OPEN-SOURCE SCRIPT

Updated PBoC Liquidity Injections [tedtalksmacro]

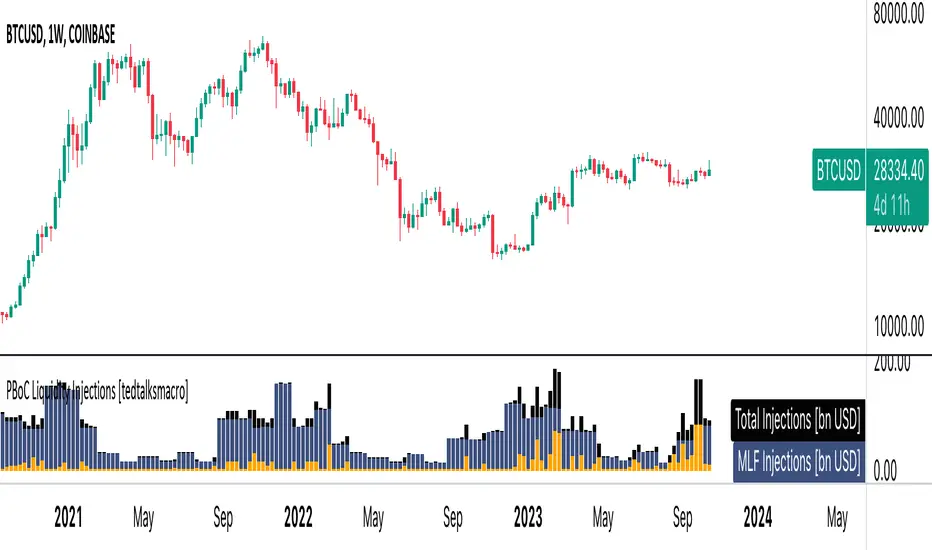

This script shows open market operations by the world's fourth largest central bank (by assets) - the people's bank of china.

Use this script on the 1D timeframe and higher to understand where there are periods of heightened intervention by the PBoC where financial conditions in China are loosened! Looser financial conditions often correlate with higher risk asset prices.

Takes into account:

- PBoC RR operations [ CNLIVRR]

CNLIVRR]

Use this script on the 1D timeframe and higher to understand where there are periods of heightened intervention by the PBoC where financial conditions in China are loosened! Looser financial conditions often correlate with higher risk asset prices.

Takes into account:

- PBoC RR operations [

Release Notes

title updatesRelease Notes

Total Social Financing added to give more rounded view of injections.Release Notes

Reserve Ratio Requirements added to demonstrate whether bank reserves are falling or increasing.Release Notes

Title updateRelease Notes

This PBoC Liquidity Injections indicator tracks the major liquidity operations by the People's Bank of China - namely the Reverse Repo (RRP) and Medium-term Lending Facility (MLF).It can provide insights into China's monetary policy stance and serve as an indicator for risk assets:

Increased PBoC liquidity injections suggest an accommodative/dovish monetary policy. This provides more liquidity into the Chinese economy and financial system.

Higher liquidity typically correlates with stronger performance of risk assets like stocks and commodities. The added liquidity can spur economic growth and investing activity.

Decreased PBoC liquidity injections imply a tighter monetary policy. Reducing system liquidity tends to negatively impact risk sentiment.

Tighter liquidity can precede pullbacks in stocks and commodities, as it tightens financial conditions. Fears of slower growth in China also weigh on global risk appetite.

So monitoring the stacked bar chart of RRP and MLF gives a quick glance on China's monetary policy. Rising liquidity stacks signal supportive conditions for risk assets. Falling liquidity suggests potential headwinds for stocks/commodities and upside for safe haven assets.

The indicator visualizes the liquidity flows from China's central bank. Analysts watch these measures closely to gauge China's economic trajectory and its implications for global markets.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.