US Tech 100 Cash Index forum

Speak My Mind: NASDAQ Execution – Structure Told the Story

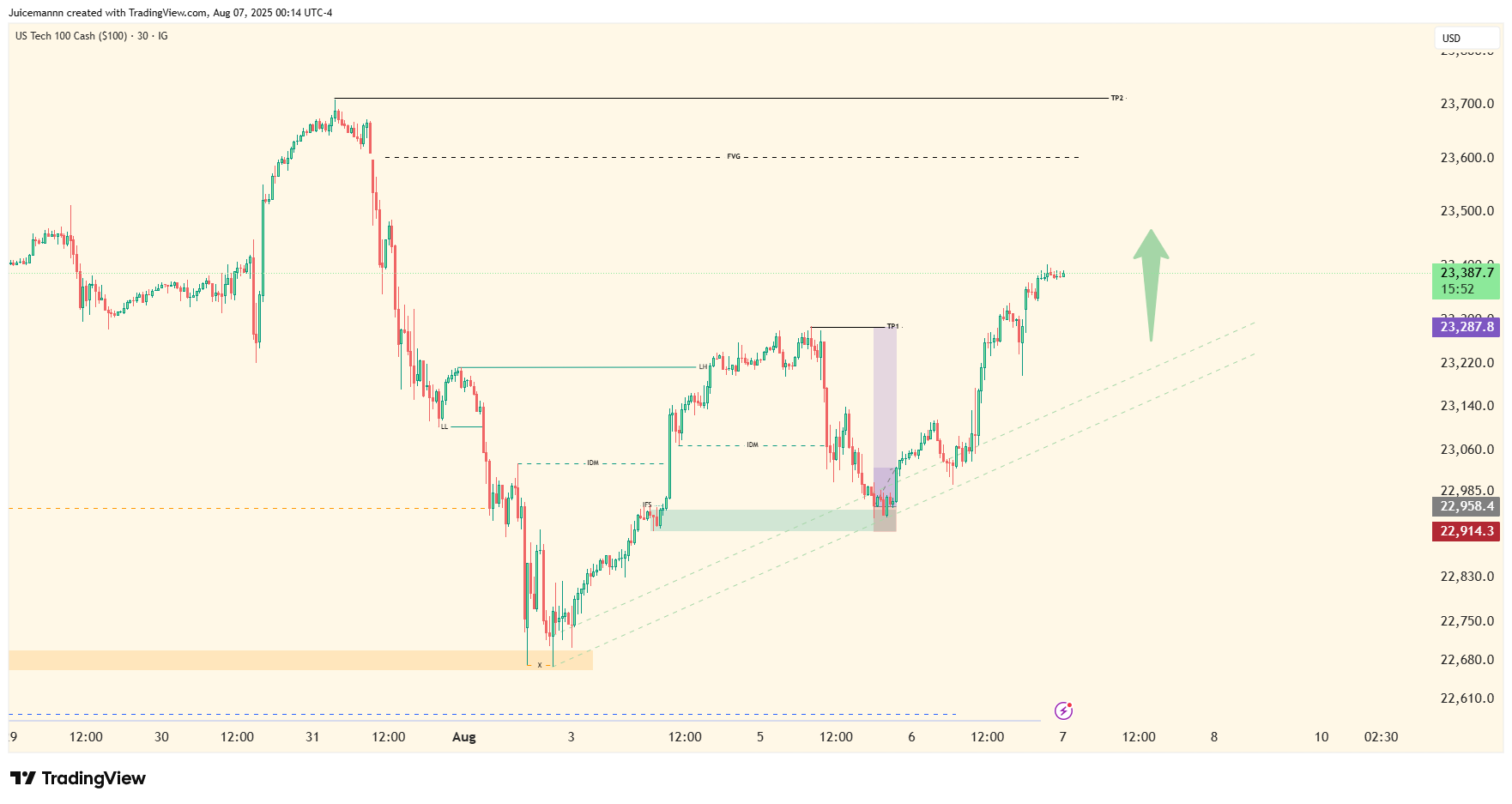

Been riding with this NASDAQ setup all week long. She been showin’ strong bullish intent on the 4H, clear as day — real refined structure, no confusion, just clean upside momentum.

I dropped down to the 30-minute, got inside the engine. Mapped out that internal structure, spotted that liquidity sweep, and marked off my OB like a craftsman layin’ bricks. Once that sweep came through and price tapped that block, I didn’t rush — I waited for my CHoCH on the lower time frame to give me the green light.

Soon as that shift hit, I switched gears straight into execution mode. Entered clean, no hesitation. Held that position tight all the way to TP1 — textbook move.

Now price? Still lookin’ bullish. Strong momentum carryin’ it toward TP2, but I chose peace over greed. Bagged what I came for and left the rest. That’s growth right there.

Moral of the play: When you let structure lead and don’t force the entry, the market speaks to you loud and clear.

You take a buy from your largest HL to your largest HH.

It’s as simple as that.

Sells are only temporary retracements in the master trend.

The index is bullish and has been for a very very very long time.

Just know that short positions are always fighting the trend.

Now I am not saying never short as some can carry it out. However the vast majority will get trapped or stopped out by holding sells.

I feel sorry for poor souls who are holding shorts from 16500. Their trade will probably never be broken even. Not impossible but very unlikely.

Now this also doesn’t mean to blindly buy every dip, you wait for your HL to form. It takes patience.

Enjoy the bull run everyone! :)

f**ers have bad eyesight stereotype for a reason.