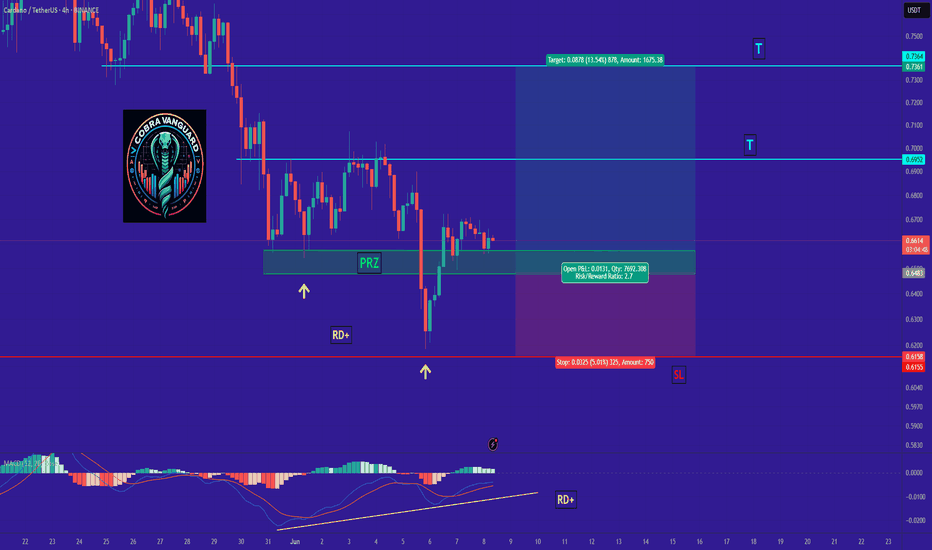

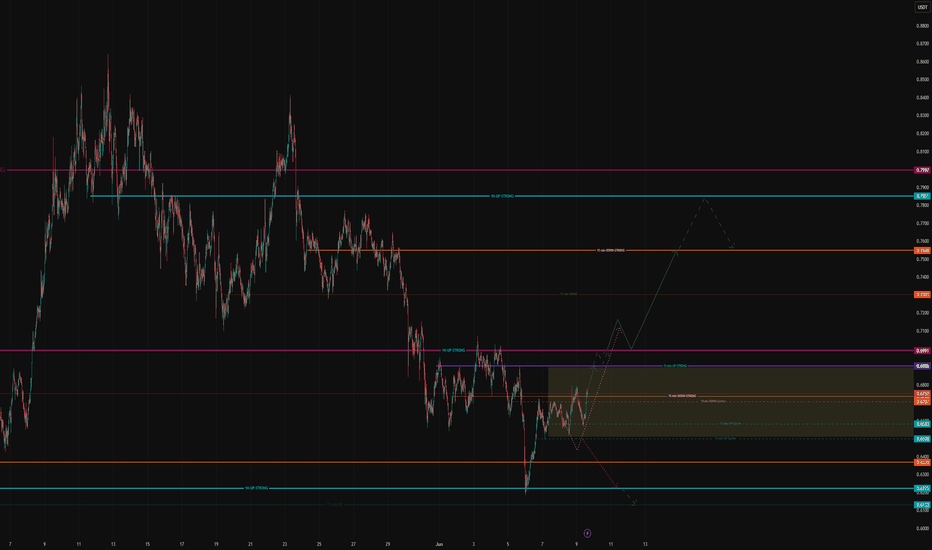

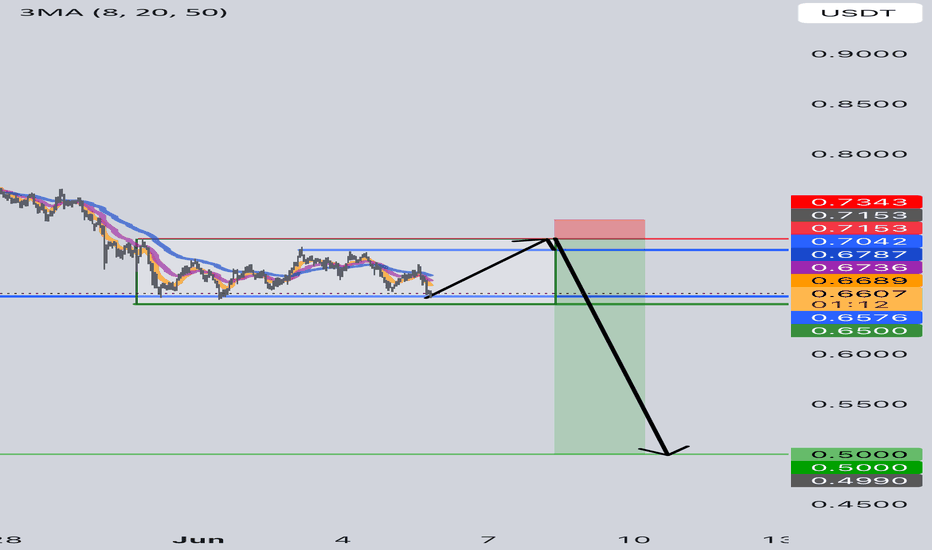

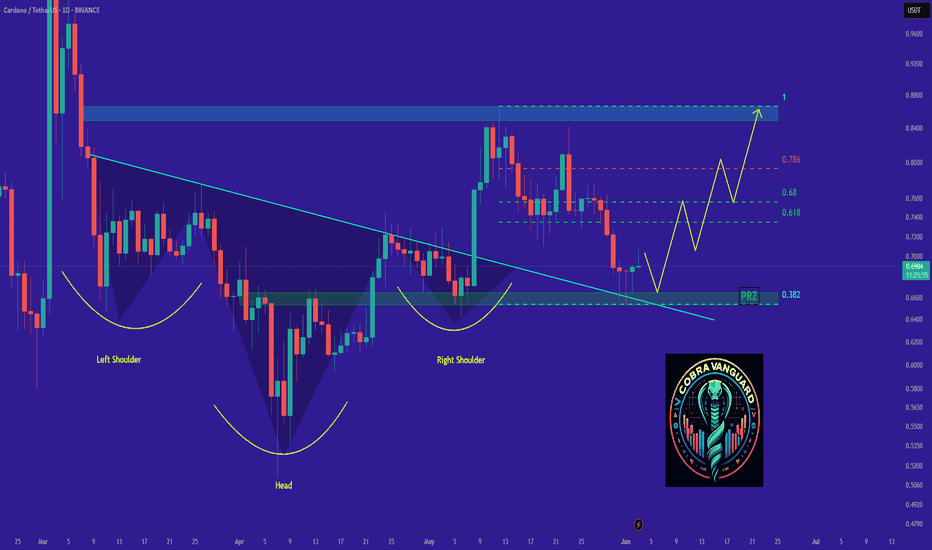

ADA road map (4h)What I currently expect is that the price could correct slightly, as shown on the chart, and then pump by about 13% from the PRZ (Price Reversal Zone). This signal is strengthened by the presence of strong positive divergence. In summary, the PRZ is a good entry point, derived from the confluence of touchlines and pivots. However, if the price ignores this zone and drops below it, my analysis will be invalidated.

Best regards CobraVanguard.💚

ADAUSDT.PS trade ideas

TradeCityPro | ADA: Holding Key Support Inside Descending Channe 👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ADA coin for you, one of the most popular cryptocurrencies, currently ranked 10th on CoinMarketCap with a market cap of 23 billion dollars.

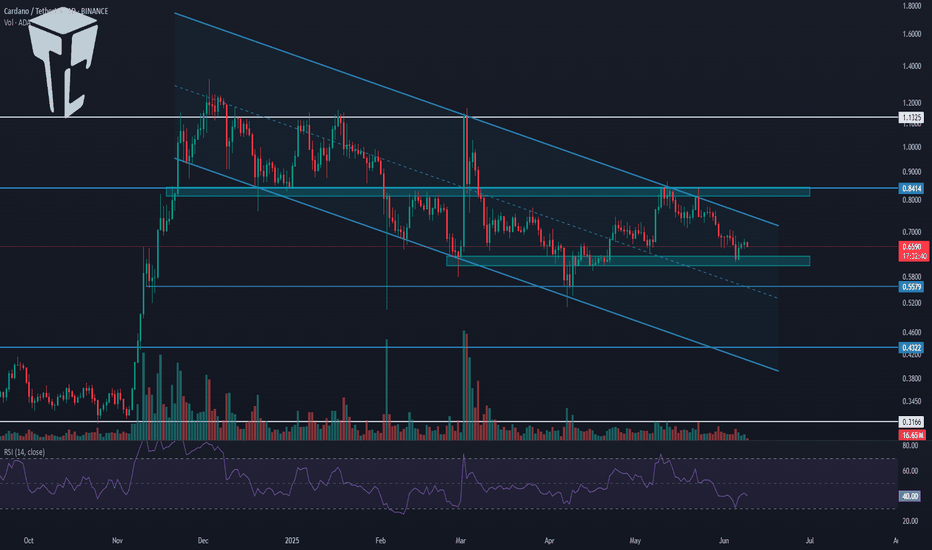

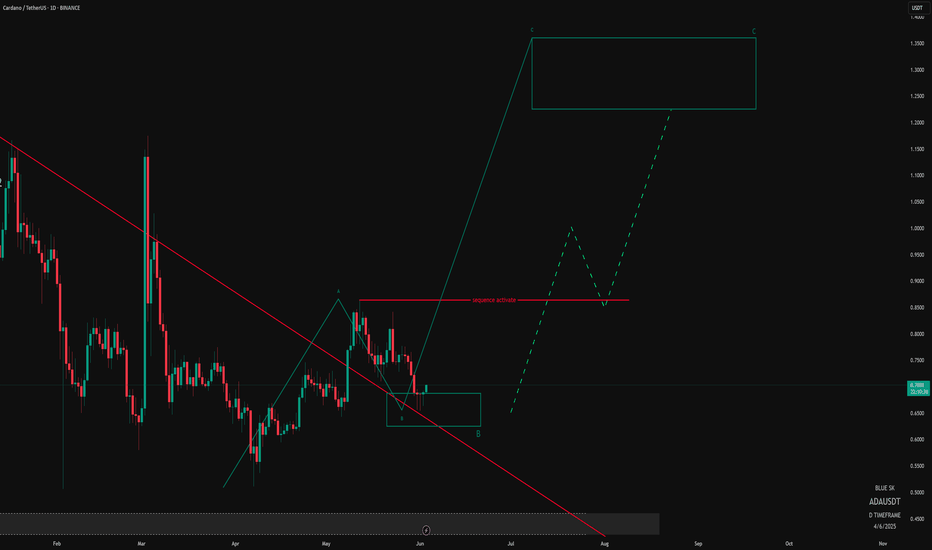

📅 Daily Timeframe

As you can see in the daily timeframe, the price is fluctuating between two key support and resistance zones. Additionally, there's a descending channel in play, and the price has recently been rejected from the top of this channel and moved down to the support zone.

✨ The 0.61 zone is a very strong area, and the price has reacted to it multiple times. It was broken once, but as the price reached the bottom of the channel, it was supported again and moved back above the level — indicating a possible fakeout.

✔️ If this zone is broken again, the likelihood of another drop toward the 0.5579 level or the bottom of the box increases. So I think it’s worth considering a short position on lower timeframes if this zone breaks.

💥 RSI entering the oversold area would be a strong momentum confirmation trigger for this trade.

📊 Currently, ADA's volume is quite low, and with this low volume, it’s not suitable for either long or short positions. I suggest waiting until significant volume enters ADA before taking a position.

🛒 For spot buying or long-term long positions, the first trigger is the price's reaction to this support zone. If a confirmation candle forms here, we can consider entering. However, in my view, this trigger is risky, and I personally prefer to wait for more reliable confirmations.

📈 A more reliable trigger would be a breakout of the descending channel. If either the channel itself or the 0.8414 trigger is broken, we can enter a position. And if you want the strongest confirmation and wish to enter with the main trend, you should wait for the 1.1325 level to be broken.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

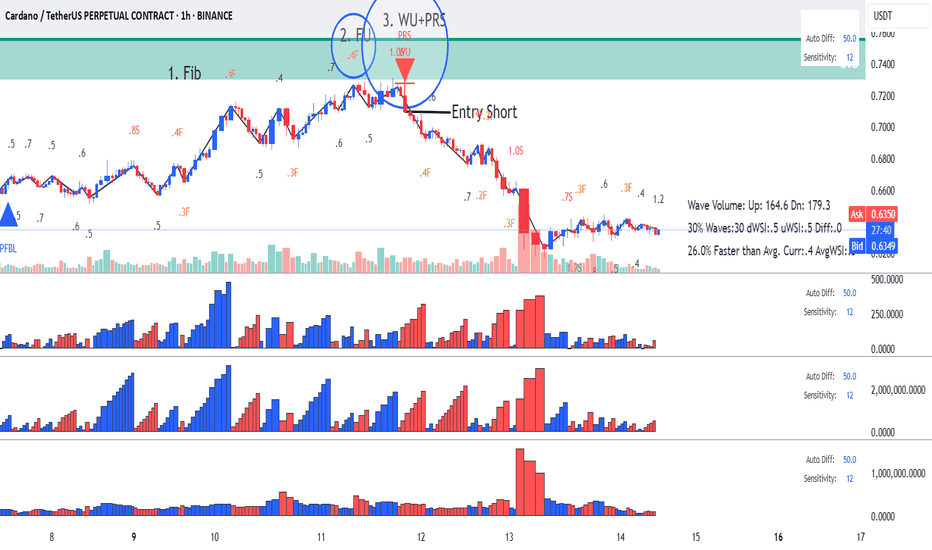

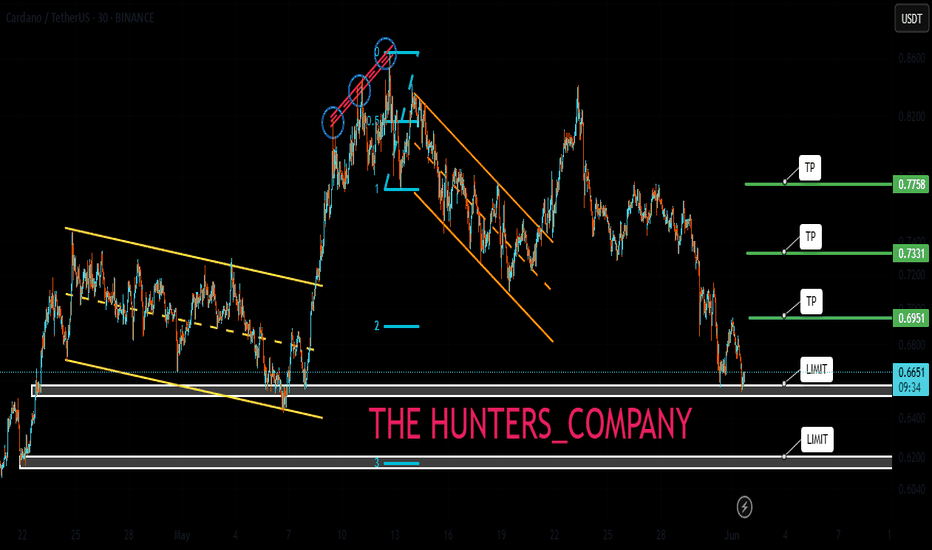

Wyckoff Up-Thrust - This is how to identify using Speed indexClassic Wyckoff Up-Thrust formation, this is how to read it using Speed Index (annotations in sync with the chart):

1. Fib Area - this is where sellers might come in

2. FU - Fast Up wave with SI 0.4F

3. Next up wave with an abnormal SI of 1.0S while the average speed at 0.5, which means price has a hard time to move up (more sellers on the up move). Following the up wave on the down move we have double Short signals WU-Wyckoff Up-Thrust and PRS-Plutus Reversal Short and this where we enter.

I hope this was helpful. Enjoy!

ADA/USDT – Decision Zone & Probabilities (Zarvān Tools)🔰 ADA/USDT – Strategic Analysis (Spring 2025)

Powered by Zarvān | Dynamic Field S/R Engine

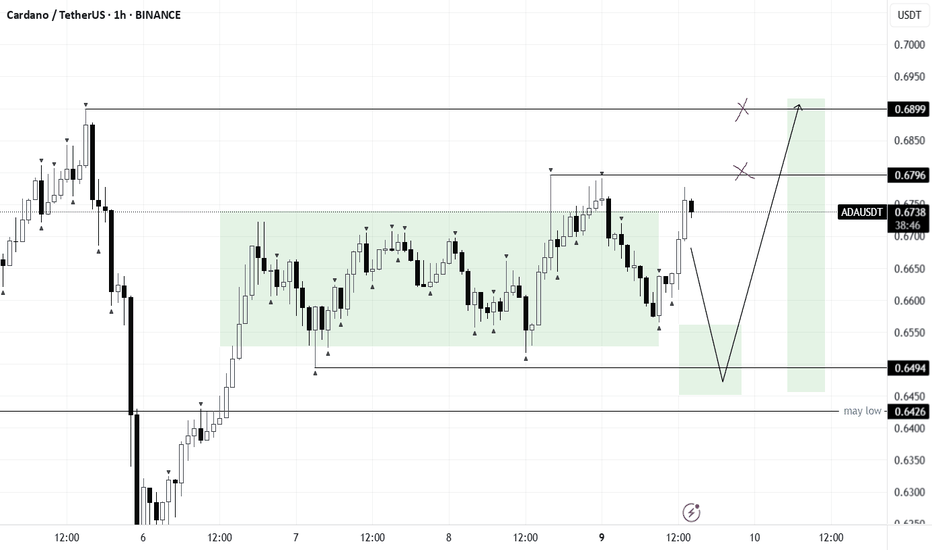

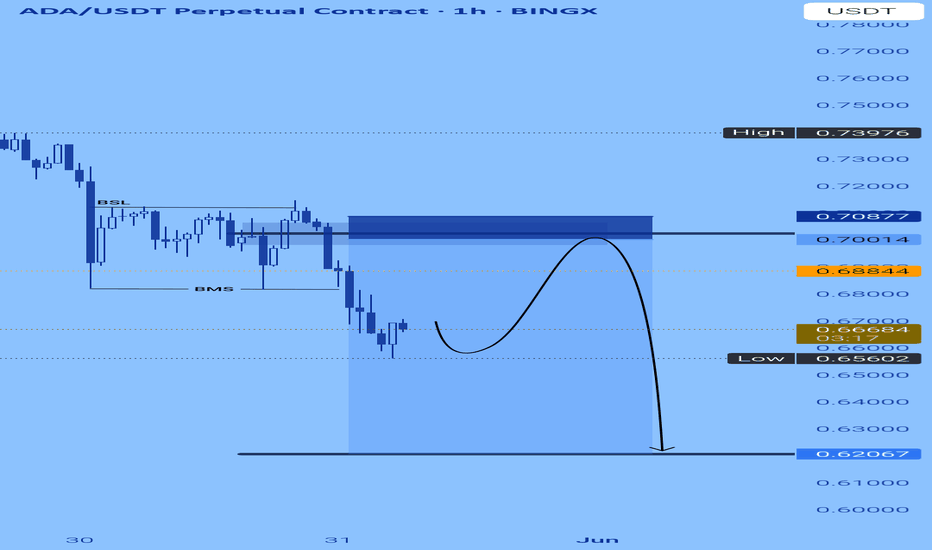

ADA/USDT is now trading inside a crucial decision zone, highlighted by the golden background on the chart. This area marks a period of market indecision—typically a precursor to a strong breakout move in either direction.

Key Technical Levels:

Dynamic Support: 0.6580 – If this level fails, watch for the next support at 0.6430, and, in extension, 0.6225.

Dynamic Resistance: 0.6991 – This is the key short-term resistance. A confirmed breakout here opens the path towards 0.7540 and potentially 0.7851.

Major Resistance: 0.7997

Potential Scenarios:

Bullish Outlook:

Should ADA/USDT decisively break and hold above 0.6991, a rapid move towards 0.7540—and possibly higher to 0.7851—is on the table. (Green projection on chart)

Bearish Outlook:

Conversely, losing the 0.6580 support level could trigger a drop to 0.6430, then 0.6225. (Red projection)

What Makes This Analysis Unique?

This forecast is built upon a suite of proprietary Zarvān indicators, not available to the general public. These include:

Zarvān | Dynamic Support & Resistance (Divergence-Based)

A smart, adaptive S/R system built on divergence, structural bias, and market energy—not simple pivots or Fibonacci retracements.

Zarvān | Composite Field Engine

Measures “hidden field energy,” imbalance, and latent reversal potential using a layered logic unique to the Zarvān methodology.

Zarvān | Adaptive Reversal SmartView

Detects nuanced phase transitions, emerging reversals, and the “pulse” of the trend—well before classic indicators react.

MACD-Zarvān (Normalized)

An advanced, context-aware MACD, normalized and dynamically weighted by field conditions for vastly improved divergence detection.

Why Trust These Tools?

Noise Resistant: Zarvān indicators filter out “fake” moves and sideways traps, reacting only to truly significant field events.

Energy-Focused: Rather than just price or volume, they assess the interplay of forces behind every market move.

Signal Selectivity: Alerts are only generated when the underlying field energy and trend conditions truly align.

Practical Takeaway:

While price remains inside the highlighted decision zone, patience is advised. A confirmed breakout in either direction, validated by Zarvān indicators, can offer high-quality trading opportunities.

Set alerts at the levels above and wait for a clean setup.

Probability Outlook:

Given the current market structure and the price’s position within the decision zone, the probability of an upward move is slightly higher at this point. Both bullish and bearish scenarios remain valid, but recent price action—together with subtle positive divergence signals detected by proprietary Zarvān indicators—shifts the balance modestly in favor of the bulls.

At present, I estimate the odds at roughly 55% bullish versus 45% bearish.

This analysis is powered by Zarvān Field Intelligence. Our indicators are proprietary and developed exclusively for advanced phase-field market research. Please do not redistribute or copy our logic without permission.

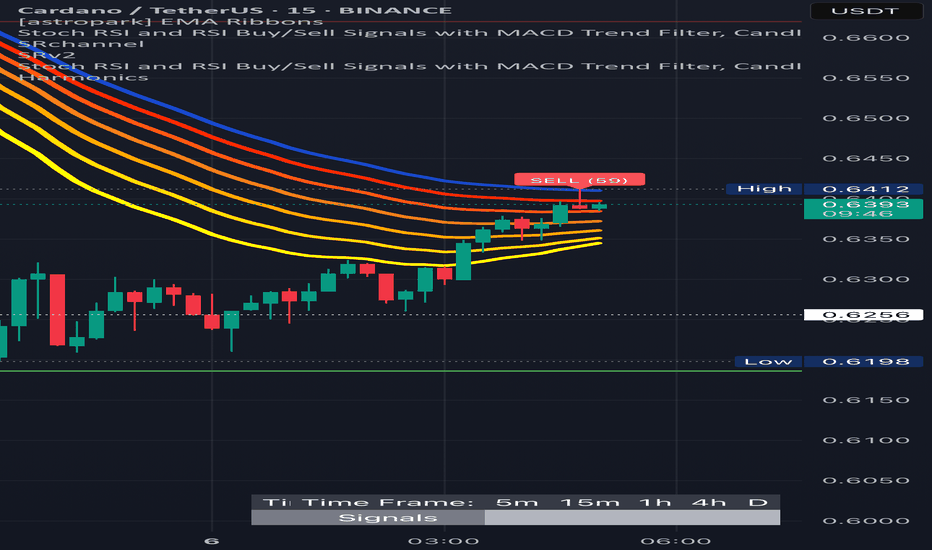

Smartmoney11//@version=5

indicator("ADA 4H Trend-Following Alerts", overlay=true)

// === INPUTS ===

fastLen = input.int(21, "MACD Fast Length")

slowLen = input.int(50, "MACD Slow Length")

signalLen = input.int(9, "MACD Signal Length")

rsiLen = input.int(14, "RSI Length")

stochLen = input.int(14, "Stoch RSI Length")

kLen = input.int(3, "Stoch K")

dLen = input.int(3, "Stoch D")

useDailyTrend = input.bool(true, "Require Daily Uptrend Filter?")

emaFilterLen = input.int(50, "Daily EMA Length")

// === MACD ===

= ta.macd(close, fastLen, slowLen, signalLen)

macdCrossUp = ta.crossover(macdLine, signalLine)

macdCrossDown = ta.crossunder(macdLine, signalLine)

// === StochRSI ===

rsi = ta.rsi(close, rsiLen)

rsiMin = ta.lowest(rsi, stochLen)

rsiMax = ta.highest(rsi, stochLen)

stochRsi = (rsi - rsiMin) / (rsiMax - rsiMin)

k = ta.sma(stochRsi, kLen)

d = ta.sma(k, dLen)

stochBounce = k > 0.2 and ta.cross(k, 0.2)

// === Daily Trend Filter ===

dailyEma = request.security(syminfo.tickerid, "1D", ta.ema(close, emaFilterLen))

dailyTrendUp = close > dailyEma

// === SIGNAL CONDITIONS ===

longSignal = macdCrossUp and stochBounce and (not useDailyTrend or dailyTrendUp)

exitSignal = macdCrossDown

// === ALERTS ===

alertcondition(longSignal, title="Buy Signal", message="ADA 4H BUY: MACD + StochRSI signal")

alertcondition(exitSignal, title="Sell Signal", message="ADA 4H SELL: MACD cross down")

// === PLOTS ===

plotshape(longSignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(exitSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

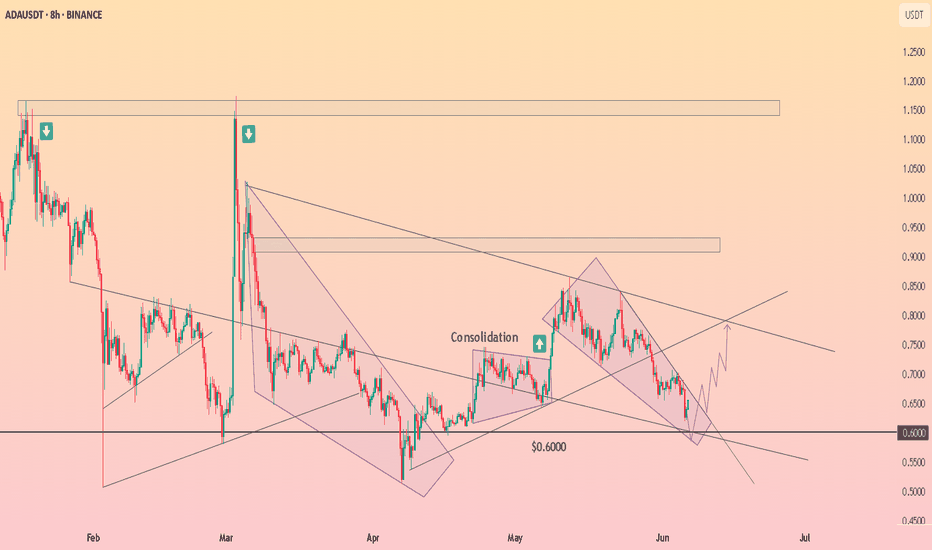

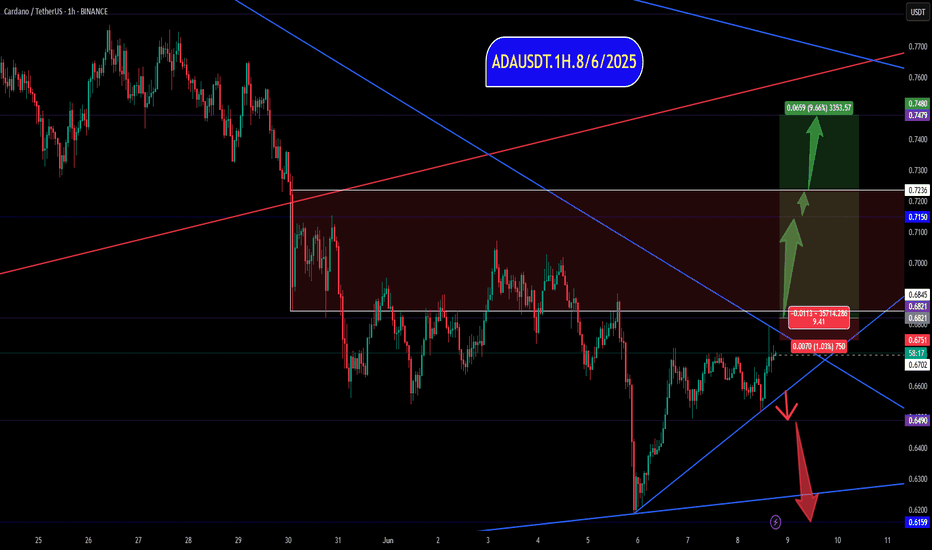

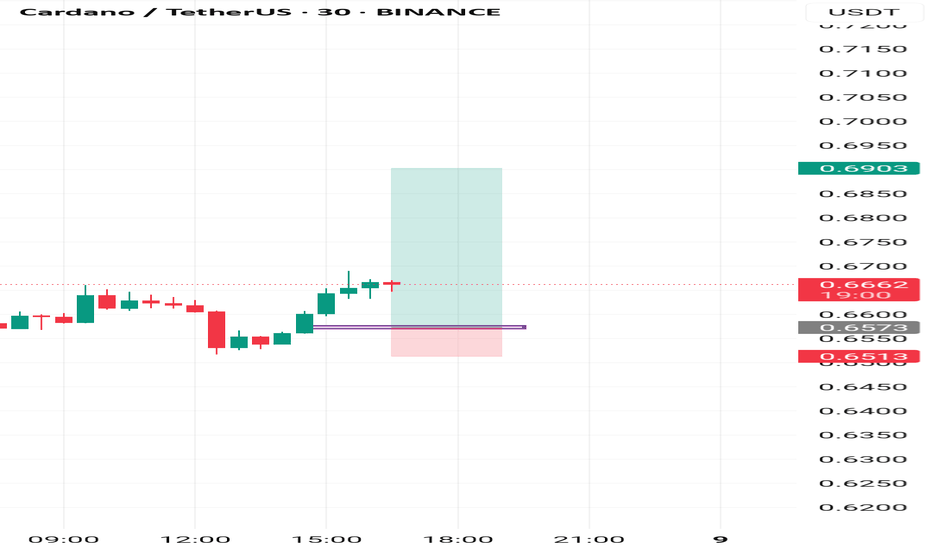

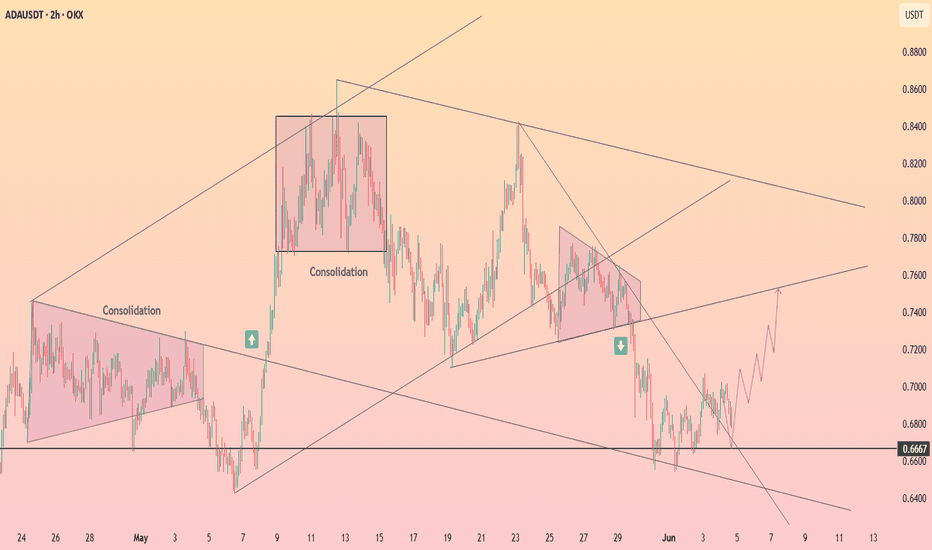

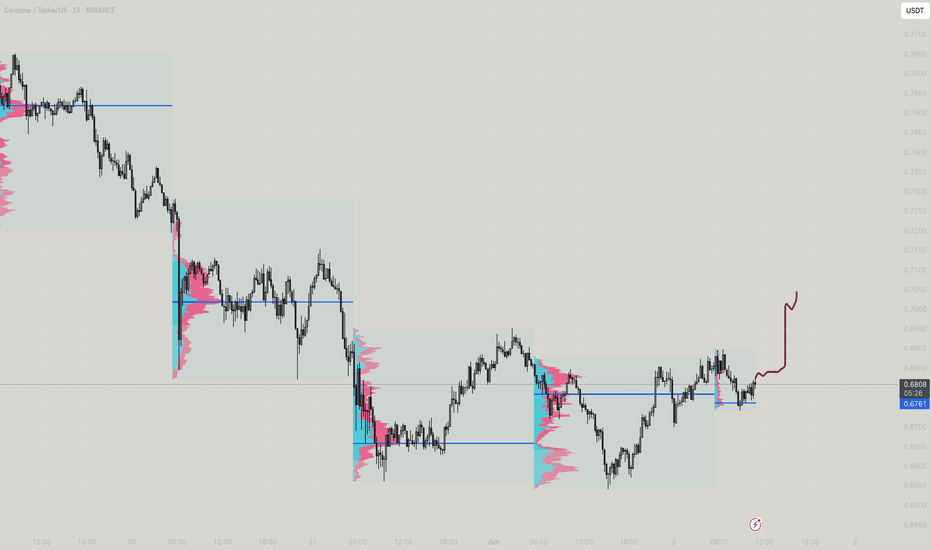

HolderStat┆ADAUSD triangle breakCRYPTOCAP:ADA rebounds off the 0.666 base, slicing through a two-hour down-trend line. Stacked consolidation boxes now act as demand, and an emerging ascending channel eyes 0.75 – 0.76, maybe 0.80. Key support flip, improving momentum and bullish breakout pattern align for higher highs.

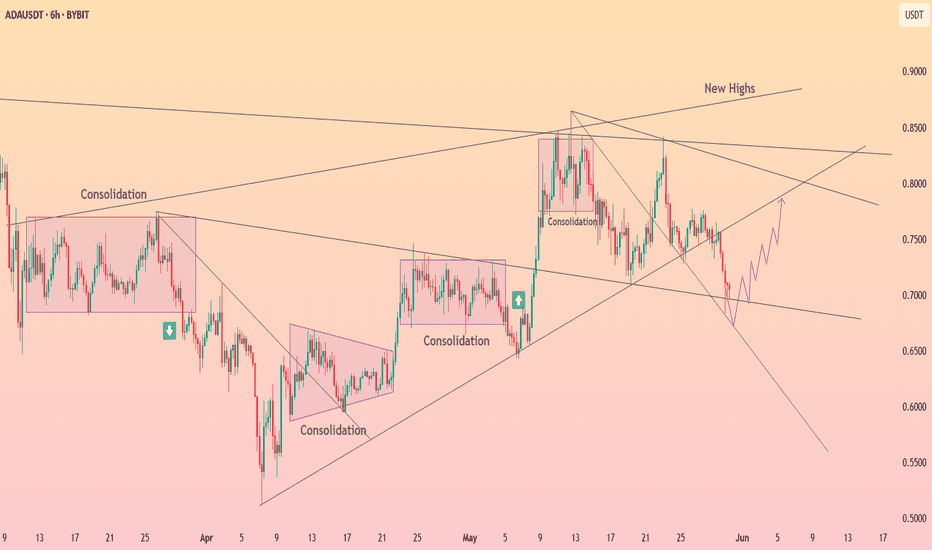

HolderStat┆ADAUSD coiled for new highsCRYPTOCAP:ADA has printed boxy consolidations, respected its rising base and survived a sharp pullback; price now rests on ascending support. With prior “new highs” still warm and trendline resistance nearby, the setup flags a rebound toward 0.78 amid persistent bullish price action.

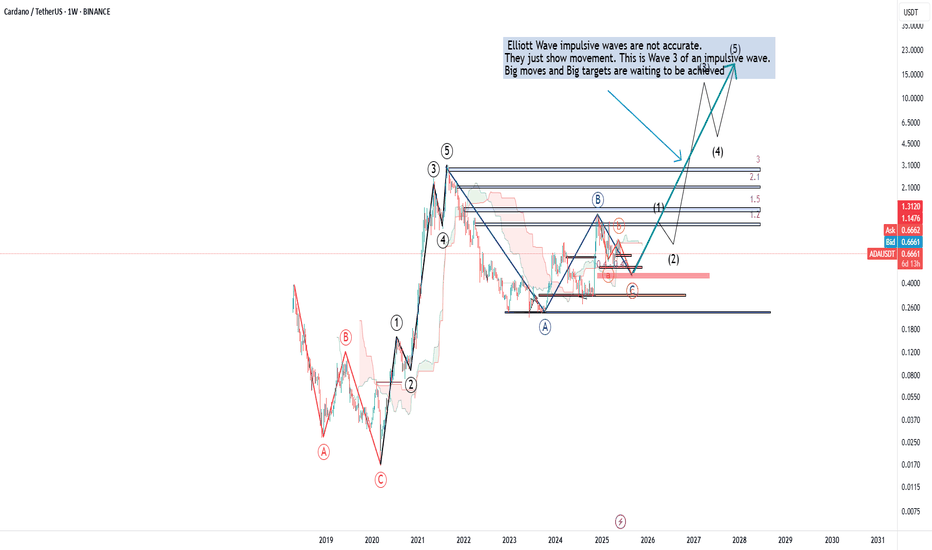

ADA is going to catch big targetsWe are currently experiencing a Wave 2 correction after completing an impulsive Wave 1. Once the ABC correction is complete, we can expect to enter an impulsive Wave 3. As time goes on, if it seems like we are entering Sub-Wave 1 of Wave 3, I will publish an idea to outline new targets. For now, we should anticipate new movements in the market.

Is it time to buy Cardano?Hello friends

According to the analysis and review we conducted on ADA, we reached almost definitive results:

This currency has fallen, which has caused the price to reach important and fundamental supports, and here we can buy in steps at the supports, depending on the level of risk and our capital management, and move with it to the specified goals.

*Trade safely with us*

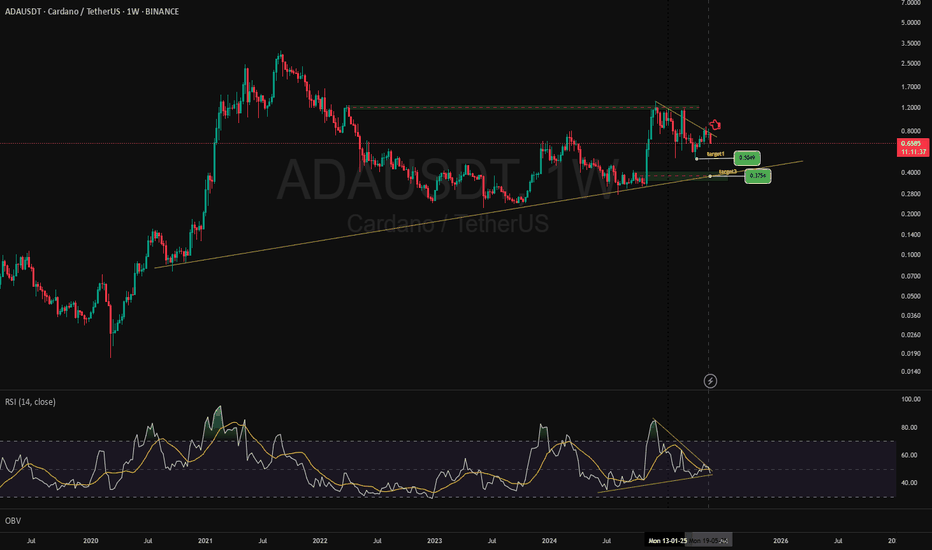

ADAUSDTBINANCE:ADAUSDT shows potential for an upward movement towards the targets of $1.3378 and $1.6435, making the current price zone attractive for long-term investment . While a correction towards $0.6453 or even $0.5803 is possible, these levels present favorable buying opportunities for investors with a long-term perspective. Even if a deeper correction occurs, the market geometry suggests that reaching the aforementioned targets is a likely outcome.

Bearish Divergence Warning: Will ADA Break the Channel?Hello guys!

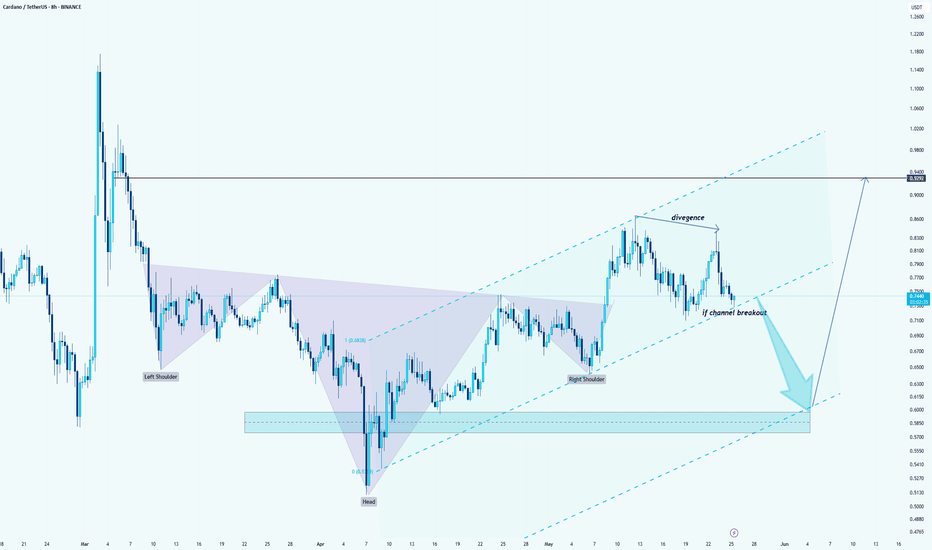

Cardano has been trading within a rising parallel channel after forming a clear Inverse Head and Shoulders pattern, triggering a bullish breakout. However, recent price action has shown signs of weakness, especially with a noticeable bearish divergence between the price and RSI.

What I see:

The price is approaching the lower boundary of the ascending channel.

A channel breakout to the downside could lead to a deeper correction toward the $0.58–$0.62 support zone (highlighted area), which aligns with previous consolidation and the neckline of the inverse H&S.

If bulls defend the channel and push price higher, a potential rally toward the $0.93 resistance level remains in play.

⚠️ Keep an eye on the channel support and RSI behavior to anticipate the next move.