ADAUSD viciously sold, but a vicious buyback in play!

This is a Cryptocurrency ADAUSD has been sent downwards in its price this year like most other Crypto's, lately trying to stage its turnaround, I think it will happen real soon as Bitcoin is set to move much higher anytime soon, very soon now I think and Crypto is very bullish today across the board, many things up 5% already.

This would represent a massive upside move for ADAUSD as the forces are set to take Cryptocurrency's much higher following their big sell-downs this year.

ADAUSD.P trade ideas

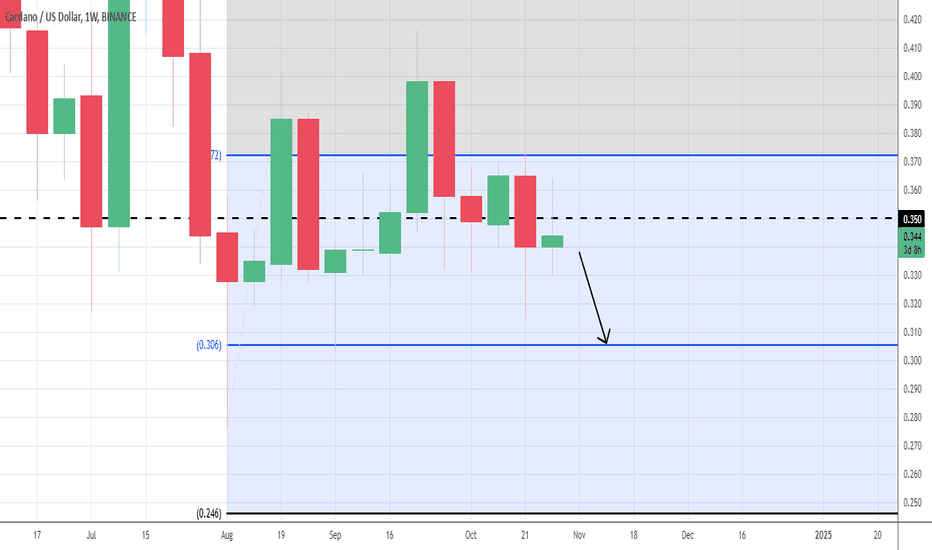

ADAUSD If you ask meIf you asked me a couple of years ago mainly 2021, I would say I would tell every buy ADA buy ADA!!!...... Now that I am a functioning adult and have gone through the phase of unplugging and learned a few things. According to Historical Chart Patterns I am seeing a Descending Triangle here and as we know Descending Triangles are an indicator for shorting. It may go down but with tomorrow being such a critical day be on the lookout for potential buy situations.

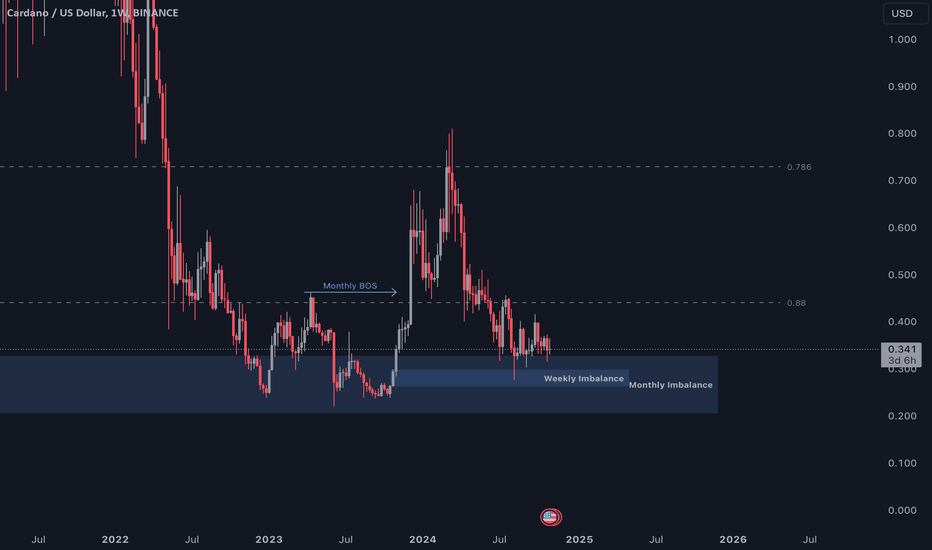

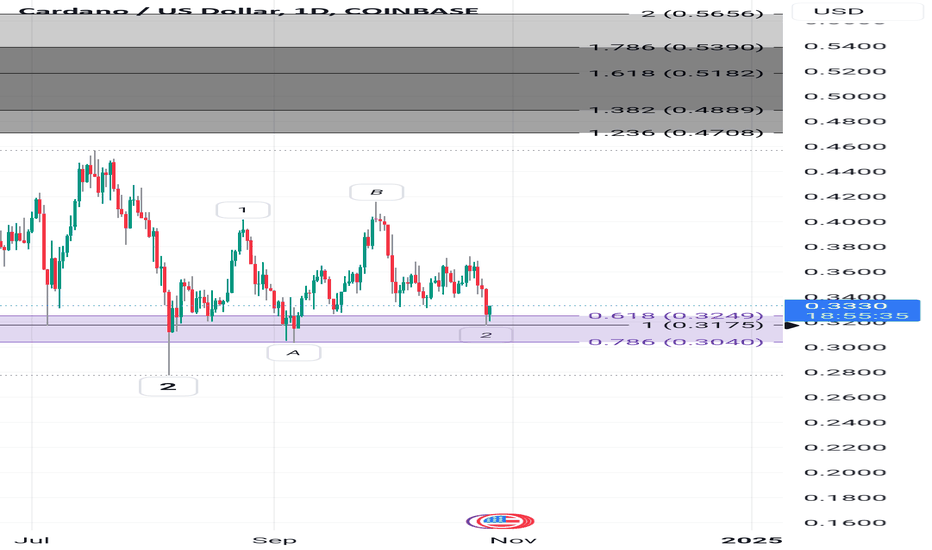

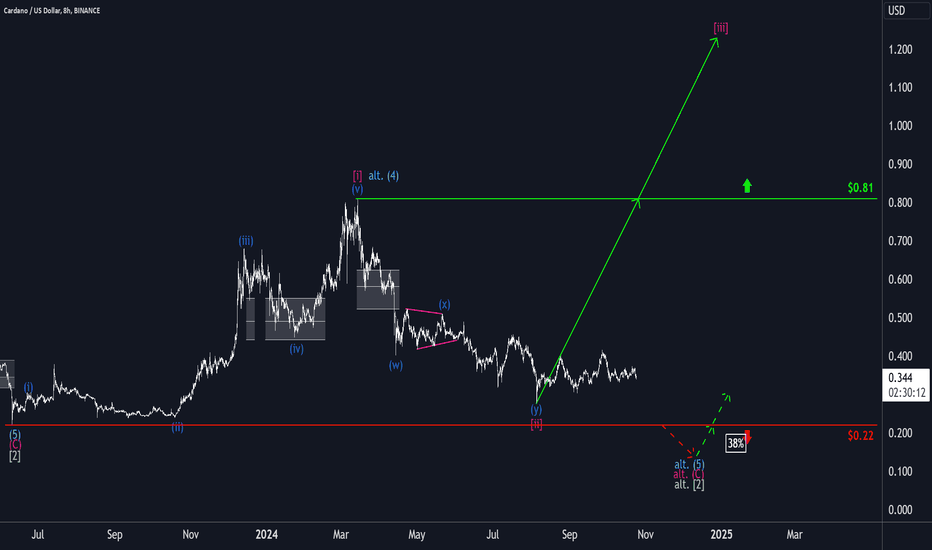

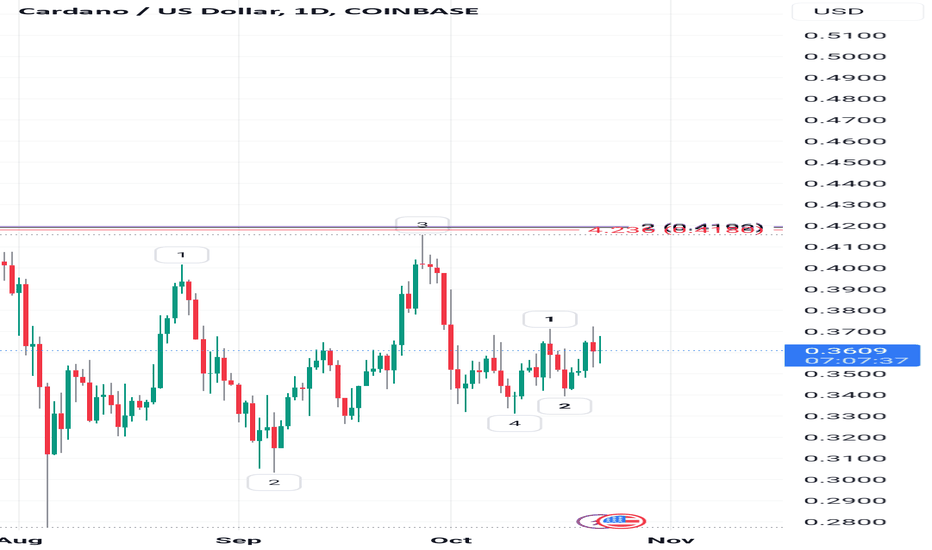

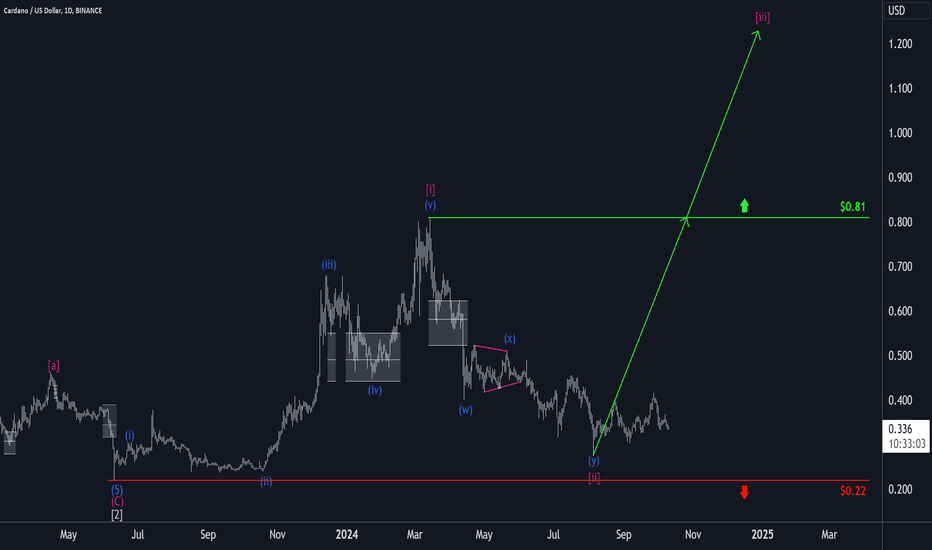

ADA: Still in Wave 2 (updated EW count)ADA/Cardano and its forever sideways price action has led me to redo the count for the two yearslong bear market. Previously my assumption was that Oct 2023 was the termination of primary wave 2. However, the price action for an entire year since then has not been impulsive. It is possible that Primary degree 2 is done and this price action is another 1/2 on a smaller degree, but it is odd to start the wave 3 of primary degree this weak and this slow. So, looking at the structure again and new thesis is ADA is at its last leg of the Primary wave 2 correction. Either it finishes up the y wave of the minor degree as a triangle, or it could correct deeper as an ABC, where the triangle structure forming right now drags on longer for a B wave triangle and then get a C wave back to $0.16 - $0.14 area to complete the correction. This could drag on till next year Q2 where BTC correction could also end, on a different degree of trend. For now, I am only going to wait and watch.

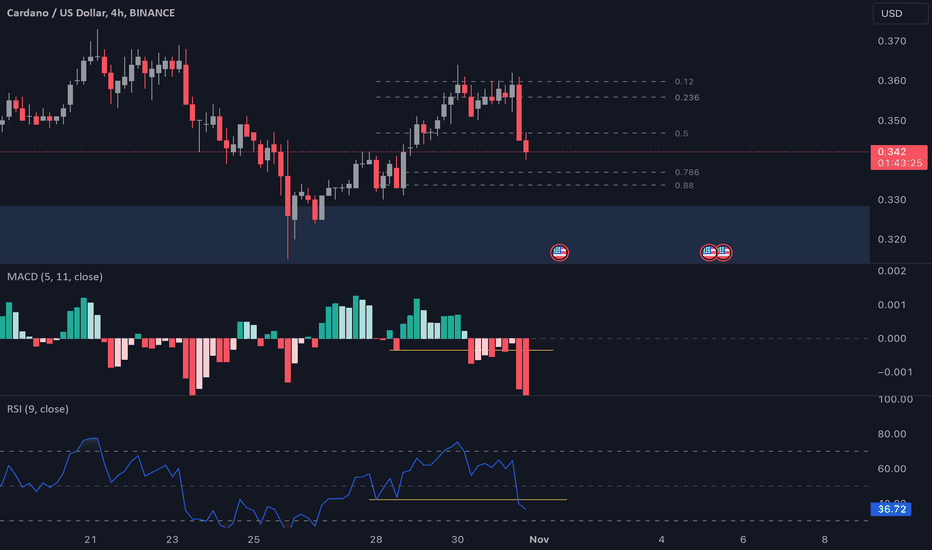

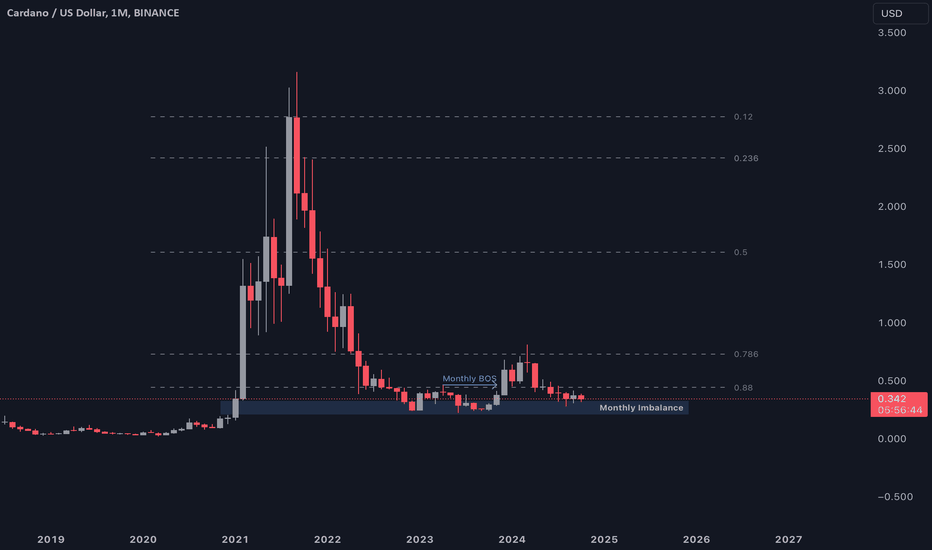

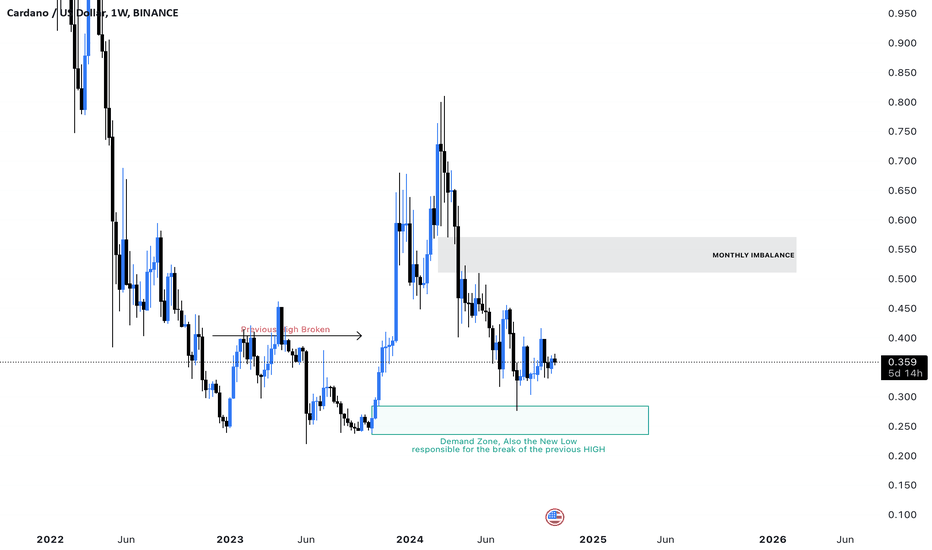

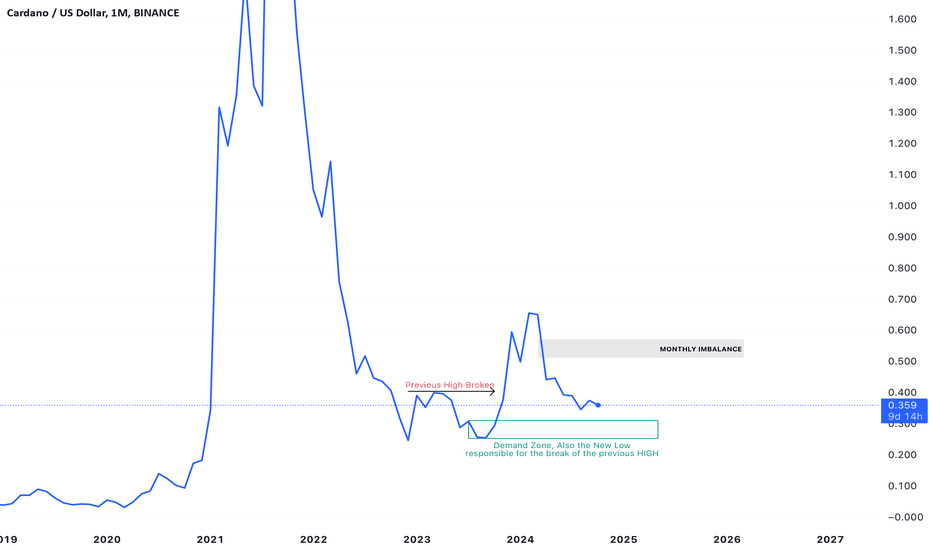

Imbalance Zones We have entered a Monthly and weekly Imbalance Zone, best time to buy!! Looking at the Fibonacci we are below the 0.88% Zone , known as the Extreme Zones another good place to buy from, once we get a solid break above the 0.88% Level, that will be our first indication to start stacking up on Ada as we will see more Bullish movement!!!

Ada Bullish ConfirmationLooking at the Monthly time frame we can see a lot of bullish signs , we have broken the previous monthly high, we have retraced back into the Demand Zone that caused the break of the previous high, we are now waiting for that final break towards the upside to support the bullish move, this will be the best time to stock up on ADA!!!

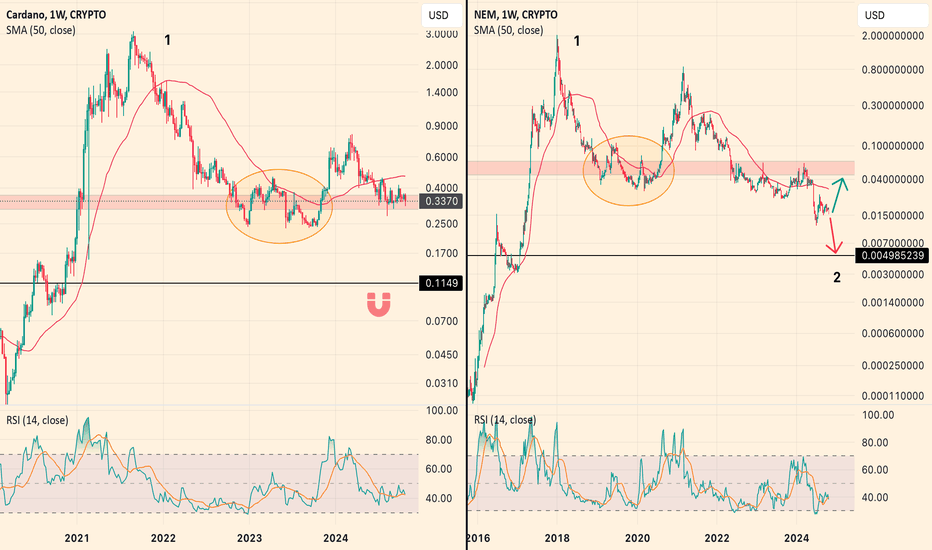

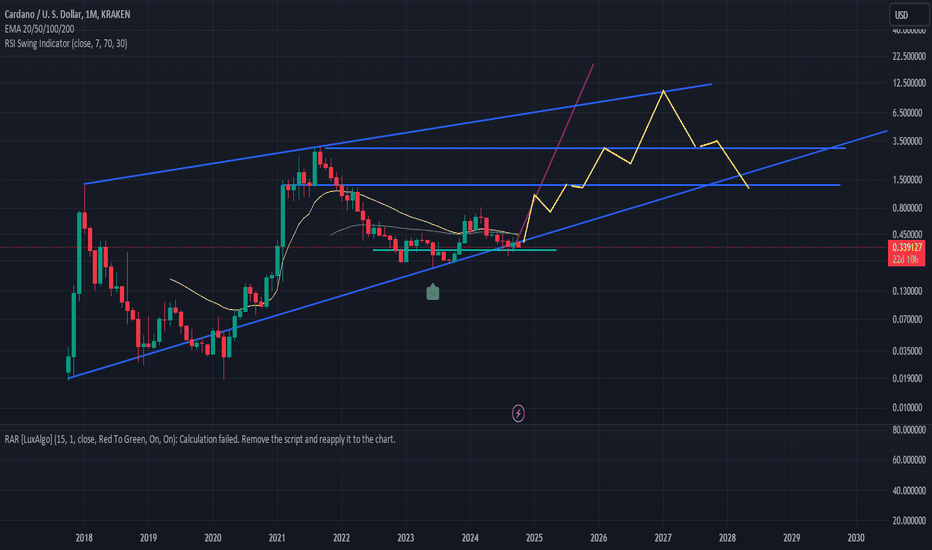

ADA Caution!Considering cycle theories and assuming Altcoins - especially those from 2015-2017 - could be in different corrective phases than Bitcoin, investors could be in a big surprise for the next upcoming months. While Bitcoin is potentially in its last cycle (retail wave 5) before its first major correction, the older Altcoins are still in their wave 2 which results in a long exhaustive ABC phase and often corrects more than 50% of the first impulsive wave which would also coincide with the 1.618 Fib.

This would mean that alt-season - for the older big coins - is not here yet. Regarding their meteoric rises after more than 10k% the fundamentals need to catch up to overvalued prices, which takes time.

A lot of people are confused and complaining about the "blue chip coins" not going up, especially Cardano, while Market Makers play the long game and suppress Altcoin prices artificially, simply keeping them in a big trading range and in corrective mode till their first cycle ends and the next begins.

ADA e.g. shows striking resemblance to NEM (XEM) with a similar corrective structure and sits on long time life support. The more it pokes on it the more it's gonna get dangerous for the next breakdown to the 0.10-0.20$ region.

Cardano: FlatlandsCardano showed little volatility last week, moving mostly sideways. We still expect it to rise in magenta wave (iii), surpassing the resistance level at $0.81. Only our 38% probable alternative scenario could disrupt this plan. This alternative scenario will come into play if the price drops below the support level at $0.22, implying a deeper low for green wave alt.(2)

Cardano: Potential Cup and Handle Signaling a Bullish Breakout?In recent weeks, ADA Cardano has shown signs of forming a classic "cup and handle" pattern, often considered a bullish continuation signal in technical analysis. The gradual U-shaped consolidation (the "cup") suggests that the market is absorbing selling pressure, potentially paving the way for an upward breakout. The "handle" formation, characterized by a slight pullback, may act as the final consolidation before a significant price surge.

Traders often look for volume increases during the breakout from the handle, which can indicate strong momentum. If the pattern completes successfully, Cardano could see a strong upward rally, supported by bullish fundamentals like network upgrades and ecosystem developments.

While technical patterns like this one can provide valuable insights, it’s important to consider the broader market environment and potential resistance levels ahead to assess ADA's longer-term potential.

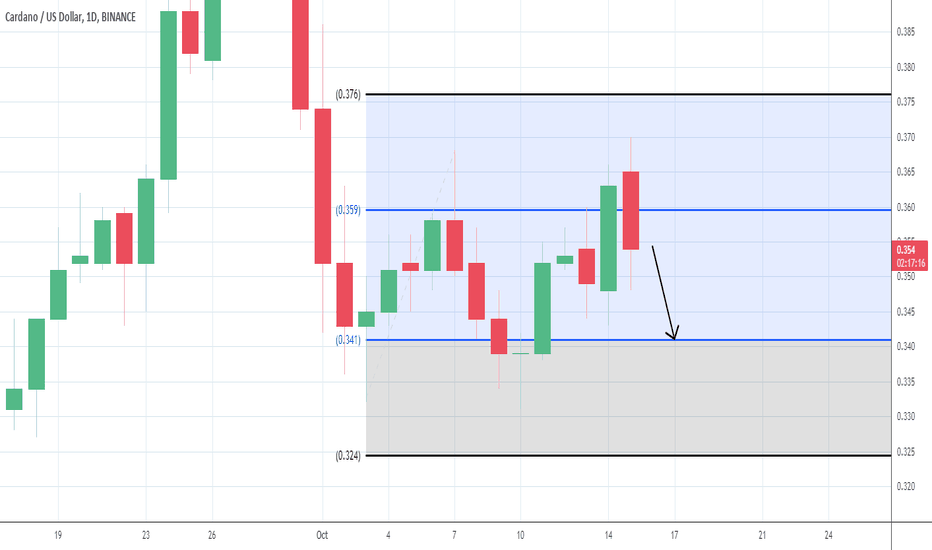

#ADAUSD 1DAYADAUSD (Cardano vs US Dollar)

Timeframe: 1 Day (Daily Chart)

Pattern: Uptrend Channel

Description:

The ADAUSD pair is currently exhibiting a well-established **uptrend channel** on the daily chart. This pattern is defined by a series of higher highs and higher lows, with the price consistently moving within two parallel ascending trendlines. The lower trendline serves as dynamic support, while the upper trendline acts as resistance. The price action within this channel indicates that buyers are in control, with bullish momentum driving prices higher over time.

Forecast:

The recommendation is to take a **buy** position, as the price is expected to continue moving upward within the channel. The trend shows strong bullish signals, and unless there is a break below the lower support line, the uptrend should persist. If the price approaches the upper resistance line, it may face some temporary consolidation or correction before continuing higher.

Entry Point: A buy entry is suggested near the lower support of the channel for optimal risk-reward.

Stop-Loss: Place a stop-loss slightly below the lower support line of the channel to mitigate risks in case of a downward breakout.

Take-Profit: The take-profit target should be set near the upper resistance line of the channel, or you may trail your stop-loss to lock in profits as the price advances. A breakout above the resistance line could signal further upside potential.

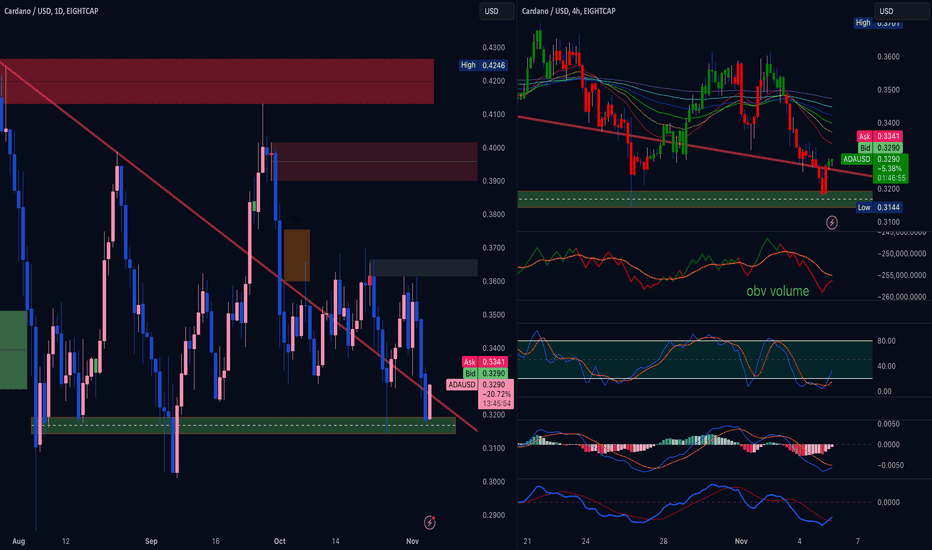

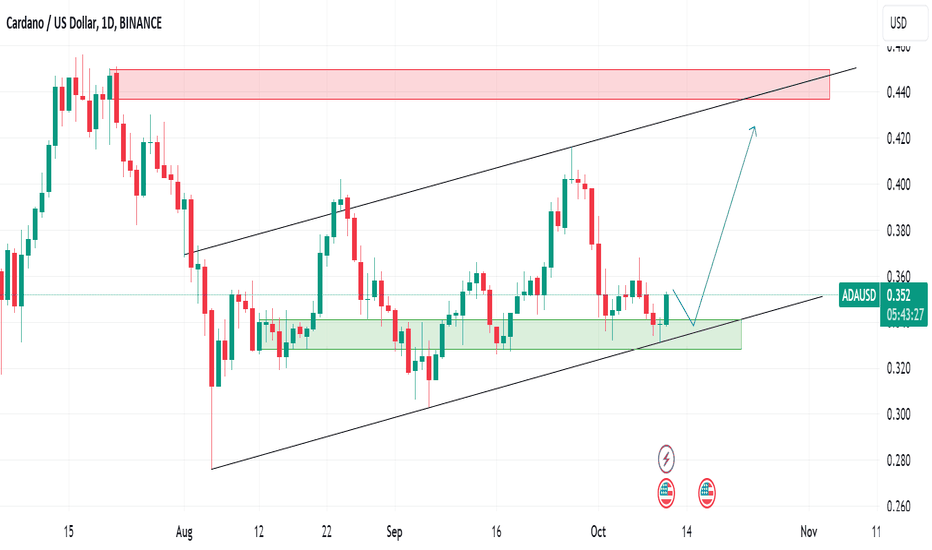

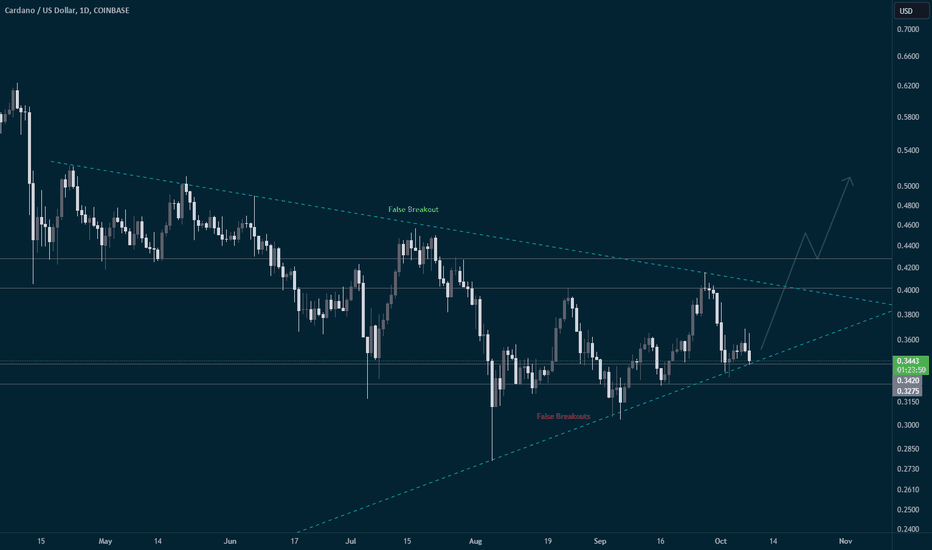

ADA | Back to bear market lows, or back to your portfolio?ADA has been out of the top 5 cryptos for a while and largely out of the spotlight. But is that about to change? Let’s dive into a few key factors that could offer insight into what’s coming next.

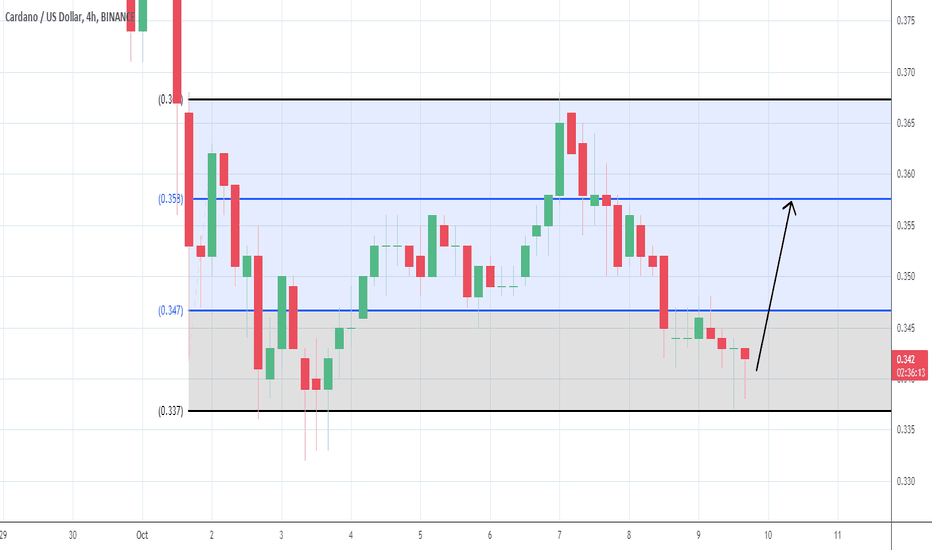

-- Support & Resistance

Currently, ADA is trading near the bottom of its range at around $0.34, a key level that has historically divided bull market price action from long-term bear market accumulation since 2022. In a bull market, this is the kind of price level investors can only dream of buying at. However, with Bitcoin consolidating at its previous cycle’s all-time high for the past seven months, altcoins have suffered, allowing prices to fall to these accumulation-friendly levels.

The top of the range sits between $0.40 and $0.43, where we've seen two rejections and one false breakout. Despite this, I wouldn’t lean towards a bearish outlook, as we’ve had two false breakouts and three successful support holds, suggesting bulls have more control over this range.

-- Trendlines

As shown on the chart, ADA is forming a large pennant pattern, a key signal of potential consolidation before a significant move. Currently, the price is testing the lower trendline of this pennant, which aligns with the range’s support level. This convergence provides strong confluence, reinforcing the idea that we could see a bounce from here. The pattern's structure suggests that, as long as the lower boundary holds, ADA may be positioning for a breakout. Watching how price action reacts to this area will be crucial in determining the next move.

--

In conclusion, ADA is showing signs of potential strength at key support levels, both in terms of price range and trendline confluence. With bulls maintaining control over the range and a possible breakout on the horizon, the upcoming price action could signal a shift back into the spotlight for ADA.

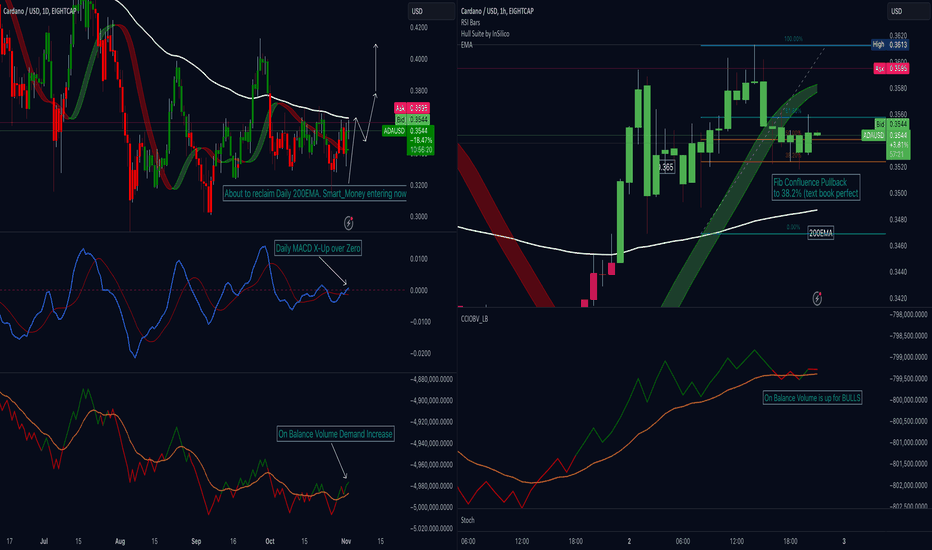

ADAUSD Breakout confirmed. Target 1.0500.Cardano / ADAUSD has broken above the Descending Triangle pattern and despite a pull back on the 1day MA200, it is now resuming the uptrend.

This is a similar price action with 2023. Break above Triangle, consolidation before the 1day MA200 break and then huge rally to the 2.618 Fibonacci extension.

Buy and target 1.0500.

Previous chart:

Follow us, like the idea and leave a comment below!!