OPEN-SOURCE SCRIPT

StochFusion – Multi D-Line

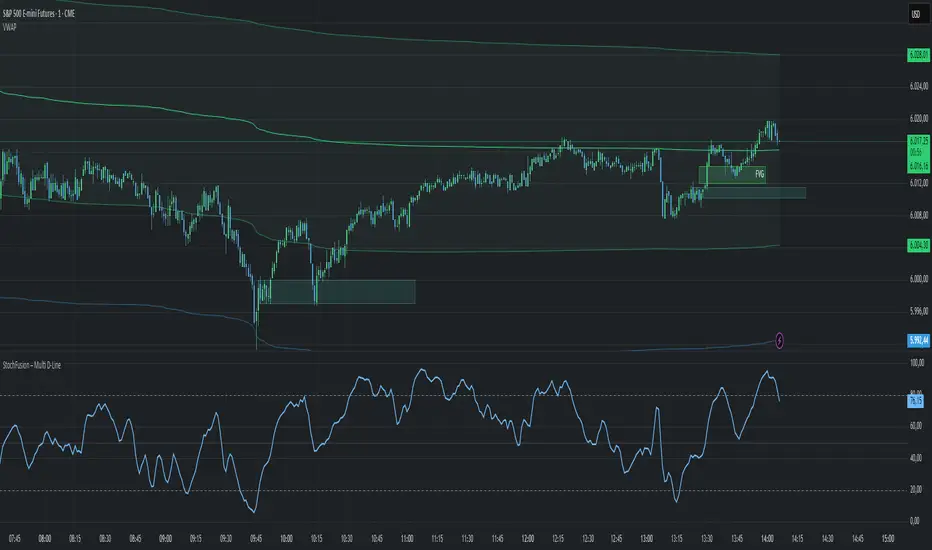

StochFusion – Multi D-Line

An advanced fusion of four Stochastic %D lines into one powerful oscillator.

An advanced fusion of four Stochastic %D lines into one powerful oscillator.

- What it does:

Combines four user-weighted Stochastic %D lines—from fastest (9,3) to slowest (60,10)—into a single “Fusion” line that captures both short-term and long-term momentum in one view. - How to use:Adjust the four weights (0–10) to emphasize the speed of each %D component.

Watch the Fusion line crossing key zones:

– Above 80 → overbought condition, potential short entry.

– Below 20 → oversold condition, potential long entry.

– Around 50 → neutral/midline, watch for trend shifts.

- Applications:Entry/exit filter: Only take trades when the Fusion line confirms zone exits.

Trend confirmation: Analyze slope and cross of the midline for momentum strength.

Multi-timeframe alignment: Use on different chart resolutions to find confluence.

- Tips & Tricks:Default weights [1,2,3,4] give more influence to slower %D—good for trend-focused strategies.

Equal weights [1,1,1,1] provide a balanced oscillator that mimics an ensemble average.

Experiment: Increase the fastest weight to capture early reversal signals.

- Developed by: TradeQUO — inspired by DayTraderRadio John

“The best momentum indicator is the one you adapt to your own trading rhythm.”

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.