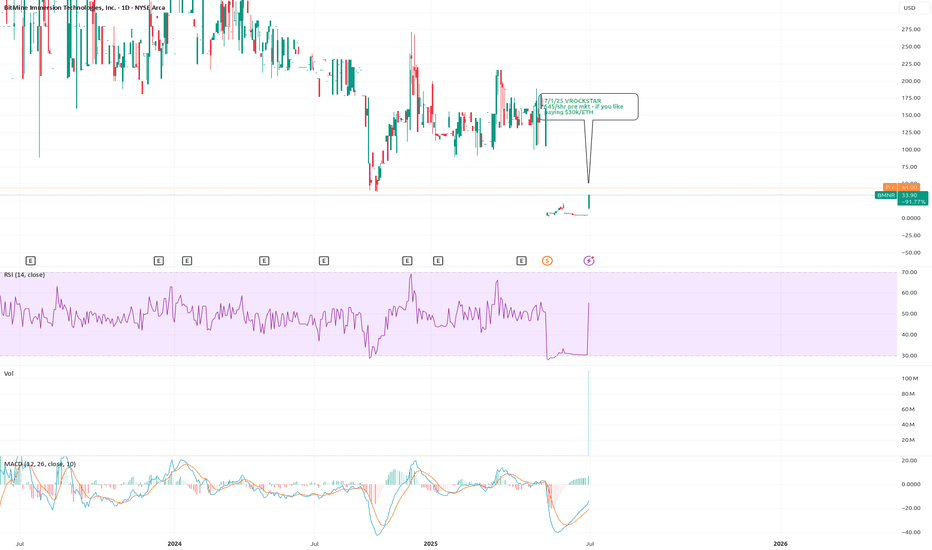

ETH is not having its "2017" moment, neither is BMNRDespite Tom Lee calling for ETH to $18k (which I happen to agree on btw), I think his timing is completely off. He's thinking that ETH is bullish here and that we're going to go to new highs this year.

I think the opposite. I think the top is already in for the year and that we're going to head to new lows first before we make our way to new highs.

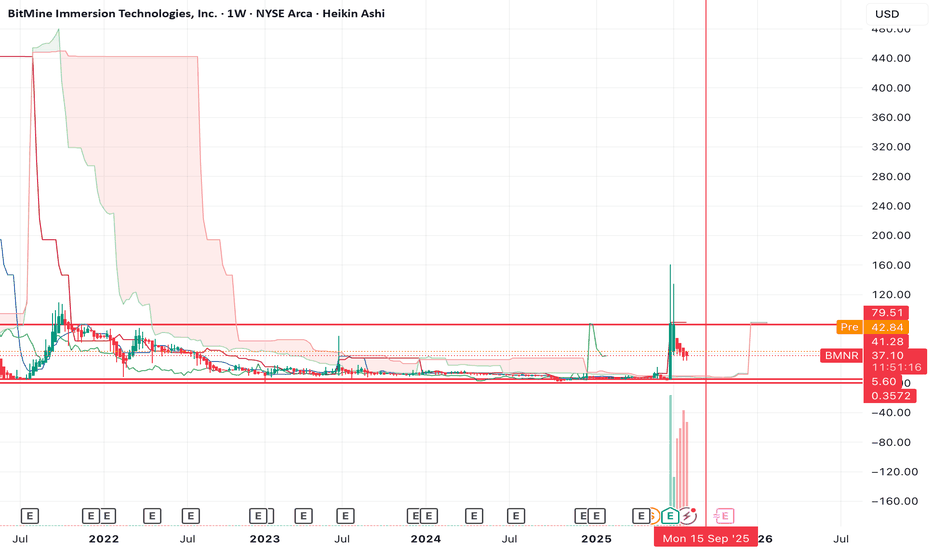

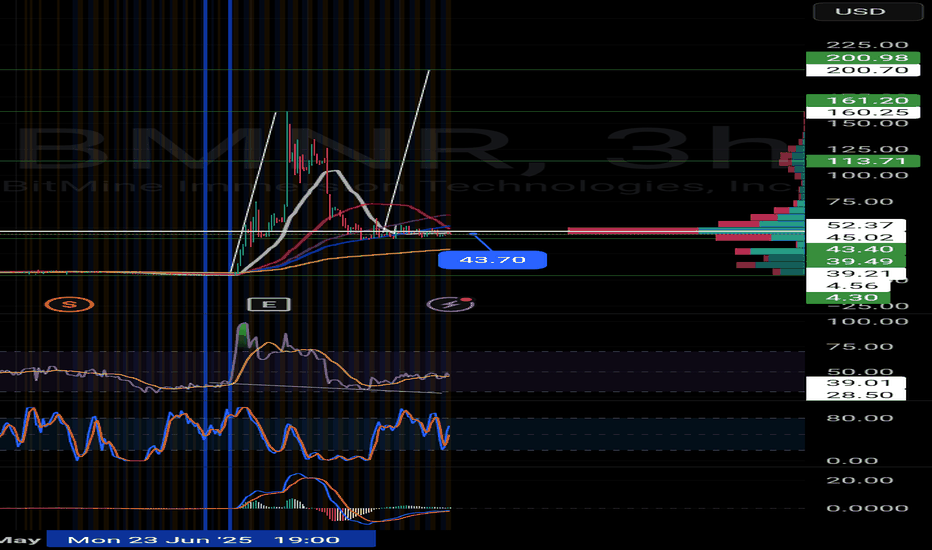

BMNR doesn't look good either. The chart is bearish on the 3W and 1M timeframe with a bearish divergence on the RSI.

I think it's more likely that BMNR retests the lows before it sees any large pump.

Let's see how the chart plays out over the coming weeks/months.

BMNR trade ideas

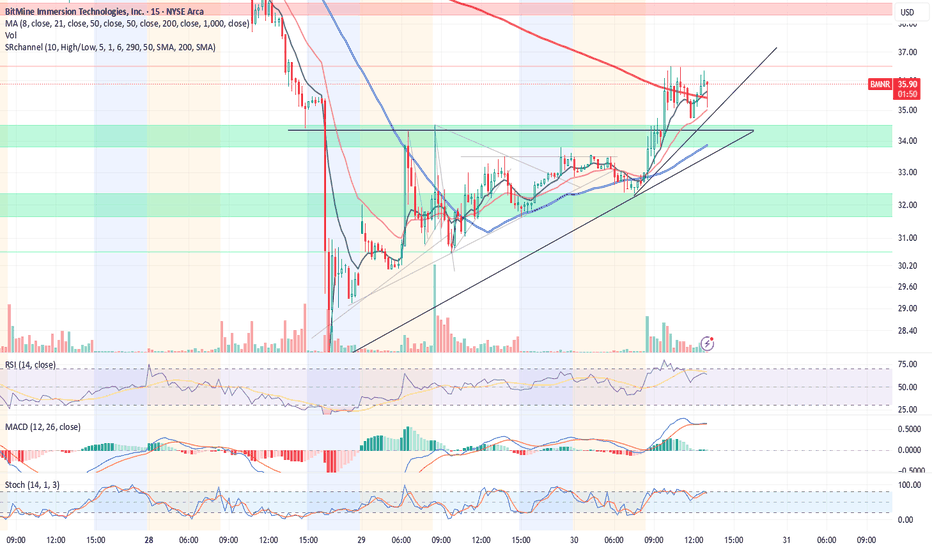

7/28/25 - $bmnr - mNav more reasonable now (1.3x at ~$30/shr)7/28/25 :: VROCKSTAR :: AMEX:BMNR

mNav more reasonable now (1.3x at ~$30/shr)

- i'd link the docs but tradingview wants you to do the digging and doesn't want me to "promote" doing your own DD. ironic.

- so here's how you get there

- go the sec dot gov website search edgar in google

- type in the ticker

- check out the latest 8K

- click presentation

- slide 30 shows "BMNR NAV Detail"

- about 23 bucks per share NAV on fully diluted shares

- AH this thing trading at $30 ish... so 1.3x mnav

- considering view that ETH becoming a captured/ "knighted" winner by the tradfi gremlins, $10k/eth or higher not unlikely this cycle

- this type of "ROE" on a Kc of probably 10-15% means a 3..4...5x mNAV at cycle top not unreasonabl

- so if ETH declines here 50% (also reasonable to expect the worst, you're at $10-15/shr assuming mnav toward 1)... and then a say 2x mnav on $10k/eth would mean shares (considering no additional moves/ accretion from here - also unlikely and conservative) would mean a 4x on the current share px so conservatively that's $100 again.

- does it get to ATH?

- honestly the way that euphoria trades if we make a run for $100... probably yeah moar ATH, but that's unlikely to happen ST unless ETH has a monster run (and it already has)

- nevertheless... i'm finally (VERY) slowly adding this to my exposure, which for me means 50 bps at the AH px of $30.

V

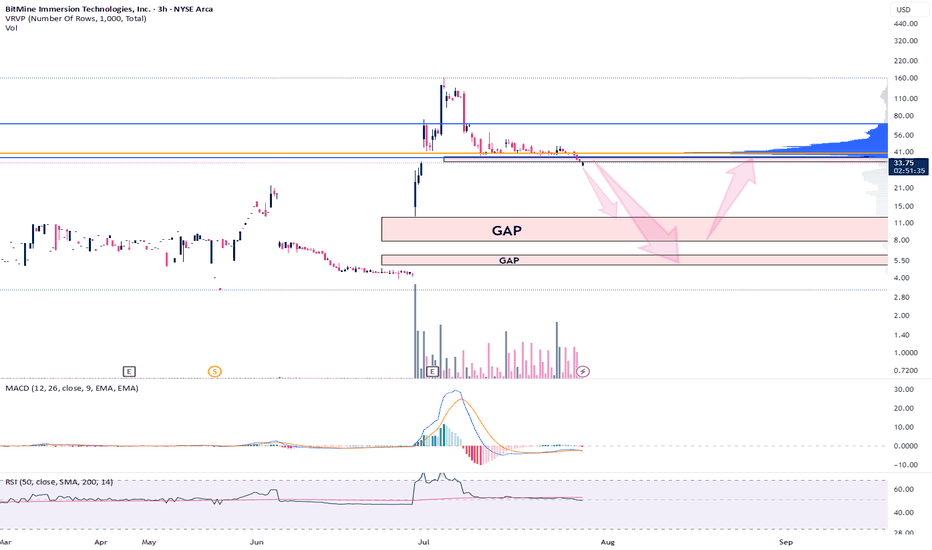

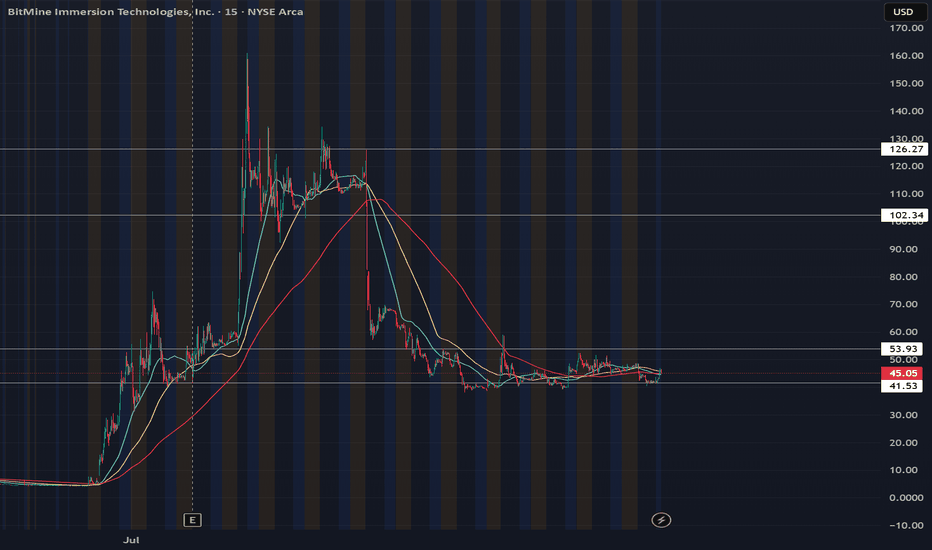

BMNR - Gaps to fill before lift offAMEX:BMNR is in competition to become the single largest ETH treasury globally with a slightly different twist - staking for a 2-5% annual return + performance.

Just like NASDAQ:SBET , AMEX:BMNR are diluting their stock to raise capital to additional purchases. This was announced a couple of weeks ago and has not yet concluded.

I expect the gaps to be filled before it really takes off.

Ideally the first gap completes at $7.92 which would be a perfect 61.8 fib retracement (EWT Target), however, if we go this low, I naturally would expect the lower gap to be taken out or at least entered.

Lower gap: $5.10 to $6.13

Higher gap: $7.92 to $12.30

If this plays out, it will be a generational buying opportunity. Like buying NASDAQ:MSTR at $11.

Cathie Wood ( CBOE:ARKK ) also made large purchases of this stock via several of her ETF's. If we follow her trend of poor buying decisions from a technical perspective, then we can certainly expect a large discount on this stock. History has a tenancy of repeating itself.

Not financial advice.

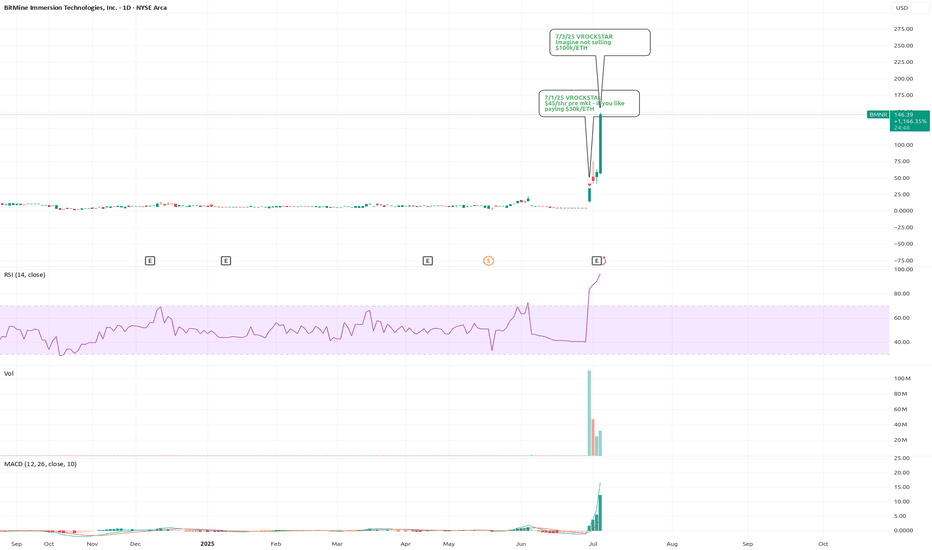

BACK TO 100Bought shares today at close new legislation is going to send this sky high. BMNR just may actually be the MSTR of ETH with the players they have. SBET BTBT COIN all will do great, but BMNR currently holds the lead for largest ETH treasury. Maybe more chop to average shares but this will be going SOON. As long as the daily RSI is above 50, we should be holding local support until breakout of this is accumulation zone.

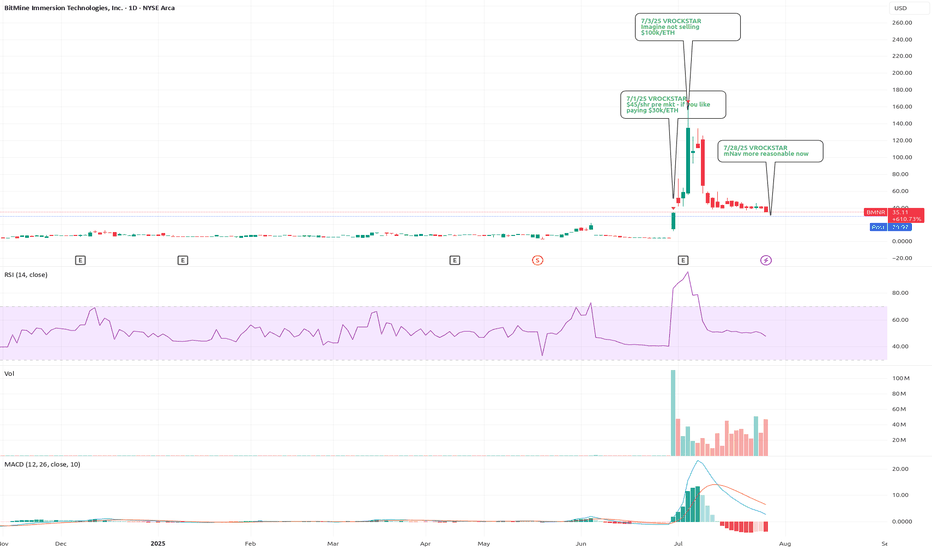

7/3/25 - $bmnr - Imagine not selling $100k/ETH7/3/25 :: VROCKSTAR :: AMEX:BMNR

Imagine not selling $100k/ETH

- somehow your eth bag is worth more than BTC per token

- and you're convinced it's going higher

- anyone who's not using this liquidity to get light literally deserves what's coming, 100%.

V

7/1/25 - $bmnr - $45/shr pre mkt - if you like paying $30k/ETH7/1/25 :: VROCKSTAR :: AMEX:BMNR

$45/shr pre mkt - if you like paying $30k/ETH

- about $4/shr of eth... lets pay $45/shr pre market 'cuz

- listen, these guys could raise (debt) and get all creative and get you some "yield" to justify paying maybe $10... $15... (holds nose) $20... but $40? momo train wreck

- congrats if you've played this but just know what you're participating in

- after HOOD announced their L2 on arbitrum y day, and a few others have done similar (tokenizing stonks)... ETH is going no where

- many stables providers will likely own ETH out of obligation and the nexus of consensus will likely *need* to be in USSA

- so the buying pressure will be ETH from BTC

- and i'd not be surprised to see $10-15k/ETH this cycle at some pt

- i'd prefer to play thru other vehicles, will get into that another day

- but this one is too much at pre-mkt $45 lol

V