategy blends advanced smoothing (ALMA) with volatility filters and trend/momentum indicators to generate reliable buy and sell signals, while managing risk dynamically through ATR-based stops and profit targets. It aims to adapt to changing market conditions by filtering noise and confirming trends before entering trades.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.