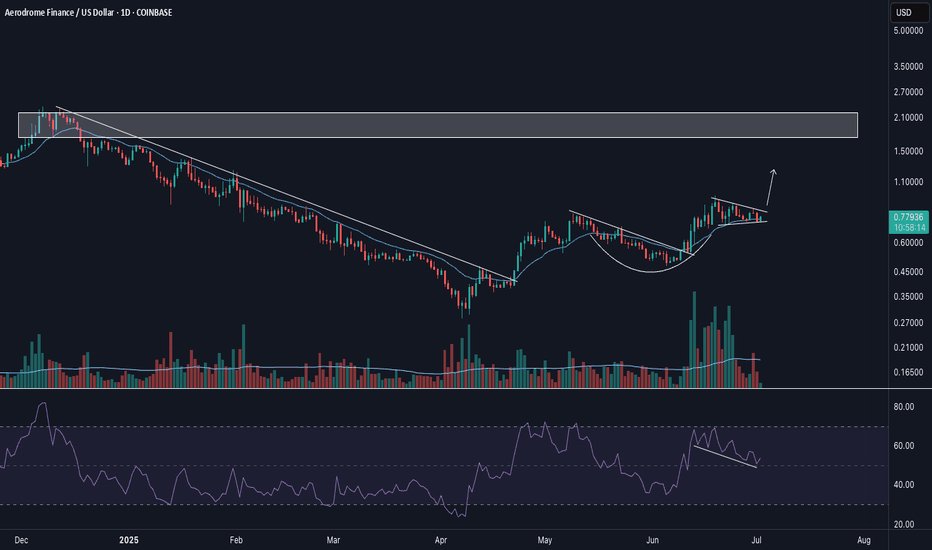

Cup w/ HandleAERO completing a cup w/ handle. Been showing relative strength the past couple weeks with hidden bullish RSI divergence in the handle.

Coinbase recently announced that they're integrating BASE Dex's soon into their main app, so their millions of users can easily begin trading onchain. AERO is the primary Dex on Base (>50% of revenues)

AEROUSD trade ideas

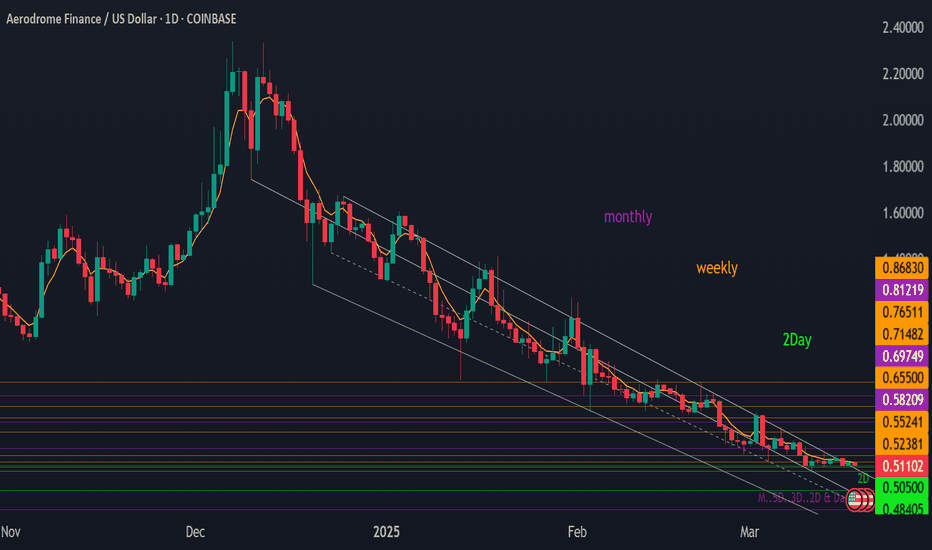

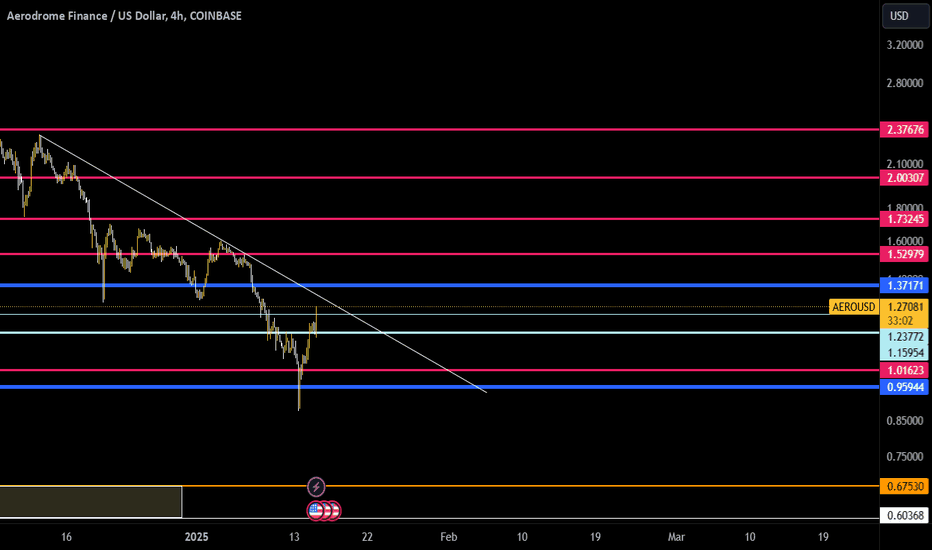

AEROUSD – Holding the Line?After chopping for nearly two days, AERO launched off the 0.730–0.740 base and surged into 0.850. Now we’re seeing profit-taking and a series of lower highs. Bulls need to defend the 0.785 level, which was a key resistance flipped support. If it holds, a bounce to 0.820 is likely. Lose it, and the whole move risks unwinding.

AERO, break down or the sound barrier!?If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

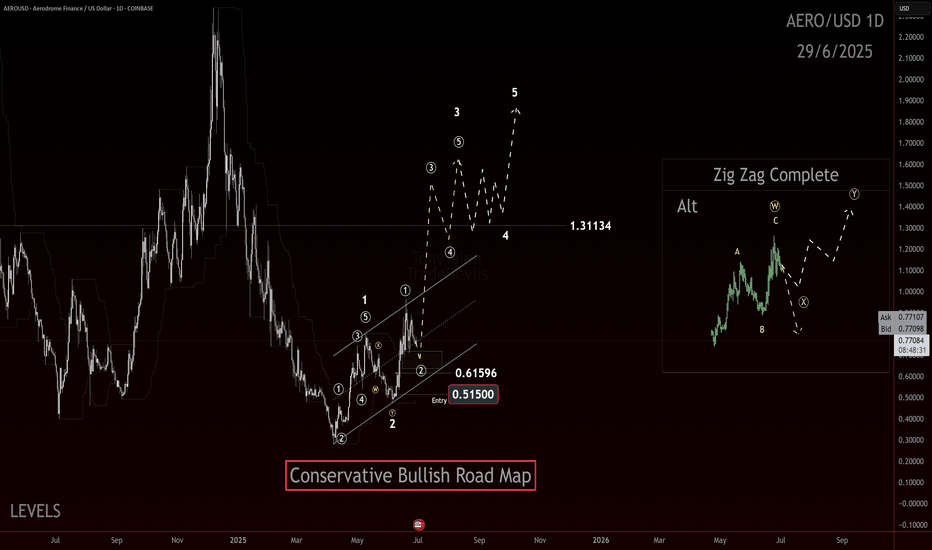

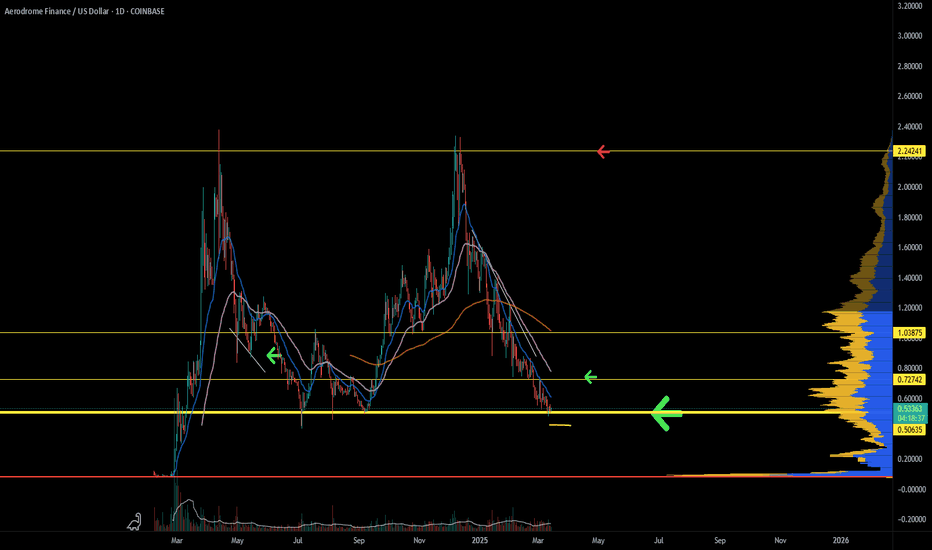

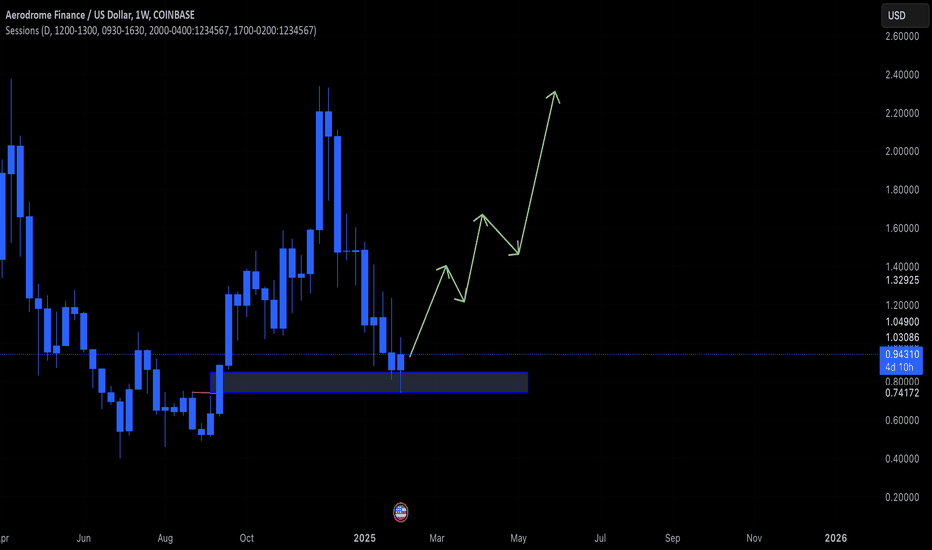

AERO started by showing the kind of impulsive structure that could lead to a much larger advance. The internal retracement off the low was deep enough to flush weak hands but shallow enough to retain the broader bullish context.

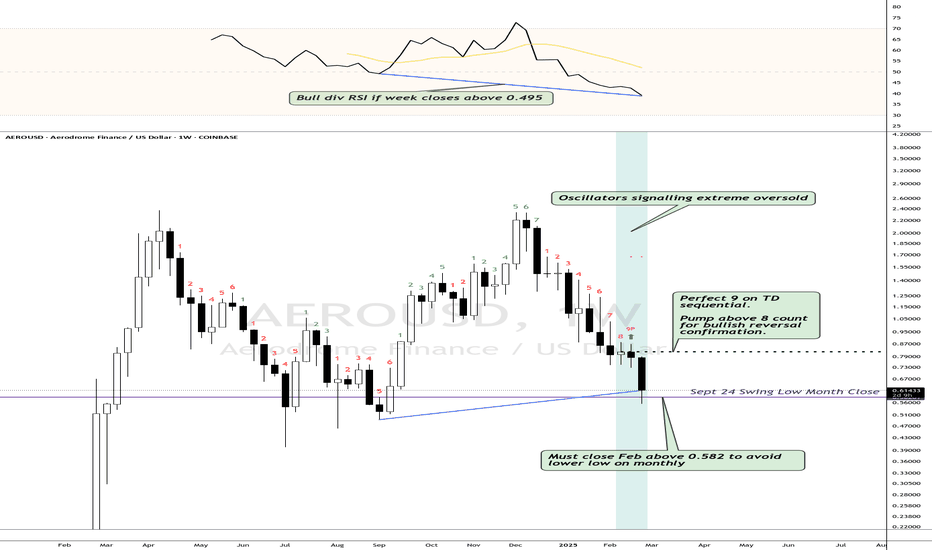

The structure looks like a completed wave 2 correction: a double zigzag down into that .51-.61 pocket, finishing with an impulsive pop off the lows. That initial thrust is exactly the type of reaction you want to see if this is the early stages of a wave 3 or C advance.

What’s next? Ideally, price continues to respect the 0.615 level and we see price return back to the channel and then breaks above it with momentum, signaling the start of the next leg up. A clean swift move above .965 would help confirm that bulls are in control and we’re not dealing with an extended corrective mess.

Upside targets are layered: 1.31 is the first zone to watch—an area of prior structural reaction. Beyond that, the move has potential to extend above 1.80+ in a classic wave 5 push, provided we continue to see impulsive follow through.

Bias is bullish while price holds above .61 and continues to print higher lows. Any significant break back into that .51-.61 zone without reclaim would invalidate this setup and shift focus back to low prices.

Trade safe, trade clarity!

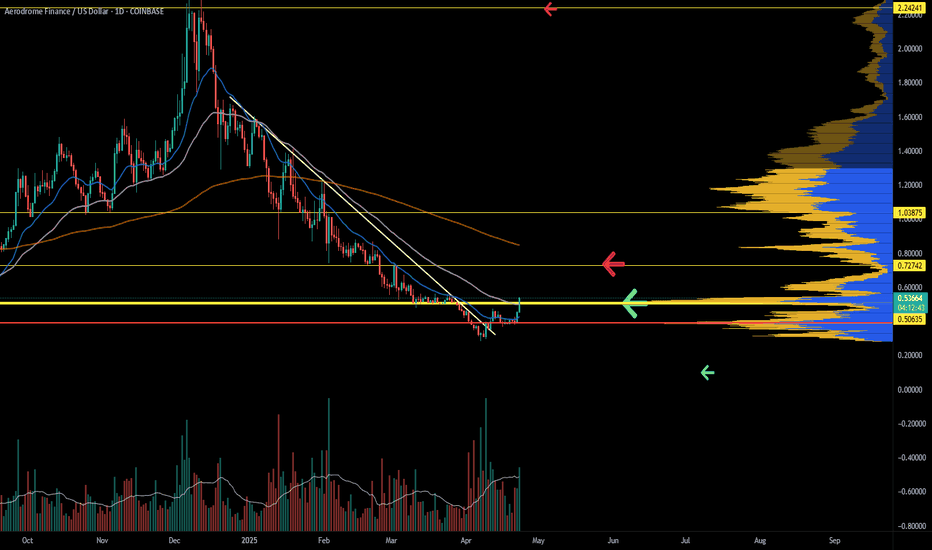

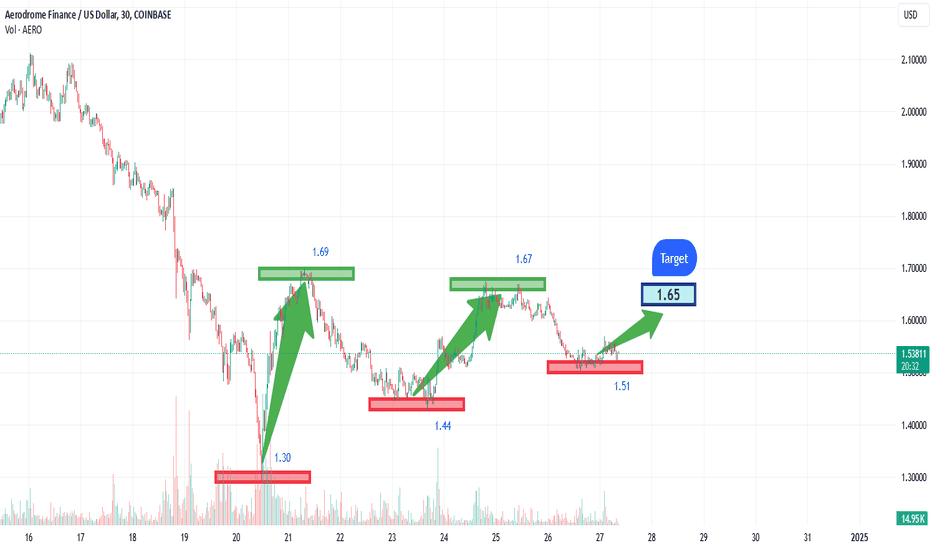

AERO: Clears the Runway! Can it gain altitude!?AERO gave a valid long setup

We were eye a possible retrace of an impulsive move and it displayed enough to trigger a rules-based entry.

Technical Breakdown

Key structural elements supported the setup:

Initial leg up showed impulse-like behavior

Pullback found support at a clearly defined AOI

Multiple MLT levels aligned with a common zigzag framework

Swift bounce off the Golden Corner Pocket (GCP)

Break and close above 0.54 completed the impulse structure

Prior resistance flipped into support

Volume confirmed the move, and price reached the first algo target, producing a reactive wick and confirming potential of algo activity.

This created a textbook TDU-style GCP/Algo/C-3 setup with measured entry and exit.

Risk Management

Partial profit was taken at the first MLT zone

Stop loss was moved into profit post-structure break

Scenario planning:

If move continues: positioned

If move stalls as a larger zigzag: no loss

Outlook

Attention now shifts to the next actionable level, possible second entry long

0.62 is the AOI for re-entry atm

Ideal scenario = Continuation in a wave 3, obvi

Alt scenario = Clean corrective to AOI + long

Bear scenario = Zig Zag complete

Conclusion

The trade played by the book!

Confluence across AOI, GCP, MLT, and volume created a qualified entry — not a guess.

This remains a great example of structure over sentiment and waiting for the market to meet criteria before engaging.

AERO: Take Off!?If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

Long Entry at $0.515

Recap

SPARKS:AERO caught a bid after Coinbase news hit, but world events quickly clipped the rally’s wings. Price bounced cleanly off the .48 level, which aligned with an Area of Interest (AOI), a Level of Interest (LOI), and a golden zone retracement displayed in the last analysis.

Explanation

The .48 level was key and the reaction was textbook. The Coinbase news provided a catalyst just as price reached the .55 level. However, macro uncertainty remains a headwind.

Now, all eyes are back on .55. Bulls need to defend this structural level. The current pierce of .75 is an encouraging move. Continuation and a proper flip of that level would keep confidence high. Wave 3s are a sight to see, so a retrace may not even occur if price simply sends. Still, while AERO stood up and moved counter to the broader market when world news dropped, that alone may not be enough if global bearish reactions continue.

Outlook

Entry projected in the previous analysis has played out in ideal fashion, but the market remains fluid. Key levels:

.75 recent break

.55 ideal hold

.48 impulse invalidation

Current trend at the lesser degree is up and holding higher lows. Next objective: take out the .80 pivot and change the trend at the higher degree.

Break of the higher lows at the lesser degree would be the first sign of weakness. I’m watching for a definitive correction for a potential long add. A swift move that breaks higher lows could signal danger to bulls.

Trade Safe!

Trade Clarity!

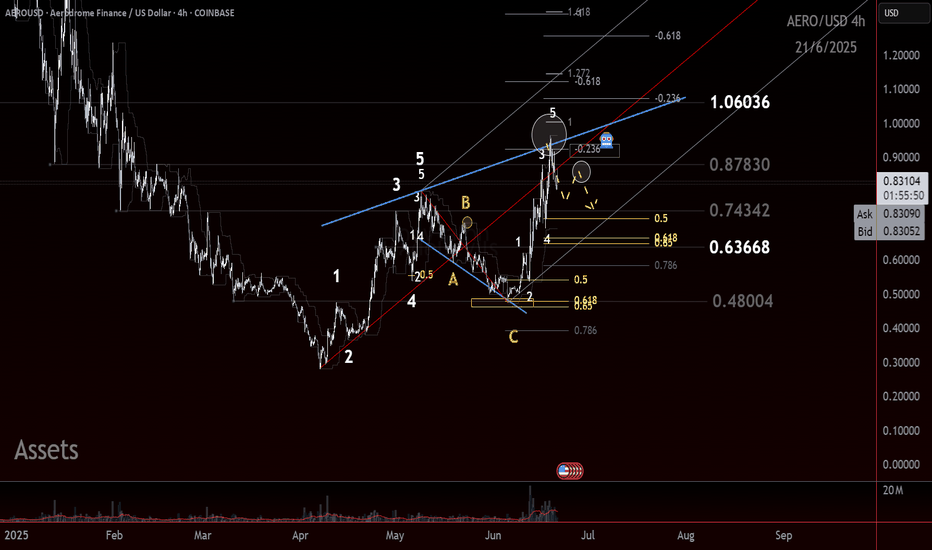

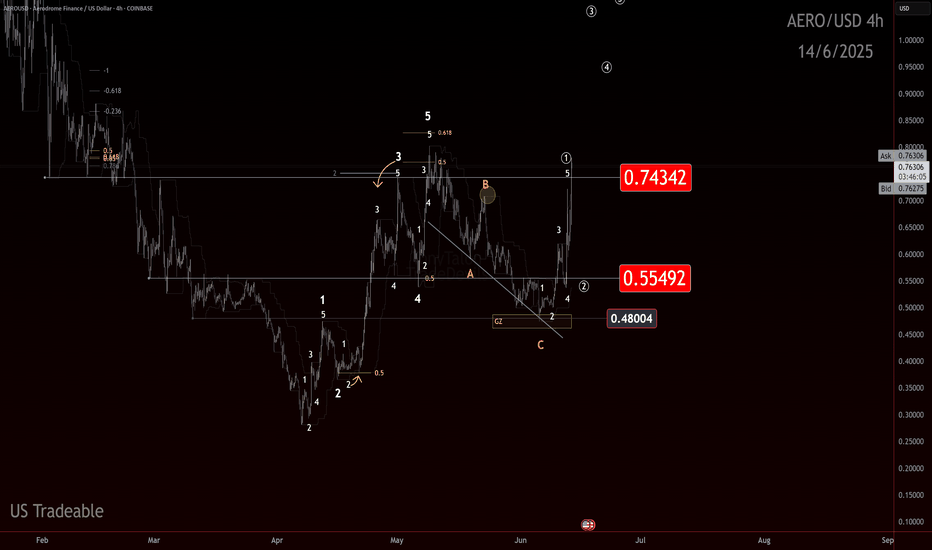

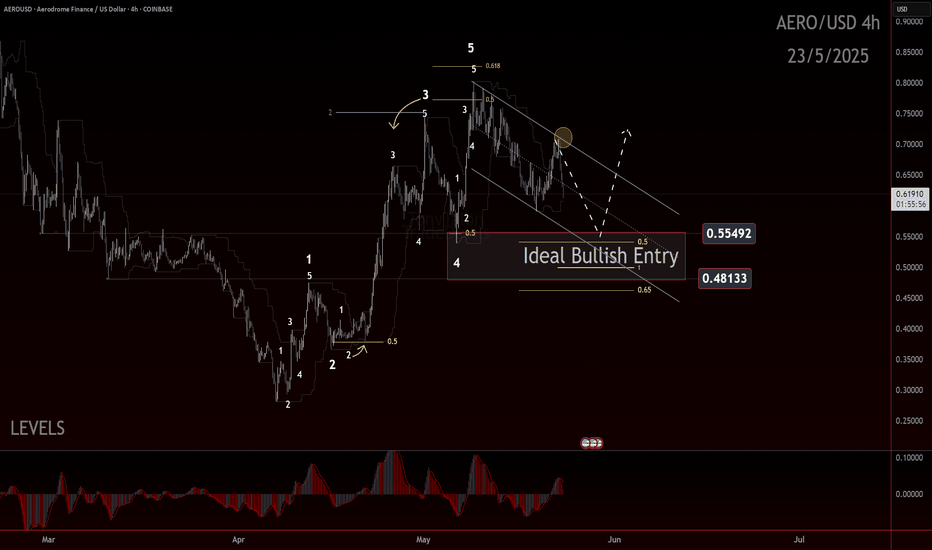

AERO: Coming in to Refuel… or Crash Land!? AERO: Coming in to Refuel… or Crash Land!?

📅 Date: May 23, 2025

🧠 Framework: Elliott Wave with Fibonacci structure

🔍 Context: 4H timeframe

🔁 Recap of the Move

AERO rallied off the 0.3465–0.3475 double bottom in what appears to be a clean 5-wave impulsive sequence. The price action respected both structural and Fibonacci guidelines:

Wave 2 and Wave 4 both pulled back to 0.5 retracements.

Wave 3 extended and subdivided with strong momentum, a common characteristic

Wave 5 completed between 0.5 and 0.618 of Wave 3 from the Wave 4 low — a textbook termination zone

Subdivisions within Wave 5 were also visible, including a smaller internal Wave 3 and 5, reinforcing the case for a completed motive wave.

⚠️ Current Price Behavior

Post-impulse, the market is showing signs of correction. This pullback could mark the beginning of a deeper retracement, or it may be the early stages of a new larger-degree impulse if the uptrend continues.

📏 Levels to Watch

Retracement zone: 0.54–0.49 (50–61.8% of the full move)

Upside resumption: Requires a strong bounce from the retrace zone and break of the Wave 5 high

🔮 Outlook

Two scenarios remain on the table:

Bullish: This is a Wave 2 retracement in a larger degree move. If support holds, a strong Wave 3 may follow.

Bearish/Neutral: The 5-wave or 3-wave structure is fully complete, and a deeper correction could be in play.

Confirmation will come through structure, not assumption. Keep watching how price behaves around the key retrace levels.

📣 Trade safe, trade clarity. More updates coming as structure evolves.

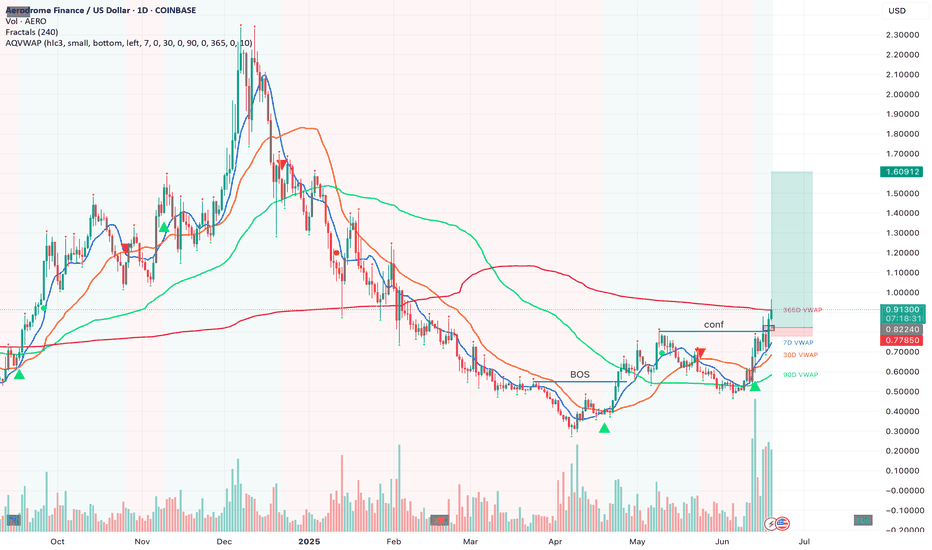

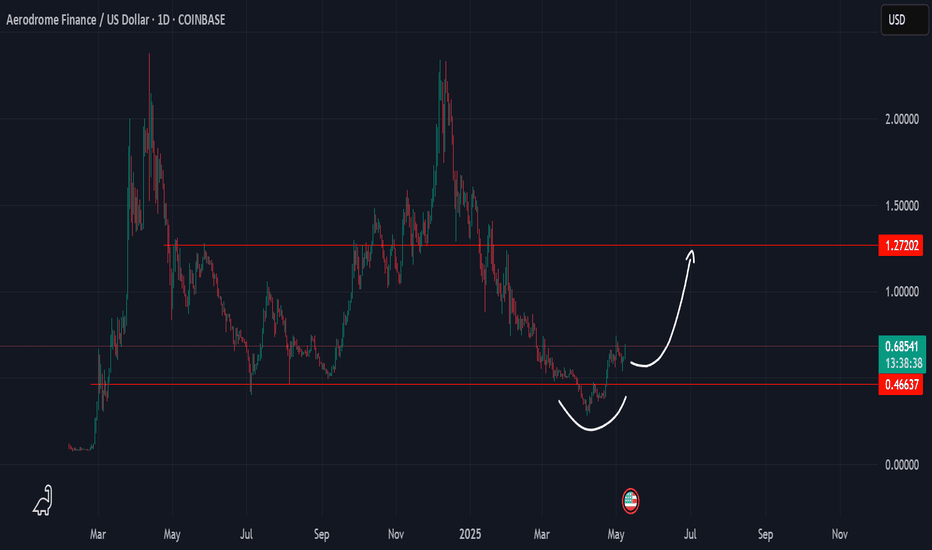

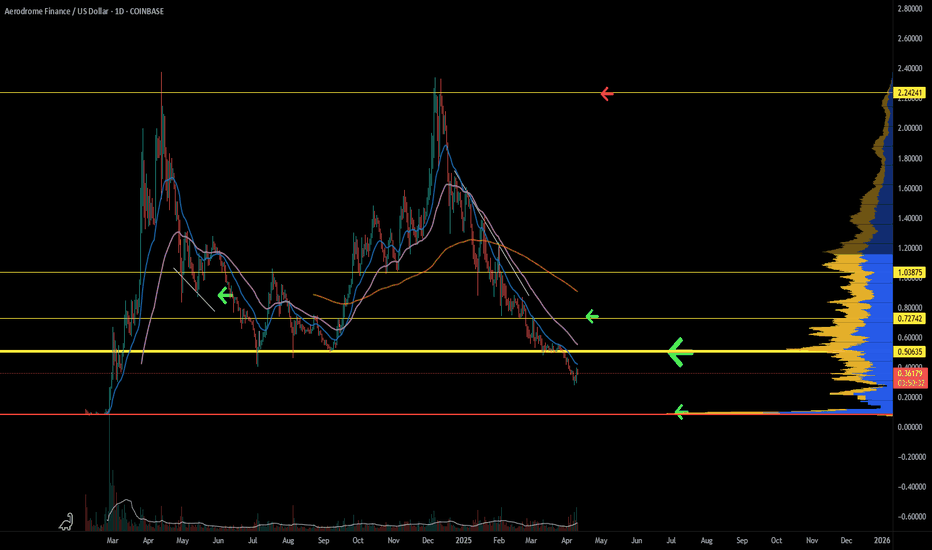

Aerodrome falling below support but this could be an opportunityAERO has fallen below historical support but it's not over yet. A confirmation of a downtrend, using horizontal resistance is a possibility. However, breaking back above horizontal as support could be the opportunity to see a reversal. This is what I call a trading moment. DCA and wait for proper confirmation.

Full TA: Link in the BIO

coinbase stock is struggling and so is the liquidity arm AEROthe liquidity arm and dex token for Coinbase 'AERO' is struggling to catch ground. its going to the ground lol. i do like it for a long term play hold.

41&32₵ is looking good, specially 32cents if you can get it.

i have bids at 48,41,32

with an average high of 2.22 it can easily go $3.00 with volume soo low.

BIG $ here~

AERO is looking for support at the bottom of the range.AERO is at the bottom of the range. Momentum is somewhat bottomed out while there are multiple drives of bullish divergence on lower timeframes. There are no confirmations of a choch but it's time to put this on a watch list. RR is very healthy.

Full TA: Link in the BIO

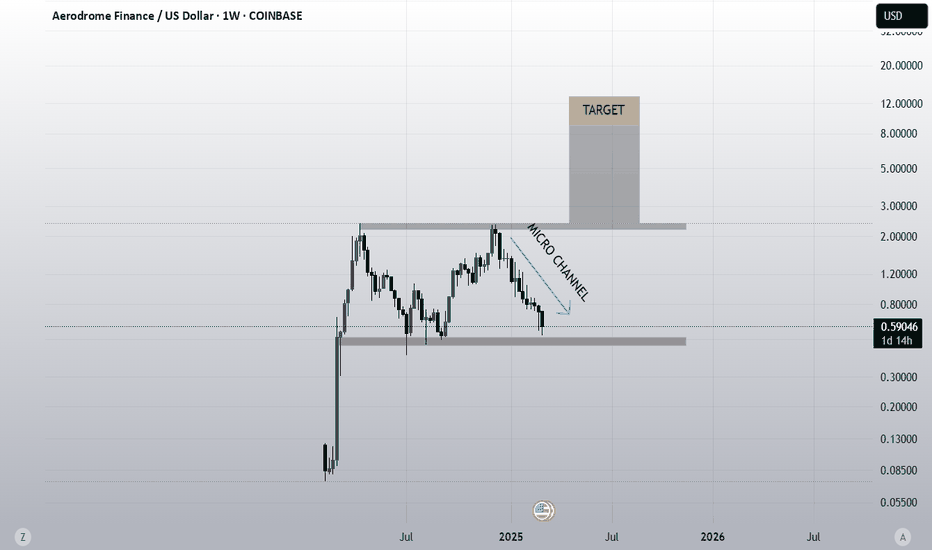

Top 3 high conviction altcoin AeroAs I consolidate my losers against Bitcoin a few tokens stand out that I have been adding weight to. As a general rule, if you internet money is not trending higher against BTC then it most likely will underperform through May of next year. I have taken a few of my slow movers specifically NEAR & AKT & INJ and divived those profits into the three I will cover today.

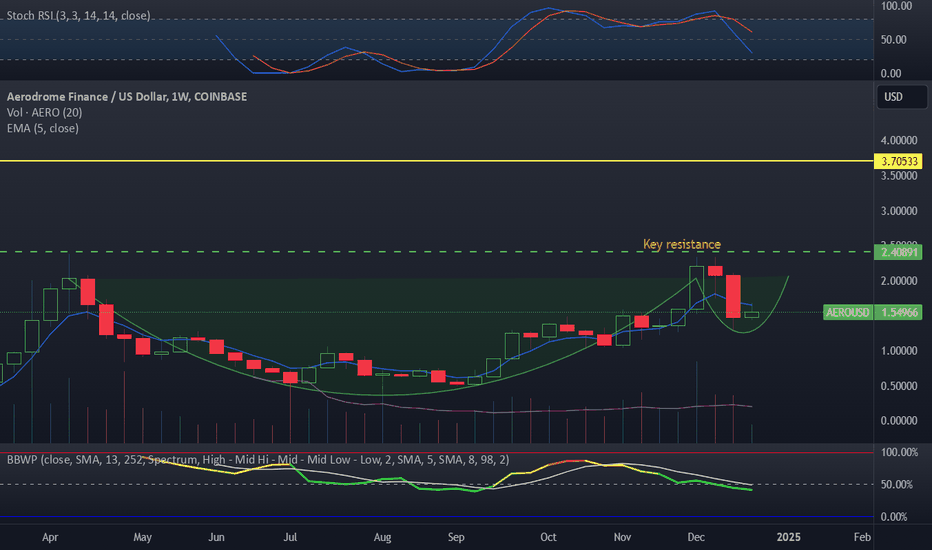

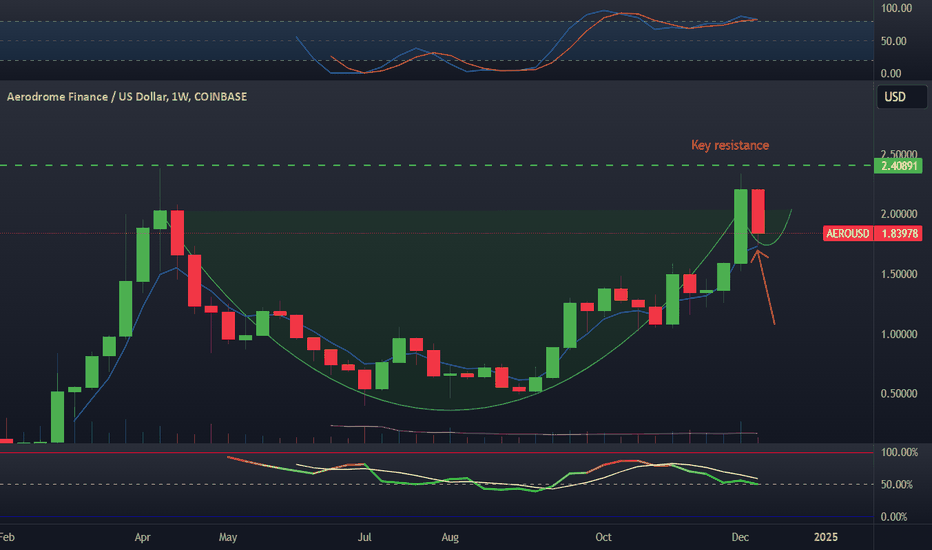

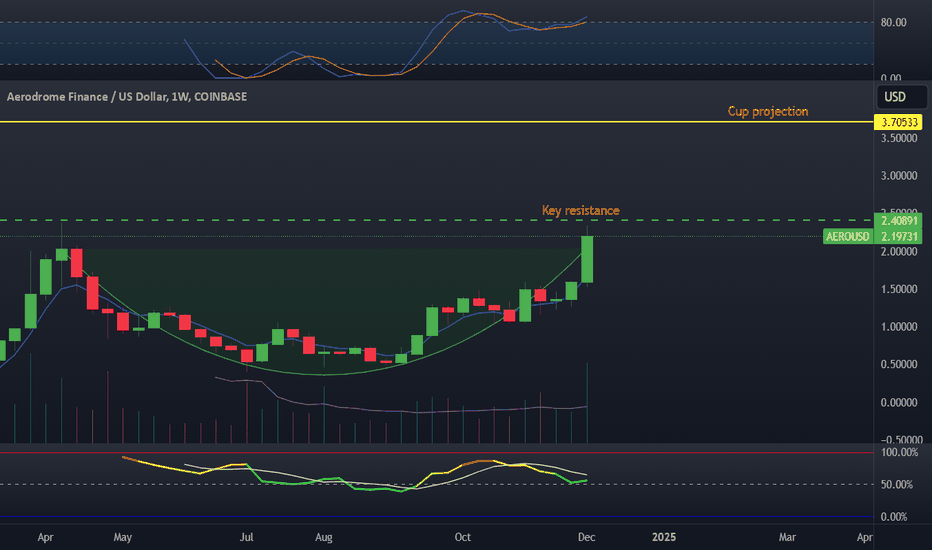

Looking at Aero you will note a very massive cup and handle. The handle is till forming and I believe we will see alts and BTC generally sucking until Jan 13th. My target for Aero remains 3.7$, this is PT area 1.

Aero set to explodeAero I just started covering and its showing one of my favorite setups. Cup and handles sweeping lows on these massive time frames are just great setups. I was hoping for the pullback we are seeing here. We just need maybe another week of consolidation and down. My target is still 3.7, but I expect this token to be a leader and possibly push 10-14$ Q1-2. Note the test of the 5 week EMA as well.

Aero a pretty obvious runnerAero has performed much better than many solidly style dex/liquidity vacuums. This is likely due to first mover advantage and being on the base blockchain which has drawn immense popularity. This cup and handle is a famous pattern especially in crypto, in general market uptrends coming from a macro bottom these tend to play out very nicely. My short term area o interest is the previous all time high wick, this is a brief historic level and should not be hard to break. My early Jan target is 3.7$. I do believe this could easily 10-20x if this bull run really takes off in Q1.