GDX trade ideas

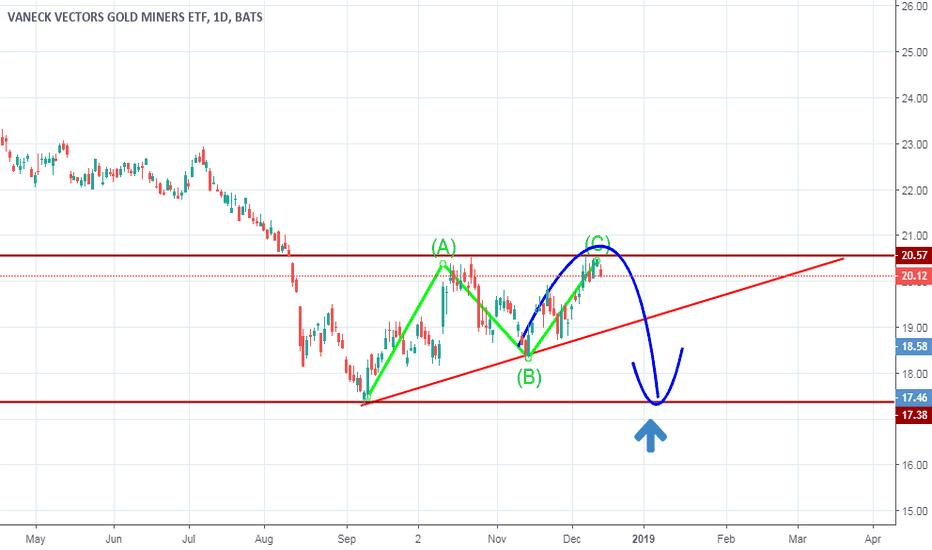

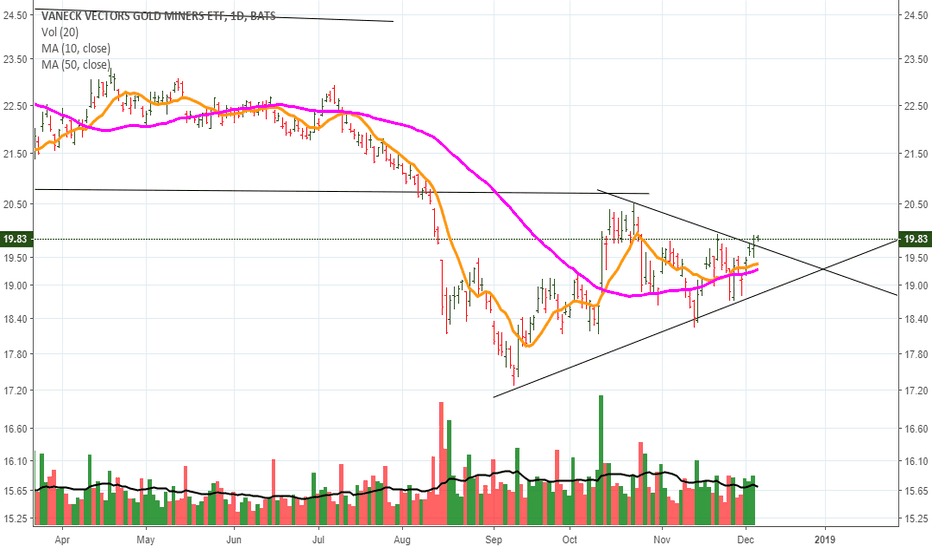

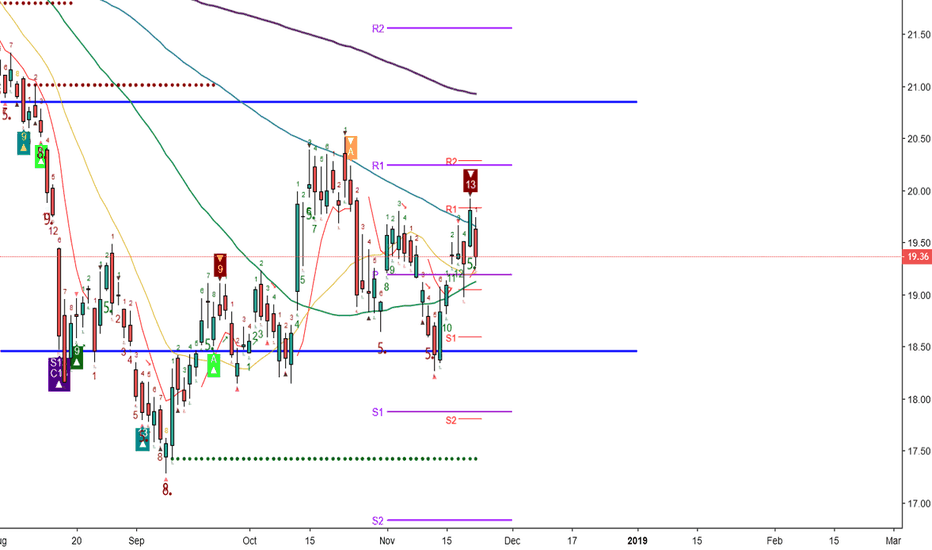

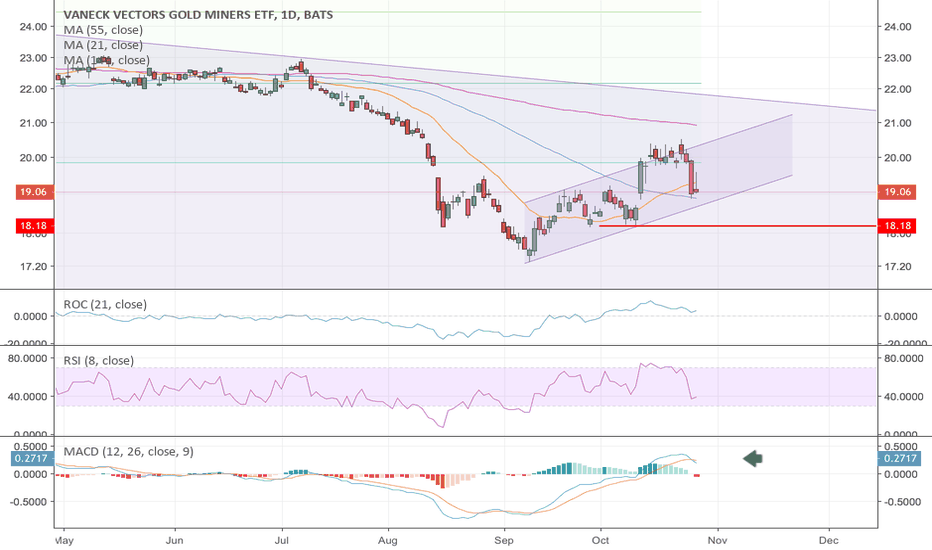

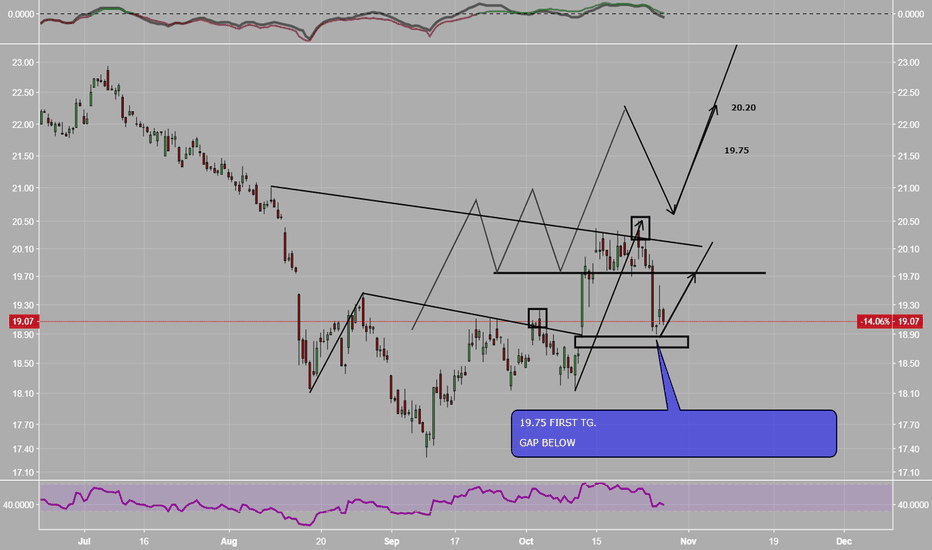

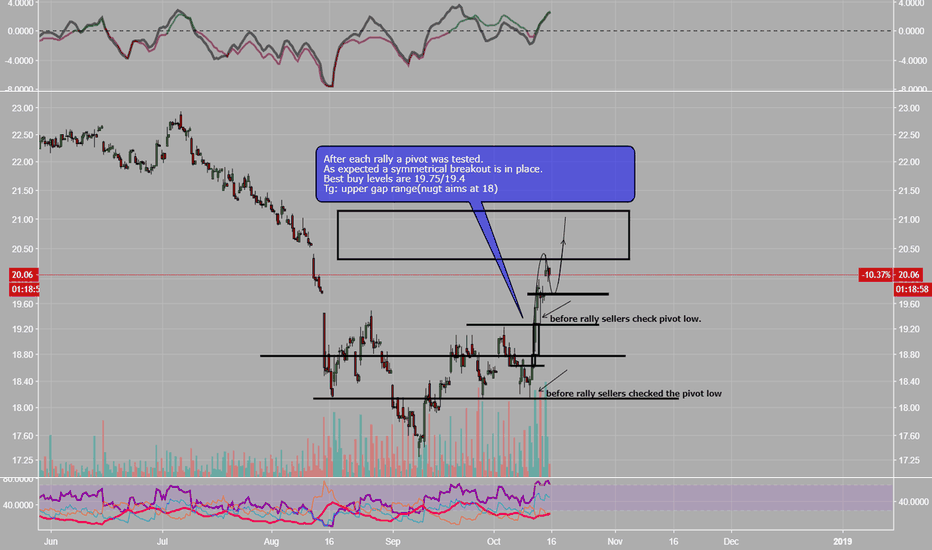

$GDX $NUGT $JNUG Short play - Is this where you want to go long?I rarely post two charts in a day but this one seemed pretty good. Self explanatory chart, Classic support turned resistance. I also see divergence between the price of gold and the gold miners, with gold not moving at resistance and GDX pushing up. I think that signals GDX is over extended. I can update it later to put more detail if needed. Short/sell at the Red rectangle, cover at the green ones.

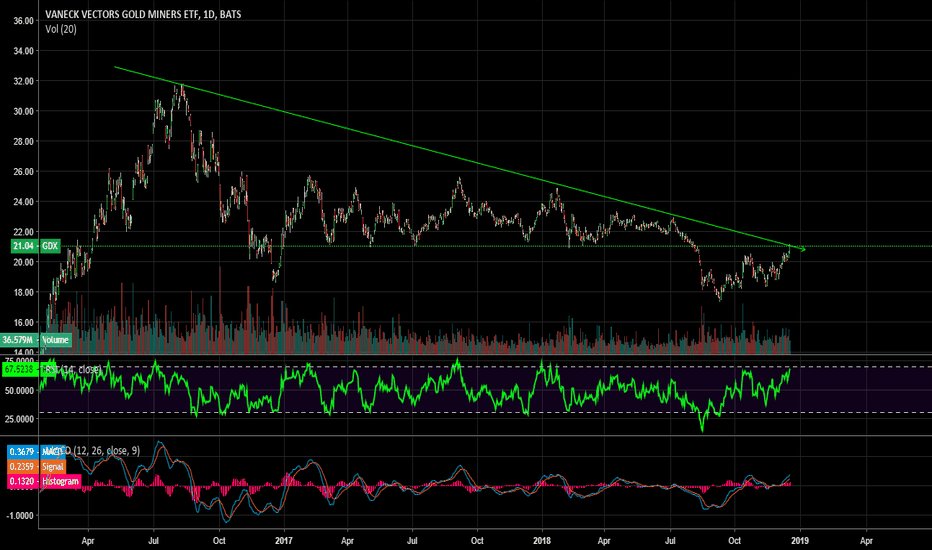

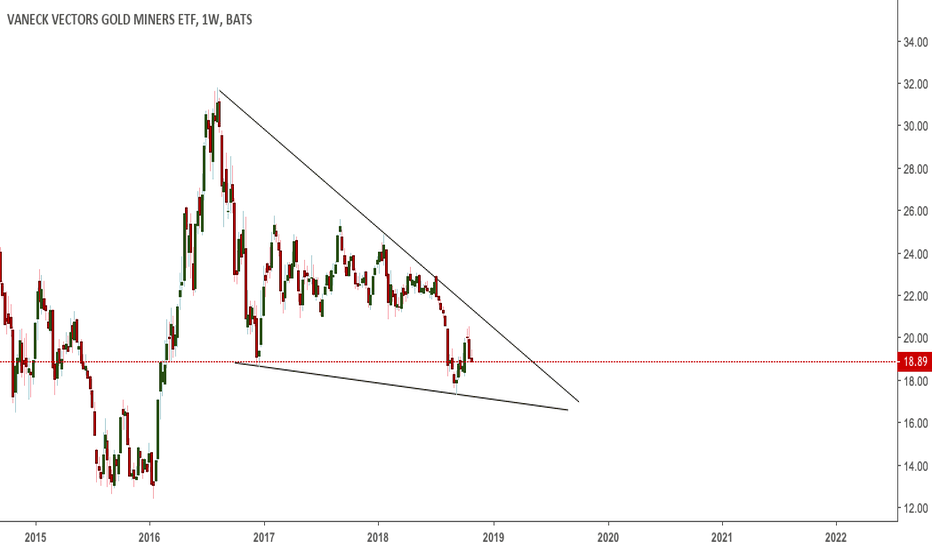

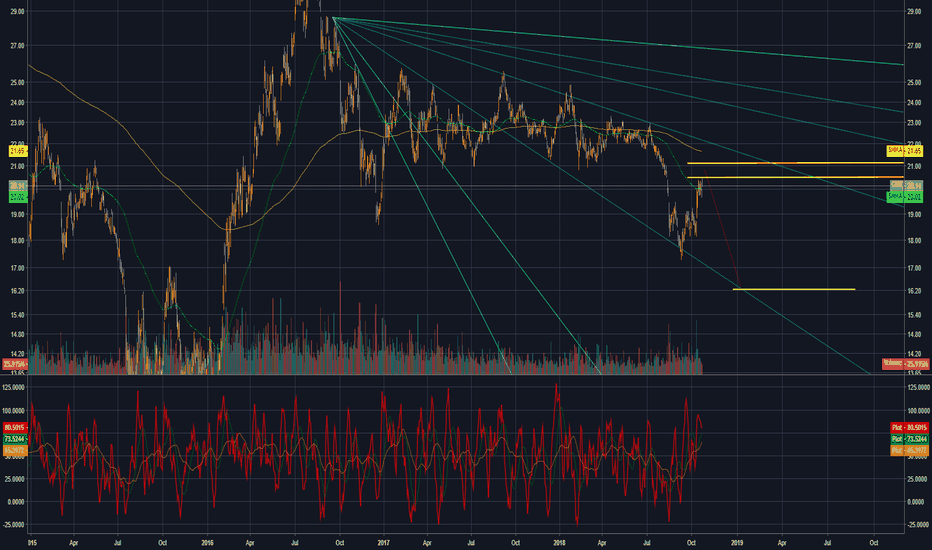

Keep in mind this is 2016-2018, seems pretty solid. If you agree/disagree leave a comment.

Update: Forgot to add there's a trendline we're hitting if you connect Jan 23 2018, July 10 2018, and now. That's lot of resistance signals in one place.

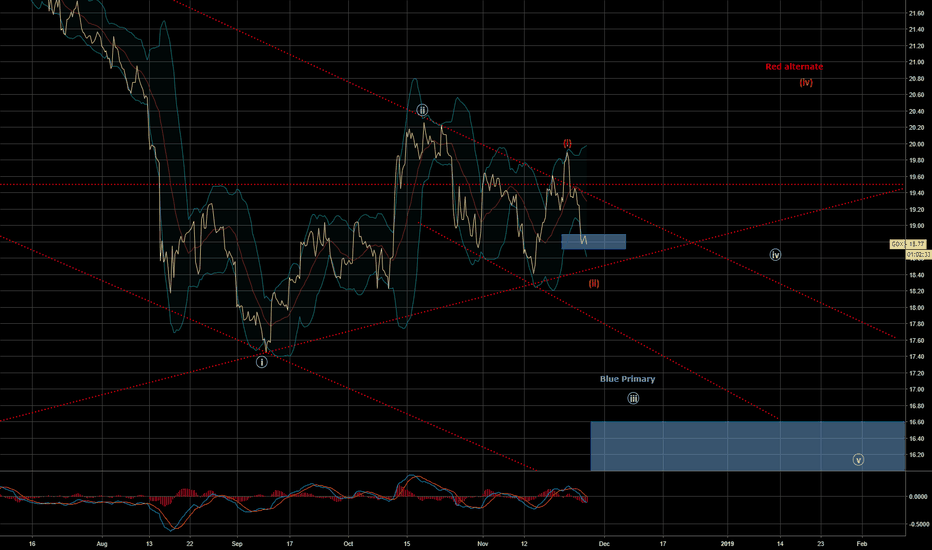

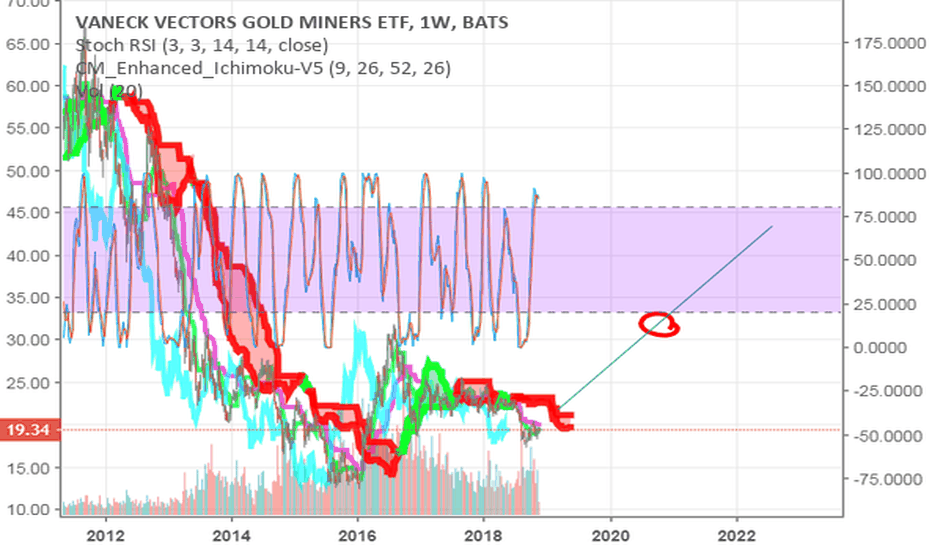

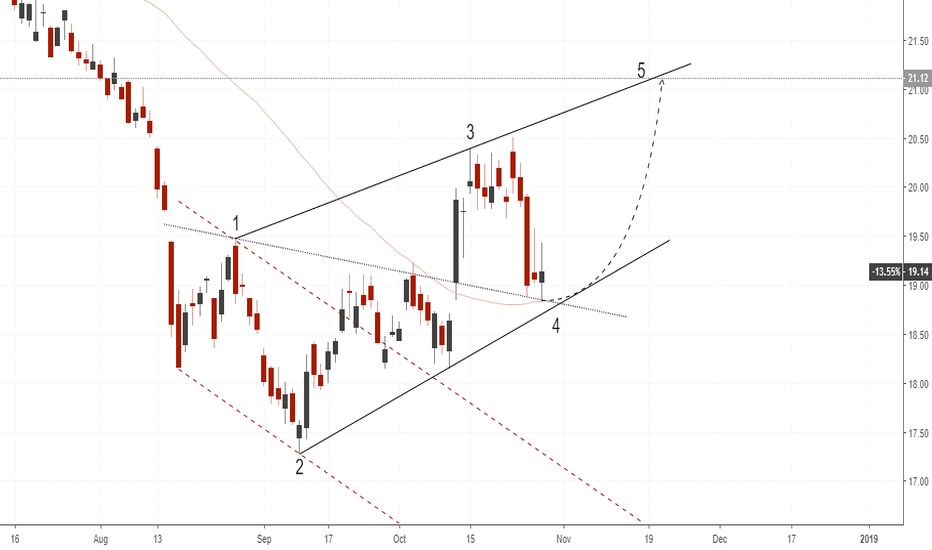

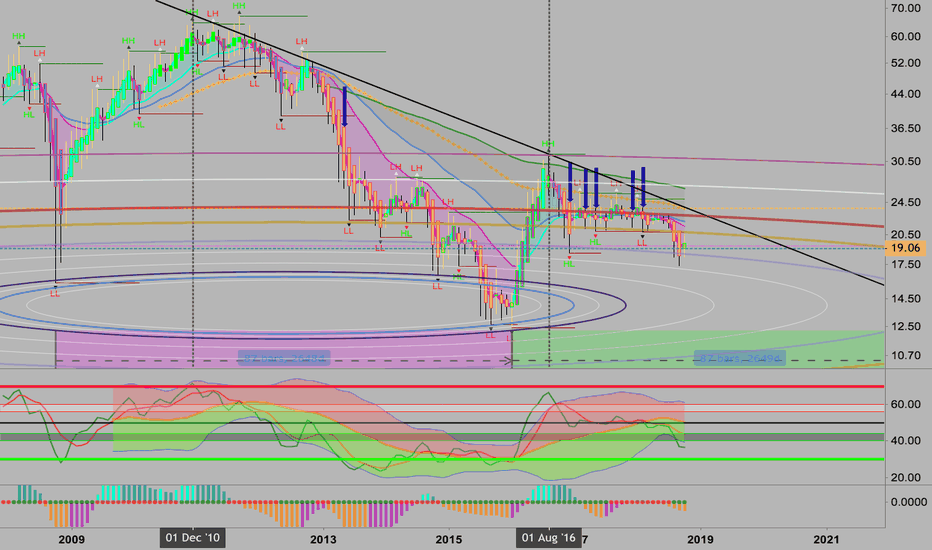

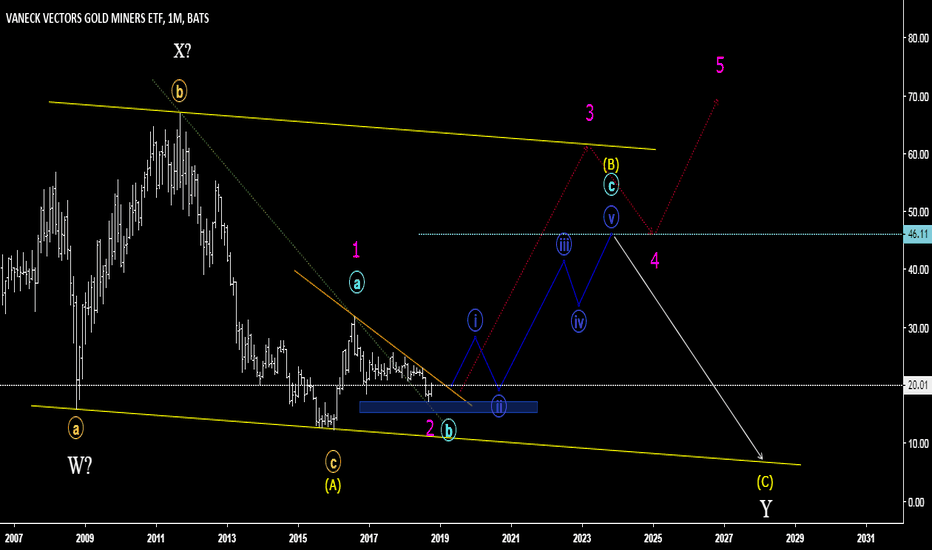

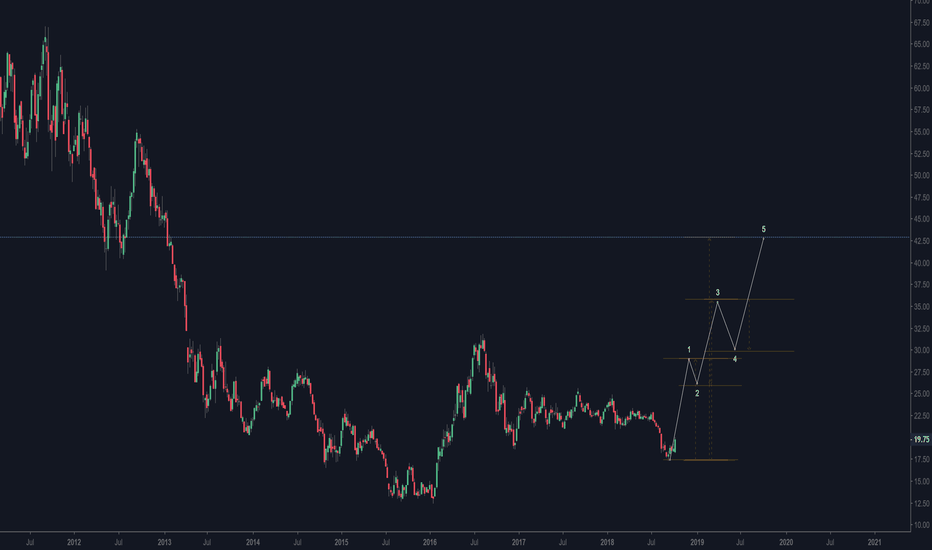

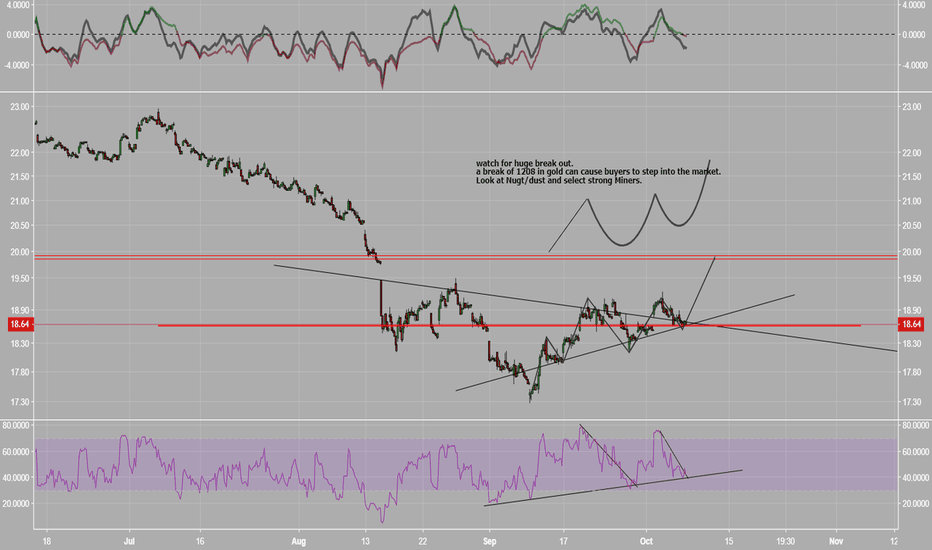

GDX Inflection PointFor those who trade in gold and silver resource stocks, looks like we are at a major inflection point. The blue EW looks to be the most plausible path for GDX while the red is still a viable alternative. The small blue diagonal box will tell us a lot as this is the inflection point IMHO. A break above this and the trend line would indicate the bottom is in place for Primary wave 2. Below this box and we have OML. Just my opinion.

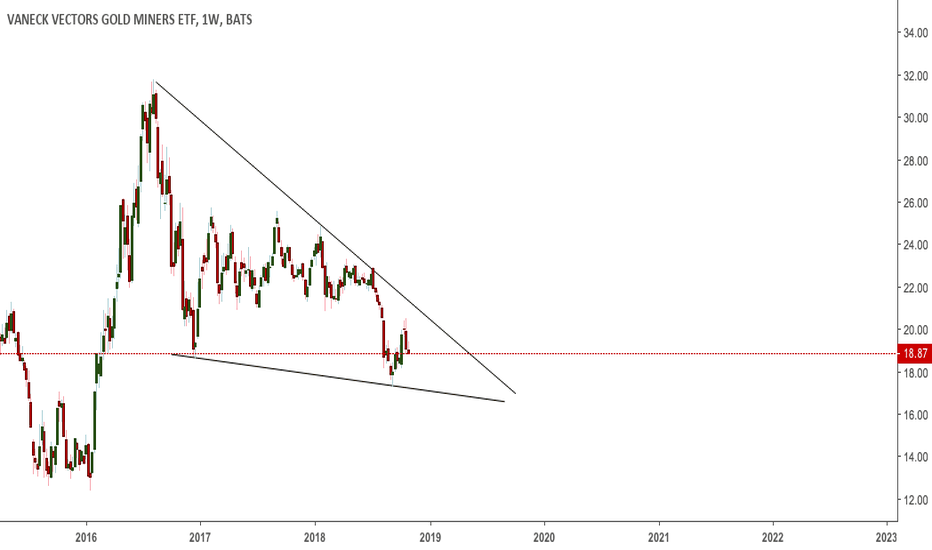

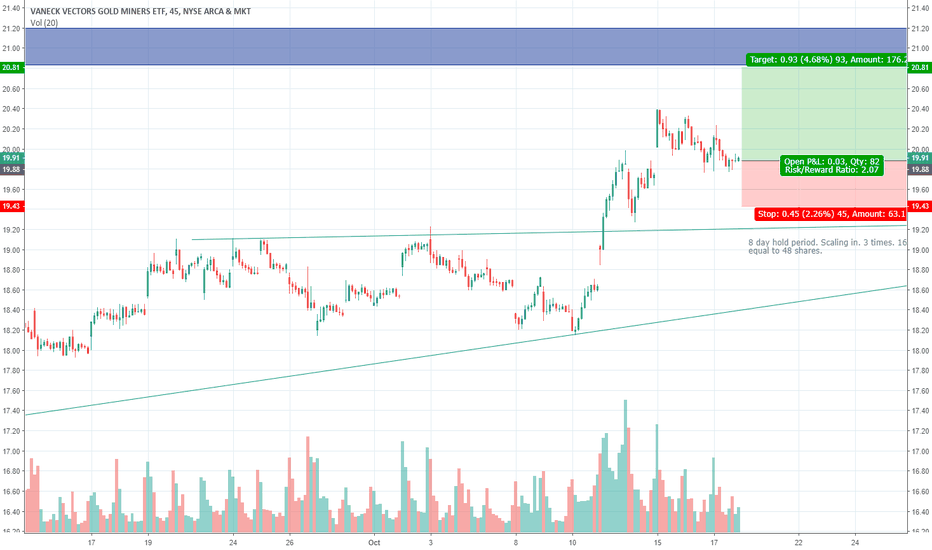

GDX VANECK VECTOR stands in front of a large rise...GDX VANECK VECTOR stands in front of a large rise. Your exchange rate can practically doubled. Therefore, gold miners' stocks are a good investment. The exchange rate increase can be achieved by building a triple wave structure. The first correction can start at 29 usd levels. Its size is 0.25 D1 ATR. Next, the second wave structure could be built with a target price of 35.89 usd. Then a 0.5 D1 ATR correction is expected and further rise. The third wave structure can reach 43 usd levels.