OPEN-SOURCE SCRIPT

TrendWay Strategy

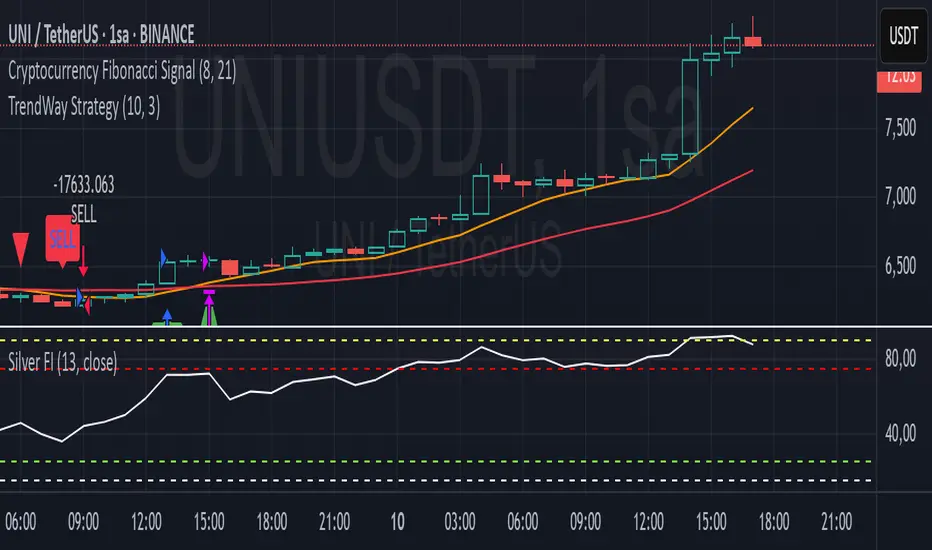

📈 TrendWay Strategy – Smart Trend Following Algorithm

The TrendWay Strategy is a powerful trend-following algorithm designed for traders who aim to capture sustained market movements with clarity and precision. Built on the principle of combining volatility with trend strength, this strategy utilizes the Average True Range (ATR) and dynamic support/resistance levels to generate high-probability buy and sell signals.

🔍 Key Features:

ATR-Based Volatility Filter: Adjusts sensitivity based on market volatility using customizable ATR periods and multipliers.

Dynamic Trend Lines: Adapts trailing stop levels based on price action, helping to stay in trends longer and reduce false signals.

Clear Entry/Exit Signals: Visual Buy (🔼) and Sell (🔽) markers provide intuitive decision-making on the chart.

Signal Highlighting Option: Easily switch between visual trend highlighting or a clean chart view.

⚙️ Parameters:

ATR Period (default: 10)

ATR Multiplier (default: 3.0)

Source (e.g., hl2)

Option to toggle ATR method (SMA or standard)

Optional signal markers and trend coloring

✅ Suitable For:

Swing traders and intraday traders

Crypto, forex, and stock markets

Traders looking for a reliable way to trail trends and exit on reversal signals

Note: Like all strategies, TrendWay should be used in conjunction with sound risk management and market awareness. Always backtest and forward-test before using with live capital.

The TrendWay Strategy is a powerful trend-following algorithm designed for traders who aim to capture sustained market movements with clarity and precision. Built on the principle of combining volatility with trend strength, this strategy utilizes the Average True Range (ATR) and dynamic support/resistance levels to generate high-probability buy and sell signals.

🔍 Key Features:

ATR-Based Volatility Filter: Adjusts sensitivity based on market volatility using customizable ATR periods and multipliers.

Dynamic Trend Lines: Adapts trailing stop levels based on price action, helping to stay in trends longer and reduce false signals.

Clear Entry/Exit Signals: Visual Buy (🔼) and Sell (🔽) markers provide intuitive decision-making on the chart.

Signal Highlighting Option: Easily switch between visual trend highlighting or a clean chart view.

⚙️ Parameters:

ATR Period (default: 10)

ATR Multiplier (default: 3.0)

Source (e.g., hl2)

Option to toggle ATR method (SMA or standard)

Optional signal markers and trend coloring

✅ Suitable For:

Swing traders and intraday traders

Crypto, forex, and stock markets

Traders looking for a reliable way to trail trends and exit on reversal signals

Note: Like all strategies, TrendWay should be used in conjunction with sound risk management and market awareness. Always backtest and forward-test before using with live capital.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.