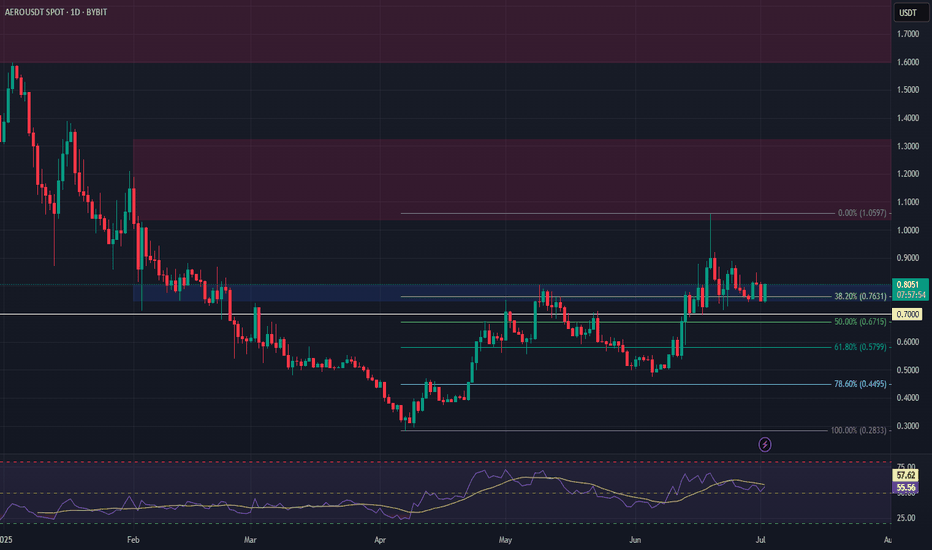

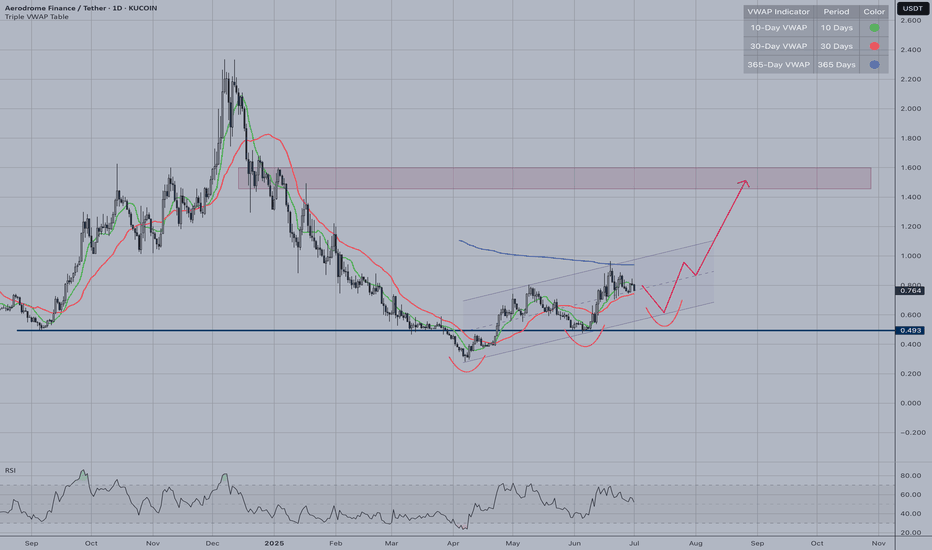

AERO Long Swing Setup – Strong Pullback into Fibonacci SupportAERO has shown notable strength in recent months and is now retracing into a key support zone, aligning with the 38.2% Fibonacci level. The $0.75–$0.80 area offers a solid long swing opportunity.

📌 Trade Setup:

• Entry Zone: $0.75 – $0.80

• Take Profit Targets:

o 🥇 $1.04 – $1.32

o 🥈 $1.60 – $2.05

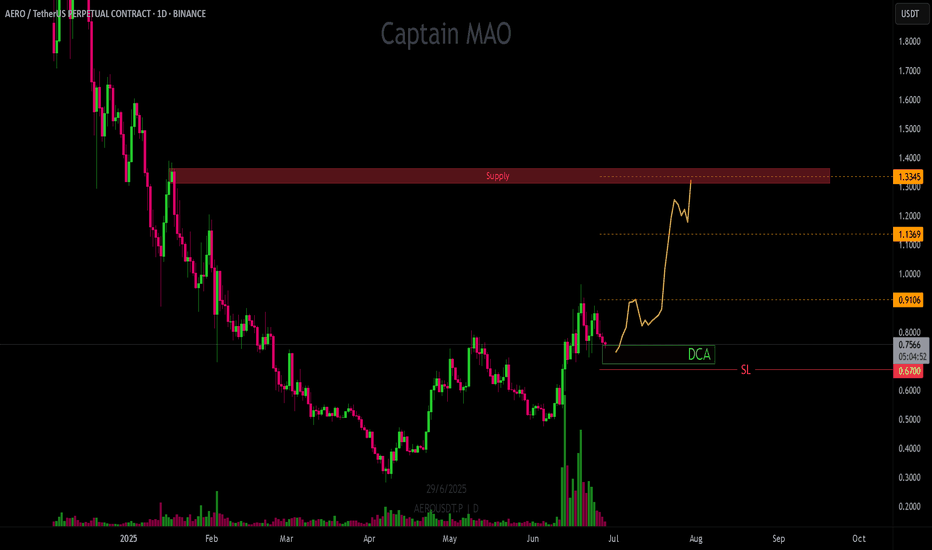

AERO/USDT parabolic moveAERO/USDT is setting up for a parabolic move, with price structure aligning perfectly with a major daily supply zone near the $1.33 level. After consolidating and holding above key support, the chart suggests strong upside momentum may be imminent.

Entry Zone: $0.69 – $0.75 (green box)

Take Profit

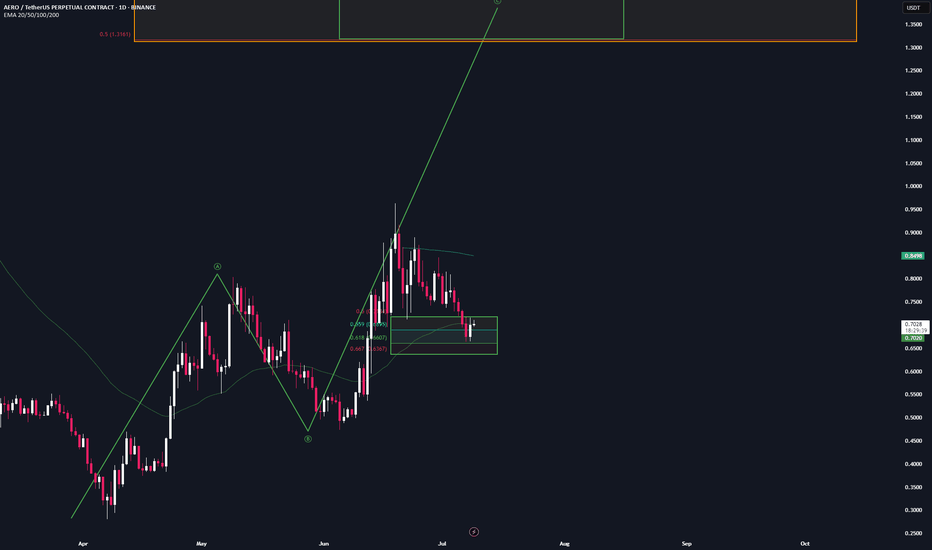

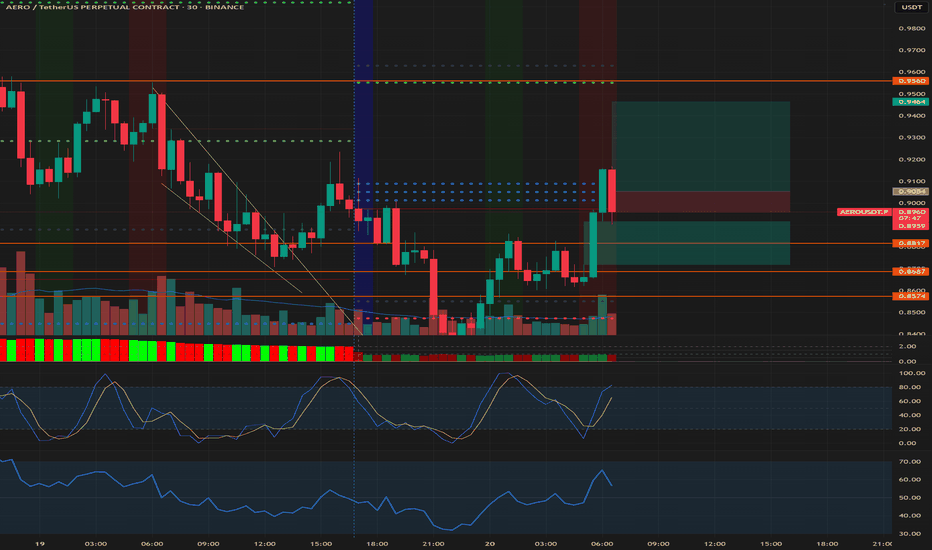

AERO | Waiting for a Higher LowThe setup favors patient entry on any pullback that forms a higher low, confirming the bullish momentum while minimizing downside risk.

Entry Strategy:

• Wait for higher low confirmation

• Validates uptrend continuation

• Better risk/reward positioning

Bullish Signals:

• RSI reset from oversold le

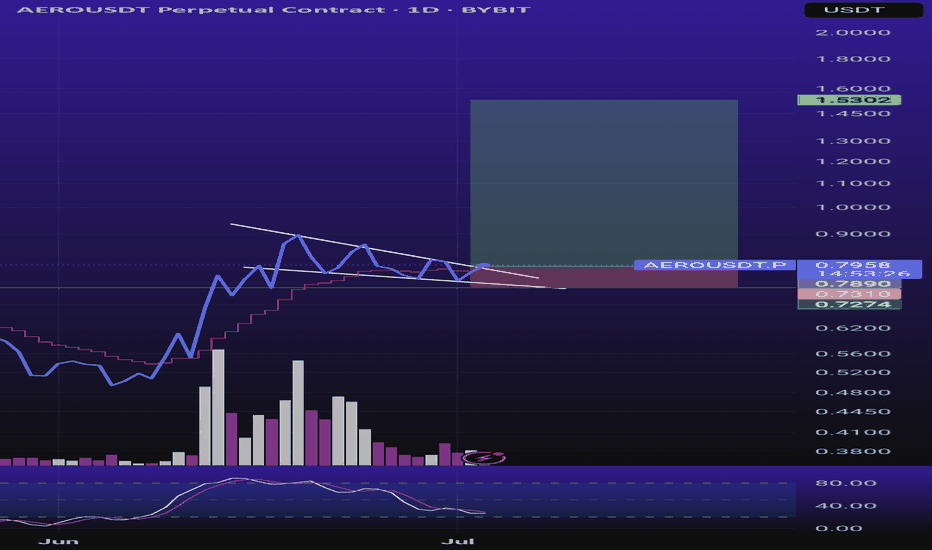

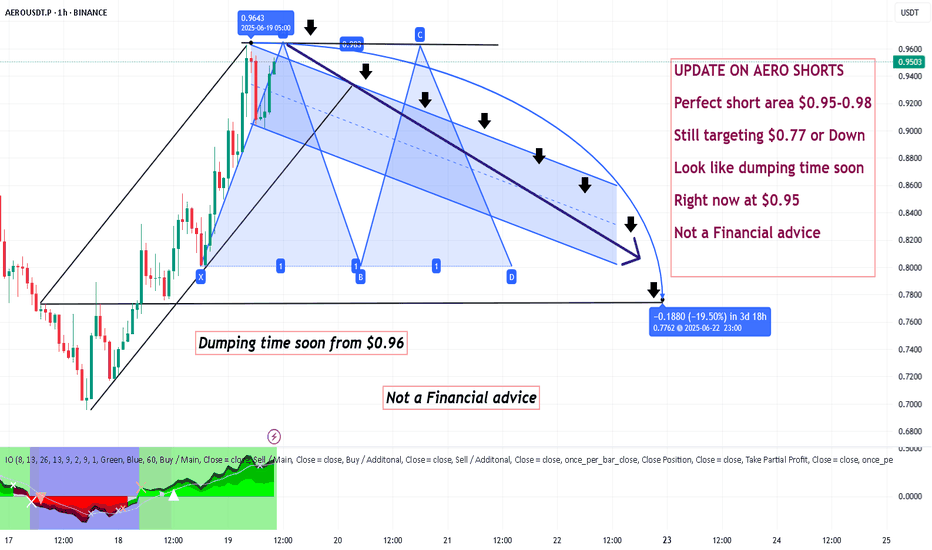

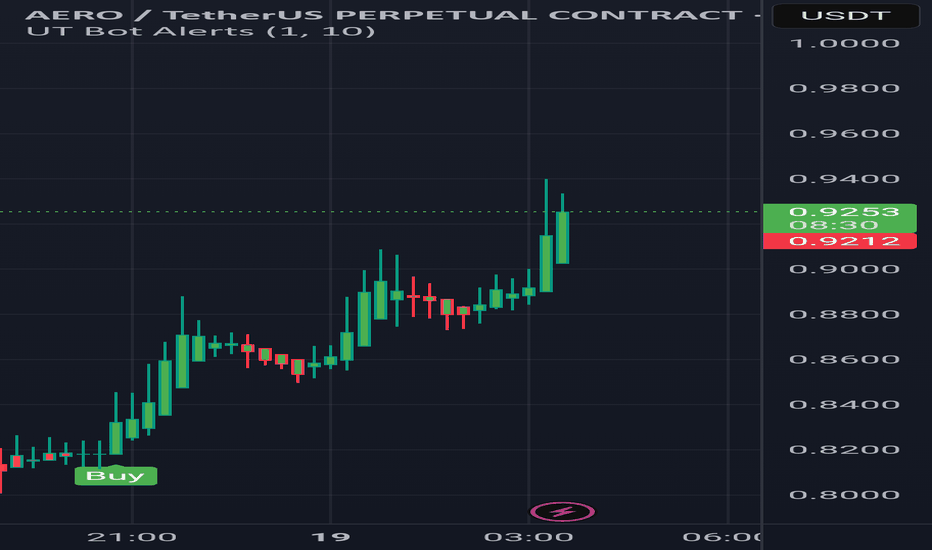

Bullish Tone, and made a trade based on Pivots amd FVG in comboTrade Analysis

(1) Trade Plan:

The idea was that the short term trend looked bullish, hence I marked up the key levels and checks to see if the price was at any of the pivot levels. Based on the idea when price crosses the Centre Top Pivot and is above a support . Further more it already visited a

SPKUSDT Long Opportunity | UT Bot Signal + Fib Extension PlaySPKUSDT showing a bullish setup after a UT Bot BUY signal at 0.0530–0.0535 zone.

Confirmation with:

📈 Volume breakout

✅ QQE MOD green spike

💹 EMA crossover

🎯 Targets:

TP1: 0.0560

TP2: 0.0578

TP3: 0.0600 (Fibonacci 1.618 extension)

🛡️ SL: 0.0518 (below swing low)

Risk-to-reward is favorable. A

See all ideas