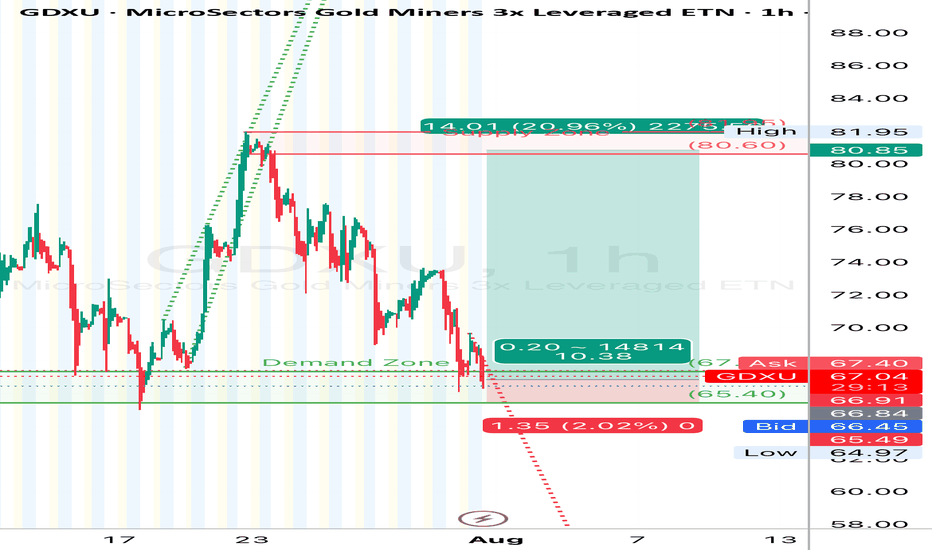

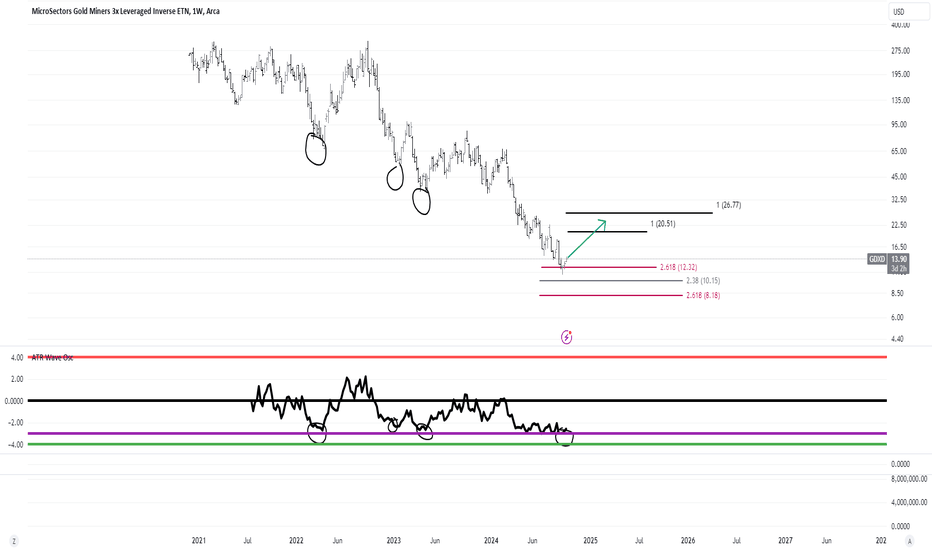

GDXU (Gold Miners 3x Bull ETF) Long SetupGDXU (Gold Miners 3x Bull ETF) | 1H Chart**

**The Fed held rates flat**, signaling a potential **pause or pivot**, which gave a bullish jolt to gold and miners.

* Lower rate expectations = weaker dollar = stronger gold = **GDXU gets rocket fuel**.

* This macro tailwind is **highly favorable** for

Key stats

About Bank Of Montreal MicroSectors FANG+ 3X Leveraged ETNs

Home page

Inception date

Feb 19, 2025

Structure

Exchange-Traded Note

Distribution tax treatment

Qualified dividends

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

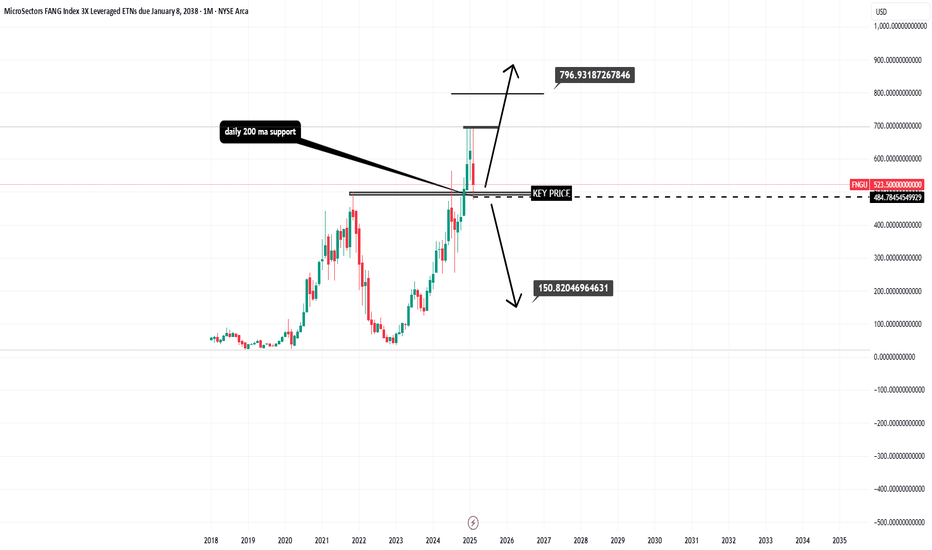

FNGU offers 3x exposure to an index of FANG companies (Facebook, Apple, Amazon, Netflix, and Google), and other similar companies. Presumably, the index will always include these five companies, an index committee is responsible for selecting the additional names. At least ten stocks must be included in the index, the number it held when the note launched so investors can expect a high level of concentration. All holdings are equally weighted. As a geared product with daily resets of exposure, FNGU is designed as a short-term trading tool and not a long-term investment vehicle. Long-term returns could materially differ from those of the underlying index due to daily compounding. Prior to June 24, 2025, the fund utilizes the ticker FNGB.

Related funds

Classification

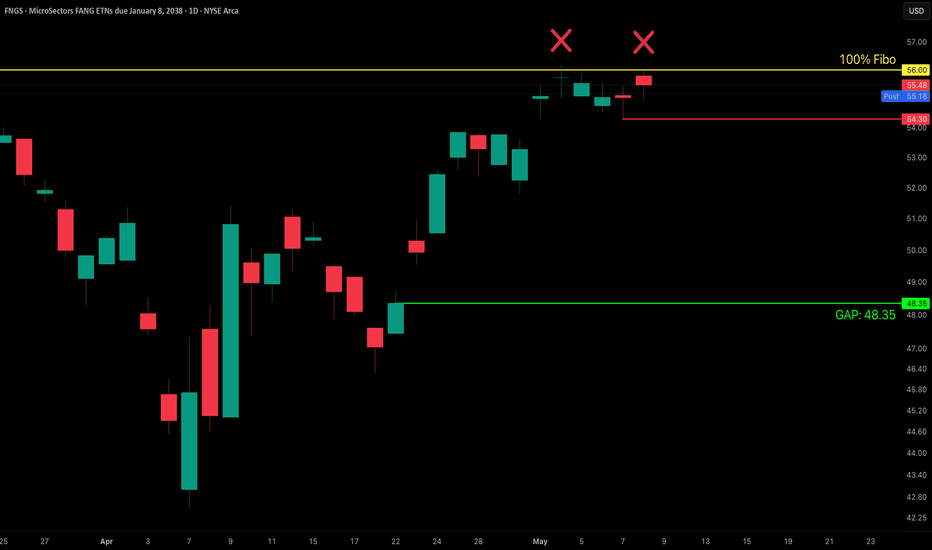

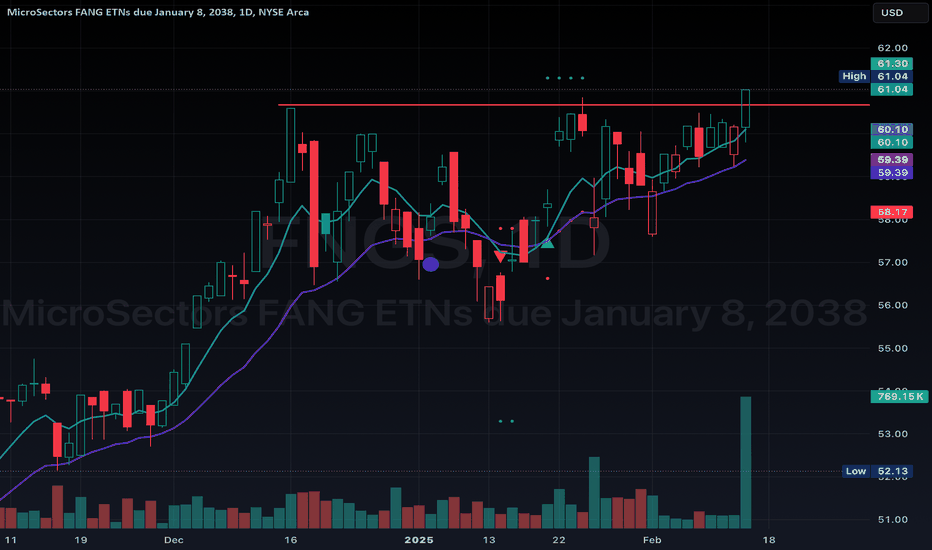

Double Top Alert on $FNGS!🟠 Double Top Alert on AMEX:FNGS 🟠

Price just got rejected at the 100% Fibonacci extension around $56 — a textbook resistance level.

Bearish confirmation could send us down to fill the gap at $48.35 👇

⚠️ Watch $54.30 as the critical neckline!

📉 Rejection + Gap = Potential Opportunity

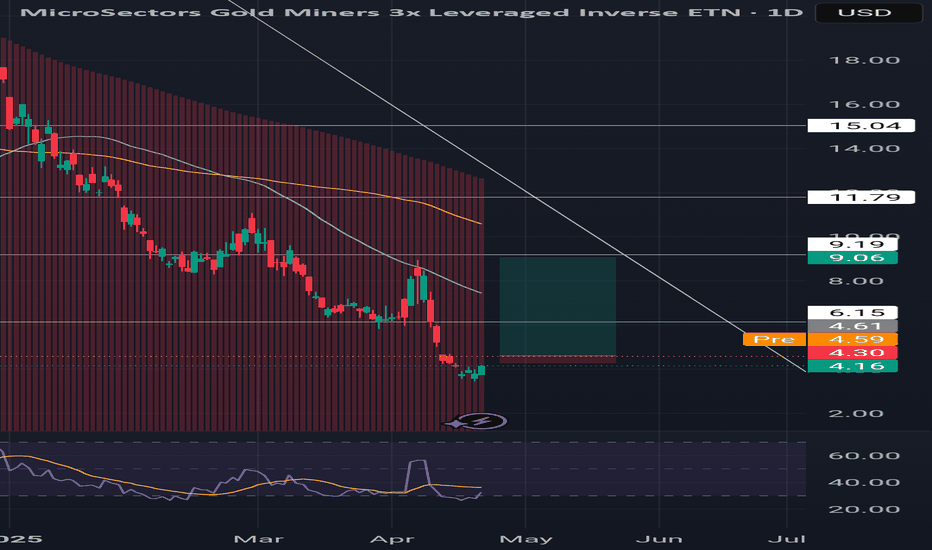

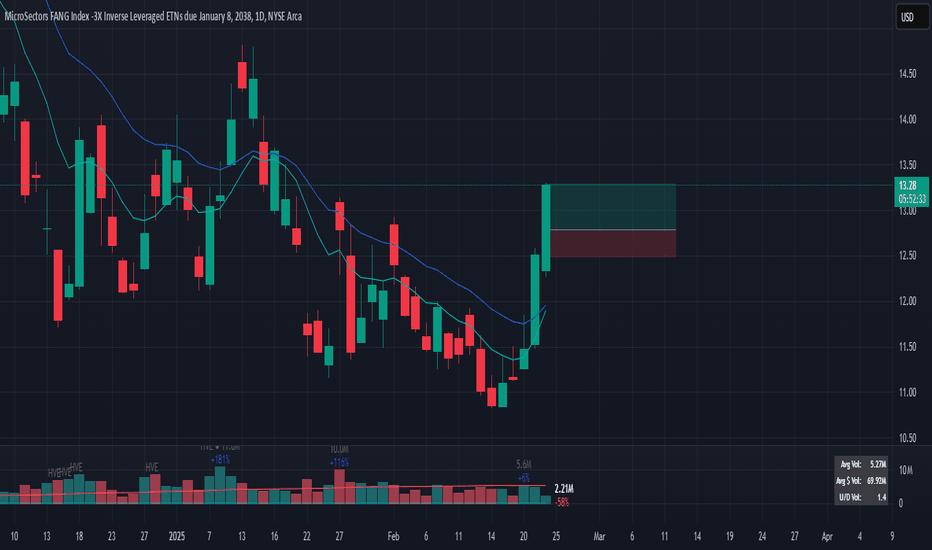

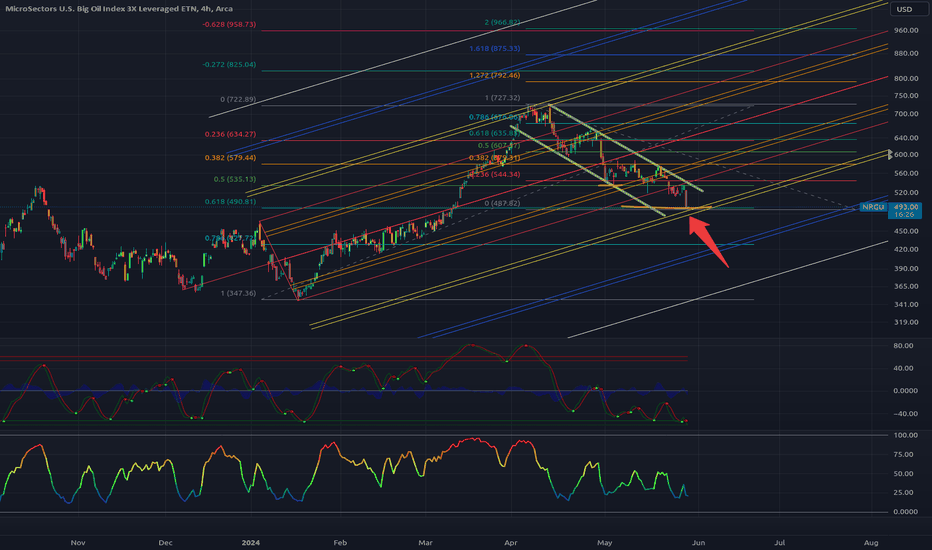

Inverse gold miner3x inverse gold miner for short exposure bought this morning at 4.50. Looking at 9 for first target see if gold bounces at support should be around that range. Could easily bounce sooner but short/medium term I'm looking for gold back at 3050. Weekly gold candle is setting up for major top if it doe

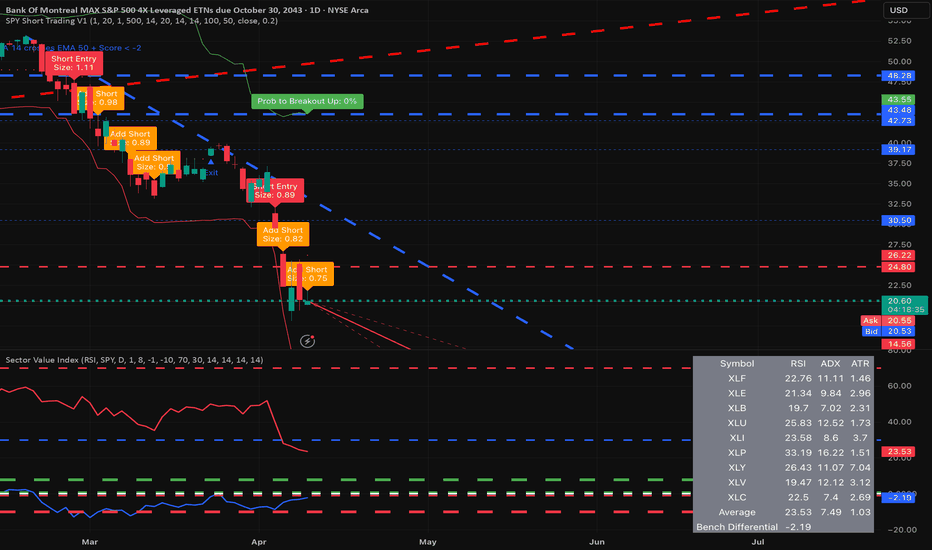

Who Benefits from the Dunce Tariff Tsar? The Art of The Short: When SPY Bleeds, Dracula Drinks

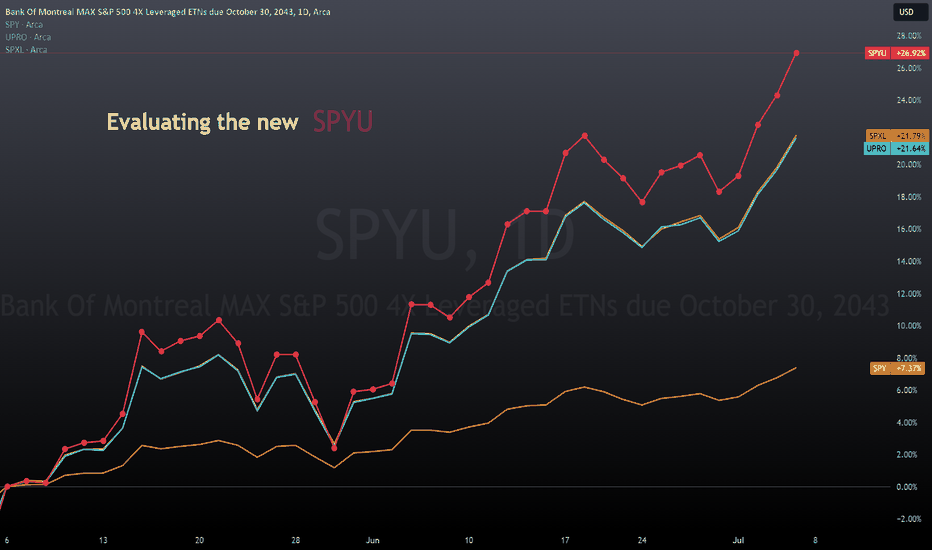

Today we’re diving deep into the MAX S&P 500 4X Leveraged ETN (SPYU), the ultimate degenerate’s playground for snorting the market when SPY takes a nosedive.

Tonight, my fellow nightwalkers, I wipe my mouth after my fangs bite into MAX S&P 5

Comparing the new SPYU to UPRO and SPXLI am not sure if anyone else noticed, because quite frankly I completely missed it, but there is a new leveraged share on the block that aims to track the S&P 500 ( SP:SPX ). That ticker is $SPYU.

Now this isn’t a conventional leveraged share. Most leveraged shares are between 2 x to 3 x max. Howev

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

FNGU trades at 25.73 USD today, its price has risen 3.04% in the past 24 hours. Track more dynamics on FNGU price chart.

FNGU net asset value is 25.75 today — it's risen 6.40% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

FNGU assets under management is 1.99 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

FNGU fund flows account for 1.26 B USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

FNGU expense ratio is 2.60%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

Yes, FNGU is a leveraged ETF, meaning it uses borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

No, FNGU doesn't pay dividends to its holders.

FNGU trades at a premium (0.09%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

FNGU shares are issued by Bank of Montreal

FNGU follows the NYSE FANG+ Index. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Feb 19, 2025.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.