OPEN-SOURCE SCRIPT

LANZ Strategy 6.0 [Backtest]

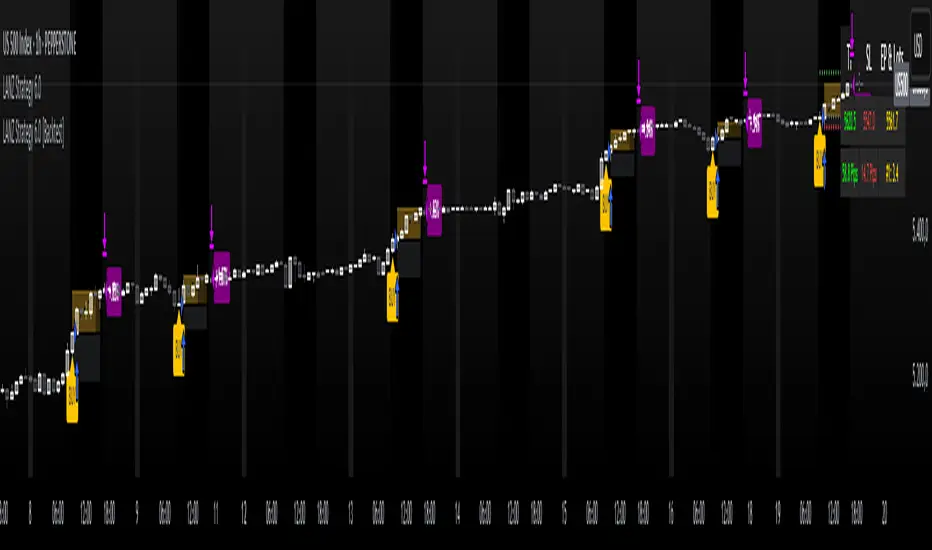

🔷 LANZ Strategy 6.0 [Backtest] — Precision Backtesting Based on 09:00 NY Candle, Dynamic SL/TP, and Lot Size per Trade

LANZ Strategy 6.0 [Backtest] is the simulation version of the original LANZ 6.0 indicator. It executes a single LIMIT BUY order per day based on the 09:00 a.m. New York candle, using dynamic Stop Loss and Take Profit levels derived from the candle range. Position sizing is calculated automatically using capital, risk percentage, and pip value — allowing accurate trade simulation and performance tracking.

📌 This is a strategy script — It simulates real trades using strategy.entry() and strategy.exit() with full money management for risk-based backtesting.

🧠 Core Logic & Trade Conditions

🔹 BUY Signal Trigger:

⚙️ Stop Loss / Take Profit Logic

SL can be:

Wick low (0%)

Or dynamically calculated using a % of the full candle range

TP is calculated using the user-defined Risk/Reward ratio (e.g., 1:4)

The TP and SL levels are passed to strategy.exit() for each trade simulation.

💰 Risk Management & Lot Size Calculation

Before placing the trade:

🕒 Manual Close at 3:00 p.m. NY

📊 Backtest Accuracy

✅ Ideal For:

👨💻 Credits:

💡 Developed by: LANZ

🧠 Logic & Money Management Engine: LANZ

📈 Designed for: 1H charts

🧪 Purpose: Accurate simulation of LANZ 6.0's NY Candle Entry system

LANZ Strategy 6.0 [Backtest] is the simulation version of the original LANZ 6.0 indicator. It executes a single LIMIT BUY order per day based on the 09:00 a.m. New York candle, using dynamic Stop Loss and Take Profit levels derived from the candle range. Position sizing is calculated automatically using capital, risk percentage, and pip value — allowing accurate trade simulation and performance tracking.

📌 This is a strategy script — It simulates real trades using strategy.entry() and strategy.exit() with full money management for risk-based backtesting.

🧠 Core Logic & Trade Conditions

🔹 BUY Signal Trigger:

- At 09:00 a.m. NY (New York time), if:

- The current candle is bullish (close > open)

- → A BUY order is placed at the candle’s close price (EP)

- Only one signal is evaluated per day.

⚙️ Stop Loss / Take Profit Logic

SL can be:

Wick low (0%)

Or dynamically calculated using a % of the full candle range

TP is calculated using the user-defined Risk/Reward ratio (e.g., 1:4)

The TP and SL levels are passed to strategy.exit() for each trade simulation.

💰 Risk Management & Lot Size Calculation

Before placing the trade:

- The system calculates pip distance from EP to SL

- Computes the lot size based on:

- Account capital

- Risk % per trade

- Pip value (auto or manual)

- This ensures every trade uses consistent, scalable risk regardless of instrument.

🕒 Manual Close at 3:00 p.m. NY

- If the trade is still open by 15:00 NY time, it will be closed using strategy.close().

- The final result is the actual % gain/loss based on how far price moved relative to SL.

📊 Backtest Accuracy

- One trade per day

- LIMIT order at the candle close

- SL and TP pre-defined at execution

- No repainting

- Session-restricted (only runs on 1H timeframe)

✅ Ideal For:

- Traders who want to backtest a clean and simple daily entry system

- Strategy developers seeking reproducible, high-conviction trades

- Users who prefer non-repainting, session-based simulations

👨💻 Credits:

💡 Developed by: LANZ

🧠 Logic & Money Management Engine: LANZ

📈 Designed for: 1H charts

🧪 Purpose: Accurate simulation of LANZ 6.0's NY Candle Entry system

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.