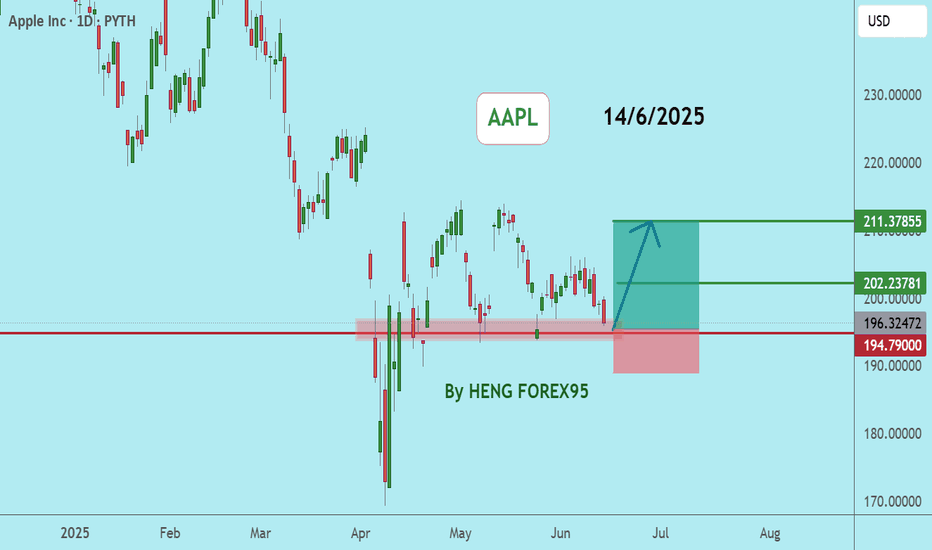

AAPLAAPL price is near the support zone 195-193. If the price can still stand above 193, it is expected that the price will rebound. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

AAPL trade ideas

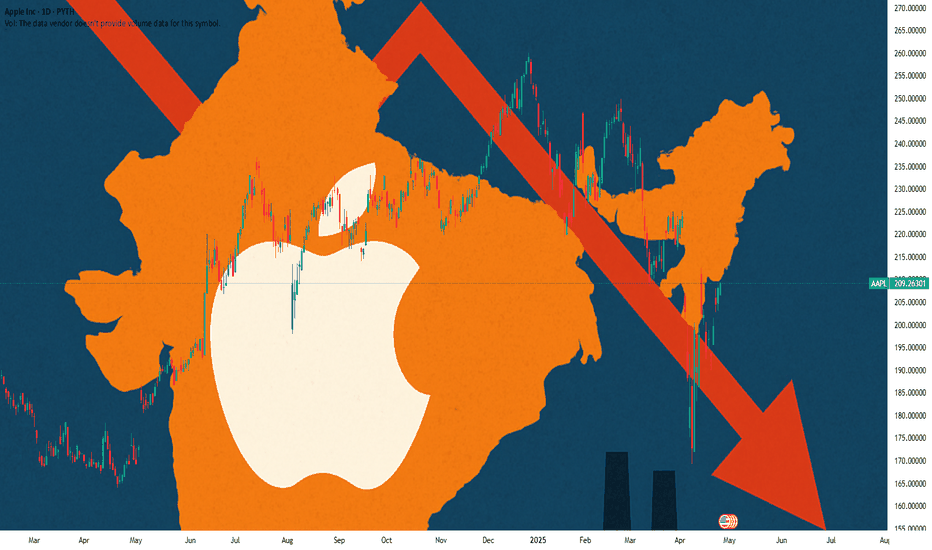

Gravions IG: Why Apple's Shift to India Could Trigger a Drop in Apple is betting heavily on changing its production geography, planning to move a significant portion of iPhone assembly from China to India by 2026. Analysts at Gravions IG have assessed the situation and concluded that this move could negatively impact the company’s stock value in the near term.

Key Risks of Production Relocation

Indian manufacturing facilities, although growing rapidly, have not yet achieved the level of quality and logistical efficiency seen at Chinese plants. Gravions IG emphasizes that reconfiguring production processes takes time, and potential disruptions in supply chains or reduced quality in the early batches could trigger dissatisfaction among consumers and partners.

According to their analysis, the transition could increase product costs and squeeze profit margins, putting pressure on Apple’s financial results over the next few quarters.

Investor Reactions

Current market behavior reflects investor caution: Apple's share price has already fallen nearly 17% since the start of the year, with technical indicators suggesting further declines. The formation of a "death cross" — where the 50-day moving average crosses below the 200-day moving average — heightens concerns about a prolonged downtrend.

Gravions IG stresses that until the Indian production lines are fully operational and stable, Apple's stock will likely remain under selling pressure.

Strategic Perspective: Opportunity or Risk?

In the long run, diversifying manufacturing could benefit Apple by reducing its dependence on China and insulating it from potential geopolitical or economic shocks. Additionally, the Indian government's efforts to bolster its manufacturing sector could provide Apple with a stronger foundation for future expansion.

Still, Gravions IG insists that until Indian facilities reach consistent quality and scale, Apple will be vulnerable to market sentiment swings and potential reputational risks.

Conclusion

Relocating production is a strategically sound but high-risk move for Apple in the short term. Gravions IG advises investors to closely monitor product quality and supply chain stability in India before making long-term investment decisions regarding Apple's stock.

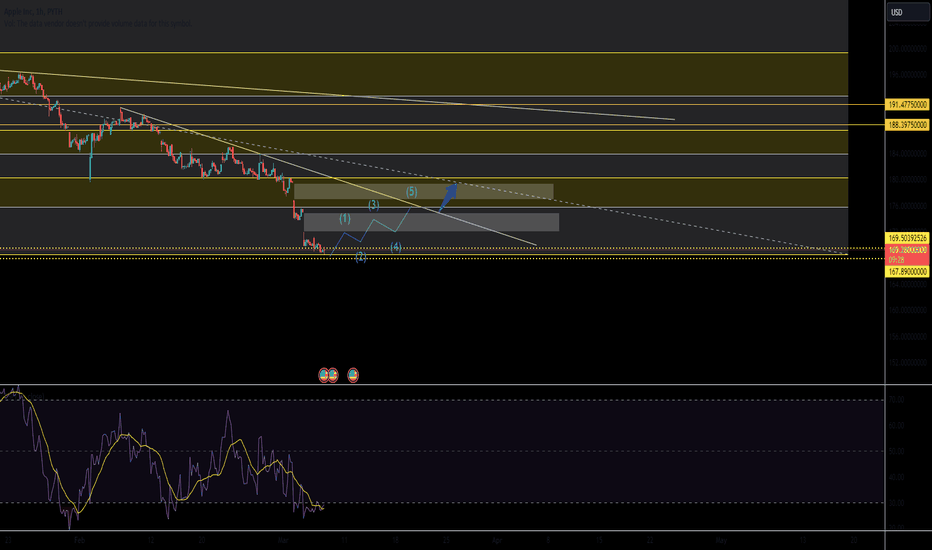

$AAPL could be bottoming around $169.4There are two more levels below: 167.4 and 165.5. I think the game could be a waiting game for $APPL to bottom, but seems like a good risk-reward to add $175c for a bounce play at these RSI levels, into perhaps end of month. Market makers will do all efforts to maintain the stock below 175 I imagine. It's always safer for these type of bottoming plays to go longer in expiration and to hedge below, perhaps at 165 in the shorter term. Trade safe.

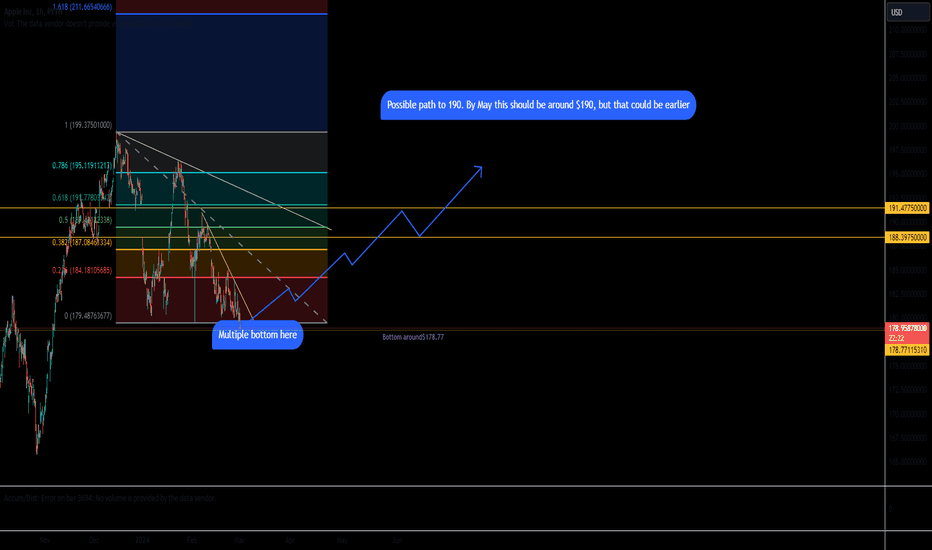

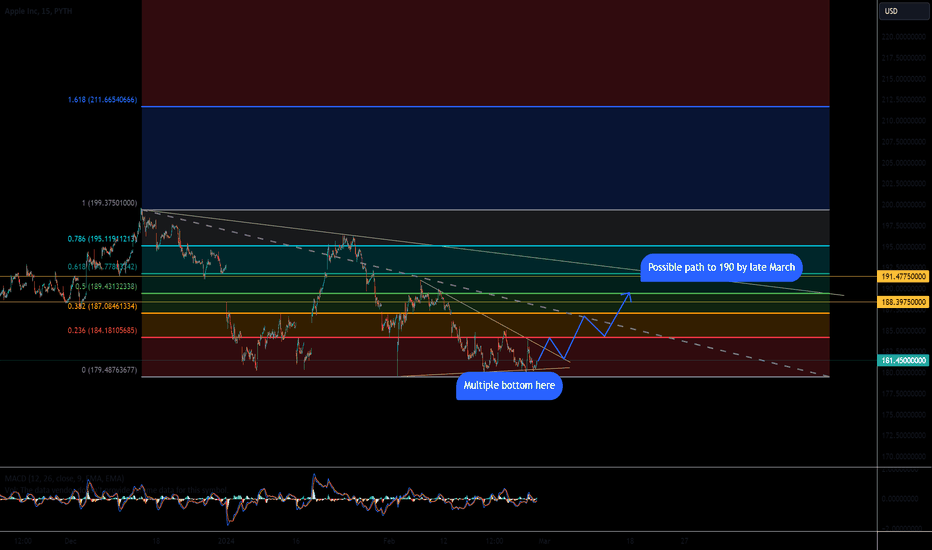

$APPL path to $190 updatedBriefly touched $178.7 in the pre market, but needs to touch it perhaps in real trading hours. This in an important level that should hold. Or better said, must hold or $APPL may end up trading lower into the $175s. Acceptance below $175 takes it to $171 where it can find a strong buyer. The ride to $190 is full of bump, perhaps with an initial impulse buying up into $185.

Level above> Acceptance above 180.54 sends it to $184.77 then break of $185 leads to $189. Break of $189.5 leads to $194. Acceptance above $194.6 brings $199, above this no man's land.

$APPL so far has been able to stay inside the wedgeI think Apple is preparing to hold the market during march and april 2024. The fact that Apple has filtered the end of the EV era at Apple makes me think there was a lot of pressure inside the company's leadership to put an end to what appeared to be a non-lucrative enterprise. At least not as lucrative as manufacturing phones and computers with 50% margins, unless the car was sold above the $150k mark or so. It is bullish but not in the short term as Apple needs to refocus on its AI powerhouse. For some reason they have been reluctant to push the button to transform Siri into a modern version of an AI that should be able to compete with Open AI's chat gpt. I can imagine the project is in the works, and it is a matter of time for them to push the button and upgrade Siri. The VR googles sill early but they seem to be on the right path in terms of hardware, however META has an edge in the market given the amount of data Whatsapp has amassed including Facebook itself. Apple should start moving to compete neck to neck with Meta i think in the next 24 months or so. I'd take calls no higher than 200 strike expiring in april and beyond or a mix of call spread to sell the 200 and buy the 180-190 depending on how much you want to risk. Perhaps grabbing a couple of puts just to hedge below 175 in the short term, in case Tim Apple goes SNOW style.

Is AAPL Worth Considering for Dividend?Introduction:

As a trader, you constantly seek investment opportunities that offer promising returns. While Apple Inc. (AAPL) has long been known for its innovative products and market dominance, it's worth questioning whether it is equally attractive regarding dividend investing. In this article, we delve into the breakdown details of Apple's dividend and explore whether AAPL is worth considering for dividend-focused traders like yourself.

Call-to-Action: Worth Considering AAPL for Dividend

Considering the breakdown details of Apple's dividend, it becomes evident that AAPL is a stock worth considering for dividend-focused traders. Here's why:

1. Consistent Dividend Increases: Apple has a track record of consistently increasing its dividend payout, reflecting its commitment to rewarding shareholders.

2. Competitive Dividend Yield: With a dividend yield of , AAPL offers a competitive return compared to other dividend-paying stocks in the market.

3. Potential for Future Growth: Apple's commitment to dividend growth suggests that there is potential for further increases in the future, which could enhance your investment returns.

4. Strong Financial Position: Apple's relatively low payout ratio indicates its ability to sustain and potentially increase dividend payments in the long run, supported by its strong financial position.

In conclusion, while Apple's primary focus may be on its product innovation, the breakdown details of its dividend program make AAPL a compelling option for dividend-focused traders. By considering AAPL for dividend investing, you can benefit from consistent dividend increases, competitive dividend yield, and the company's strong financial position. So, why not explore the potential of AAPL as a dividend investment opportunity?

Disclaimer: It is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.