OPEN-SOURCE SCRIPT

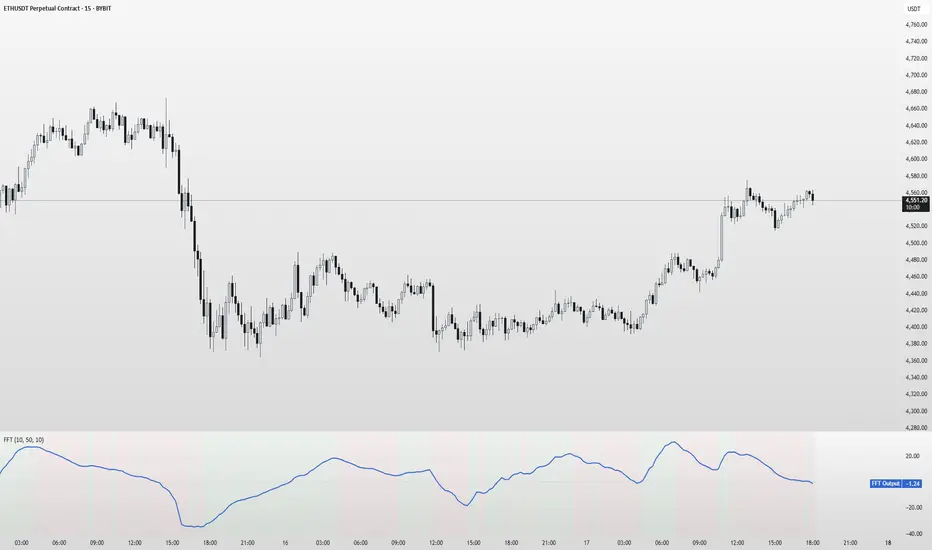

Updated FFT Signal Analyzer

FFT Signal Analyzer

The FFT Signal Analyzer uses a simplified Fast Fourier Transform (FFT) approach to extract dominant cyclical components from price data. By detrending and applying adaptive smoothing, the indicator highlights frequency-driven signals that traditional indicators often miss.

This tool is ideal for traders who want to visualize cyclical market behavior, identify turning points, and confirm entries/exits with frequency-based momentum signals.

How it works:

Removes price trend via detrending (moving average subtraction)

Applies a bandpass filter (EMA) to isolate dominant frequency components

Normalizes the signal using a z-score for consistent visibility

Amplifies the signal for easy interpretation

Highlights slope changes with background coloring (green = rising, red = falling)

Use Cases:

Use zero-line crosses to detect cycle shifts or momentum pivots

Combine with trend filters (e.g., GRJMOM) for high-probability setups

Ideal for detecting underlying rhythm in sideways or oscillating markets

Best for:

Swing traders, scalpers, and cycle analysts looking for frequency-aware confirmation signals

Works on all timeframes and asset classes

The FFT Signal Analyzer uses a simplified Fast Fourier Transform (FFT) approach to extract dominant cyclical components from price data. By detrending and applying adaptive smoothing, the indicator highlights frequency-driven signals that traditional indicators often miss.

This tool is ideal for traders who want to visualize cyclical market behavior, identify turning points, and confirm entries/exits with frequency-based momentum signals.

How it works:

Removes price trend via detrending (moving average subtraction)

Applies a bandpass filter (EMA) to isolate dominant frequency components

Normalizes the signal using a z-score for consistent visibility

Amplifies the signal for easy interpretation

Highlights slope changes with background coloring (green = rising, red = falling)

Use Cases:

Use zero-line crosses to detect cycle shifts or momentum pivots

Combine with trend filters (e.g., GRJMOM) for high-probability setups

Ideal for detecting underlying rhythm in sideways or oscillating markets

Best for:

Swing traders, scalpers, and cycle analysts looking for frequency-aware confirmation signals

Works on all timeframes and asset classes

Release Notes

FFT Signal AnalyzerOverview:

This indicator applies basic signal processing concepts including detrending and smoothing to create an oscillating signal from price data. The methodology uses moving average-based calculations rather than actual Fast Fourier Transform mathematical operations.

Technical Methodology:

Detrending: Subtracts a moving average from price to remove the underlying trend component

Smoothing Filter: Applies exponential moving average to the detrended signal

Normalization: Uses z-score calculation to standardize the signal amplitude

Amplification: Multiplies the normalized signal by a scaling factor for visual clarity

Slope Analysis: Determines rising or falling direction of the oscillating signal

Visual Elements: Background coloring indicates signal direction

Parameters:

Detrend Length: Period for moving average used in trend removal

Smoothing Length: Period for exponential moving average smoothing

Normalization Length: Lookback period for z-score calculation

Amplification Factor: Multiplier for scaling the final output

Important Clarifications:

This indicator does not perform actual Fast Fourier Transform calculations. True FFT involves complex mathematical computations for frequency domain analysis that cannot be replicated with simple moving average operations. This indicator provides a detrended, smoothed oscillator based on basic signal processing concepts.

Calculation Process:

Price trend is removed using moving average subtraction

Detrended signal is smoothed using exponential moving average

Result is normalized using z-score methodology over a specified lookback period

Final signal is amplified for visual presentation

Technical Limitations:

All calculations are based on historical price data and introduce lag

Detrending effectiveness varies significantly with market conditions

Z-score normalization can produce unstable readings during low volatility periods

Signal quality depends heavily on parameter selection and market characteristics

The indicator does not identify actual frequency components or cycles

Usage Framework:

Zero-line crossings indicate changes in the detrended price momentum

Signal amplitude shows the magnitude of price deviation from trend

Background coloring provides visual reference for oscillator direction

Critical Warnings:

This is not a frequency analysis tool despite the name reference

Does not predict future price movements or identify true market cycles

Should be thoroughly tested across different market conditions before use

Past signal behavior provides no guarantee of future performance

Requires additional analysis methods for trading decision-making

Technical Note:

Users seeking actual frequency domain analysis should understand that true FFT requires mathematical implementations beyond the scope of moving average-based indicators.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.